Fha Insurance Vs Pmi Costs

Which costs less per month, FHA mortgage insurance or private mortgage insurance? The answer depends on your credit score.

FHA monthly mortgage insurance payments are lower for borrowers with credit scores under 720, according to the Urban Institute. But monthly payments for PMI are slightly less for borrowers with credit scores of 720 to 739, and significantly less for borrowers with credit scores of 740 and higher. You can estimate the cost by using a PMI calculator.

» MORE:FHA loan requirements

Why Is Your Property Insurance So High 10 Ways To Lower The Cost

Inflation comes in many guises. In some areas of the country, the cost of insurance, particularly property insurance, is rising dramatically faster than the currently high general inflation rate.

One participant in the recently reported: Our homeowners insurance bill just came in and reflects a 22% increase over last year. Thats after a 15% increase last year over the previous year. Prior to that it was a reasonable 4% increase per year.

Calculating Mortgage Insurance By Loan Type

Conventional PMI mortgage insurance is calculated based on your down payment amount and credit score. Rates can vary a lot by borrower but are often around 0.5% to 1.5% of the loan amount per year .

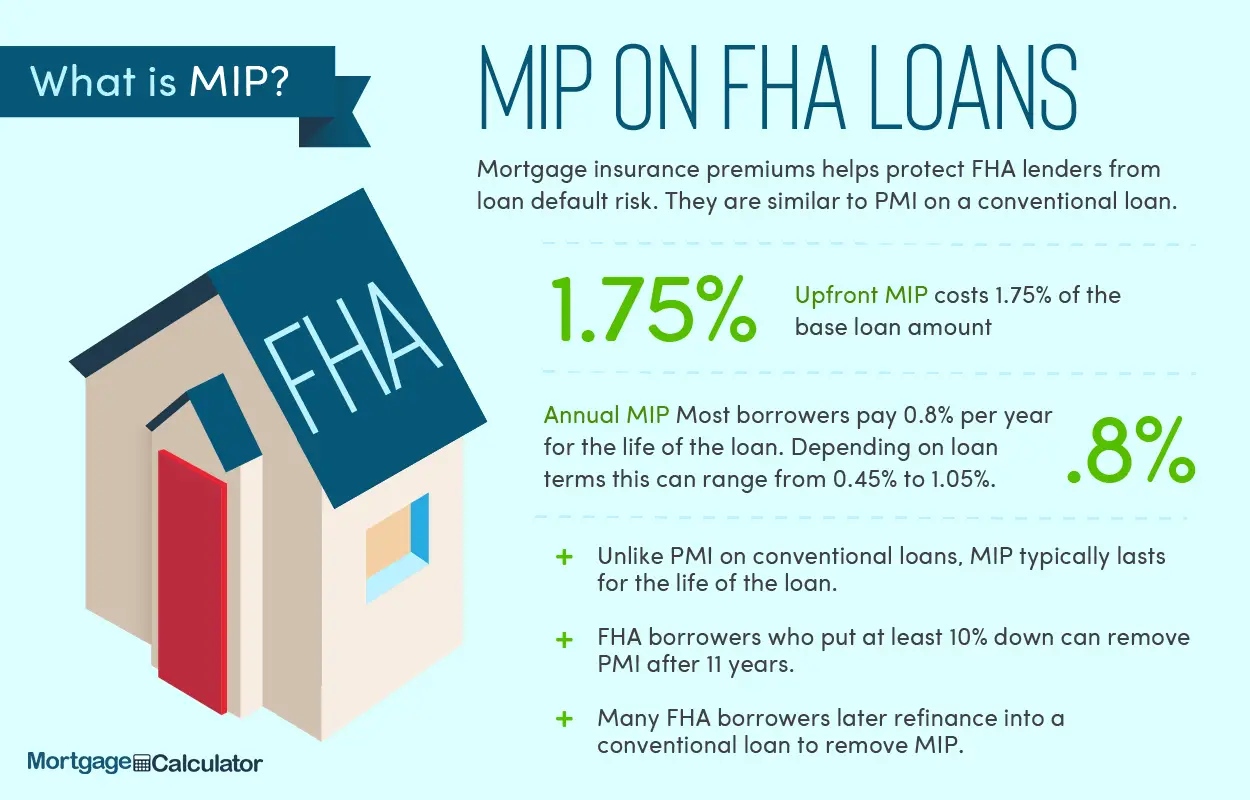

For FHA, VA, and USDA loans, the mortgage insurance rate is pre-set. Its the same for just about every customer.

- FHA: 1.75% of loan amount upfront and 0.85% annually

- USDA: 1% of the loan amount upfront and 0.35% annually

- VA: Between 0.5% and 3.6% upfront depending on borrower and loan purpose

Typically, the ongoing annual premiums for mortgage insurance are spread across 12 monthly installments. You simply pay it each month as part of your regular mortgage payment.

Recommended Reading: How Long Is A Credit Report Good For Mortgage

How Much Does Mortgage Insurance Cost

Mortgage insurance isnt free. Your lender pays a mortgage insurance fee or premium calculated as a percentage of the total mortgage amount. In most cases, your lender adds the cost of the mortgage insurance premium to your mortgage amount.

The percentage decreases depending on the down payment amount:

For example, if you put 5% down on a $400,000 home youd need a mortgage of $380,000, or 95% of the purchase price. The CMHC mortgage premium would be 4% of the mortgage amount, or $15,200. This amount could get added onto your mortgage, bringing your total mortgage amount to $395,200.

How Mortgage Insurance Works

In Canada, you can buy a home of $500,000 or less with a 5% down payment. Homes between $500,000 and $1,000,000 require a down payment of 5% on the first $500,000 and then 10% on the remainder. Homes over $1 million require a down payment of at least 20% on the entire purchase price.

And thats good news for many homebuyers. Saving for a down payment while juggling other household expenses can be a challenge.

The mortgage insurance companies provide mortgage insurance to lenders. The three mortgage insurance companies are CMHC, SagenTM, and Canada Guaranty.

As a borrower, you likely wont deal with your mortgage insurance company directly. Instead, you apply for mortgage financing through your lender. If your down payment is less than 20% of the homes purchase price, youll need a high-ratio mortgage. Your bank or mortgage lender will apply to one of the mortgage loan insurance companies on your behalf.

Recommended Reading: Is Bank Of America Good For Mortgages

What Does Private Mortgage Insurance Cover

When you take out a mortgage and you cannot afford to put a 20% down payment, the lender is at risk. First, since you cannot afford to make a 20% down payment you are viewed as a riskier borrower. Secondly, when the lender has to lend you more money than they would have with the 20% down payment, a greater amount of money is put at greater risk. Therefore, lenders turn to private mortgage insurance companies to assume some of that risk.

The coverage a private mortgage insurance company offers determines what portion of the amount lost the lender will be able to recover in the case that the borrower defaults on their mortgage. For example, if the PMI provider provides 30% coverage, this means that the lender will be paid back by the insurer for 30% of the losses related to the borrowers default. These losses can include the unpaid principal balance, interest that the lender would otherwise get, and 30% coverage for the lenders costs associated with the foreclosure.

For example, imagine that you wish to purchase a $300,000 home with a 5% down payment. The coverage provided by the PMI company is 30%. If you then default on your mortgage while you still owe 90% or $270,000 to the lender, the lender would be able to recover $81,000 from PMI, instead of losing the whole amount. This can help supplement the amount recovered from aforeclosure. PMI would also cover 30% of interest loss and foreclosure costs.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How Can I Get Help With My Mortgage

You Have Multiple Insurance Policies

If you have multiple policies, such as for your car, motorcycle, or personal property, all from different insurance providers, you could be missing out on the opportunity to save.

How to lower your costs: Bundle your plans.

Using one insurance company for two or more policies can lead to up to 25% off your home insurance. Its also easier to keep track of bills and coverage if its all under the umbrella of one provider.

How To Avoid Borrower

Borrower-paid PMI is the most common type of PMI. BPMI adds an insurance premium to your regular mortgage payment. Lets take a look at what home buyers can do to avoid paying PMI.

Make A Large Down Payment

You can avoid BPMI altogether with a down payment of at least 20%, or you can request to remove it when you reach 20% equity in your home. Once you reach 22%, BPMI is often removed automatically.

Take Out An FHA Or USDA Loan

While its possible to avoid PMI by taking out a different type of loan, Federal Housing Administration and U.S. Department of Agriculture loans have their own mortgage insurance equivalent in the form of mortgage insurance premiums and guarantee fees, respectively. Additionally, these fees are typically around for the life of the loan.

The lone exception involves FHA loans with a down payment or equity amount of 10% or more, in which case you would pay MIP for 11 years. Otherwise, these premiums are around until you pay off the house, sell it or refinance.

Take Out A VA Loan

The only loan without true mortgage insurance is the Department of Veterans Affairs loan. Instead of mortgage insurance, VA loans have a one-time funding fee thats either paid at closing or built into the loan amount. The VA funding fee may also be referred to as VA loan mortgage insurance.

Take Out A Piggyback Loan

You May Like: Should You Buy Mortgage Points

Types Of Mortgage Insurance

There are four kinds of PMI:

- Borrower-paid monthly. This is just what it sounds likeâthe borrower pays the insurance monthly typically as part of their mortgage payment. This is the most common type.

- Borrower-paid single premium. Youâll make one PMI payment up front or roll it into the mortgage.

- Split premium. The borrower pays part up front and part monthly.

- Lender paid. The borrower pays indirectly through a higher interest rate or higher mortgage origination fee.

You might choose one type of PMI over another if it would help you qualify for a larger mortgage or enjoy a lower monthly payment.

Thereâs only one type of MIP, and the borrower always pays the premiums. But FHA loans donât just have monthly MIPs. They also have an up-front mortgage insurance premium of 1.75% of the base loan amount. In this way, the insurance on an FHA loan resembles split-premium PMI on a conventional loan.

How To Get Rid Of Fha Mortgage Insurance

Paying for FHA mortgage insurance for 11 years or longer might sound like a drag, but the expense doesnt have to last forever.

Many borrowers use FHA loans as a stepping stone that can help them reach the dream of homeownership, says Gary Acosta, co-founder and CEO of the National Association of Hispanic Real Estate Professionals. From there, they take steps to improve their credit scores and acquire more equity in their homes so they can refinance out of their FHA loan into a conventional loan with better terms.

The FHA is a wonderful starter loan but, at some point, it can also be beneficial to refinance out of it for lower monthly payments, including no or PMI, Acosta says.

Its also possible to get out of FHA mortgage insurance by paying down your mortgage, but that can take a significant amount of resources to do. Before paying off your loan, make sure to weigh the financial pros and cons.

Don’t Miss: Can You Buy A House Without A Mortgage

Is Mortgage Insurance Overpriced

Question: We want to buy our first house with FHA financing, but the cost of mortgage insurance is shocking. Dont you agree that the cost of interest and FHA mortgage insurance together is too high?

Answer: Imagine that you want to buy a home for $200,000. With a conforming mortgage, you will put down 20 percent or $40,000. Because of the down payment size theres no requirement to buy mortgage insurance. You borrow $160,000 and with a 4.25 percent interest rate fixed over 30 years with monthly payments on principal and interest at $787.10.

With an FHA loan, the numbers for the same $200,000 property look like this:

- You put down put down 3.5 percent . You agree to finance $193,000. This is the base loan amount.

- You then pay a 1.75 percent up-front mortgage insurance premium . The total cost is $3,377.50. You can pay the up-front MIP at closing, but to save cash most will add it to the debt. The result is a final mortgage amount of $196,377.50, but well round it to $196,378.

- With the FHA program you also pay an annual mortgage insurance premium . At the time this article was written, the annual MIP is calculated at .85 percent of the outstanding mortgage balance.

- The monthly payment for principal and interest is $966.06. The monthly expense for the up-front MIP is $136.71. The total monthly cost is $1,102.77.

No doubt, the monthly FHA loan cost is higher. But is it somehow unfair?

There are a few points to be made here.

Peter Miller

Reverse Mortgage Insurance Faq

Itâs important to make sure you understand the different aspects of mortgage insurance when getting a reverse mortgage.

Can you cancel reverse mortgage insurance?

In general, you cannot cancel reverse mortgage insurance. If you have an HECM, then insurance from the FHA is required throughout the life of the loan. The only way to get out of paying reverse mortgage insurance premiums is to pay off the loan.

Can you shop around for reverse mortgage insurance?

Reverse mortgage insurance on HECMs is handled by the FHA, which means that shopping around isnât an option. For non-HECMs, your lender can advise you on acceptable insurance providers.

Recommended Reading: Can You Write Off Points On A Mortgage

Why Term Life Insurance Is A Better Choice Than Mortgage Insurance For Protecting Your Home

1. Considerably lower premiums

Term life insurance premiums are decided by many factors ranging from current age and health to personal habits and medical history. The underwriting process covers all stops, leaving no stone unturned. Thus a healthy person can get a higher coverage at a low premium cost.

Moreover, the premiums remain the same throughout the term. Lender-provided mortgage insurance premiums are guaranteed for only your mortgage term they can go up when you renew your term.

2. Stable payout value

Mortgage insurance coverage declines in conjunction with your mortgage debt. As you pay off your mortgage, the coverage of the insurance benefit you receive decreases.

Term life insurance includes a guaranteed payout if the insured passes away. And the payout doesnt change no matter the amortization period.

3. Get more coverage

When you buy mortgage insurance, it only covers your mortgage value and not a penny more than that. This can be a problem for those who want their families to receive extra benefits after their death. The coverage of a term life insurance policy can be increased to include cash benefits that can go towards keeping your familys future safe.

4. Flexibility to use coverage as desired

The benefits of mortgage insurance go only towards paying out your mortgage. You or your heirs have no say in how the money should be used. So any extra costs such as consumer debt and student loans remain a burden on your family.

5. Guaranteed coverage

How Long Are You Required To Pay For Mortgage Insurance

One more important difference between MIP and PMI is the length of time you are required to pay it. If you buy a house today with an FHA loan, you will be required to pay mortgage insurance premiums for at least 11 years. If you make a down payment of less than 10%, you will need to pay MIP throughout the life of the loan. Homeowners with FHA loans sometimes refinance to a conventional loan to stop paying mortgage insurance premiums.

With a conventional loan, you only need to pay for private mortgage insurance until your home equity reaches 20%. Then you can request your lender cancel your PMI payments. Learn more about how to remove PMI from your mortgage.

Also Check: What Score Is Needed For A Mortgage

Cost Of Private Mortgage Insurance

The cost of your PMI premiums will depend on several factors.

- Which premium plan you choose

- Whether your interest rate is fixed or adjustable

- Your loan term

- Your down payment or loan-to-value ratio

- The amount of mortgage insurance coverage required by the lender or investor

- Whether the premium is refundable or not

- Your credit score

- Any additional risk factors, such as the loan being for a jumbo mortgage, investment property, cash-out refinance, or second home

In general, the riskier you look according to any of these factors , the higher your premiums will be. For example, the lower your credit score and the lower your down payment, the higher your premiums will be.

According to data from Ginnie Mae and the Urban Institute, the average annual PMI typically ranges from .55% to 2.25% of the original loan amount each year. Here are some scenarios: If you put down 15% on a 15-year fixed-rate mortgage and have a credit score of 760 or higher, for example, you’d pay 0.17% because you’d likely be considered a low-risk borrower. If you put down 3% on a 30-year adjustable-rate mortgage for which the introductory rate is fixed for only three years and you have a credit score of 630, your rate will be 2.81%. That happens because you’d be considered a high-risk borrower at most financial institutions.

Factors Impacting Your Homeowners Rate You May Be Able To Control

Current market conditions that affect your insurance premiums may be out of your control, but there are steps you can take to help keep the cost of your homeowners coverage in check.

*Travelers Decreasing Deductible is not available in California.

Current market conditions are challenging. Catastrophic weather events are on the rise. Pandemic-era disruptions, including shortages in building materials and skilled labor, are driving rate changes. But there are factors within your control when it comes to the premiums you pay. Its smart to take advantage of them.

Find a local independent agent or contact a Travelers representative to get a home insurance quote today.

Recommended Reading: What Do You Need For Pre Qualifying Mortgage

What’s The Difference Between Pmi And Mortgage Protection Insurance

Unlike PMI, which is solely for the lender’s protection, mortgage protection insurance will continue to cover your mortgage payments after you die. This insurance can help protect your family members facing foreclosure on the property after you have passed on. This insurance is sometimes referred to as mortgage life insurance.

Why Mortgage Insurance Is So Expensive

As mentioned, mortgage life insurance is usually provided by the lenders themselves. Bundled along with the mortgage payments, the entire mortgage insurance process is streamlined. Theres no need to shop around for a new insurance provider or assess different schemes. This convenience is the biggest selling point for lender-based mortgage insurance.

Another point here is the absence of any underwriting. Mortgage insurance requires no medical checkups or detailed underwriting. This allows those with poorer health to get insurance instantly. But the lack of a medical checkup doesnt mean that coverage is guaranteed. The insurer holds the right to change the terms of coverage or deny any benefits if the health of the insured declines.

Without medical underwriting, insuring your life is much riskier, and in turn more expensive. The mortgage insurance provider passes those extra costs onto you, thus mortgage insurance is much more expensive than medically underwritten life insurance.

So, before you sign up for mortgage life insurance ask yourself are the additional monthly premiums worth it? And if they arent, is there a better product out there that offers you the same mortgage coverage with more flexibility and benefits?

You May Like: What Is The Current Mortgage Loan Interest Rate