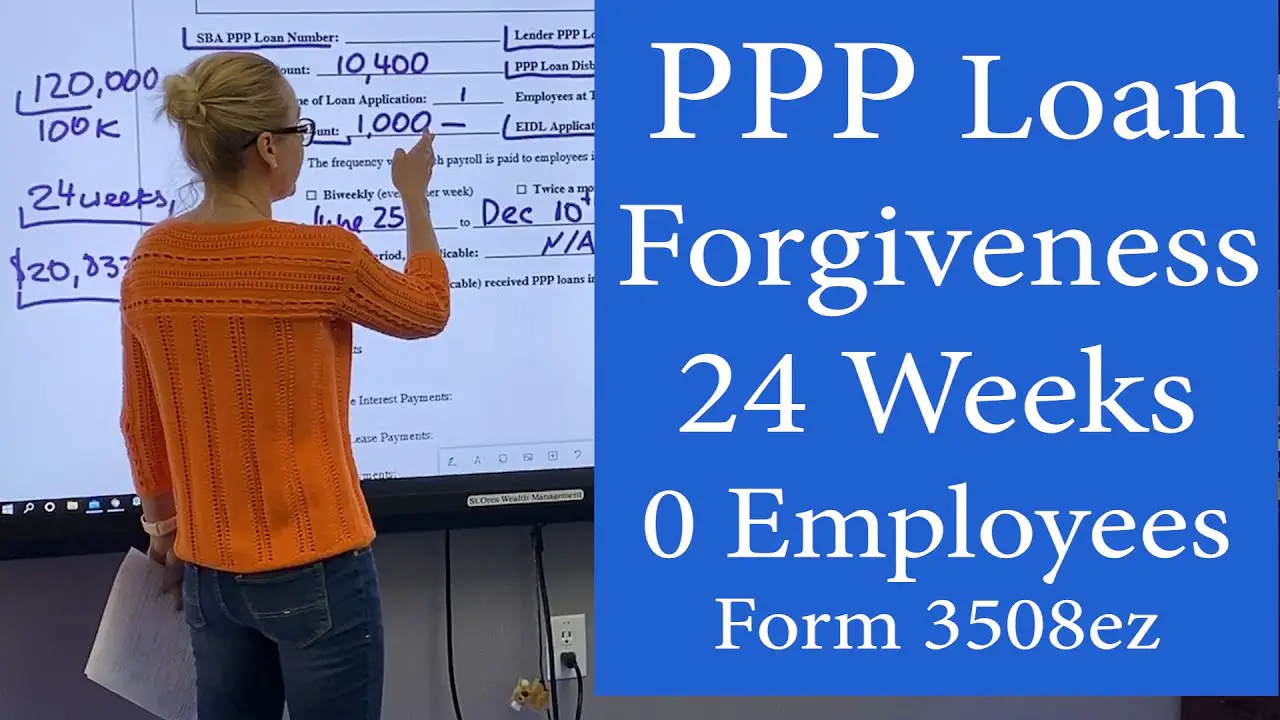

Ppp Loan Forgiveness: You Need To Apply

The CARES Act requires that you apply to your lender for loan forgiveness at the end of the eight- to 24-week period following disbursement of your loan . To apply, you must submit the following:

- The total amount requested to be forgiven

- Verification of the number of full-time employee equivalents on payroll and their pay rates, including IRS payroll tax filings and state income, payroll, and unemployment insurance filings

- Verification of your payments for covered mortgage interest, rent/lease obligations, and utilities

- Certification from an authorized representative of your company that the supplied documentation is true and that the amount forgiven complies with PPP guidelines

Your lender must make a decision on your application for forgiveness within 60 days.

Student Loan Guideline Changes

Prior to June 2015, student loans did not present nearly as many problems as they have since that date. What happened?

While it may be an oversimplified explanation, in short, new rules were created for all federally backed loans to specifically address the future unknown or variable status of some student loan repayment plans.

Federally backed mortgages include Conventional loans that follow Fannie Mae or Freddie Mac underwriting guidelines, FHA, VA, and USDA mortgage loans.

After June 2015, any student loan repayment plan other than a fully amortized repayment plan that will pay the loan in full at the end of the loan term is going to be treated differently, depending on the type of mortgage you are trying to qualify for.

Student loans that are deferred, in forbearance, or on an income influenced repayment plan like IBR, IDR, PAYE, REPAYE and Graduated payment plans are now subject to wildly different outcomes depending on what type of mortgage loan you use and the experience of your loan officer.

What If You Still Cant Afford Your Mortgage Payments After Forbearance

The worstcase scenario: Forbearance ends and you still cant pay your monthly mortgage. What can you do?

Youll probably need to consider disposition options, says Boies.

This may include selling your home if you can no longer afford it. Foreclosure, short sale, and deedinlieu are other ways of disposing of a home you cant afford.

Boies warns, These options may be damaging to your credit and should be reserved until youve exhausted all other solutions.

Read Also: Does Rocket Mortgage Service Their Own Loans

How Does Debt Forgiveness Work

Depending on the type of debt you have, you may qualify for total debt forgiveness or a partial debt forgiveness option that makes your debt easier to manage. With debt settlement, you hire a company to negotiate a one-time, lump-sum payment with your creditors for less than the amount you owe.

Debt settlement is ideal for people with more than $10,000 of unsecured debt from medical bills, utility bills or credit cards. The process usually takes two to four years, and it may lower your credit score initially.

However, sometimes a debt settlement company is unable to reach an agreement with your creditors. In that case, you still have to pay off your entire original debt amount and any fees you might owe to the debt settlement company. Secured debts, such as car loans and mortgages, are not eligible for debt settlement.

You might consider filing for bankruptcy. Filing for bankruptcy may discharge some or all your debts, including medical bills, unsecured loans, credit cards and utility bills. Depending on the type of bankruptcy you file for, you may have to forfeit some of your possessions or still repay your debts over time. Bankruptcy can send your credit score plummeting up to 200 points and stay on your credit report for seven to 10 years, so its often a last resort.

What Has President Biden Been Doing To Offer Mortgage Relief

According to a White House press release: “Shortly after taking office, the Biden-Harris Administration extended the foreclosure moratorium and mortgage forbearance enrollment period for homeowners with government-backed mortgages to provide relief to struggling homeowners.” Additionally, as part of President Biden’s American Rescue Plan $9.961 has been provided for the Homeowner Assistance Fund, encouraging loan modifications and payment reduction options on all federally backed mortgages.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How To Request Homeowner Assistance Funds

Homeowner assistance funds are in the process of being distributed to states for redistribution to homeowners. The U.S. Department of the Treasury has provided guidance for states to use in developing their individual HAF plans.

You will request funds from your state after your states HAF plan has been approved and its system is up and running. Meanwhile, the National Council of State Housing Agencies Homeowner Assistance Fund webpage features a map showing the status of each states HAF to date.

Mortgage Forbearance End Dates

Under the CARES Act, homeowners with conventional, FHA, VA, or USDA loans could request an initial home loan forbearance for up to six months. They could also request a sixmonth extension, for up to one year of total forbearance.

Forbearance plans are based on when you requested them, explains David Shapiro, president and CEO of EquiFi Corporation.

That means homeowners who entered forbearance plans early in the coronavirus pandemic are likely nearing their forbearance end dates.

For example:

- Say you have a conventional mortgage loan

- You initially requested forbearance on September 1, 2020

- At the end of your sixmonth forbearance period, you requested a sixmonth extension

- Your current forbearance plan would be set to expire on September 1, 2021

Remember that when you exit forbearance, youll need a plan to make up the payments you missed during that period. Here are your options.

Don’t Miss: Chase Recast Calculator

Sema Loan Forgiveness Program

This is a scholarship and loan forgiveness program that rewards individuals who start a career in the automotive industry. You must work for an employer that is part of the Specialty Equipment MarketAssociation .

Note: This program is the law, but Congress has failed to allocate money to the program.

Check out some other options for student loan forgiveness for engineering majors.

This program will pay $2,000 toward outstanding student loans, mailed directly to your lender.

You can learn more here.

Biden Administration Extends Federal Student Loan Payment Pause Through August

The Biden administration announced last week that it has officially extended the federal student loan payment pause through Aug. 31, 2022. This extension gives federal student loan borrowers an extra four months of breathing room.

Federal student loan payments and interest accrual will continue to be stalled through August, as will collections activities on defaulted loans. The Education Department made it clear in a press release that the extension is necessary to allow for a responsible phase-down of pandemic relief.

The department also stated that it will allow federal student loan borrowers with defaulted student loans or delinquent payments to reenter repayment in good standing and promised that it will use this time to improve federal servicer accountability.

How this affects student loans

Borrowers can continue to pause their federal payments through Aug. 31, though they can also choose to make interest-free payments doing so reduces the total principal balance once interest begins to accrue again in September. Federal borrowers who choose not to make payments should establish a repayment plan and research all of their relief options in advance of the August deadline.

Don’t Miss: Recast Mortgage Chase

Targeted Eidl Advance: Non

You may not use your EIDL Advance for:

- Replacing lost sales or profits

- Business expansion

- Refinancing long-term debt

Consequences of EIDL non-permitted use: If you use all or part of your advance for non-permitted uses, it will not be forgiven and may be subject to immediate payback.

Because the EIDL loan and loan advance are considered disaster funds, if the SBA determines you misused the funds, the penalty could be immediate repayment of one-and-a-half times the original loan amount, plus possible criminal charges.

Tax Years 2007 And 2008

In the wake of the 2007 American housing market collapse and subsequent mortgage crisis, the U.S. Congress enacted the Mortgage Forgiveness Debt Relief Act of 2007 and Emergency Economic Stabilization Act of 2008 .

These Acts include provisions under federal law that, subject to certain conditions, that allows taxpayers to exclude from their federal taxable income the discharge of debt on their principal residence that they would otherwise have been required to report .1 The special federal rules relating to qualified principal residence apply to debt reduced through mortgage restructuring, as well as to mortgage debt forgiven in connection with a foreclosure.

For Conformity information see Tax Years 2009 through 2012.

Federal guidelinesYou have COD income as the result of a foreclosure on other property, such as:

|

You may still be able to exclude COD income under other provisions if:

|

| If | Then |

|---|---|

| The amount of debt relief for federal purposes is the same as or less than the California limit. | No adjustment is necessary on Schedule CA . |

| The amount of debt relief for federal purposes is more than the California limit. | Include the amount in excess of the California limit on Schedule CA line 21f, column C. |

Don’t Miss: Rocket Mortgage Loan Requirements

Federal Mortgage Debt Relief

If your loan is owned by Fannie or Freddie, your mortgage servicer is required to evaluate you for a forbearance plan of up to 12 months if youve run into financial difficulty due to COVID-19, such as job loss, reduction in work hours or illness. The servicer is not required to obtain documents demonstrating your hardship.

Forbearance allows you to temporarily pause or reduce your mortgage payments during a period of financial difficulty. You pay the difference at a later date.

Under the FHFAs coronavirus relief plan, your servicer is required to work with you on a mortgage modification by the time your forbearance period is over so that you can afford your new monthly payments. It also must suspend foreclosures and evictions through at least mid-May.

If your loan is owned by Fannie Mae, you can contact your loan servicer or the enterprises Disaster Response Network for individual attention. Freddie Mac asks borrowers to contact their loan servicer directly for help.

What Are The Major Changes To Student Loan Forgiveness

The Biden administration announced major changes to student loan forgiveness. As a result, student loan forgiveness will become more accessible and you can get student loan forgiveness more easily. By simplifying student loan forgiveness, for example, public servants can count prior student loan payments made for FFELP Loans and Perkins Loans, count late payments, get credit if they used the wrong plan for student loan repayment, and count student loan payments made before student loan consolidation. This is in addition to 22 months of student loan relief and temporary student loan forbearance as a result of the Covid-19 pandemic. As a result, student loan borrowers collectively will get $110 billion of student loan cancellation. .

Read Also: Rocket Mortgage Payment Options

The Bottom Line Mortgage Debt Relief Can Be Complicated

We know tax exclusion and QPRI laws can be tricky. That said, we hope weve cleared up a few of your questions. Even if you dont qualify for one exemption, you might be eligible for another. In order to pay fewer taxes on your mortgage debt relief, you need to be knowledgeable about these exceptions.

With that in mind, the best strategy is to talk to someone with expertise in mortgage and taxes, like our Reali agents. Well help you sort through your concerns and help you decide what solution is best for your situation. We can also help you with a home loan refinancing as well as traditional home loans. Contact us today!

Tags

Form 982 For Mortgage Forgiveness

Use IRS Tax Form 982 to claim the mortgage forgiveness tax break. On this form you can report the exclusion of forgiven debt for your mortgage loan that is associated with principal forgiveness, foreclosure, a deed-in-lieu of foreclosure, or a short sale. Note that you will only need to fill out part of Form 982 because it is also used for other purposes. Complete the appropriate lines and then attach Form 982 to your regular income tax return.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

Options After Your Forbearance Plan Ends

If youre ready to resume payments at the end of the forbearance period, be prepared for what happens next.

Forbearance is not loan forgiveness. Borrowers will still owe the principal and interest that they didnt pay during the forbearance period, notes says Dongshin Kim, assistant professor of finance and real estate at Pepperdine Graziadio Business School.

Borrowers will need to make both the regular mortgage payments and also all the payments they missed while the loan was in forbearance.

You will typically have several options for repayment once forbearance expires:

Biden Still Wants Congress To Cancel Student Loans

Biden hasnt wavered from his position that Congress should cancel student loans for borrowers. . As a presidential candidate, Biden said that Congress should cancel up to $10,000 of student loans for borrowers. Psaki reminded the public of the presidents position. And I would note that, again, he would encourage Congress to send him a bill canceling $10,000 in student debt, something that he talked about looking forward to signing on the campaign trail. Biden has said he would sign any bill on student loan cancellation that Congress sends him. To date, Congress hasnt sent him a single bill on wide-scale student loan cancellation. .

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

White House: Biden Is Considering Student Loan Forgiveness

Biden is still considering student loan forgiveness. Here was the most recent exchange between a reporter and White House Press Secretary Jen Psaki at Wednesdays White House press briefing:

Reporter: And has the President, at this point, ruled out a possible executive-level cancellation on a wide-scale of student debt?

Psaki: He has not ruled out, but I don’t have any update on that.

The good news for student loan borrowers is that wide-scale student loan cancellation isnt off the table. However, its unclear whether that means its a strong possibility. Based on Psakis comments, it doesnt appear that Biden has modified his position since extending the student loan payment pause through August 31, 2022. . Biden hasnt commented recently on any plans for wide-scale student loan cancellation. Rather, he has been focused on targeted student loan cancellation for specific groups of student loan borrowers such as public servants, borrowers with disabilities, and borrowers who got student loan forgiveness through borrower defense to repayment. .

To 24 Weeks Of Expense Coverage

Expenses eligible for forgiveness are those that are incurred over the 8 to 24 week period, starting from the day you receive your PPP loan from your lender. This is not necessarily the date on which you signed your loan agreement.

You do not need to adjust your payroll schedule. All payroll that your employees incur over the 8 to 24 week period is eligible for forgiveness, even if the actual payout date falls outside the covered period.

Recommended Reading: Monthly Mortgage On 1 Million

Treatment Of Canceled Debt And Taxable Income

Despite the extensions, Congress has declined to make the mortgage forgiveness exclusion permanent. With the latest pandemic stimulus figure greatly reduced from the original $2 million and terminated in 2025, future extensions are unlikely.

Once the exclusion is gone, well be back to the old rules Internal Revenue Code Section 61 and only by or legal insolvency will those forgiven mortgage debt on their principal residence be able to avoid taxes on the amount waived.

If you own a farm, you may have more luck getting canceled debt excluded from taxes. There are three elements that will allow farming debt to not be considered taxable. The debt has to be directly tied to operation of the farm more than half of your income from the prior three years has to be from farming and the creditor has to be a person or agency regularly engaged in lending. As with most tax policy, there are a lot of ins and outs to this, so its best to get help from a tax professional in order to get the best bang for your buck.

Other instances when canceled debt isnt considered taxable by the IRS are:

Student Loan Forgiveness Is Possible If Your College Tricked You

Borrower defense to repayment is a rule from the Obama administration that protects student loan borrowers who were misled by their college or university. This can include several examples, ranging from misleading employment statistics to false promises about tuition or accreditation. With borrower defense to repayment, you could get partial or total student loan forgiveness. .

Read Also: How Much Is Mortgage On 1 Million