How To Calculate Your Mortgage Repayments

Gauging the approximate cost of your monthly repayments using our mortgage calculator is easy. First, simply input in the total amount that you think youll need to borrow and detail how many years you would like the loan over normally for new mortgages for first-time buyers this will be around 25 years, however more lenders are now happy to offer mortgages over periods of up to 40 years.

Next, you need to specify the interest rate in order to calculate your monthly mortgage repayments. If you have no idea of the mortgage interest rate, you can always take a look at our mortgage comparison charts to get an idea of the deals currently available for your needs and circumstances.

Finally, our mortgage repayments calculator will need to know what type of loan repayment you need: capital and interest or interest only. Dont panic if you arent sure. Simply put, capital and interest repayments mean that each month you pay off a proportion of the sum borrowed plus interest, while interest only means that you are just paying off the monthly interest on your loan without ever repaying the sum youve borrowed. To find out more about the different types of mortgage repayment options and those that may be suitable for you check out our handy guide: Repayment and interest-only mortgages explained.

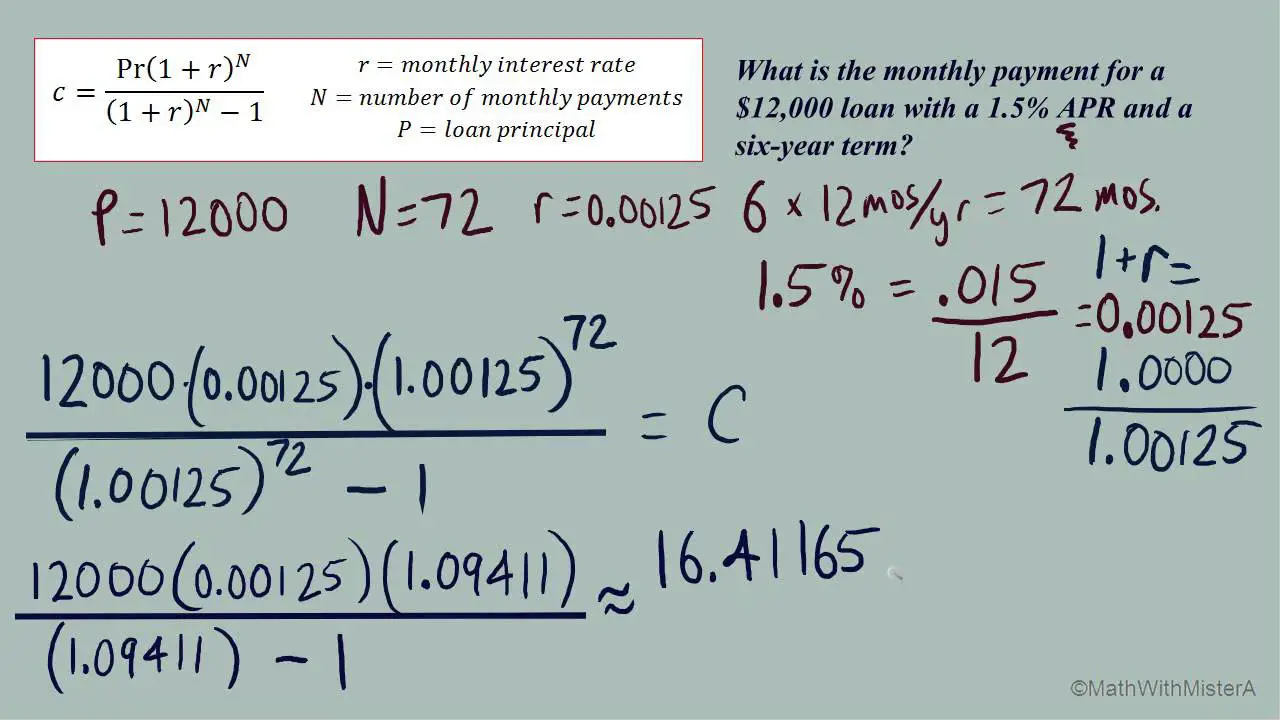

How Mortgage Payments Are Calculated

With most mortgages, you pay back a portion of the amount you borrowed plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each payment into principal and interest.

If you make payments according to the loan’s amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

The term, or length, of your loan, also determines how much youll pay each month. The longer the term, the lower your monthly payments will typically be. The tradeoff is that the longer you take to pay off your mortgage, the higher the overall purchase cost for your home will be because youll be paying interest for a longer period.

How Long Youll Stay In Your Current Home

When you refinance, there are origination and other closing costs associated with taking out the new loan. Because of this, its important to have a decent idea of the number of years you might stay in the home.

Your time in the home will help you calculate the breakeven point and determine whether its worth it for you to do the refinance. For instance, if it takes you 2 years to break even in payment and interest savings after paying closing costs, you know you have to stay in the home longer than that for the refi to make sense.

The key here is to have an idea of your situation. If you have some sense of what your future plans might be, then you can sit down and do the math.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Gross Debt Service Ratio

Your GDS ratio is based on your monthly housing costs , divided by your gross household income. For example, lets say you have a gross household income of $100,000 per year. If your new home costs you $3,000 per month, you would have a GDS ratio of 36%.

Your GDS ratio cannot exceed 39%, according to the Canada Housing and Mortgage Corporation .

Should I Borrow The Maximum Amount

It can be tempting to borrow your maximum mortgage amount and buy the most expensive property you can afford but that may not be the right thing to do. High monthly payments could leave you little wiggle room should interest rates go up, or your income go downor both!

This could also leave you house poor where you own a house, but you have no funds left to pay for everyday things without going into debt.

Borrowing less money could mean you buy a smaller house, but give you a better quality of life as your finances are not over-stretched.

Whats more, you may just find your deposit goes further. If you have £20,000 as a deposit, thats only 5% of a £400,000 property, but 10% of a cheaper £200,000 property. Instead of being restricted to 95% LTV mortgages, you can check out those 90% LTV deals that have invariably cheaper rates.

The other thing to remember is that mortgage products are usually arranged in a tiered fashion, with a lower interest rate offered every time your LTV goes down by 5%.

If youre looking at buying a property and your LTV would be 87%, you might consider raising a slightly larger deposit to push yourself into the 85% LTV threshold.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

How Do I Reduce My Monthly Mortgage Payments

There are many ways you can reduce your monthly mortgage costs if you find the amount you just calculated is too high for you to afford.

One of the simplest ways is to opt for a longer repayment term this will immediately reduce the amount you pay each month. However, think carefully before doing this as it wont reduce the total amount you pay over the loans term. Instead it will mean you end up paying more because of the extra interest youll be paying on the additional months or years added to your mortgage.

If you already have a mortgage you can remortgage. You could see if you can remortgage to a cheaper deal, or extend your loan term to make your monthly payments more manageable, allowing you to pay for other expenses and live more comfortably. Remember, extending your loan term will mean you pay more in total.

Also, putting together a larger deposit will reduce the monthly payments you have to pay. If you want to lower the financial impact of your mortgage repayments, why not wait a few years to save up a larger deposit?

An interest-only mortgage means your monthly repayments are smaller than they would be for a standard repayment mortgage, as you are only paying the interest on the amount you borrow. At the end of the mortgage term youll then pay off the initial capital you borrowed. Most interest-only mortgage holders do this using the proceeds from their property sale, although this comes with a risk as the property may have fallen in value.

How Much Deposit Do I Need To Get A Mortgage

In most cases, you will need a minimum of a 5% deposit to secure a mortgage, meaning youll need a 95% mortgage loan.

The size of the loan versus the property value is referred to as the loan-to-value ratio, or LTV. A 95% loan is often called a 95% LTV mortgage.

If you are able to save more, however, and can offer a 10, 15 or 20% deposit, youll increase your chances of being accepted for cheaper mortgage products.Not only will you need to borrow less, you will be charged a lower interest rate on the money you borrow. Its a win-win.

The cheapest mortgages are generally only available if you have a big deposit, or if youre remortgaging or moving house a large amount of equity in your property.

You May Like: Requirements For Mortgage Approval

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Calculate The Number Of Payments

The most common term for a fixed-rate mortgage is 30 years or 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

Recommended Reading: Reverse Mortgage Mobile Home

Things To Remember About Excel Mortgage Calculator

- The Excel shows the monthly payment for the mortgage as a negative figure. This is because this is the money being spent. However, if you want, you can make it positive also by adding sign before the loan amount.

- One of the common errors that we often make when using the PMT function is that we dont close the parenthesis, and hence we get the error message.

- Be careful in adjusting the interest rate as per monthly basis and loan time period from years to no. of months .

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how much your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

How Do Mortgage Lenders Calculate Monthly Payments

For most mortgages, lenders calculate your principal and interest payment using a standard mathematical formula and the terms and requirements for your loan.

Tip

The total monthly payment you send to your mortgage company is often higher than the principal and interest payment explained here. The total monthly payment often includes other things, such as homeowners insurance and taxes. Learn more.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Also Check: Chase Recast

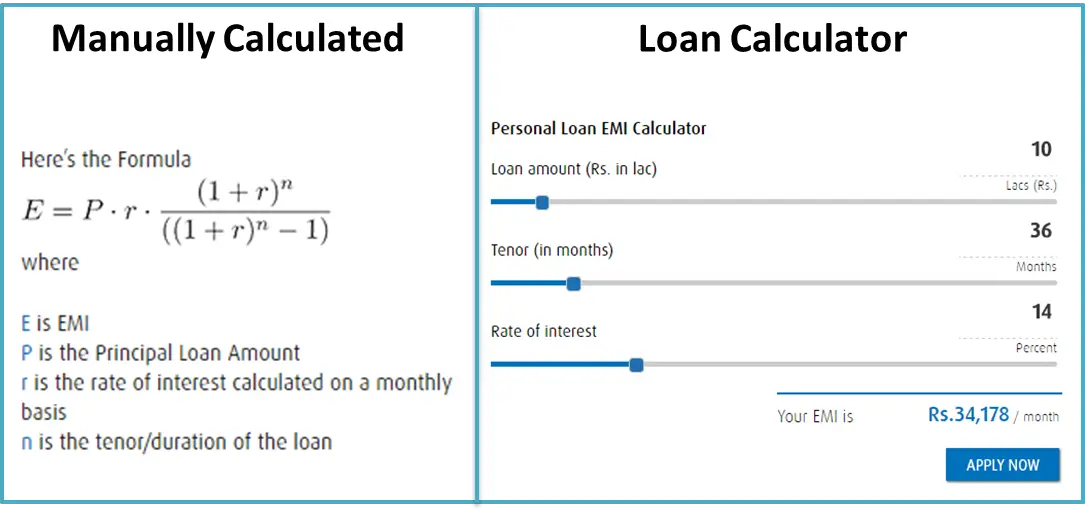

How Does The Money View Mortgage Loan Emi Calculator Work

Every loan is repaid through a set amount of money each month called EMI from the borrower to the lender until the loan amount has been repaid fully. The EMI amount is determined by the principal amount availed, the interest rate charged, and the repayment term.

Knowing the EMI amount that you will potentially have to pay will help you plan out your finances and check the impact of the same on your budget.

We understand that such calculations might be tedious and prone to mistakes. Therefore, we have designed our calculator to be as simple as possible. To use our calculator all you will need to do is as follows –

-

Enter the loan amount that you want to avail yourself of. You can use the slider to adjust the amount.

-

Next, provide the rate of interest and this can be adjusted by using the slider.

-

Lastly, use the slider to enter the repayment tenure. choose

Thats it! Three simple steps to find out the EMI amount you will have to pay. EMI calculation has never been simpler.

How Much Mortgage Can I Afford

How much mortgage you can borrow and how much mortgage you can afford are slightly different. While a lender may be prepared to let you borrow a lot, you may prefer a smaller mortgage so that you can still afford to do other things.Before you borrow the maximum amount, you should think about whether you could comfortably afford the monthly repayments on a large mortgage.

A general rule of thumb is that you don’t want to spend more than 30% of your take home salary on mortgage repayments.

Any more than that and you risk being “house poor” – where you own a house, but lack the money to do other important things

In London, where house prices are very high, it can be hard to keep your repayments under 30% of your income.

Before getting a mortgage, it is vital to work out what the total cost of home ownership would be for you. If your mortgage payments and household bills look like they will take up 40 or 50% of your income, you should consider getting a smaller mortgage.

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

Mortgage Loan Apr Explained

A mortgage loan APR stands for annual percentage rate, a way of showing the true cost of a home loan or other type of loan. It takes into account not only the interest rate you pay, but also the closing cost fees that are charged as part of the loan and expresses them in terms of an annual percentage. Our mortgage APR calculator makes it easy to calculate the numbers and compare lenders.

FAQ: Shopping for a mortgage can be confusing. Borrowers have to sort through a mix of interest rates, fees, points and all the rest to try to figure out what’s the best deal. Many borrowers make the mistake of focusing solely on the mortgage interest rate when they go shopping for a home loan. But the mortgage rate is only part of the picture. Closing costs and other fees can significantly affect the total cost of a mortgage. Discount points in particular can reduce your rate but mean much higher costs up front. The mortgage APR takes all of these into account and expresses them in terms of an interest rate.

Mortgage APR is defined as the annualized cost of credit on a home loan. It is the interest rate that would produce the same monthly payment on your loan amount with no fees as you would pay if you rolled all your fees into the loan itself.

That’s what this mortgage APR calculator can determine for you, in addition to calculating your interest costs and producing a full amortization schedule.

Whether The Home Is Too Expensive

Another thing a mortgage calculator is very good for is determining how much house you can afford. This is based on factors like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering emergency funds and any other financial goals. You dont want to put yourself in a position where youre house poor and unable to afford retiring or going on vacation.

Don’t Miss: Rocket Mortgage Vs Bank

What Will My Mortgage Cost

See examples of costs for different mortgage types, payment terms and interest rates.

The monthly payment and rate you’ll pay until your introductory period ends.

Follow-on payments and rate

The payments and rate you’ll pay after your introductory period ends if you dont change anything.

Use the annual percentage rate of charge to compare the cost of our mortgages, including interest and fees, with those from other lenders.

Mortgage fee

You can pay this fee when you submit a mortgage application, or add it to the amount you borrow.

Total of monthly payments

The information below shows roughly how your monthly payments will affect your mortgage balance over time. But they don’t include any other fees or payments you may need to make.

Loan to value

The percentage of the property value that you’re going to borrow. We divide your mortgage amount by the property value to work out the LTV.

Early repayment charge

The amount you’ll pay if you want to pay off the mortgage early or make an overpayment that’s more than we’ve agreed to.

Fixed-rate

Your rate stays the same for a set period, so your monthly payments remain the same even if our base rate changes.

Tracker

Your rate is a certain amount above our base rate. If base rate goes up or down, your payments will too .

Offset

Money you have in another account with us is used to lower the mortgage balance we charge interest on. All our offset mortgages are trackers.

Filter your results