Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whos suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you dont have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wont show up on your credit report as its usually counted as one query.

Finally, when youre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadas Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.

Td Bank Fixed Mortgage Rates

A TD Bank fixed rate mortgage can help reduce the risk of interest rates moving up in the future, by allowing you to lock in the current interest rate over your entire mortgage term. This can give peace of mind to homebuyers since the interest rate on their mortgage will not rise if interest rates do, however they will not benefit if interest rates go down. If you get pre-approved for a fixed rate mortgage on a future or current home, the interest rate will be guaranteed for 120 days. Even if interest rates go up during that time, you will be guaranteed the lower rate still.

| 2.74% | $1,843 |

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

Also Check: Chase Mortgage Recast Fee

What Drives Calgary’s Mortgage Outlook

Like most housing markets in Alberta, Calgarys mortgage market is heavily influenced by the health of the energy sector, primarily oil and gas. The citys economy is also driven by tourism thanks to its proximity to the Rocky Mountains and its annual Calgary Stampeded rodeo that draws crowds from around the world.

Housing has historically boomed when the oil and gas industry is performing well. But since oil prices plummeted in 2014-15 and 2020, Calgarys housing market has suffered due to rising job losses. Like most other regions, housing and mortgage demand are expected to remain weak into 2021 before starting to recover in 2021 or 2022.

Compared to more rural communities in Alberta, homes in Calgary are easier to sell and have higher prices. Nonetheless, mortgage underwriters often exercise slightly more caution with Calgary deals given ongoing difficulties in the oil and gas sector, which create risk of defaults, home price weakness and higher losses.

Mortgage default rates in the province stood at 0.52% as of January 31, 2020. Again, much of this is due to lost incomes from the struggling oil and gas industry. By comparison, the default rate was just 0.09% in Ontario and 0.15% in British Columbia.

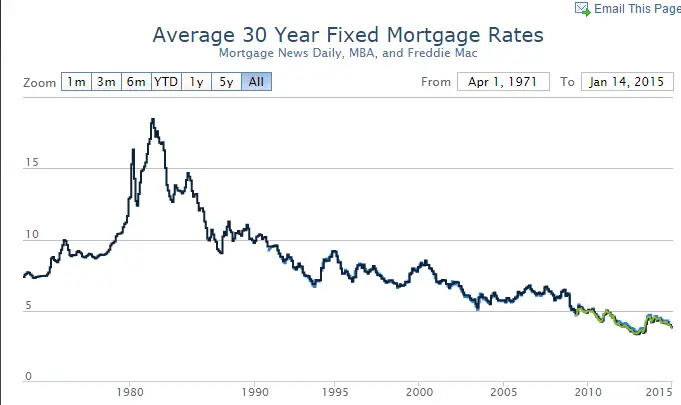

Historical Canada Mortgage Rates

Looking at historical mortgage rates is a good way to understand which types of mortgage attract higher rates. They also make it easier to understand whether weâre currently in a low or higher rate environment, relatively speaking.

Here are some of Canadaâs mortgage rates for different types of mortgage over the past five years.

| 2016 |

Also Check: Bofa Home Loan Navigator

Interesting Facts About Fixed Mortgage Rates In Canada

Current fixed mortgage rates are encouraging many people to buy homes in Canada, but there are some trends that suggest people are preferring shorter loan terms. For example, about 40 percent of all Canadian homeowners in 2012 held a loan with a 5-year term. Today, only about a third of all homeowners would consider a loan of up to 10 years. This is a change from past decades in which the 10-year loan was the most popular fixed-rate mortgage option. Clearly, many people believe that they can get the best fixed mortgage rates on loans that have terms of 10 years or less.

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

Recommended Reading: 70000 Mortgage Over 30 Years

Calgary Mortgage Rate Forecast

The best rates in Calgary are often slightly better compared to mortgage rates in other parts of the province thanks to the number of lenders and brokers in the city, and the liquidity of its real estate market .

Due to the COVID-19 crisis, mortgage rates in Calgary, like all other parts of the country, have been near record-lows. Thats true even though many people are still unemployed and unable to take advantage of such rates.

Mortgage activity should start to recover by the end of 2021 as the economy fully re-opens, rates remain low and people regain employment. But much depends on the level of oil prices, given the correlation with business investment in the region.

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Read Also: Reverse Mortgage For Mobile Homes

What Is A Good Mortgage Rate

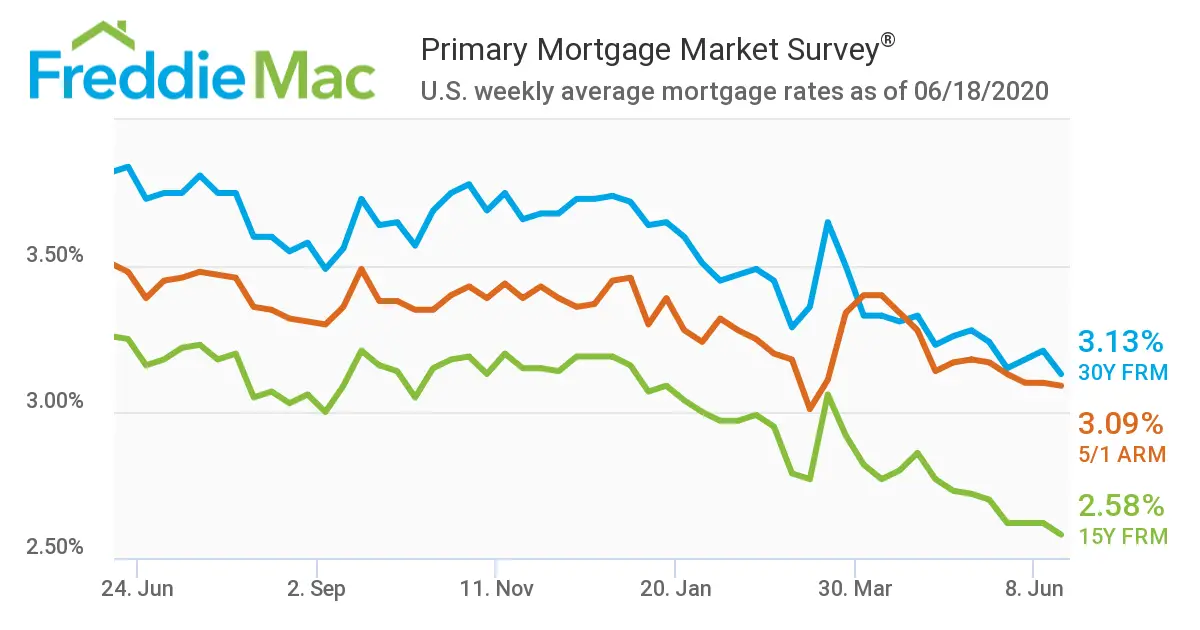

Average mortgage rates have been at historically low levels for months, even dipping below 3% for the first time earlier this year. Since then, rates have been on a slow but steady increase but are still in the favorable range. If youre considering a refinance, a good mortgage rate is considered 0.75% to 1% lower than your current rate. New homebuyers can also benefit from the latest mortgage rates as they are approximately 1% lower than pre-pandemic rates.

Even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

You May Like: Rocket Mortgage Loan Types

Canada’s Most Popular Mortgage: The 5

In Canada, out of the $1.2 trillion CAD in outstanding residential mortgages in May 2021, the 5-year fixed rate mortgage takes the crown with over $660 billion, or more than 50%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

How To Calculate Mortgage Payments

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be difficult to understand what youre paying forand what you can actually afford.

To estimate your monthly mortgage payment, you can use a mortgage calculator. It will provide you with an estimate of your monthly principal and interest payment based on your interest rate, down payment, purchase price and other factors.

Heres what youll need in order to calculate your monthly mortgage payment:

- Interest rate

Recommended Reading: Chase Recast

Read Also: 10 Year Treasury Vs 30 Year Mortgage

Should I Work With A Bank Or A Mortgage Broker

There are benefits and drawbacks to working with either a mortgage broker or a bank. Working with a mortgage broker gives you access to mortgage rates from a wide variety of lenders. That maximizes the chance that you’ll find a lower rate than you would by going directly to a bank. On the other hand, getting a mortgage from a bank can be quick and simple, especially if you already bank with them. We’d generally recommend seeing what rate your current bank will offer you, while also speaking to a local mortgage broker to see what other rates are on offer.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

We compare the most competitive brokers, lenders and banks in Canada to bring you today’s lowest interest rates, free of charge. Canadaâs current mortgage rates at the top of this page are updated every few minutes, so are the best rates currently on offer. to better understand what rate you could be eligible for in a few simple steps – – again, itâs completely free to use and youâre under no obligation whatsoever.

What Is The Difference Between Interest Rate And Apr

Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis . The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

How To Compare Mortgage Rates

While online tools, , allow you to compare current average mortgage rates by answering a few questions, you’ll still want to compare official Loan Estimates from at least three different lenders to ensure you are getting the best mortgage rate with the lowest monthly payment.

After applying for a mortgage, the lender will provide a Loan Estimate with details about the loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees . The higher the fees and APR, the more the lender is charging to procure the loan. The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges.

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If youre not sure about a lenders credentials, ask for its NMLS number and search for online reviews.

Also Check: Rocket Mortgage Loan Requirements

Why Should I Compare Mortgage Rates

Choosing a mortgage is a major financial decision since it involves borrowing a significant amount of money. The mortgage interest rate is one of the factors that affects the total amount of money you will have to pay over the course of the amortization period. So, you could save money by finding the lowest rate. But, along with the mortgage rate, you should also compare the terms and conditions of each type of mortgage in order to find the right one for you.

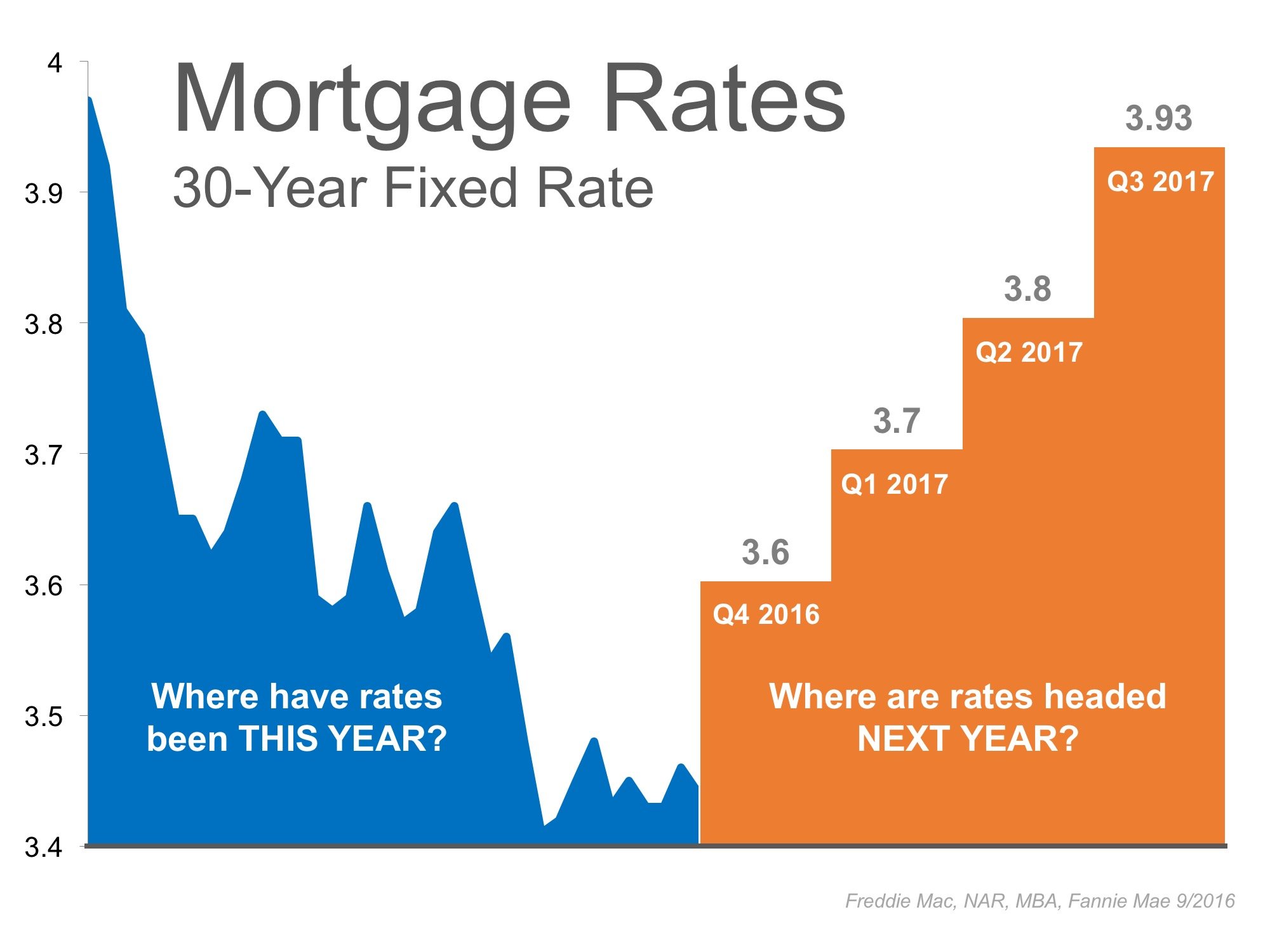

Mortgage Rates Jump Again Causing Headaches For Homebuyers

- The 30-year fixed mortgage rate is now at the highest level since April 2020.

- Rates are closing in on a full percentage point gain from a year ago.

- “Some will be at 3.625%, but many are already up to 3.75%,” said Matthew Graham, COO of Mortgage News Daily.

The average rate on the popular 30-year fixed mortgage hit 3.7% Tuesday morning, according to Mortgage News Daily. That is the highest since early April 2020 and now 83 basis points higher than the same time one year ago.

Rates are reacting to surging bond yields, as financial markets react to swifter and more aggressive monetary policy tightening by the Federal Reserve. Mortgage rates loosely follow the yield on the 10-year U.S. Treasury, but they are also affected by demand for mortgage-backed bonds. The Fed had been buying those bonds aggressively during the pandemic in order to keep rates low, but it is now pulling out of the MBS market faster than expected.

Mortgage rates, “would be higher, but lenders are compressing their margins to compete in a rising rate environment. Some will be at 3.625%, but many are already up to 3.75%,” said Matthew Graham, COO of Mortgage News Daily.

Lenders are losing vast amounts of refinance business, which had been booming just a year ago when rates were much lower. Applications to refinance a home loan were down 50% from a year ago, according to the most recent weekly survey from the Mortgage Bankers Association.

You May Like: Rocket Mortgage Conventional Loan

Td Annual Mortgage Prepayment

You are able to prepay up to 15% of your original mortgage principal on aclosed mortgagein one lump sum payment every year. This will help to reduce your interest payments and help you pay down your mortgage much faster, considering that all of your pre-paid lump sum amount will go towards the mortgage principal. If you want to pay down more than 15% of your mortgage principal, you will be charged a penalty. This means that if you plan on paying back your mortgage very aggressively, an open mortgage might be the better option for you.

All 6 big banks in Canada offer similar pre-payment amounts per year, ranging from 10% all the way up to 20% of your original mortgage principal:

| Canadian Bank Closed Mortgage Prepayment Amounts |

|---|

| RBC |

| 10% |

How Much Does 1 Point Lower Your Interest Rate

The exact amount that your interest rate is reduced depends on the lender, the type of loan, and the overall mortgage market. Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Other times, the reduction in interest rate for each point paid may be smaller. Each lender has their own pricing structure, and some lenders may be more or less expensive overall than other lenders – regardless of whether you’re paying points or not. When comparing offers from different lenders, ask for the same amount of points or credits from each lender to see the difference in mortgage rates.

Read Also: What Does Gmfs Mortgage Stand For

Current Mortgage And Refinance Rates For January 20th 2022

Mortgage rates edged higher for all loan terms compared to a week ago, according to data compiled by Bankrate. Rates for 30-year fixed, 15-year fixed, 5/1 ARMs and jumbo loans jumped.

Current average mortgage rates| +0.08 |

Rates accurate as of January 20, 2022.

The rates listed above are averages based on the assumptions shown here. Actual rates listed on-site may vary. This story has been reviewed by Bill McGuire. All rate data accurate as of Thursday, January 20th, 2022 at 7:30am.

You can save thousands of dollars over the life of your mortgage by getting multiple offers. It is so important to shop around, says Greg McBride, CFA, Bankrate chief financial analyst. Not everyone offers the same price, and some lenders may have motivation to be very competitive on price.