Contact Multiple Lenders Now

Consumers typically dont think twice about shopping around for cars, or even basic household items. Dont be afraid to apply this same logic when it comes to shopping for a mortgage loan.

Applying for more than one mortgage at once allows you to compare costs, rates, program options and even test-drive lenders prior to committing to just one lender.

At the link below, get connected with multiple loan experts and start the shopping process today.

The Mortgage Agreement In Principle

Obviously, you cant complete the mortgage process until you have found a property to buy. Not least because the lender will need to do a valuation survey to ensure it is a good investment for them. All lenders will give you an indication of how much they are prepared to lend you and on what terms, given your circumstances.

Most lenders will go further and offer you a mortgage in principle after you have supplied them with the evidence they need of income etc. They offer this in the hope that you will use them as your lender once you find the property you want to buy and so you have evidence of having funds in place when you make an offer on a property.

To get your mortgage in principle you should:

What To Look For In A Mortgage Deal

Once they’ve found a range of mortgages for you, a broker will be able to talk you through the pros and cons of each of deal.

Before deciding which one to apply for, think about:

- whether you want a fixed-rate, discount or tracker mortgage

- the cost of mortgage fees

- whether a mortgage offers cashback or other incentives

- the lender’s customer service and reputation.

Read our guide to finding the best mortgage deals for more information on what to look for and check out our mortgage lender reviews to find out whether the provider is any good.

Recommended Reading: How Much Take Home Pay For Mortgage

How To Get A Mortgage: A Step

You probably already know that a mortgage is a type of loan that you use to buy a home. Its a good idea to learn as much as you can about getting a mortgage before you start shopping for a home.

The best way to avoid wasting time is to know the players and the process. That means working with a lender to get the best possible loan.

In this article, well get you ready to go mortgage shopping by going over what lenders are looking for, the paperwork involved and the five steps it takes to complete the mortgage process.

Bad Credit Mortgages With Multiple Applicants

Generally, mortgage applicants are as quick as the slowest wheel i.e. if one has bad credit and the other clean, the bad credit is still taken into account by the lender.

If, for example, you have three applicants on a mortgage and one of them has had credit issues. This means you may end up paying a slightly higher interest rate, depending on the severity and how recent the credit issues are. Interest rates and mortgage deals for those with credit issues looking to apply for a bad credit mortgage are extremely competitive currently, and many people are surprised by how attractive the rates are.

That said, some borrowers may still benefit from applying in sole name, particularly if issues are more severe and they are ineligible as a result.

As well as considering all of the multiple applicants credit scores, lenders will consider all of your incomes, your debt-to-income ratios and the size of deposit you are able to accumulate.

If one of your fellow applicants has bad credit, your overall credit score can be raised by others who have clean credit, though perhaps not enough to put you in a position for you all to borrow from a lender under the most favourable terms.

Recommended Reading: How Many Years Are Mortgage Loans

What Do I Do If My Application Is Rejected After Getting A Mortgage In Principle

Some buyers may be given an agreement in principle, and then later find that their mortgage application has been declined. This can happen if a deeper credit search reveals something concerning, or if you fail to meet the eligibility criteria set by the mortgage underwriters. While this can be incredibly frustrating, its important to remain calm and find out why you were rejected.

If you can resolve the issue, you will be able to re-apply with the same lender. However, if you cant fix the problem then you may need to go through the process again, which can put your house purchase at risk. Read more about what to do if your mortgage application is declined.

Consider Which Type Of Broker To Use

While most mortgage brokers work with customers in person or over the phone, there’s now a growing number of ‘robo mortgage advisers’ – web-based services which allow you to carry out some or all of the mortgage application process online.

There are pros and cons to this approach. Our guide to online mortgage brokers explores how some of the best-known companies work.

Don’t Miss: Why Is Mortgage Insurance So High

Check Your Credit Before Getting Preapproved

Well before you begin the homebuying processideally six months to a year before you seek mortgage preapproval or apply for a mortgageit’s wise to check your credit report and credit scores to know where you stand, and to give you time to clear up any credit issues that might prevent your credit scores from being the best they can be when you’re ready to buy your new home.

Mortgage preapproval can give you an important strategic advantage when you’re buying a home in today’s red-hot real estate markets. Correct timing of your preapproval application is an important tactic in your homebuying game plan.

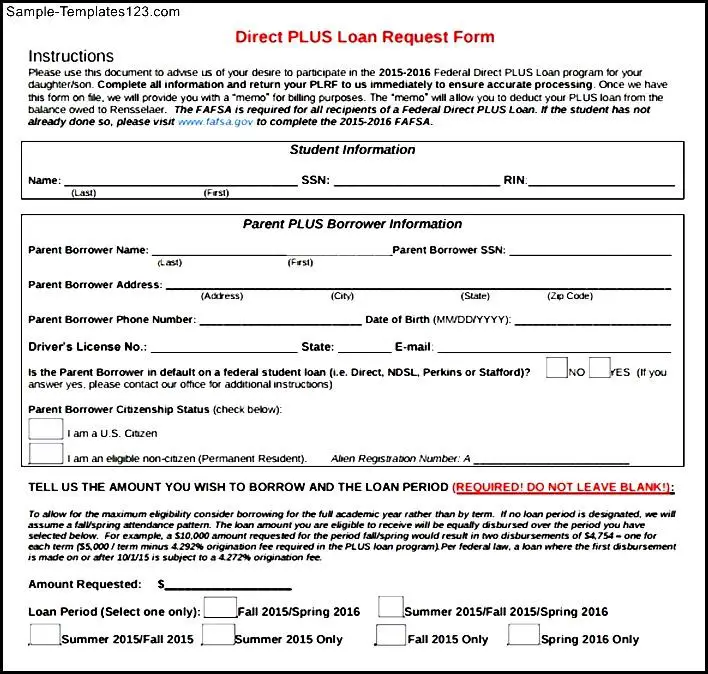

Property Information And Purpose Of Loan

You will need to write in the details of the property you want to buy its address, the year built, the legal description of the property and the number of units in the building. Then you will need to write in why you want the loan: Is it to purchase the property, a refinance, a construction loan or some other reason? You will also need to list whose names the title will be in and the source of the down payment.

Also Check: Can I Get A Mortgage With A 730 Credit Score

Key Things You Need To Know When Thinking About Applying For A Mortgage

Almost two thirds of UK adults say their understanding of mortgage terminology is not good

- 14:24, 29 NOV 2022

Say goodbye to confusion and a lack of understanding I am here to help. Admittedly in my early adult years I had no idea what a mortgage was and that was for a few reasons, but I could no longer blame those reasons because the information was out on the internet.

However, just because the information is out there doesn’t mean everyone will understand it. Because I certainly didn’t.

A survey of more than 2,000 UK adults, including 570 mortgage holders found that they are less sure of mortgage terminology, mortgage products and their ability to choose and secure the best mortgage to suit their needs. And I am here to help change that.

Read more:Major change made to mortgage support scheme for struggling homeowners

Research from Homeowners Alliance reveals homeowners in the UK may be leaving themselves at risk of financial hardship by not staying informed when it comes to their mortgage. So here’s some helpful tips on mortgages, how they work and how to apply.

Bringing It All To A Close

Youâve made it to the final step in the home-buying process. All the planning, preparation and waiting are finally over. But before you get the keys to your new home, you have one more thing to do.

At your closing, you will meet with your closing agent to sign all your mortgage documents. Take your time, make sure you understand what youâre signing and donât be afraid to ask questions. And voilà , once youâve dotted all the Iâs and crossed all the Tâs, youâll officially be a homeowner!

The closing process doesnât have to be nerve-wracking if you know what to expect. We can help you prepare for this exciting step, so your big day is a success.

We understand how overwhelming the home-buying and mortgage process can be. You can count on us to help you through it. Buying a home can be one of the most exhilarating â and stressful â moments of your life. But finding a home you can call your own makes it all worthwhile.

You May Like: How To Afford Veterinary Care Without Mortgaging

How Long Will It Take To Get Your Mortgage Approved

You’ve sent in copies of your last two paycheck stubs. You’ve provided a letter from your employer verifying your job status. You’ve made copies of your tax returns from the last two years.

Now how long will you have to wait before earning approval on your mortgage loan?

The answer? It depends.

Weve all seen commercials from mortgage lenders who promise to make the application process easier. But just because you can submit a loan application with the press of your computers Return key doesnt mean that your approval will be coming in any faster.

Ellie Mae, in its latest report, said that it all mortgage loans an average of 49 days to close during November. Ellie Mae reported that it took mortgage refinances an average of 51 days to close and purchase loans an average of 47 days.

What causes loans to take so long to close? There are plenty of factors.

The underwriting process — the process by which mortgage lenders determine if you are a good risk for a mortgage loan — can be delayed if you don’t provide all the necessary documents that lenders need to verify your income and savings. Marks on your credit report such as late or missed payments can delay the process, too.

How Can I Speed Up My Mortgage Application

A mortgage broker can help speed up the mortgage process, because they are already familiar with the mortgage products on the market, including the specific criteria each lender looks for. This can considerably cut back on the time youll spend doing your own research and having to make appointments with or speak to individual lenders directly.

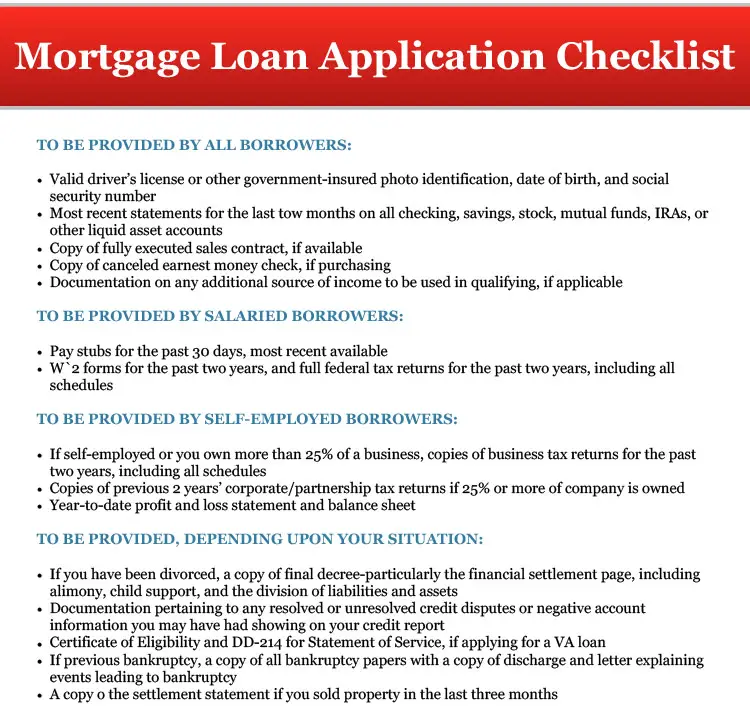

You can help speed up your mortgage application by having all the documents youll need handy and sending them through as soon as possible. Its also a good idea but not a stipulation to make a list of all your financial outgoings as well as your income because your broker/lender will want to know that youll find the mortgage affordable.

Don’t Miss: How To Get A Mortgage Loan

Time: 1 Hour To Several Hours

You

Applying to more than one lender has given you options. Now use your Loan Estimate forms to compare terms and costs.

At the upper right corner of the first page youll see expiration dates for the interest rate find out if it’s locked and closing costs. Ask the lender to explain anything you dont understand.

If the numbers seem dizzying, Dont focus too much on rate, Burrage says. Instead, look at the four numbers in the Estimates Comparisons section, on page 3. These will allow you to easily compare offers:

-

Total cost in five years. This is all charges including interest, principal and mortgage insurance that you’ll incur within the mortgage’s first five years.

-

Principal paid in five years. This is the amount of principal youll have paid off in the first five years.

-

APR. Also known as its annual percentage rate.

-

Percent paid in interest. This is the percentage of the loan paid in interest over the entire life of the mortgage. It’s not the same as the interest rate.

The lender

The lenders job is to answer all your questions. If you cant get good answers, keep shopping.

Get Preapproved Before House Hunting

A mortgage preapproval will give you a valid estimate of how much a lender is willing to loan you. Many first-time home buyers make the mistake of applying for a mortgage too late, and not getting preapproved before they begin house hunting.

How late is too late to start the preapproval process? If youre already seriously looking at homes, youve waited too long.

You really dont know what you can afford until youve been officially preapproved by a mortgage lender. Theyll determine your exact home buying budget by looking at your full financial portfolio, including bank statements, tax returns, pay stubs, credit reports, and 1099 forms or profit and loss statements if youre a self employed borrower.

Even if you think you know what you can afford, you might be surprised. Existing debts can reduce your home buying power by a startling amount. You also cant be sure how things like credit will affect your budget until a lender tells you.

Recommended Reading: Is It Better To Pay Off Mortgage Or Refinance

Your Mortgage Application Doesnt Have To Be Perfect

Sure, youll have the biggest home buying budget if you have no other debts and a large salary.

But those things arent required. As a home buyer, its all about starting where you are now.

Figure out what makes sense for you based on your own salary and needs, rather than aiming for a budget based on a rule of thumb.

Many people find that when they approach it this way, home buying is more attainable than they ever thought possible.

Popular Articles

Know What You Can Afford

Its fun to fantasize about a dream home with every imaginable bell and whistle, but its much more practical to purchase only what you can reasonably afford. With interest rates rising, monthly mortgage payments will be higher, so you might have to adjust your budget to find an affordable home.

Katsiaryna Bardos, finance department chair at Fairfield University in Fairfield, Connecticut, says one way to determine how much you can afford is to figure out your debt-to-income ratio , which is something lenders look at. DTI is calculated by summing up all of your monthly debt payments and dividing that figure by your gross monthly income.

Fannie Mae and Freddie Mac loans accept a maximum DTI ratio of 45 percent. If your ratio is higher than that, you might want to wait to buy a house until you reduce your debt, Bardos suggests. Many financial advisors recommend keeping the ratio closer to 36 percent.

Even with the 45 percent threshold, the lower your DTI ratio, the more room youll have in your budget for expenses not related to your home. Thats why Andrea Woroch, a Bakersfield, California-based finance expert, says its essential to take into account all your monthly expenses and your set-asides for far-off plans.

The last thing you want to do is get locked into a mortgage payment that limits your lifestyle flexibility and keeps you from accomplishing your goals, Woroch says a condition known as house poor.

You May Like: How Does Private Mortgage Insurance Work

Income And Job History

One of the first things that mortgage lenders consider when you apply for a loan is your income. There is no set dollar amount that you need to earn each year to be able to buy a home. However, your mortgage lender does need to know that you have a steady cash flow to pay back your loan.

Your lender will want to look at your employment history, your monthly household income and any other forms of money you have coming in, like child support or alimony payments.

Home Equity Loan: Definition

A home equity loan is a type of loan that one can apply against their home equity. This basically is the difference between the value of your home and how much you owe on the mortgage. If your home is valued at $250,000, for example, and you still owe $100,000 in the mortgage, you would have $150,000 home equity. It is, however, worth noting that you can only use your home equity to take a loan/borrow money, not cash-out refinancing.

Although you may not know this, the balance cannot be refinanced, and the interest rate and duration of the mortgage remain unchanged on the primary mortgage. In other words, a home equity loan isnt tied or added to your primary mortgage, hence the difference in repayment schedule and interest rates. That said, a home equity loan can be referred to as a secondary mortgage.

A home equity loan might be what you need when looking to make home upgrades/renovations, pay for your kids college, fund a business, or even consolidate debt. It would thus be a bad idea to take a home equity loan to pay for trips, uncertain investments, or expensive purchases that depreciate with time.

Don’t Miss: How Long Can I Lock In A Mortgage Rate

How To Get A Mortgage On A Rental House

Sharing the apartment that used to be just for you isn’t easy, and you know it’s time to move when you stuff is bursting out of the closets. To make the transition from renting to owning, you’ll need to pull together a joint financial profile that encourages a mortgage lender to take a chance on you. Although there’s no set amount of time in advance needed to apply for a loan, the sooner you apply, the sooner you’ll be able to purchase a larger living space and move.

Tips For Applying To Multiple Mortgage Lenders

If you take the path of least resistance and only apply to two lenders, keep in mind that you could miss out on a better deal. On the flipside, you are putting your credit score at risk if you submit too many applications exceeding 45 days.

Another reason to be wary of engaging with too many lenders is that the national credit agencies sell your information to other mortgage companies that you have not applied to. This is known as a trigger lead.

Once other lenders know you are actively shopping for a mortgage, you might get inundated with phone calls, emails and direct mailings from would-be competitors with offers that might be too good to be true.

In order to pick the best mortgage, you should request a loan estimate from multiple lenders. This way you can compare and contrast to see which has the best deal. Also, requesting a loan estimate is straightforward and no paperwork is required.

The only information you have to provide is your:

Recommended Reading: What Are Prepaid Items On A Mortgage