How Do I Compare 15

When shopping for the best mortgage rate you need to consider the overall cost of the loan, not just the interest rate. Mortgage closing costs can be 3%-6% of the loan amount and the fees you pay vary by lender. The lender with the lowest rate could be more expensive overall if it is charging higher origination fees or adding in discount points. This is why you should compare annual percentage rates , which factor in certain fees in addition to the interest rate, as opposed to just the interest rate.

You can compare interest rates and fees by looking at the Loan Estimate, which the lender must provide within three business days from when you submit a mortgage application. Since all lenders are required to use the same Loan Estimate form, its easy to evaluate multiple offers.

Nerdwallets Mortgage Rate Insight

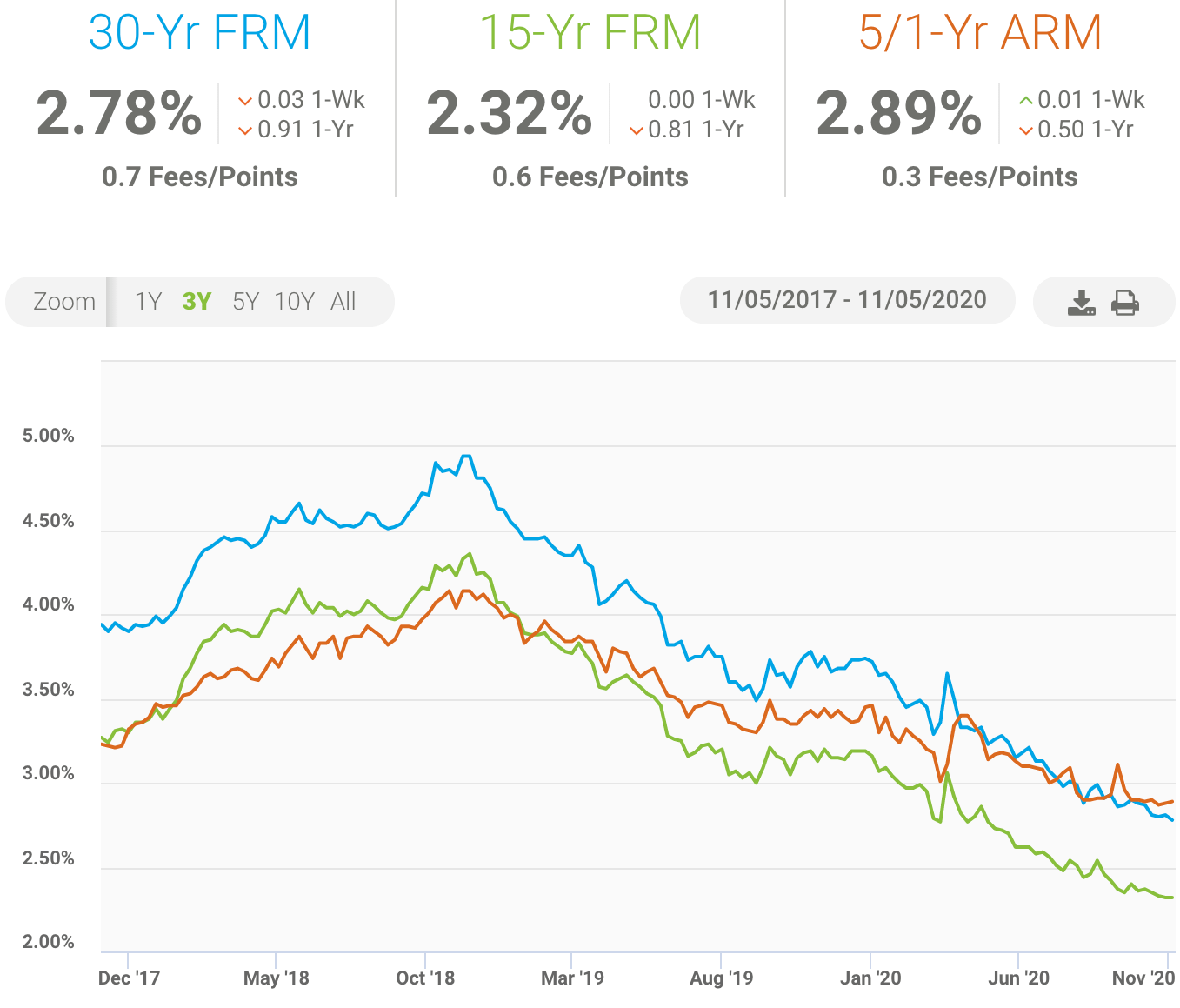

On Thursday, December 23rd, 2021, the average APR on a 30-year fixed-rate mortgagerose 2 basis points to 3.105%. The average APR on a 15-year fixed-rate mortgagerose 1 basis point to 2.291% and the average APR for a 5/1 adjustable-rate mortgage remained at 2.828%, according to rates provided to NerdWallet by Zillow. The 30-year fixed-rate mortgage is9 basis points higher than one week ago and24 basis points higher than one year ago.

A basis point is one one-hundredth of one percent. Rates are expressed as annual percentage rate, or APR.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Chase Mortgage Recast

What Is A 15

A 15-year mortgage will be paid off completely in 15 years if you make all the payments on schedule. These mortgages typically have a fixed rate, which keeps the principal and interest rate the same for as long as you hold the mortgage. Your taxes and insurance costs can change, though.

In 2018, lenders wrote nearly 22 times as many 30-year home purchase mortgages as they did those with 15-year terms, according to NerdWallet analysis of Home Mortgage Disclosure Act data. Among loans for nonmanufactured, single-family homes, 3.6 million were for 30-year terms vs. roughly 165,000 for 15-year terms.

The monthly payment on a 15-year loan is typically much higher than that of a 30-year mortgage.

No doubt many borrowers shy away from these shorter home loans when they learn the monthly payment can be more than 50% higher around $2,017 a month for a 15-year mortgage vs. $1,318 for a similar 30-year loan, for example.

Consider the pros and cons of 15-year, fixed-rate mortgages to decide which home loan is best for you.

How Long Will You Live In The Home

It would help if you also considered how long youd be living in your home. This can make a big difference in whether a 30-year or 15-year mortgage is the best decision.

If you plan on living in your home for a short period of time say eight years or less then a 30-year loan might make the most sense. Youll benefit from the lower monthly payments, and you wont have to pay as much interest because youll be selling your home long before your loans pay-off date.

If, though, you want to live in your home for 15, 20, or more years, the 15-year loan might make more financial sense. However, if you plan on living in your home for the long-term, you might as well shave tens of thousands of dollars off the amount of interest youll pay while living there.

Recommended Reading: Chase Recast

Pay Off Your Home Prior To Passing

If youre older and dont expect to live 30 more years, Mescher says you should look at a shorter-term mortgage if you want to leave your home to your children free and clear of debt. A 15-year mortgage allows you to pay off your home debt faster, and increases the likelihood that youll own 100% of your home prior to your passing.

Of course, if youre buying a home that you dont expect to live in until the end of your life, this may not be a concern. But even then, youll still have more equity in your home with a 15-year mortgage if you decide to sell it in your later years.

How Can I Pay Down A 30

You have options to pay off your mortgage faster even with a 30-year mortgage. You can choose to make biweekly payments instead of the regular monthly payment, meaning youll make one extra full payment over the course of the year. You can also choose to make a larger payment each month. Be sure to ask your lender to apply your extra payments to your principal balance.

One word of caution: Double-check that your mortgage doesnt have a prepayment penalty before going this route. Most of the time, such a penalty only applies if you pay off your entire mortgage early. But in some cases, you might face a fee if you make small payments toward principal ahead of time.

Recommended Reading: 70000 Mortgage Over 30 Years

Year Mortgage Rates Faq

What are 15-year mortgage rates?

Just like all interest rates, 15year mortgage rates go up and down most days sometimes more than once a day. You can see current 15year mortgage rates in the table above. They move roughly in line with 30year rates meaning theyve fallen a lot over the last decade or so. At the time of writing, 15year fixed rates are close to alltime lows.

Are 15-year mortgage rates always lower than 30-year rates?

It would be a very weird day indeed if 15year fixed mortgage rates were higher than 30year fixed rates. That almost never happens. But the gap between the two sometimes narrows or widens. For instance, at one point in 2013, 15year fixed rates were nearly 1% lower than 30year rates. Currently, they are about 0.50% lower. A 15year fixed mortgage becomes more attractive it offers substantially lower rates than the 30year.

How much is a 15-year mortgage?Is a 15-year mortgage a good idea?Is it harder to qualify for a 15-year mortgage?

Its harder to qualify for a 15year mortgage because a lender needs to determine you can afford the higher monthly payments on your current budget. Aside from this consideration, its not too different. Minimum credit score and down payment requirements are typically the same for 15 and 30year fixed mortgages.

Who has the best 15-year fixed mortgage rates? Is it better to get a 15-year mortgage or pay extra on a 30-year mortgage? How can I get the best 15-year interest rate?

What Are The Benefits Of A 15

The main advantages of a 15-year fixed mortgage are outlined below. An experienced U.S. Bank mortgage loan officer can help you learn more.

- Stability Youll be able to lock in the interest rate on your mortgage for the entire 15-year term. This gives you a degree of predictability you wont have with an adjustable-rate mortgage .

- Lower interest rate Interest rates on 15-year loans are usually lower than on 30-year loans.

- Less time to own your home With a 15-year term, youll pay off your loan in half the time of the more common 30-year term loan.

- Lower total cost of borrowing Between a lower interest rate and a shorter term, you’ll reduce the total interest you pay over the life of the loan.

Don’t Miss: How 10 Year Treasury Affect Mortgage Rates

You Care About Building Equity

If building home equity fast is a concern for you, the 15-year mortgage will help you build equity faster. Youll pay more principal toward the loan each month, which allows you to own the home much faster. The 30-year term offers a slow and steady pace with a more affordable payment, but it takes longer to see equity in the home.

On the other hand, just because you care about building equity doesnt mean you have the resources to do it rapidly. Here are some reasons to not refinance to a 15-year loan.

How Mortgage Terms Impact Cost

A mortgage is simply a particular type of term loanone secured by real property. For a term loan, the borrower pays interest calculated on an annual basis against the outstanding balance of the loan. Both the interest rate and monthly payment are fixed.

Because the monthly payment is fixed, the portion going to pay interest and the portion going to pay principal change over time. In the beginning, because the loan balance is so high, most of the payment is interest. But as the balance gets smaller, the interest share of the payment declines, and the share going to principal increases.

A shorter-term loan means a higher monthly payment, which makes the 15-year mortgage seem less affordable. But the shorter term makes the loan cheaper on several fronts. In fact, over the full life of a loan, a 30-year mortgage will end up costing more than double the 15-year option.

Because 15-year loans are less risky for banks than 30-year loansand because it costs banks less to make shorter-term loans than longer-term loansa 30-year mortgage typically comes with a higher interest rate.

Also Check: Monthly Mortgage On 1 Million

The Pros And Cons Of A 15

As with any home mortgage loan and financial product, a 15-year mortgage comes with benefits and drawbacks attached. Readers considering applying for or refinancing to a 15-year mortgage would do well to consider their budgets, financial goals, and individual situations when deciding which mortgage type and term to pursue.

Is It A Better Time To Buy Or Sell A Home

There are more economic factors on balance, putting downward pressure on home prices than upward pressure. However, that was also the case in the first three months of 2021 when Canadians desperate for more living space pushed home values higher.

-

If you believe that the rise in buying activity is explained by Canadians seeking more living space, then the end of pandemic restrictions coming this summer might trigger an end to this economic real estate cycle.

-

If you believe that interest rates are the primary driver of home prices, then the forecasted rise in rates would indicate prices will moderate in the second half of 2021.

-

Population growth is also expected to remain below average in 2021, so population growth shoudnt come into play until 2022.

Homebuyer Advice

If you plan to buy in the next three years, be mindful that there is a risk that prices will fall in the short run, so that a wait-and-see approach may be appropriate.

The low mortgage rates provide more purchasing power for buyers who are still employed than in 2019, but less than six months ago. In a weakened market, low rates are a gift to homebuyers however, it inflates the value of a standard home in markets with low supply.

Home Seller Advice

Unemployment is still high, and if we use past recessions as a guide, there will likely be a weakening in home valuations.

Like this report? Like us on .

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Considerations Before Choosing A 15

The 15-year mortgage can provide enormous long-term savings to a homeowner as compared to other, longer-term loan products. However, the program wont be for everyone.

Most notably, the monthly payments on a 15-year mortgage are considerably higher than the payments on a comparable 30-year loan.

At todays rates, the payment on a 15-year loan is 50% higher than a 30-year.

An increase such as this can be a budget-breaker to some households and, it can be harder to qualify for a mortgage with higher payments because of debt-to-income requirements put forth by a lender.

Therefore, before selecting a 15-year mortgage to finance your next home, make sure the monthly payment is a manageable one and, be sure to check with your lender.

This mortgage calculator can help you compare payments.

If you find 15-year fixed-rate mortgage payment to be too high for your comfort, but you still want the benefits of having a 15-year loan, theres another path you can take.

As a homeowner, theres no rule against refinancing and, with mortgage rates low, its an excellent time to consider any low-rate product not just the 15-year fixed.

To copy the benefits of a 15-year loan, do the following:

Youll also remain in control of your repayment schedule. If theres ever a month you dont want to send extra monies to the bank, you dont have to.

Pros And Cons Of A 15

With a 15-year mortgage, you’ll repay your home loan in half the time it would take to repay it under a 30-year loan. That means each monthly payment of yours will be higher on an individual basis, but you’ll also save money overall on mortgage interest for two reasons:

If you can afford a higher monthly payment, a 15-year loan may be worth it. But if you can’t manage a higher monthly payment, then stretching your budget to keep up with a 15-year loan could put you in a position where you risk falling behind on your mortgage, and so pave the way to foreclosure. Ouch.

Furthermore, don’t forget that when you take on higher monthly payments, you lose out on the opportunity to do other things with that money. A 15-year mortgage could, therefore, make it more difficult for you to consistently fund a retirement plan or save for college. But on the flip side, you’ll be done with those payments sooner than you would be with a 30-year loan. So while you may need to put other goals on hold in the near term, you’ll then have an opportunity to catch up once your home is paid off.

Check out today’s 15-year mortgage rates here.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

The Benefits And Disadvantages Of A 15

Choosing a 15-year fixed home loan is advantageous if you can afford the shorter payment period. Its also a refinancing tool for people who want to reduce their current loan term and interest rate.

But before you decide this is right for you, you must understand the drawbacks of making larger monthly payments. The higher payments will stifle your spending power. Youll also have less savings and cash for emergencies. Moreover, you may not qualify for a higher loan amount to afford your prospective home.

Below are the benefits and disadvantages of taking a 15-year fixed mortgage:

| Benefits | |

|---|---|

| Gain home equity faster, pay off your debt sooner | Less money for savings |

| Get loan-level price adjustments and pay less fees if your loan is from a government-backed company | Less money for emergencies riskier if youre faced with a medical emergency or unemployment |

| Lower insurance premiums are charged for 15-year borrowers if your loan is from the FHA | Hinders opportunities for other profitable investments |

How Popular are 15-Year Fixed Home Loans?

Fifteen-year fixed mortgages are quite popular among U.S. consumers. According to the Urban Institute, 15-year fixed-rate terms accounted for 14.2 percent of new mortgage originations in April 2020. It is the second most purchased type of mortgage product next to 30-year fixed-rate loans. This data is based on Housing Finance at a Glance: A Monthly Chartbook released in June 2020.

When Should I Refinance To A 15

After weighing the pros and cons of refinancing to a 15-year mortgages, you should also think about whether its the right time to refinance. Here are a few signs it may be a good time to refi to a 15-year:

- Youve had an income increase since your initial loan approval.

- Your credit score has increased since your initial loan approval.

- Interest rates are lower than your current mortgage rate.

- Youre able to afford a higher payment.

- You have more than 15 years left on your mortgage.

As with any loan, youll need to show proof of income, such as your W-2s or pay stubs from the previous 2 3 months. Youll also need to show your current insurance policy to prove youre covered, and you may be required to have the home appraised.

Most lenders will also consider your debt-to-income ratio , the amount of equity you have in the home and how long your name has been on the title of your home. Generally, you must have your name on the title of your home for at least 6 months before you can refinance.

You May Like: Can You Refinance A Mortgage Without A Job

Types Of 15year Mortgage Rates

If you want to save on interest, and you can afford the higher monthly payments, here are some of your options to lock in current 15year mortgage rates:

- 15-year refinance Refinancing from a 30year mortgage to a 15year mortgage can lower your interest rate even further and help you pay off your home sooner

- Conventional 15-year rates Lower rates than 30year conventional loans and much lower total interest payments. If you have a 20% down payment you can avoid private mortgage insurance

- VA 15-year rates Often the lowest interest rates of all. But you must be VA loaneligible: a veteran, still serving in the military, or a member of select associated groups

- FHA 15-year rates 15year FHA rates are low, but watch out for mortgage insurance premiums that typically last the life of the loan. This added cost could make your APR higher than other loan types

- 15-year jumbo loan rates Jumbo loan rates, including 15year jumbo loans, can be very competitive. But youll want to shop around carefully because these loans are not backed by any agency and rates can vary a lot from one lender to the next

We can only generalize about the 15year mortgage rates youre likely to be offered. To be sure of what youre in line for, youll need to request personalized quotes from multiple lenders.