How A 10year Refinance Could Help You Pay Off Your Loan Faster

Many people refinance their existing 30year mortgage to a new 30year loan without a second thought.

But many homeowners should consider refinancing to a shorter term.

Suppose youve already been paying your home loan for 10, 15, or 20 years. Resetting the clock on your mortgage means youll be repaying your loan for 30 more years.

Remember, your interest payments reset with the new term, too.

If your new mortgage rate isnt substantially lower than the original one, you could end up paying more in interest overall even though your monthly payments are lower.

Many lenders offer 10, 15 or 20year refinance loans that could help you secure a lower rate and pay off your mortgage when you originally planned.

10year refinance rates are low, just like 10year home purchase rates. And they let you pay off the loan sooner than you would have otherwise.

Especially if youre older and retirement is a much closer prospect than it used to be paying off your mortgage as soon as you can might make your golden years much more comfortable.

What Is The Average 30

As of July 16, 2019, the average interest rate for a 30 year mortgage is 3.83% with an annual percentage rate of 3.95%, according to bankrate.com. With a 30-year fixed loan, youâll pay off your house in 30 years and your monthly principal and interest mortgage payment with stay the same each month. Interest rates are highly dependent on your own credit score, your location, and other situational factors, so ask your preferred lender for your most current rate, or visit the Consumer Finance Protection Bureau.

First Mortgage Direct Best No

First Mortgage Direct, the online division of First Mortgage Solutions, offers both purchase loans and refinancing to borrowers in several states.

Strengths: First Mortgage Direct never charges hidden fees and doesnt participate in limited-time offers, so you can rest assured youre getting the best rates and terms available based on your circumstances.

Weaknesses: First Mortgage Direct is only available in California, Colorado, Connecticut, Florida, Georgia, Idaho, Illinois, Kansas, Missouri, Nebraska, New Jersey, Oregon, Pennsylvania, South Carolina, North Carolina, Tennessee, Texas, Virginia and Washington.

Recommended Reading: Rocket Mortgage Payment Options

What Is A 15

A 15-year mortgage will be paid off completely in 15 years if you make all the payments on schedule. These mortgages typically have a fixed rate, which keeps the principal and interest rate the same for as long as you hold the mortgage. Your taxes and insurance costs can change, though.

In 2018, lenders wrote nearly 22 times as many 30-year home purchase mortgages as they did those with 15-year terms, according to NerdWallet analysis of Home Mortgage Disclosure Act data. Among loans for nonmanufactured, single-family homes, 3.6 million were for 30-year terms vs. roughly 165,000 for 15-year terms.

The monthly payment on a 15-year loan is typically much higher than that of a 30-year mortgage.

No doubt many borrowers shy away from these shorter home loans when they learn the monthly payment can be more than 50% higher around $2,017 a month for a 15-year mortgage vs. $1,318 for a similar 30-year loan, for example.

Consider the pros and cons of 15-year, fixed-rate mortgages to decide which home loan is best for you.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

Check : Do You Have A Sufficient Emergency Fund

I often say it’s worthwhile having a cash emergency fund for those who are debt-free – apart from their mortgage .

Yet, when you overpay most mortgages the cash is gone. So if you’ve an emergency and you’d overpaid with all spare cash, you could be forced to borrow again instead. Your earlier overpayments may not stop lenders charging you for being in arrears if you miss monthly repayments .

So it’s always a good idea to keep an emergency fund in a top savings account I always say three to six months’ worth of cash is a good guide, enough to live on if you lost your job, for example. If you’re thinking of using newly arriving extra income to overpay your mortgage, then build up an emergency fund first.

This applies even if the calculator shows you’d be better off overpaying your mortgage. It’s what’s known as ‘a premium for liquidity’. In other words, it’s sacrificing some interest for easy access to cash when needed.

The exception mortgages with flexible features

Mortgages with flexible features allow you to overpay and borrow the money back. So you can overpay the mortgage, then withdraw cash without penalty if you need it again. If you have one of these, there’s no problem putting all spare cash in the mortgage.

This example shows how it can work:

On a £150,000, 25-year mortgage, offsetting £25,000 of savings could mean you pay off your mortgage one year and 10 months early, and save £3,350 in interest, while still having access to your savings if needed.

Refinancing Starts Your Loan Over

Since refinancing replaces your current mortgage with a new one, it starts the loan over. And in many cases, borrowers reset the clock with another 30year term.

Starting a fresh 30year loan term can offer the biggest monthly savings. Yet this isnt always the smartest move, depending on the number of years left on your existing mortgage.

If youve had the original loan for five, 10, or even 15 years, starting over with a new 30year mortgage means youll pay interest on the home for a total of 35 to 45 years. That could increase the total amount of interest you pay over the life of the loan even if your monthly payments go down.

Of course, this doesnt always happen.

Some people receive a payoff date thats similar to their original loan. For this to happen, you have to refinance into a shorter term.

Lets say youve already had the original mortgage for five years. Instead of another 30year mortgage, you can refinance into a 15 or 20year mortgage. Or, if youve had the original loan for 20 years, you could refinance into 10year mortgage.

Just note that shorterterm loans almost always have higher monthly payments. Thats because you have to repay the same loan amount in a shorter time frame.

But, as long as your new interest rate is low enough, you should see significant overall savings with a shorter loan term.

Don’t Miss: Reverse Mortgage Manufactured Home

How To Research The Best Mortgage Deals Yourself

Alternatively, if you do want to go it alone the first thing you need to work out is what fixed rate you will get. This will depend on, among other things, the amount you want to borrow compared to the value of your property , your credit rating, your earnings and the type of mortgage you want.

A good starting point is our mortgage calculator , powered by Habito. This can give you an idea of the best and cheapest deals you may be eligible for.

If You Arent Bothered By Higher Monthly Payments A 10

While 30-year fixed-rate mortgages remain the most popular way to finance a home purchase, many homeowners opt for a 15-year loan when they refinance to shorten their loan term.

When mortgage rates are extremely low, a shorter-term loan can be an attractive option for refinancing. The payments may be nearly the same as the previous 30-year loan, depending on the remaining loan balance being financed and the change in interest rate.

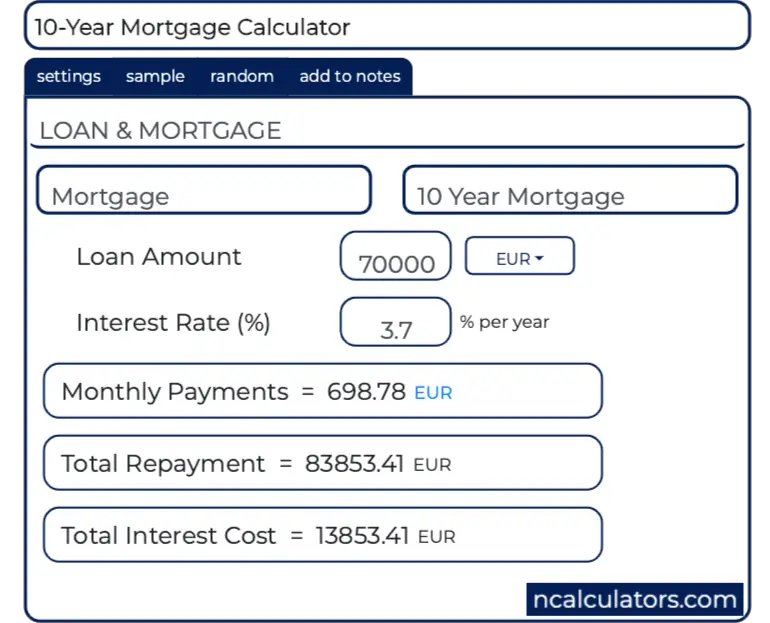

While the 10-year loan is one of the least utilized options, it does fit well in some clients financial plan, Tom Trott, branch manager at Embrace Home Loans Frederick, Md., office, wrote in an email. The 10-year mortgage loan is not as popular as longer loans, such as 20- and 30-year mortgages. Clients must have significant discipline and strong cash flow to qualify for 10-year mortgages.

For borrowers with a specific goal in mind, such as paying off their mortgage before retirement or before paying college tuition, a 10-year loan could be a good option.

The two main advantages of a 10-year fixed-rate mortgage, wrote Trott, are the lower interest rate vs. longer-term loans and the faster pace at which you can build equity in your home.

Also Check: Recasting Mortgage Chase

Is It Worth Getting A 10

If you can lock in a low interest rate, have a low debt-to-income ratio, and work a steady job with a good income, a 10-year fixed mortgage may be the best option. In fact, youâd save more than $100,000 over the lifetime of a $200,000 loan at a 4% interest rate by opting for a 10-year mortgage over a 30-year.

Plus, mortgages with shorter terms typically come with lower interest rates, so you could save even more â if you can afford those high monthly payments. In this scenario, your monthly payment would be about $1,000 higher with a 10-year loan.

Speak To A Mortgage Broker For Free

Readers of Moneyfacts.co.uk can speak to a mortgage broker for free if they choose our preferred broker Mortgage Advice Bureau.

Disclaimer

Information is correct as of the date of publication . Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfacts.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions.This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.

Also Check: Can You Refinance A Mortgage Without A Job

If My Payments Can Go Up Why Should I Consider An Arm

The initial interest rate for an ARM is lower than that of a fixed-rate mortgage, where the interest rate remains the same during the life of the loan. A lower rate means lower payments, which might help you qualify for a larger loan.

How long do you plan to own the house? The possibility of rate increases isn’t as much of a factor if you plan to sell the home within a few years.

Do you expect your income to increase? If so, the extra funds might cover the higher payments that result from rate increases.

Some ARMs can be converted to a fixed-rate mortgage. However, conversion fees could be high enough to take away all of the savings you saw with the initial lower rate.

Less In Total Interest

![Do You Know the Cost of Waiting? [INFOGRAPHIC] Do You Know the Cost of Waiting? [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/do-you-know-the-cost-of-waiting-infographic-keeping.jpeg)

A 15-year mortgage costs less in the long run since the total interest payments are less than a 30-year mortgage. The cost of a mortgage is calculated based on an annual interest rate, and since you’re borrowing the money for half as long, the total interest paid will likely be half of what youd pay over 30 years. A mortgage calculator can show you the impact of different rates on your monthly payment, as well as the difference between a 15- and a 30-year mortgage.

You May Like: Mortgage Rates Based On 10 Year Treasury

The Short Answer: Interest Rates And Remortgaging

On the 11th March 2020 the Bank of England made an emergency rate cut in a bid to reduce the economic impact of the coronavirus outbreak. Interest rates were cut from 0.75% to 0.25%, meaning they were back to the previous record low, last experienced between August 2016 and November 2017. In a surprise move, the Bank made a further emergency rate cut on the 19th March 2020, reducing rates to an all-time low of 0.10%.

Fast-forward to winter 2021 and inflation is rising, consistently hitting levels above the 2% target the Bank of England has for it. The Bank’s Monetary Policy Committee decided on 16 December to increase the base rate to 0.25% to try to control the situation. Its hope is that by making small rate rises over a period of time, it will be equivalent to “easing off the accelerator rather than applying the brakes” for the economy.

This has serious implications for the mortgage market, which will inevitably start to price in these predicted rises, as well as this initial rise. The message is, if you are in a position to remortgage, it will pay to act sooner rather than later to secure the best deal.

Year Fixed Rate Mortgage Faqs

Whether or not a 10 year mortgage is right for you will depend on your circumstances. If you are confident that you will stay in your property for at least a decade and you would like the knowledge that your payments will stay the same for a long time, it may be an option for you. However, be sure to consider the potential downsides to a 10 year mortgage before you commit.

Most mortgages allow you to overpay a set amount of money each year towards your mortgage. The amount that you can repay will depend on your individual policy, so check with your lender before making any overpayments and incurring an expensive early repayment charge.

One of the main advantages of fixing your mortgage interest rate for a long time period is that regardless of any changes in the base rate, your monthly mortgage payments will remain the same. This can be helpful for budgeting and planning ahead, as you have the security of knowing what your payments will be.

If you want the security of knowing what your mortgage repayments will be you may want to consider remortgaging. If you are in a fixed rate deal you will need to wait until that deal ends before remortgaging, otherwise you may have to pay a fee.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

Todays Mortgage Refinance Rates: 3 Key Rates To Sink Money

Our goal here is Credible Operations, Inc., NMLS Number 1681276, referred to as Credible below, which gives you the tools and confidence to improve your finances. Although we do promote products from our partner lenders who pay for our services, all opinions are our own.

Check out the mortgage refinancing rates Jan. 24, 2022, which are down from last Friday.

Based on the data compiled by Credible, the current mortgage refinance rates fell for three repayment terms and the longest term for unchanged last Fridays.

- 30-year fixed-rate refinance: 3.625%, unchanged

- 20-year fixed-rate refinance: 3.250%, down from 3.375%, -0.125

- 15-year fixed-rate refinance: 2.750%, down from 2.875%, -0.125

- 10-year fixed-rate refinance: 2.625%, down from 2.875%, -0.250

Here. Actual rates may vary.

Even though mortgage refinance rates have been steadily climbing since the end of 2021 and into 2022, rates for 20-, 15- and 10-year terms slipped down today, offering homeowners multiple money-saving opportunities. Since mortgage rates are often fluctuating from day to day, homeowners may want to lock in a rate that is much higher today.

These rates are based on the assumptions shown Here. Actual rates may vary.

How Can I Find Current 10

NerdWallets mortgage rate tool can help you find competitive 10-year fixed mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

Also Check: How Much Is Mortgage On A 1 Million Dollar House

How Do I Pay Off A 30

There are a few ways to pay down a 30-year mortgage in 15 years. First, you could consider refinancing your current mortgage into a 15-year fixed mortgage. Another way is to make extra payments towards the principal amount or make biweekly payments equally one additional mortgage payment per year. This might not get you to the 15-year mark, but the amount of principal would most certainly go down.

Refinance With A Shorter

A shorter term on the mortgage means it goes away sooner, but at the cost of a much higher monthly payment and perhaps some out of pocket closing costs. Examine the loan closely.

The monthly payment on a 30-year, $200,000 mortgage at 2.5% would be $790 a month.

The monthly payment on a 15-year, $200,000 mortgage at 2.25 % would be $1,310.

Thats another $520 a month to finish paying off your mortgage 15 years sooner.

30 Years vs 15 Years of Payments| 30 Years of Payments |

|---|

| $235,830 |

| *For a $200k mortgage |

The bottom line on this decision is the bottom line: Can you afford the higher monthly payment of a 15-year loan, or are you better off contributing extra each month when you can to a 30-year payment?

Also Check: Mortgage Recast Calculator Chase

Is It Hard To Get A 10 Year Mortgage

Since the loan is amortized or spread out over 10 years, the principal portion of the payment is higher than all other mortgage terms. This makes the loan more difficult to qualify for due to debt-to-income ratio calculations. Most loan programs require a maximum debt-to-income ratio of 43 percent.