Get Started On Your First

If youre ready to get serious about buying a house, talk to a mortgage advisor about your first-time home buyer loan options. Theres a wide range of programs available and its important to find the loan that meets your needs best. This will make it easier to qualify and should reduce your mortgage costs, too.

Ready to get started?

The Usda Home Loan Program

The USDA loan program is one of the best mortgage loans available for qualifying borrowers.

Theres no down payment required, and mortgage insurance fees are typically lower than for conventional or FHA loans. USDA interest rates tend to be below-market, too.

To qualify for 100% financing, home buyers and refinancing homeowners must meet standards set by the U.S. Department of Agriculture, which insures these loans.

Luckily, USDA guidelines are more lenient than many other loan types.

Why Doesnt Every Buyer Use The Usda Home Loan Program

Most homebuyers would prefer to do a USDA loan, but perhaps the areas in which they are looking are not USDA-eligible. Larger urban and surrounding areas are not eligible, since the point of the program is to encourage rural development. Still, a surprising number of developed suburban areas are still eligible.

Recommended Reading: Can You Refinance A Mortgage Without A Job

What Sort Of Community Do I Need To Buy A Home In To Qualifyfor A Usda Loan

USDA loans are often called “Rural Development Mortgages.” As aresult, people often think they need to buy in a rural community in orderto qualify. However, the USDA’s definition of “rural” in this case is farbroader than you may think. Many small towns and smaller suburbancommunities also qualify.

To see if a house or area you’re interested in would qualify for a USDA loan, check out this USDA property eligibility map.

Usda Mortgage Eligible Geographic Areas

The property must be located in a USDA-eligible area. Borrowers can search USDAs maps to browse certain areas or pinpoint a specific address. If you are unsure if a property is eligible, check with a USDA loan officer here

Think your area is not eligible? Well, about 97% of United States land mass is USDA-eligible, representing 109 million people. Many properties in suburban areas may be eligible for USDA financing. Its worth checking, even if you think your area is too developed to be considered rural. The USDA eligibility maps are still based on population statistics from the census in the year 2000. This is a unique opportunity to finance a suburban home with this zero-down mortgage program before the USDA updates their maps.

Don’t Miss: Monthly Mortgage On 1 Million

Usda Loans For Realtor Clients

On Q Financial works with you and your clients to find the best loan programs to match their needs and ensure that well close on time.

We offer products and services to make sure your clients have the simplest mortgage experience with our Simplicity mobile app, On Time Closing Guarantee, Multicultural Advantage, quality service, and more.

Construction And Rehab Loans

If youre building a home, a construction loan lets you finance the cost of the lot, materials, labor, and permits. One option is a construction-only loan which only covers the building process. Youll then refinance into a permanent mortgage upon completion of the home.

Another option is a construction-to-permanent loan. This covers the construction cost and the completed home. Conventional, FHA, VA, USDA, and jumbo programs have construction loan options.

If youre buying and renovating an existing fixer-upper home, you can also finance the purchase price and eligible renovations into a single rehab loan.

Rehabilitation loan options include:

Read Also: 10 Year Treasury Yield Mortgage Rates

How Much Does Mortgage Insurance Cost

Not every potential homebuyer can afford the traditional 20% down payment. In fact, many Americans struggle to pull together enough finances for a substantial down payment on a mortgage. However, that doesnt mean your dream home is out of reach. When that happens, potential buyers can still purchase their property with the help of mortgage insurance. Mortgage insurance is one of the ways lenders protect themselves from potential loss. And while its a common cost, it doesnt last forever. Consider consulting a financial advisor on how to make sure your mortgage doesnt disrupt your financial plan.

Where Does The Property Need To Be Located

The property you purchase or refinance must be located within the rural boundaries that the USDA sets forth. These boundaries are created based on the latest census and change periodically. Typically, a large portion of the United States is considered rural in the eyes of the USDA, which means many people are eligible for this program based on the location of their property alone. In general, the USDA considers any area that is open country or has a population less than 10,000 to be rural.

Also Check: Can I Get A Reverse Mortgage On A Condo

Does Mortgage Insurance Go Away With Usda

US Department of Agriculture loans to borrowers do not have mortgage insurance as of this writing. The mortgage insurance on USDA guaranteed loans has been replaced by an annual guarantee fee. The guarantee fee, which is paid to USDA by the approved lender and usually included in an existing mortgage payment, is an annual expense.

Am I Eligible For A Usda Loan

Eligibility requirements for USDA loans depend on your area and your lender. There are income limits borrowers must not exceed in order to qualify they vary by geographic region and family size. A complete list of income limits by area and family size is available at the USDA.gov website.

Additionally, homes must be located within USDA-allowed zones, which are typically in rural areas or less densely populated suburban areas. To find out if you qualify, check the zone map at the USDA.gov website.

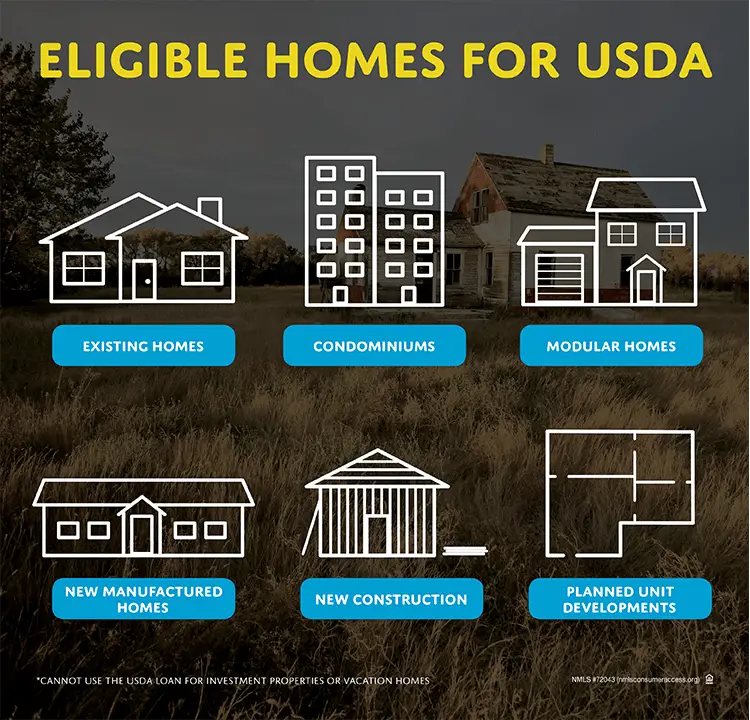

Finally, homes must be owner-occupied as USDA loans cannot be used for investment properties or vacation homes.

You May Like: Rocket Mortgage Loan Requirements

Usda Loan Fees And Requirements

USDA loans help make homeownership more affordable for buyers in rural and suburban communities. You will need to complete an application and meet your lenders credit, income, and financial requirements to get your USDA loan approved. You will need to pay closing costs too. Heres what else you need to know about USDA loans.

Can You Refinance A Usda Mortgage Loan

Yes. There’s nothing that says you need to keep your original USDA loan forever. It can be a great idea to refinance to take advantage of lower interest rates. You might also be able to get rid of mortgage insurance.

However, there’s quite a bit more to the story. For starters, you could refinance a USDA loan with another USDA loan, or replace it with a conventional loan. You might do what’s called a rate-and-term refinance to lower your interest rate or reset your loan term. Or, you might want to take cash out of the home when you refinance. To learn more about refinancing in general, check out our comprehensive refinancing guide.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

Is There Mortgage Insurance On Usda Loans

October 7, 2018 By JMcHood

USDA loans are a government program that provides low to middle-income borrowers with 100% financing. If you fit the income requirements, you can buy a home in a rural area with no down payment. Many people want to know if the USDA then charges mortgage insurance or PMI on the loan, like conventional loans charge.

Usda Home Loan Eligibility

In order to be considered eligible for a USDA home loan, borrowers must meet specific guidelines.

Eligible Geographic Areas: To get a USDA home loan, the property you buy must be in a USDA designated rural area, but its not all farmland. Almost 97% of the U.S. is eligible, which includes small towns and suburbs. The USDA Mortgage eligible area requirement map will show you all the areas where you can use this loan.

Income limits: The USDA loan was originally designed for low to moderate income earners. The programs guidelines define income level as being up to 115% of the areas median income. In many parts of the country, this can be quite generous. For lower income buyers, a households entire income is considered during the application process, which helps increase eligibility. This can include income from a child or other family member living in the house but who isnt listed on the loan application.

USDA home loans differ based on the kind of loan youre interested in, but they all have the same eligibility requirements.

Also Check: 10 Year Treasury Yield And Mortgage Rates

** Pmi Could Be Canceled On A Conventional Mortgage If The Following Conditions Are Satisfied:

- You submit a written request for cancellation

- The borrower must be current on the loan. For the definition of being current, check the CFPB definition here

- You are current on the payments required by your loan

- If requested and at the borrowers expense, evidence satisfactory to the note holder that the value of the property has not declined below its original value , and that there are no subordinate liens on the property

Keep in mind that each mortgage company has differing procedures so this is not a guarantee but for the most part, these are correct. Also, on second homes or investment properties, the PMI may not automatically cancel like a primary residence.

What Are The Usda Loan Requirements

There are three main factors the USDA considers when determining your eligibility. First, you’ll need to buy a home in a designated area. Next, your household income cannot exceed USDA income thresholds for your place of residence — 15% above the local median income. Finally, you’ll also need a credit score of at least 640, though contributing some cash toward a down payment can negate this requirement. If you meet the first two specifications but have a low credit score, you might still qualify for a USDA direct loan or FHA loan.

Otherwise, the requirements are pretty pedestrian. You’ll need to be a US citizen, green-card holder or noncitizen national. Your mortgage payment cannot exceed 29% of your monthly income, and your debt-to-income ratio must be no more than 41% of your monthly salary. You’ll also need to use the home as your primary residence, not have a record of breaking mortgages or commitments to other federal programs and meet any other lender-specific requirements.

Don’t Miss: Reverse Mortgage Mobile Home

Do You Pay Pmi On Usda

There is no need to have private mortgage insurance, or PMI, on USDA loans, since mortgage insurance does not cover all loans. Although USDA loans come with two types of fees PMI kind those are not what PMI charges. In a mortgage loan, there is an upfront guarantee fee, which is equal to 1 percent of the loan amount.

Usda And Fha Home Loans: The Basics

USDA and FHA loans are government loans backed by the U.S. Department of Agriculture and the Federal Housing Administration , respectively. These government agencies don’t actually give you a loan directly they protect your lender against loss if you default on your loan.

As non-conforming loans, USDA and FHA loans dont have to adhere to housing standards set by government-sponsored enterprises like Fannie Mae and Freddie Mac. However, like other types of loans, government-backed loans have their own qualifying criteria..

Recommended Reading: Recast Mortgage Chase

Good Neighbor Next Door

If youre a teacher, a law enforcement officer, a firefighter, or an EMT, you might qualify for the U.S. Department of Housing and Urban Developments Good Neighbor Next Door program.

Good Neighbor Next Door can offer up to a 50% discount when buying a home in a targeted revitalization area. You must live in the home for at least three years to qualify.

Ask your mortgage lender for more information if youre interested in GNND.

Usda Loans: What They Are And Who’s Eligible

Whether you’re moving to the suburbs or the country, this federal mortgage program could save you thousands.

Have you stumbled upon USDA loans during your mortgage search? USDA loans are backed by the US Department of Agriculture — yes, you read that right — as part of its Rural Development program, which promotes homeownership in smaller communities across the country. If you don’t have enough money saved for a down payment or if you’ve been denied a conventional loan, you have a good chance of qualifying for a USDA loan.

Contrary to popular belief, these loans are not just designed for homebuyers in completely rural areas — in fact, 97% of the land in the US is eligible for a USDA loan. This means even if you’re moving just outside of a city, chances are pretty high that you’re moving to a USDA-designated area. That’s great news for the increasing number of buyers looking to jump ship from crowded urban apartments to homes with more square footage and land, following the pandemic.

Let’s find out if this rural development home-buying program is right for you.

Recommended Reading: Reverse Mortgage For Condominiums

Mortgage Insurance For Usda Loans

All USDA loans require mortgage insurance. The first premium charged is an upfront one-time payment mortgage insurance premium that is financed into the loan amount and usually totals around 1 % of the loan. The second is an annual mortgage insurance premium, which is .35% of the loan amount divided by 12. The MIP is divided into 12 installments and are part of your monthly mortgage payments. Check out our Loan Calculator for the monthly breakdown of your mortgage.

Usda Loans For First Time Home Buyers

USDA loans can be a great solution for First Time Home Buyers with lower incomes and could offer 0% down in rural areas. On Q Financial offers our On Time Closing Guarantee, Simplicity mobile app with our Mortgages Simplified technology, On Time Closing Guarantee, Multicultural Advantage, and more to help qualifying home buyers achieve their dreams of home ownership. Talk to your local On Q Mortgage Consultant to get started.

Don’t Miss: Recasting Mortgage Chase

Usda Vs Conventional Vs Fha Vs Va Mortgage Insurance

Heres the bottom line: if you qualify for a USDA loan, you may save considerably on overall mortgage insurance costs, including upfront and ongoing fees. Ultimately, you may be able to buy a home with no down payment and lower monthly costs.

Heres a breakdown of the comparative insurance costs for USDA loans versus FHA, VA, and conventional loans for a $200,000 mortgage.

| Loan Type |

|---|

The Usda Guarantee Fee

The lender guarantee is partially funded by the USDA mortgage insurance premium, which is 1.00% of the loan amount . The loan also has a 0.35% annual fee .

The annual fee is paid monthly in twelve equal installments. For each $100,000 borrowed, the upfront fee is $1,000 and the monthly premium is $29.

The borrower can roll the upfront fee into the loan amount or pay it out-of-pocket. Compared to other loan types like FHA, or the private mortgage insurance on conventional loans, the USDA mortgage insurance fees are among the lowest.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

What Is The Minimum Credit Score For Usda Loans

Most lenders will lend people with a minimum of 620 as their credit score under the USDA loan program. However, if you have a lower score, you are not completely banned. According to the fine print, your loan might be approved if you experienced an extenuating circumstance that lowered your credit score.

Some of the acceptable extenuating circumstances include the following.

- Medical emergency

- Layoff due to reduction in workforce

- Other events outside your control.

Note that the extenuating circumstance must be a one-time event that will not recur. It should not be caused by your inability to manage your finances. If you have an extenuating circumstance but are not sure whether you qualify, talk to a lender.

USDA loans are not limited to buyers who have challenged credit scores. They offer fantastic value and the lowest interest rates for all types of borrowers. If you have a credit score of at least 680, you will enjoy a streamlined approval process. You dont need to provide verification of rent at this point.

Buy A Home Outside The City Limits With Usda

About USDA Home Loans

The United States Department of Agriculture gives borrowers the opportunity to own a home outside of the city limits. There are several benefits of a USDA loan,including flexible credit underwriting requirements and no down payment required.

Were here to make the USDA home loan process easier, with tools and knowledge that will help guide you along the way, starting with our

Well help you clearly see differences between loan programs, allowing you to choose the right one for you whether youre a first-time home buyer or a repeat buyer.

The USDA Loan Process

- Complete our simple

- Receive options based on your unique criteria and scenario

- Compare mortgage interest rates and terms

- Choose the offer that best fits your needs

*USDA Guaranteed Rural Housing loans subject to program stipulations and applicable state income and property limits. Fairway is not affiliated with any government agencies. These materials are not from HUD or FHA and were not approved by HUD or a government agency.

Read Also: Rocket Mortgage Requirements

Do Usda Loans Require Pmi

Do you want to buy a home but worry about coming up with a down payment? A USDA loan can ride to the rescue, thanks to its 0% down payment option.

There are a lot of reasons to love USDA loans: 100% financing, competitive interest rates, flexible credit score requirements.

But a lesser-known reason to appreciate these government-backed mortgages is that mortgage insurance for a USDA loan is typically lower than FHA loans or the private mortgage insurance youd pay on a conventional loan.

Lower mortgage insurance isnt as sexy as no down payment or competitive interest rates, but it does affect how much your home will ultimately cost you.

And when comparing loan options, all of your cost factors count.