Better Mortgage Company: Best Online Lender

Better.com is an online mortgage lender offering a range of loan products in the majority of states in the U.S, and one of Bankrates best mortgage lenders overall.

Strengths: Better.com can save you time and money with three-minute preapprovals and 21-day closings, on average, and no lender fees. If you get a more competitive mortgage rate from another lender, you can also take advantage of the Better Price Guarantee, in which Better.com either matches that rate or gives you $100. The lender offers seven-days-a-week support by phone, as well, if you need it.

Weaknesses: If youre looking for a VA loan or USDA loan, youll have to search elsewhere Better.com currently doesnt offer these loan types. Although the Better Price Guarantee can help you get a lower rate, its only available if you apply online directly through the lender.

> > Read Bankrate’s full Better Mortgage review

Are Mortgage And Refinance Rates Rising Or Falling

You may have noticed something odd. On some days, most markets are looking friendly toward mortgage rates. And yet I still predict a rise and turn out to be correct. Today is an almost exact mirror image.

That happened yesterday. All the market indicators listed above, except one, showed Good for mortgage rates. But I still said I thought mortgage rates would rise. How come?

Well, there are three reasons:

Take yesterday. Oil prices were moving down because China has implemented a savage COVID-19 lockdown. And that could reduce world demand for oil, lowering its price. But that change was unlikely to have much effect on mortgage rates.

Meanwhile, gold and stock markets were spooked by worries that the Federal Reserves anti-inflationary measures could cause a recession. If it happens, that ultimately might cause mortgage rates to fall but probably not for months, if at all. And higher mortgage rates are a part of those markets concerns.

Read the weekend edition of this daily article for more background.

Whats A Typical Bad Credit Mortgage Term Length

Bad credit mortgages are only meant to be used as a temporary stopgap measure while you get your finances in order. You wouldnt want to stay with a bad credit mortgage lender for long either. Thats why youll usually see bad credit mortgages with term lengths from 6 months to 2 years. Youll need to have an exit plan when applying for a bad credit mortgage so that you can transition back to aB lenderor A lender.

Don’t Miss: Bofa Home Loan Navigator

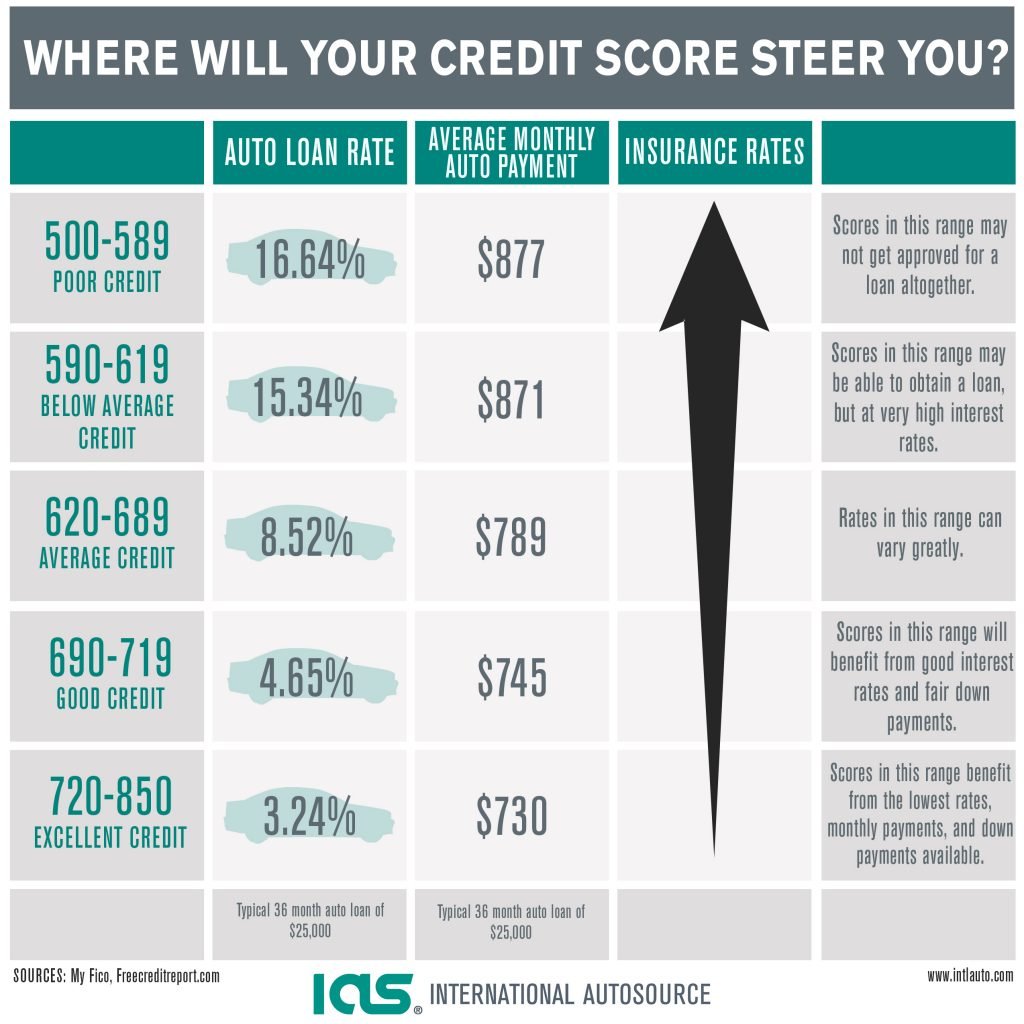

You Need An Excellent Credit Score For The Best Rates

What does all this mean? Well, before shopping for a house, you may want to take a look at your credit score. Making moves to increase your score, like checking credit reports for errors, lowering your debt utilization by paying off your credit card balances in full each month, and making all your payments on time, can help you boost your score before applying for a loan.

If you plan to put less than 20% down on your new home purchase, youll need a 760 credit score to get the lowest PMI and mortgage rates. But if youre making a down payment of 20% or more, a 740 score is usually enough to secure the best mortgage rates and loan terms.

Even if you cant lock in that perfect score, just a few points can push you into the next underwriting level for somewhat lower rates. And that small change can save you thousands over time.

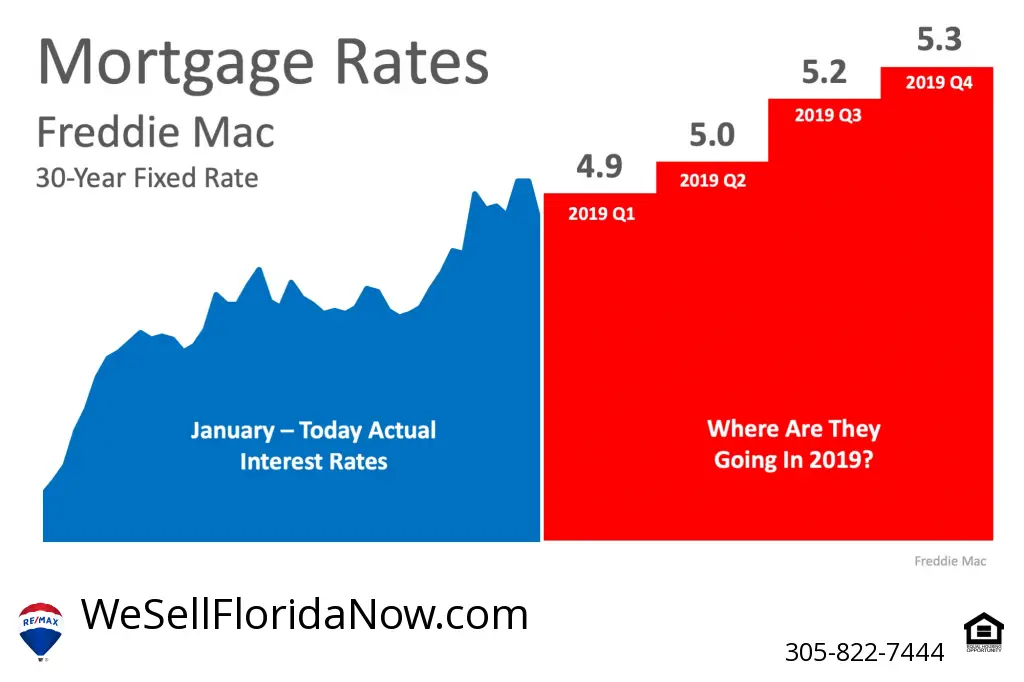

Will Current Mortgage Rates Last

As the new Omicron variant causes a new surge of the virus, uncertainty around the economic recovery is putting downward pressure on rates. With a little over a week left in the year, expect mortgage rates to remain near historic lows. Looking into next year, however, all signs are pointing to increasing rates.

Next year, the Federal Reserve expects to tighten monetary policy sooner than previously thought. Last week, the central bank announced that it expects to end its bond purchasing program by spring 2022 and raise the federal funds rate three times next year. Both of these moves will put upward pressure on mortgage rates.

On Thursday, the yield on the 10-year Treasury note opened at 1.457%, just 0.001 percentage points lower than Wednesday’s close of 1.458%. There tends to be a spread of about 1.8 percentage points between the 10-year Treasury and average mortgage rates.

You May Like: Can You Refinance A Mortgage Without A Job

When To Lock Your Mortgage Rate

Keep an eye on daily rate changes. But if you get a good mortgage rate quote today, dont hesitate to lock it in.

Remember, if you can secure a 30year mortgage rate below 3% or 4%, youre paying less than half as much as most American homebuyers in recent history. Thats not a bad deal.

*Average rates are for sample purposes only. Your own interest rate will be different. See our mortgage rate assumption here.

Ways To Improve Your Credit Score

The following are simple ways to improve credit scores

Unpaid Bills

The number one method is to pay bills on time. Delinquent bill payments can have a tremendous negative impact on credit and the longer a person pays bills on time, the better the credit score. For example: A person with a credit rating of 707 can raise their score another 20 points by paying all bills on time for a single month. Paying items such as mortgage and rent are especially important. Mortgage lenders like to look at payment trends on mortgage and rent payments.

High Credit Card Balances

Balances need to be low on credit cards. High credit card debt can hurt the credit score and lower the credit score as much as 70 points.

Many New Credit Accounts

It is important to not open credit cards that are not needed. New accounts can lower the account age, which can lower the credit score by 10 points.

Poor Payment History

It is good to have credit cards, but it is very important to manage them well. Having credit cards and installment loans raise credit scores, especially if payments are consistently made on time. Someone who doesnât have credit cards tend to be at higher risk than someone who hasnât managed their cards well.

Recently Closed Accounts in Poor Standing

Accounts still stick around when they are closed. The account will still show up on the credit report and be factored into the score.

Ensure You Are Not an Identity Theft Victim

Recommended Reading: Who Is Rocket Mortgage Owned By

Your Financial And Credit Picture

Lenders have to ensure you can repay your mortgage, and they do that by assessing your risk of default. Lenders pay close attention to your debt-to-income, or DTI, ratio, and your credit score. Your DTI ratio is the sum of all of your monthly debts in relation to your gross monthly income.

Generally, the higher your DTI ratio, the riskier you appear to a lender and the higher your interest rate will be. As a general rule of thumb, conventional lenders want to see your DTI ratio stay below 43 percent, but some loan programs will consider borrowers with a DTI ratio as high as 50 percent.

Your credit score is another indicator of your ability to manage debt and pay bills on time. Borrowers with a lower credit score pay higher interest rates and have more-limited loan options if their credit is less-than-stellar.

As mortgage rates fall, your DTI ratio falls, too, because a lower rate will drop your monthly mortgage payment, which is included in your DTI ratio calculation. As a result, you could afford to buy more house, Selitto says.

How Do Different Credit Issues Impact My Bad Credit Mortgage Interest Rates

Lenders consider some types of credit problems more severe than others. Below are the most common low credit score problems, listed from the least serious to the more severe.

Should you have a more serious adverse credit history, you can still achieve mortgage lending.

Revolution Brokers work with a broad network of specialist mortgage lenders who are used to lending to applicants with low credit scores or bad credit history.

Give us a call on 0330 304 3040, and we will be happy to walk you through the best options.

Don’t Miss: Chase Recast Mortgage

Amerisave Mortgage Corporation: Best For Refinancing

AmeriSave Mortgage Corporation is an online mortgage lender, available in every state except New York, offering an array of loan products. Along with conventional loans and refinancing, the lender also offers government loans, and is one of Bankrates best FHA lenders in 2021.

Strengths: Like other online mortgage lenders, AmeriSave Mortgage Corporation has some of the most competitive rates out there, and about half of consumers have had their loans closed in 25 days. The lender also doesnt charge a separate origination fee.

Weaknesses: Youll still need to pay a flat $500 fee.

> > Read Bankrate’s full AmeriSave Mortgage Corporation review

Can I Get Good Remortgage Rates

Yes, you may be able to get a decent rate if you remortgage your existing property. For more information, read our how to remortgage with bad credit guide.

Ask a quick question

We can help!We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in Bad Credit Mortgages.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

We are an information-only website and aim to provide the best guides and tips but cant guarantee to be perfect, so do note you use the information at your own risk and we cant accept liability if things go wrong. Please email us at if you see anything that needs updating and we will do so ASAP.

Also Check: Rocket Mortgage Requirements

Bad Credit Mortgages With B Lenders

B Lendersare non-traditional banks, such as, monoline mortgage lenders, andmortgage investment corporations. The difference between B lenders and private lenders is that B lenders usually follow federal regulations that are imposed upon federally regulated banks, and more specifically, they may refer to the Office of the Superintendent of Financial Institutions B-20 guidelines on residential mortgage underwriting.

B-20 sets minimum requirements when assessing a borrower. While B lenders can choose to follow them, and some B lenders do enforce them in their policies, not all B lenders do. On the other hand, private lenders do not follow B-20.

This makes B lenders more of a mixed bag when looking for a mortgage with bad credit. Some B lenders, such as many monoline lenders and credit unions offer CMHC-insured mortgages, and so they must follow CMHCs underwriting guidelines for high-ratio mortgages. This includes a minimum credit score of 600.

Other B lenders have looser requirements. For example, MERIX Financial has a whole product line that caters to borrowers with blemished and bad credit.

Since having bad credit already closes many doors, its best to try as many options as you can. B lenders can be a tolerable alternative if youve been declined by the banks. B lender mortgage rates are generally lower than private mortgage rates, and youll also encounter fewer fees with B lenders.

Strategies To Get A Lower Interest Rate

Heres a recap of the best strategies to get a lower interest rate and save on your mortgage loan:

And, if you have time before you plan to buy or refinance:

- Boost your credit score before you apply

- Reduce your debts before you apply

- Save a bigger down payment. The higher your down payment, the lower your mortgage rate is likely to be

With those last three, theres only so much you can do. Few of us could save more at the same time were paying down debt.

But prioritize areas where you think you have the most room to grow as a borrower. And just do what you can. Because even a little can sometimes help a lot.

Read Also: Reverse Mortgage Mobile Home

Getting Help With Debt

If youâre worried about money, youâre not alone. There are many debt charities and companies that offer free independent advice for everyone. They can advise you, and could act on your behalf to help with any debts you might have.

MoneyHelper is a free, government-backed money guidance service â their site includes a handy Debt Advice Locator tool that can help you find confidential debt advice. Other places to turn include:

National Debtline

Apply For A Mortgage With Us

Applying for a mortgage can be a complicated process, since there are several things lenders will review. Knowing what lenders are looking for and making that as attractive as possible is one of the best steps you can take in getting a great mortgage rate. Luckily, you have us.

At Assurance Financial, well work with you, assessing your situation and doing all the heavy lifting for you. Contact one of our experts today and let us help you get the perfect mortgage rate!

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

What Are The Average Mortgage Interest Rates For Customers With Bad Credit

They are constantly in flux and the current mortgage rates for bad/poor credit borrowers can change at the drop of a hat.

The important thing to remember is that while some lenders wont offer you their most favourable interest rates if you have any adverse credit against your name, there are specialist providers who might consider doing so. The terms you get will depend on the severity of the credit issue, how long it has been on your file, and how closely you meet their other eligibility and affordability requirements.

There are myriad factors which can decide which rates you can get and the rates themselves vary greatly. Get in touch with one of the bad credit mortgage advisors we work with and theyll be able to tell you which rates from the whole of market you could get.

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Calgary Mortgage Rate Forecast

The best rates in Calgary are often slightly better compared to mortgage rates in other parts of the province thanks to the number of lenders and brokers in the city, and the liquidity of its real estate market .

Due to the COVID-19 crisis, mortgage rates in Calgary, like all other parts of the country, have been near record-lows. Thats true even though many people are still unemployed and unable to take advantage of such rates.

Mortgage activity should start to recover by the end of 2021 as the economy fully re-opens, rates remain low and people regain employment. But much depends on the level of oil prices, given the correlation with business investment in the region.