Why Do Interest Rates Impact The Uk Housing Market

Rising interest rates can increase mortgage costs, making repayments more expensive and increasing the overall size of the home loan.

Rising rates can also hit house prices. A one percentage point rise in the base rate could reduce house prices from between 2% and 11% according to Sir Jon Cunliffe, the Bank of Englands deputy governor.

However many experts suggests that the UK housing market is robust enough to weather any rise in interest rates, especially with demand outstripping supply.

These 4 Main Predictions Will Be Reviewed:

A Historic Opportunity To Potentially Save Thousands On Your Mortgage

Chances are, interest rates won’t stay put at multi-decade lows for much longer. That’s why taking action today is crucial, whether you’re wanting to refinance and cut your mortgage payment or you’re ready to pull the trigger on a new home purchase.

The Ascent’s in-house mortgages expert recommends this company to find a low rate – and in fact he used them himself to refi . and see your rate. While it doesn’t influence our opinions of products, we do receive compensation from partners whose offers appear here. We’re on your side, always. See The Ascent’s full advertiser disclosure here.

Recommended Reading: How 10 Year Treasury Affect Mortgage Rates

The Rules That Could Stop You Remortgaging

The ability to remortgage and/or fix your mortgage has become a bit more difficult over recent years as the rules surrounding the affordability tests when applying for a mortgage were tightened slightly. Lenders always had to make sure borrowers could still afford to pay the mortgage if interest rates went up.

However, if you were simply remortgaging, lenders didn’t have to apply the more stringent affordability tests. Some lenders did just that which made remortgaging a bit easier. But new rules removed this option for lenders which could end up leaving some borrowers stranded on their existing deals which is why it’s important to calculate the impact of an interest rate rise and seek advice from a mortgage expert by following the steps below. It will take you a few seconds but could prevent your mortgage repayments crippling your finances in the future and help you lock into low rates while they are still available.

If you are planning on fixing your mortgage rate when interest rates do start going up, mortgage rules may prevent you â leaving you stranded on your existing deal with your mortgage repayments rising in line with the bank base rate or your lender’s whim.

Will Mortgage Rates Go Down In December

Mortgage rates keep trending sideways, only making small moves week-to-week driven by the opposing pulls of worsening coronavirus numbers and an improving economy. However, the latest news from the Federal Reserve points to rate hikes on the horizon for 2022.

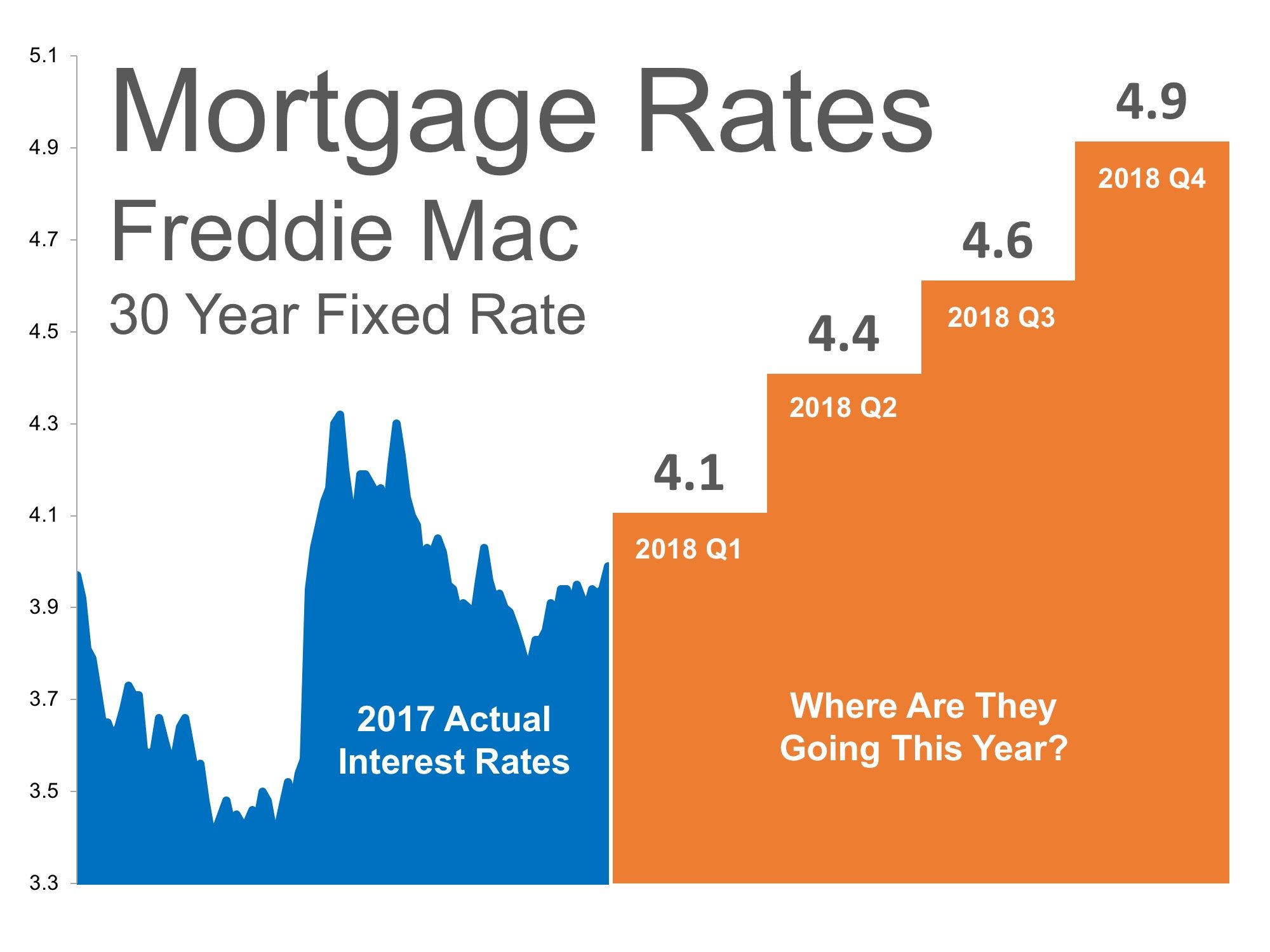

Mortgage rates inched up as a result of economic improvement and a shift in monetary policy guidance, said Freddie Mac Chief Economist Sam Khater.

We expect rates to continue to increase into 2022 which may leave some potential homebuyers with less room in their budgets on the sideline.

Most housing experts are expecting an overall upward trend through the end of 2021 and into 2022. And thats because the forces pushing mortgage rates higher arent going away:

- Inflation Higher inflation typically leads to higher rates. And the annual U.S. inflation rate was at a 30-year high in October

- Economic recovery Retail sales increased by a wider margin than expected in October. And unemployment claims fell to their lowest level since March 2020. Both are strong indicators of an improving economy, which should lead to increased rates

- Fed policy changes As the Federal Reserve continues to pull back on its Covid-era stimulus, mortgage rates should continue to rise

But there are other forces working to pull rates down, which is why weve seen spikes and drops over the past few weeks.

As has been the case since 2020, Covid trends are one of the biggest indicators for mortgage rates right now.

Recommended Reading: Rocket Mortgage Vs Bank

Im Considering Buying A House Will Mortgage Rates Go Steadily Higher

They already have in the past few months, partly in anticipation of the Feds moves, and will probably keep doing so.

Still, mortgage rates dont necessarily rise in tandem with the Feds rate increases. Sometimes, they even move in the opposite direction. Long-term mortgages tend to track the rate on the 10-year Treasury note, which, in turn, is influenced by a variety of factors. These include investors expectations for future inflation and global demand for U.S. Treasurys.

Global turmoil, like Russias invasion, often spurs a flight to safety response among investors around the world: Many rush to buy Treasurys, which are regarded as the worlds safest asset. Higher demand for the 10-year Treasury would lower its yield, which would then reduce mortgage rates.

For now, though, faster inflation and strong U.S. economic growth are sending the 10-year Treasury rate up. The average rate on a 30-year mortgage, in turn, has jumped almost a full percentage point since late December to 3.85 percent, according to mortgage buyer Freddie Mac.

How Rates Should Factor Into The Homebuying Process

There are a number of factors that homebuyers should consider when buying a home and mortgage rates, of course, are one of them.

While the low rates we’ve grown accustomed to over the last two years have gotten most of the attention, a decision about whether or not to purchase a home ultimately should not come down to interest rates.

“You shouldn’t make your buying decisions of a home based on where interest rates are,” said Shant Banosian, the executive vice president of sales at Guaranteed Rate.

Banosian, the firm’s No. 1 loan originator in the US, believes that now is as good a time as any to purchase a home. Rates are increasing from the historical lows of 2020 and 2021, but are still, generally, at a reasonable rate. He said there’s no need to panic just yet.

Although a higher interest rate will increase your monthly payment, the change might not be as drastic as you’d expect.

For example, a few months ago, you may have been able to lock in a 3.5% rate on a 30-year mortgage for $300,000. Your monthly payment on the principal and interest would have been $1,347.13.

Let’s say you apply for a mortgage for the same amount now, but you lock in a 4% rate instead. With the higher rate, that monthly payment is $1,432.25. Yes, you’d prefer the lower interest rate but your monthly payment goes up by less than $100.

Also Check: Can You Get A Reverse Mortgage On A Condo

How Will Higher Interest Rates Affect American Finances

WASHINGTON Americans who have long enjoyed the benefits of historically low interest rates will have to adapt to a very different environment as the Federal Reserve embarks on whats likely to be a prolonged period of rate hikes to fight inflation.

Record-low mortgage rates below 3 percent, reached last year, are already gone. Credit card interest rates and the costs of an auto loan will also likely move up. Savers may receive somewhat better returns, depending on their bank, while returns on long-term bond funds will likely suffer.

The Feds initial quarter-point rate hike Wednesday in its benchmark short-term rate wont have much immediate impact on most Americans finances. But with inflation raging at four-decade highs, economists and investors expect the central bank to enact the fastest pace of rate hikes since 2005. That would mean higher borrowing rates well into the future.

On Wednesday, the Feds policymakers collectively signaled that they expect to boost their key rate up to seven times this year, raising its benchmark rate to between 1.75 percent and 2 percent by years end. The officials expect four additional hikes in 2023, which would leave their benchmark rate near 3 percent.

Chair Jerome Powell hopes that by making borrowing gradually more expensive, the Fed will succeed in cooling demand for homes, cars and other goods and services, thereby slowing inflation.

How A Mortgage Rate Lock Can Help Turn Back Time

Homebuyers should know that theres a way to freeze time on rising interest rates. How? By paying to lock in your rate for a certain number of days. So even if interest rates spike, you get to keep the original rate.

The most common rate lock is for 30 days, says Jon Meyer, a licensed loan officer at The Mortgage Reports. But you can lock a rate for 15 days, 30 days, 45 days, or more.

Homebuyers pay for a rate lock and spend more money the longer their locks in place. So you pay only for what you know youll need.

If a lender quotes you 3.5% and its a 30- or 45-day lock periodbut you plan to close in 10 to 15 daysperhaps you could select a 15-day lock for something even lower, like 3.375%, Meyer explains.

If youve barely begun your house hunt, however, paying for a longer rate lock may be worth every penny for your peace of mind. The last thing you want is to be racing around trying to find a house right before your rate lock is up!

Read Also: Rocket Mortgage Launchpad

Will Mortgage Rates Keep Dropping

2021 saw an initial drop in mortgage rates. In fact, January recorded the lowest average rate ever: 2.65% for a 30year fixed loan, according to Freddie Mac.

Unfortunately, theres little chance mortgage rates will keep dropping in 2021.

The 10 experts we interviewed were unanimous: rates will either stay the same or creep toward the high3% range over the next 6 months.

Its very unlikely interest rates will drop substantially below 3 percent by yearend Bruce Ailion, Relator, real estate attorney

Its very unlikely interest rates will drop substantially below 3 percent by yearend, cautions Ailion.

Housing prices are expected to continue to rise due to demographic factors, low interest rates, and a strong economy creating demand pressure. Homebuyers who wait face the double challenge of higher home prices along with higher inflation. Waiting will likely cost buyers more.

For this reason and others, it may make sense to lock in a low rate sooner versus later if you are financially ready.

How Much Will Rates Rise

While a mortgage rate forecast can never be an exact science, industry experts have been making their own predictions based on economic history and the Feds recent announcements.

The National Association of Realtors predicts the 30-year fixed rate mortgage will rise slowly up to near 3.5% in the first half of the year and 3.9% by the end of the year.

Freddie Mac predicts the 30-year fixed rate mortgage to average 3.6% in 2022.

The Mortgage Bankers Association predicts the 30-year fixed rate mortgage rates to climb to 4% by the end of 2022.

At the end of 2021, the average 30-year fixed rate mortgage was 3.11%. So, while interest rates are predicted to rise, industry experts do not foresee skyrocketing rates a sigh of relief!

Also Check: 10 Year Treasury Vs Mortgage Rates

Mortgage Rate Forecast Canada 2022 2023

The decisions Canadians make on their mortgage in 2022 are in large part dependent on the mortgage rate forecast. Its a decision that will affect homeowners for several years to come and could lead to thousands of dollars in mortgage interest savings.

Here will look at where mortgage rates are likely headed, based on a current review of economics, years of in-depth mortgage market study, and working with thousands of mortgage files.

Overview Of 2022 Mortgage Rates Forecast

We interviewed eight mortgage, housing, and finance professionals to get their mortgage rate forecasts for 2022.

Average interest rate predictions put 30-year fixed rates at 3.88% and 15-year fixed rates at 3.27% in 2022.

| Industry Expert | |

| Al Lord | 3.75% |

| Stephen Adamo | 4% |

| Lyle Solomon | 4% |

| 3.88% | 3.27% |

Put in perspective, its important to remember that mortgage interest rates have remained relatively affordable. And for the foreseeable future, they shouldnt stray too far from alltime lows.

Ponder that, 40 years ago, mortgage interest rates were close to 17%. With that in mind, an increase to even 4% by the end of 2022 doesnt seem too scary.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

Canadian Mortgage Rates Are Going To Climb

Mortgage borrowing costs are likely to reach pre-pandemic levels soon. Our median 5-year fixed-rate forecast is 2.55% by the end of Q3 2021. Based on the most bullish yield forecast, it would rise to 2.65%. The downside yield forecast is the same as the median.

Most institutions have consistent near-term expectations. That sounds weird, but it makes sense. Near-term forecasts are the most visible, with the least number of variables compounding. As forecasts are further out, well see the gap widen as their difference in outlook is magnified.

The Best Way To Find Out Your Mortgage Options

Consumers are unaware of the new rules and the fact they could leave some people stranded on their current deals. At best their mortgage repayments will increase in line with the Bank of England base rate, at worst at the whim of their lender.

Most consumers will wrongly assume that using a price comparison site is the best thing to do when looking to remortgage. However, bear in mind

- many mortgage deals are only available via mortgage advisers so don’t appear on price comparison sites

- not everyone can get the rates quoted on price comparison sites

- price comparison sites don’t take into account your credit rating or personal circumstances which will determine whether a lender will actually lend to you. For example you may not be eligible for the deals quoted by comparison sites and won’t find out until they credit check you. That in itself will then hinder future mortgage applications

That is why you are almost always better off dealing with an independent mortgage adviser rather than going it alone. This is why 70% of borrowers now use a mortgage adviser to find the best deal from a lender who will actually lend to them. Therefore, we recommend getting in contact with a mortgage advisor yourself. You can arrange a free remortgage review in just 30 seconds using this online tool*.

If you already have an independent mortgage broker that you trust then I suggest you get in touch with them as there has never been a better time to remortgage.

Also Check: Mortgage Recast Calculator Chase

How Will That Affect The Housing Market

If youre looking to buy a home and are frustrated by the lack of available houses, which has led to bidding wars and eye-watering prices, thats unlikely to change anytime soon.

Economists say that higher mortgage rates will discourage some would-be purchasers. And average home prices, which have been soaring at about a 20 percent annual rate, could at least rise at a slower pace.

Al Lord Founder Lexerd Capital Management

30year mortgage rates forecast: 3.75%

15year mortgage rates forecast: 3%

Al Lord, founder of Lexerd Capital Management, say two widely talked about factors will influence the direction of mortgage rates in 2022.

The first is the Feds tapering of the asset repurchases program. Reducing asset repurchases creates less money supply in the market and increases interest and mortgage rates, he says.

Second is the shortage of homes for sale and limited new construction activity. The high home prices and the limited supply of homes, either from resale or new construction, will keep the demand for mortgages lower compared to 2021. As a result, mortgage rates will tend to remain near the same or marginally decline, I believe. The result of these two counteracting factors will lead to higher mortgage rates by the middle of 2022, if not earlier.

Expect inflation to accelerate in 2022 while home prices continue to escalate.

Thats why my advice to homeowners is to purchase a property sooner than later and lock in still moderate mortgage rates, adds Lord.

Also Check: Reverse Mortgage For Condominiums

Is A Federal Tax Credit Available To Help First

The federal first-time home buyer credit, offered after the housing crisis, expired in 2010. Legislation was introduced in Congress in April to offer an expanded credit, under which eligible home buyers could get a federal tax credit of up to 10 percent of their homes purchase price to a maximum of $15,000. The bills prospects are uncertain. Some states offer their own tax credits or other help for first-time buyers. Check with your states housing finance agency.

Tendayi Kapfidze Is The Head Of Economic Analysis At Us Bank

After a surge like that seen in January, rates could stay around the current level for a while, Kapfidze says. But thats just a guess.

He says the increase in rates could be momentary or could be long-term, but its not a speed that can continue for a long time.

Rates could be on an upward trend for the next year or so, he says. But that depends on what happens with the economy, what happens with inflation, what happens with the labor market.

Omicron, and the unpredictability of whats next for the pandemic, makes it hard to anticipate exactly what will happen to mortgage and refinance rates in February. COVID will also have a lot to say about where the market ends up. Theres a lot of uncertainty given the virus is still with us. It could throw curveballs at any time, he says. Unless you know what the virus is going to do, its unlikely that you know what interest rates are going to do, and I dont know that anybody knows what the virus is going to do.

Recommended Reading: Rocket Mortgage Conventional Loan