What Other Financial Factors Should I Consider

Theres one more important step in assessing your homebuyer status: considering upfront costs and big-picture finances. Here are some other costs to take into account when determining what kind of house you can afford:

- Down Payment Its recommended to put down 20% or more of your homes purchase price if possible to lower your payments and avoid private mortgage insurance.

- Closing Costs and Fees On average, homebuyers will pay around 2% to 3% of their total loan in closing costs. In some instances, there may be extra fees associated with the closing.

- Comfortable Budgeting The calculations described in this article show what you can comfortably afford, but setting your sights slightly below those numbers may allow for better financial stability.

- Lifestyle Budgeting If you like to go on a vacation every year or have an expensive hobby, these costs are worth keeping in mind. Dont just budget for your home, but for all the great things life has in store for you.

Figure Out 25% Of Your Take

Lets say you earn $5,000 a month . According to the 25% rule we mentioned earlier, that means your monthly house payment should be no more than $1,250.

Stick to that number and youll have plenty of room in your budget to tackle other financial goals like home maintenance and investing for retirement.

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Don’t Miss: Rocket Mortgage Vs Bank

How To Determine How Much Home You Can Afford

Buying a house is exciting, especially as you tour new places and eventually fall in love with a home. But how do you determine your price range? To set realistic expectations, consider your personal finances, borrowing options, and the total costs of buying.

Heres what well cover:

Follow The 25 Percent Rule

Theres a straightforward way to make sure you can afford your mortgage while managing your other goals, according to Eve Kaplan, a certified financial planner in New Jersey. Housingincluding maintenanceideally shouldnt consume more than 25 percent of a household budget. This goes for folks who rent, too, Kaplan says.

Mortgage bankers would disagree. They use various calculations to figure out how much you can afford, and the amount is often much higher than financial planners recommend. A common measure that brokers use is the debt-to-income ratio , which, for a qualified mortgage, limits your total debt payments, including your mortgage, student loans, credit cards, and auto loans, to 43 percent.

Lets say you and your spouse make a combined annual income of $90,000, or about $5,600 per month after taxes. Based on your DTI and depending on your other debts, you could be approved for a mortgage of $600,000. That might sound exciting at first, but with a monthly payment of about $3,225, it would eat up more than half your take-home pay.

Following Kaplans 25 percent rule, a more reasonable housing budget would be $1,400 per month. So taking into account homeowners insurance and property taxes, youd be better off sticking to a mortgage of $240,000 or less. If you have enough for a 20 percent down payment, the maximum house you can afford is $300,000.

Recommended Reading: Reverse Mortgage Mobile Home

Save A Bigger Down Payment To Make Your Home More Affordable

Remember, your down payment amount makes a big impact on how much home you can afford. The more cash you put down, the less money youll need to finance. That means lower mortgage payments each month and a faster timeline to pay off your home loan! Just imagine a home with zero payments!

Now, were always going to tell you that the best way to buy a home is with 100% cash. But if saving up to pay in cash isnt reasonable for your timeline, youll probably wind up getting a mortgage.

If thats you, at the very least, save up a down payment thats 10% of the home price. But a better idea is to put down 20% or more. That way you wont have to pay private mortgage insurance .

PMI protects the mortgage company in case you dont make your payments and they have to take back the house . PMI is a yearly fee that usually costs 1% of the total loan value and isyou guessed ityet another expense thats added to your monthly payment.

Lets backtrack for a second: PMI may change how much house you thought you could afford, so be sure to include it in your calculations if your down payment will be less than 20%. Or you can adjust your home price range so you can put down at least 20% in cash.

Trust us. Its worth taking the extra time to save for a big down payment. Otherwise, youll be suffocating under a budget-crushing mortgage and paying thousands more in interest and fees.

What Proportion Of Net Income Should I Spend On My Mortgage

Q I’m interested to know what the recommendations are regarding what proportion of our net monthly income should be going on mortgage payments. We’re currently on a very low rate , but we are looking to move to the south east and increase the mortgage.

Based on the amount we’re looking to borrow I’ve calculated monthly repayments at 5% to make sure they’re still affordable, as interest rates can really only go in one direction now, but not sure if I’m still being over-cautious. SH

A There’s nothing wrong with being over-cautious. Making sure that you’ll be able to afford your mortgage if interest rates rise is precisely what the Financial Services Authority would like lenders to do when assessing mortgage affordability. The FSA is worried that current low mortgage rates are disguising the full impact of unaffordable lending and the true extent of consumers’ vulnerability to a rise in interest rates.

As to what proportion of your income should go on mortgage payments, there seems to be a general view that if you spend more than half your income on servicing debt of all types not just mortgage you are heading for trouble. Some experts suggest that the total amount you pay towards your mortgage should not exceed 28% of your gross income. And you should make sure that you don’t go over 36% of gross income for the total amount you spend on all borrowing, including mortgage.

Also Check: Can I Get A Reverse Mortgage On A Condo

Use Our Mortgage Calculator To Determine Your Home Budget

Sure, you could crunch the numbers yourself by dividing a home price by 180 months and then multiplying the decreasing monthly principal balance by your interest rate. But if you’re anything like us, you probably broke a sweat just reading that formula.

To save yourself the time and headache of doing a ton of math, we built a mortgage calculator to do that for youphew!

Sticking with our example of an income of $5,000 a month, you could afford these options on a 15-year fixed-rate mortgage at a 4% interest rate:

- $187,767 home with a 10% down payment

- $211,238 home with a 20% down payment

- $241,415 home with a 30% down payment

- $281,650 home with a 40% down payment

Remember: This is just a ballpark! Dont forget that grown-up stuff like property taxes and home insurance will top off your monthly payment with another few hundred dollars or so . And if you think youll be buying a home thats part of a homeowners association , youll need to factor those lovely fees in as well.

For example, if you plug in a mortgage amount of $211,238 with a 20% down payment at a 4% interest rate, youll find that your maximum monthly payment of $1,250 increases to $1,515 when you add in $194 for taxes and $71 for insurance. To get that number back down to a monthly housing budget of $1,250, youll need to lower the price of the house you can afford to $172,600.

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Also Check: 10 Year Treasury Yield Mortgage Rates

What Happens When You Qualify For A Loan

To begin the mortgage process, youll need to meet with a lender and be prepared to provide proof of:

- Where you work

- Your assets

- How much you plan to put down on your home

Its likely your lender will approve you for more money than you should borrow. Just because you qualify for a big loan doesn’t mean you can afford it!

A good lender will clearly explain your mortgage options and answer all your questions so you feel confident in your decision. If they dont, find a new lender. A mortgage is a huge financial commitment, and you should never sign up for something you dont understand!

If youre ready to get prequalified for a mortgage loan, we recommend talking with Churchill Mortgage.

Getting A Second Mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

If you cant make your payments and your loan goes into default, you may lose your home. If thats the case, your home will be sold to pay off both your first and second mortgages. Your first mortgage lender would be paid first.

Read Also: Reverse Mortgage For Condominiums

Don’t Be Fooled By The 5

Kaplan says homeowners usually need to stay put for at least five years to make the closing costs of buying a home worthwhile. That’s a useful rule of thumb, but if you’re thinking of staying that long, you may be tempted to opt for a mortgage that’s higher than you can comfortably afford now. Be careful. Predicting future income isnt as easy as it may seem. Kaplan cautions that stretching your budget can backfire if you become unemployed for an extended period.

When they’re planning for the long term, many homebuyers may also see their home as an investment for the future, which can be an excuse for spending more today than they can easily afford. But real estate can be volatile, as we saw in the 2008 housing crash. Having too much of your net worth tied up in your home can be risky.

Calculate Your Down Payment

Considering what to offer on a home? Change the home price in the loan calculator to see if going under or above the asking price still fits within your budget.

You can also use our mortgage payment calculator to see the impact of making a higher down payment. A higher down payment will lower your monthly payments not only because it reduces the amount of money you borrow, but also because it can help you qualify for a lower interest rate. In some cases, a down payment of at least 20% of the homes purchase price can help you avoid paying private mortgage insurance .

Learn More About Buying a House

You May Like: Requirements For Mortgage Approval

How Does The 28/36 Rule Of Thumb Work

So, how do mortgage lenders use the 28/36 rule of thumb to determine how much money to lend you?

Lets say you earn $6,000 a month, before taxes or other deductions from your paycheck. The rule of thumb states that your monthly mortgage payment shouldnt exceed $1,680 and that your total monthly debt payments, including housing, shouldnt exceed $2,160 .

A mortgage lender may use this guideline to gauge or predict that youll be able to take on a certain monthly mortgage payment for the foreseeable future, Andrina Valdes, COO of Cornerstone Home Lending in San Antonio, told The Balance by email. The 28/36 rule answers the question: How much house can you afford to buy?

The rule of thumb should be something you calculate before you start shopping for homes, as it gives you an accurate estimate of how much home you can afford.

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Don’t Miss: Recasting Mortgage Chase

What’s The Difference Between Being Prequalified And Preapproved

A quick conversation with your lender about your income, assets and down payment is all it takes to get prequalified. But if you want to get preapproved, your lender will need to verify your financial information and submit your loan for preliminary underwriting. A preapproval takes a little more time and documentation, but it also carries a lot more weight when youre ready to make an offer on a home.

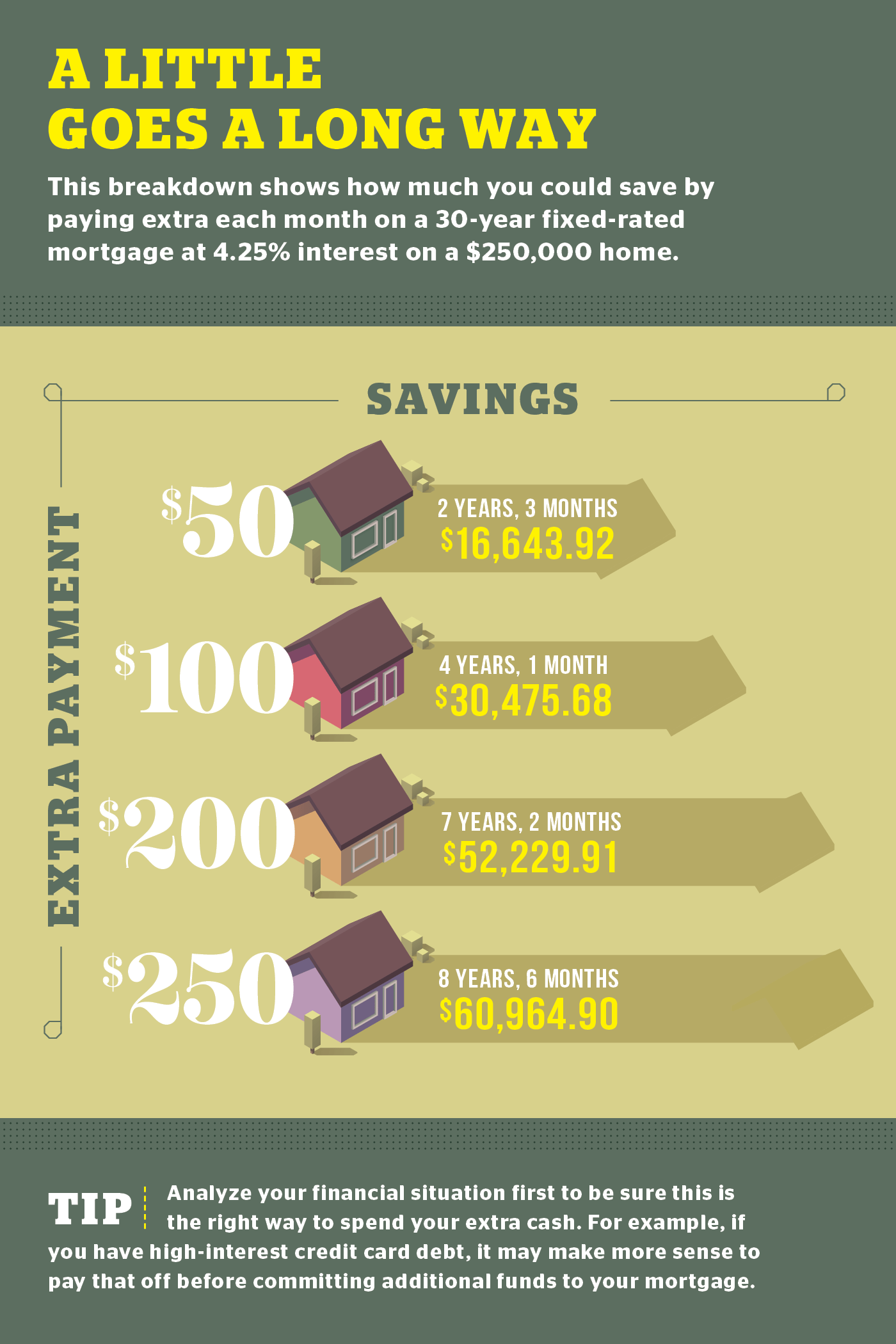

Factors To Consider When Paying Off The Mortgage Early

Living without any debt is an exciting goal, but paying off your mortgage needs to be done right. Here are some important considerations:

- Will you incur penalties for overpaying your mortgage?Some mortgage lenders have prepayment penalties or other loan terms designed to prevent you from prepaying. Make sure to contact your lender and read the fine print in your mortgage contract to determine if this applies to you.

- Do you have credit card or any other debts? Many other types of debt, like credit card debt, have higher interest rates. It’s usually more advantageous to pay off any consumer debt before you pay off the mortgage.

- Have you set aside a sufficient emergency fund? It’s generally a good idea to set aside money in an emergency fund to cover expenses that are not included in your budget or to protect from a rainy day. Build a solid financial foundation first!

- Is your debt oppressing you? Some people feel debt rules their lives. If debt is stressing you out, use the Mortgage Payoff Calculator to calculate how much extra money you need to put toward your mortgage every month to get out of debt sooner.

Once you’ve determined that you’re ready to pay off your mortgage, it’s time to start reaping the benefits!

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Recommended Reading: Can You Refinance A Mortgage Without A Job

Upfront Costs To Expect

Buying a home requires a lot of money from the get-go. Here are three factors to consider:

- Down payment: Do you have the minimum down payment amount your mortgage requires? You’ll need 3% for a conforming mortgage backed by Freddie Mac or Fannie Mae, 20% for a jumbo mortgage, and 3.5% for an FHA mortgage. You might not need any down payment for a USDA or VA mortgage.

- Closing costs: Closing costs include expenses like an application fee, appraisal fee, and settlement fee. Some lenders require you to pay some property taxes at closing, while others let you wait until your first monthly payment. According to mortgage technology company ClosingCorp, the average closing costs in 2020 were $6,087 including taxes, or $3,470 without taxes.

- Remaining savings: You probably don’t want to drain 100% of your savings to buy a home, only to find yourself in a bind if a financial emergency occurs. Think about how much money you want to have left in savings once you’ve made the down payment and covered closing costs.