What Is The Forecast For Mortgage Rates In Canada In 2022

Between January 2022 to June 2022 alone, fixed mortgage rates in Canada have gone up just over 85%. In the same time period, variable mortgages rates in Canada have increased by an average of over 300%.

The current consensus among economists is that mortgage rates will continue to rise in Canada in 2022 and possibly 2023 as well.

Current Mortgage Rates: Are Mortgage Rates Going Up Or Down

Since the start of 2022, mortgage rates have risen quickly. Unfortunately, as the year progresses, rates may increase even further, said Jacob Channel, chief economist for LendingTree. That may make buying a home even tougher as home prices continue their upward trajectory.

This has put many would-be buyers in a difficult situation where they can no longer rely on low rates to offset the high asking prices of homes on the market today, Channel said.

Mortgage Critical Illness Insurance

Mortgage critical illness insurance provides a benefit if you suffer a life-threatening issue, such as cancer, heart attack, or stroke. Critical illness insurance usually has a smaller coverage benefit, and it has slightly higher premiums. Some policies might not cover pre-existing conditions up to 24 months before the start of your coverage. You might also need to complete a health interview.

You May Like: Can You Get A Reverse Mortgage On A Second Home

What Are Mortgage Points

Also known as discount points, this is a one-time fee or prepaid interest borrowers purchase to lower the interest rate for their mortgage. Each discount point costs one percent of your mortgage amount, or $1,000 for every $100,000 and will lower the rate by a quarter of a percent, or 0.25. For example, if the interest rate is 4 percent, purchasing one mortgage point will reduce the rate to 3.75 percent.

Help Finding The Best Mortgage Deal

The best mortgage deal isnt just about interest rates. You need to consider whether the mortgage term is right for you, arrangement fees and more.

To get a better idea of the best mortgage for you, use our online mortgage service provided by the fee-free mortgage broker L& C.

L& C can compare the latest mortgage deals for you over the , or you can do it yourself in real-time online. Whichever you choose they can help search the market to find you the best mortgage deal, see if you qualify and even help you apply online, doing all the legwork to get you your mortgage offer.

Read Also: Does Pre Approval For Mortgage Affect Credit

Bank Of England Warns Interest Rate Rises To Hit 40% Of Uk Mortgages

The squeeze on household finances looks set to continue with the Bank of England estimating around 40% of mortgages will go up over the next year as it continues to increase interest rates.

Sarah Breeden, executive director for Financial Stability Strategy and Risk at the Bank of England, told MPs at a Treasury committee last month , 20% are floating so they will see the interest rate increase come through immediately.

Of the 80% that are fixed, our data suggests that around a quarter of those come out of that in the next 12 months. Of that 100% stock of mortgages actually only 40% are going to see higher rates in the immediate period ahead, she added.

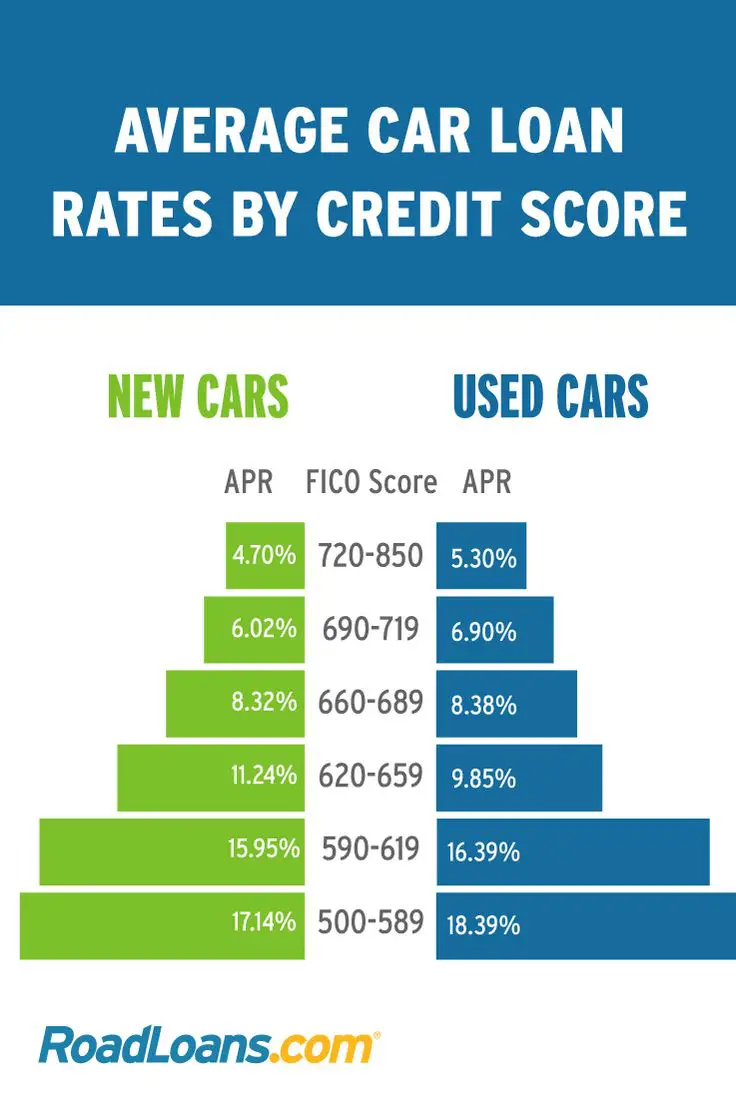

What Credit Score Do I Need To Get A Mortgage

Every loan type has a different minimum credit score to qualify, but just because you beat that minimum doesnt mean a lender will give you a mortgage. Conventional loans backed by Fannie Mae and Freddie Mac, government entities that buy mortgages on the secondary market, require a minimum score of 620. FHA loans require a minimum of 500, with at least 580 needed if you want to put down the lowest down payment of 3.5%. VA loans and USDA loans dont have minimum requirements.

To actually get a loan, you probably want a credit score well above the minimum. Having a score of 700 or higher not only increases your chances of getting approved for a loan, it likely will help bring down your interest rate. If your score is in the 500s or 600s, you may have fewer options, and they could be more expensive in the long run.

Read Also: How Much Income For A 600k Mortgage

Shall I Get A Variable Rate Mortgage

Variable rates are typically a little lower than fixed rates because the borrower takes on the risk of rates changing over time.

Variable rates are expected to remain below 4 per cent well into 2023. That’s pretty low, but it is still possible to lock in a 5-year guaranteed fixed rate pretty close to that rate today. As well, recently economists have been continually revising their forecasts upward. There’s a lot of uncertainty about the future of interest rates.

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

Read Also: How Much Can An Adjustable Rate Mortgage Increase

Very Low Mortgage Rates

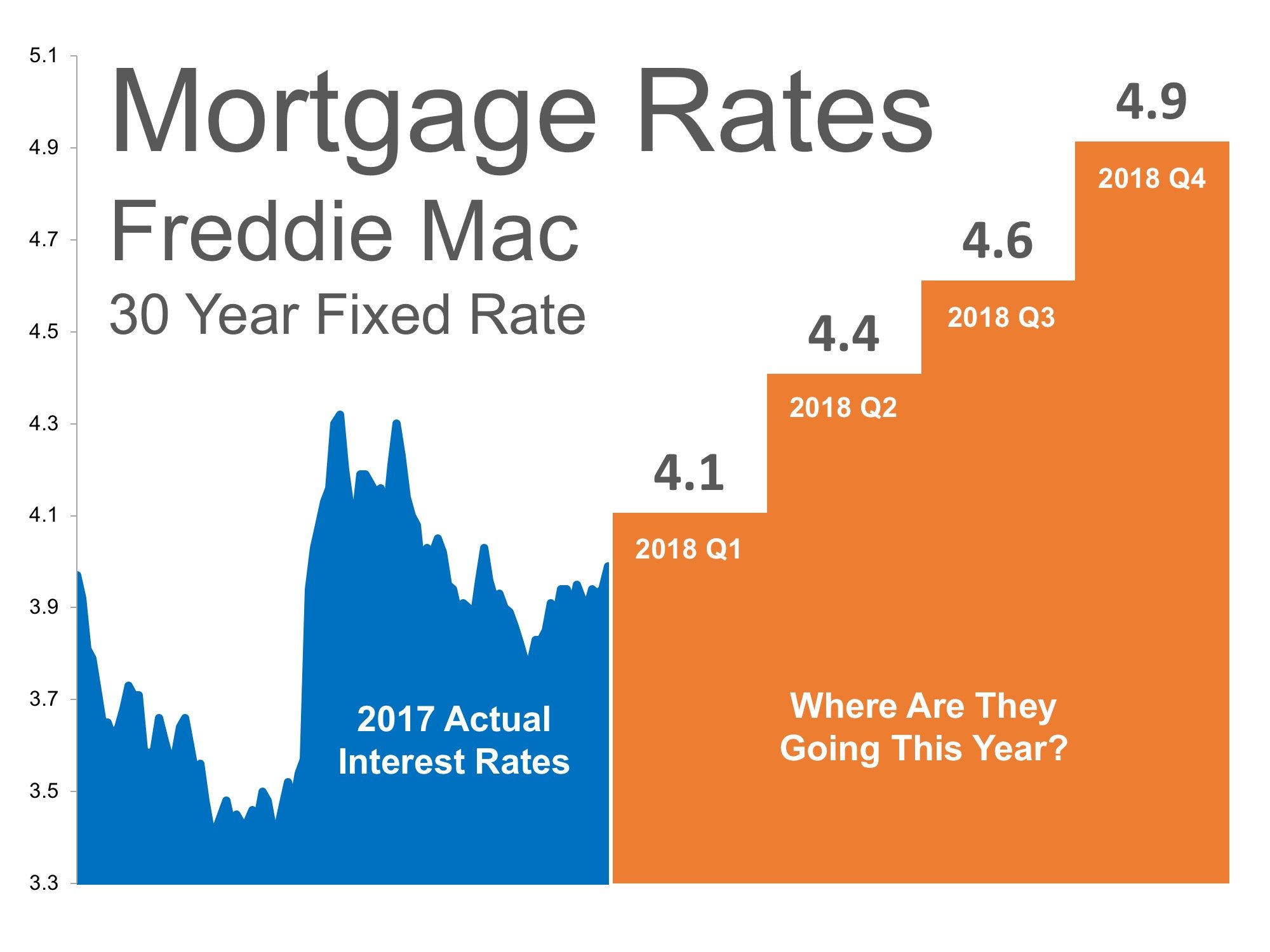

Fixed rates have risen significantly from the pandemic-induced record lows, and they are expected to continue rising. As mortgage rates rise, they reduce homebuying budgets.

The impact of early rate increases on homebuying budgets will be greater than the subsequent rate increases.

Prospective homebuyers can take advantage of this effect by getting a pre-approved mortgage 4 months before making a purchase. By the time they find a place they like, rates may have risen, and competing bidders who didnt get a pre-approved committed rate might be saddled with smaller homebuying budgets.

If your bank doesnt offer a 4-month rate guarantee with their pre-approval, then talk to a mortgage broker.

Best Help To Buy Mortgage Rates

While if youre looking for a Help to Buy mortgage Barclays offers the 5 year Fixed London Help to Buy Equity Loan Scheme mortgage at 2.99%. It has an arrangement fee of £749.

And if youre not in London, Barclays offers the 5 Year Fixed Help to Buy Equity Loan Scheme mortgage at 3.30%. It also has a £749 arrangement fee.

Read Also: What Can I Do To Lower My Mortgage Payments

How Lenders Determine Their Mortgage Rates

There are two broad categories of mortgages in Canada: fixed-rate mortgages and variable-rate mortgages. Lenders use a different approach when determining the rate of variable and fixed mortgages.

A fixed-rate mortgage is one in which a borrowers rate of interest remains the same over the entire term of their mortgage. Lenders fixed mortgage rates are closely tied to the price of five-year government bonds. As bond yields rise, the value of the bonds decreases and banks compensate for this loss by upping the rates on their fixed-rate mortgages. In contrast, when bond yields drop, banks fixed mortgage rates tend to fall.

A variable-rate mortgage is one in which the rate can fluctuate with changes in the bank or lenders prime rate. Lenders prime rates are based on the Bank of Canadas overnight rate . When the Bank raises its overnight rate , Canadas financial institutions typically raise their rates accordingly.

There are two kinds of variable-rate mortgages in Canada. With a typical variable-rate mortgage, the borrowers payment does not change with fluctuations in the prime rate instead, changes in the rate determine how much of your mortgage payment goes towards paying interest versus principal on the mortgage.

There are also adjustable-rate mortgages. With these, the borrowers mortgage payment changes as the lenders prime rate goes up or down.

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadaâs Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.

Don’t Miss: Can My Wife Get A First Time Buyer Mortgage

Factor: The Home Value

Home values under $1 million often fetch better rates. Thats because:

- theres less competition for $1 million+ mortgages

- theres no way to default insure them , and

- there are fewer ways to raise capital for such super-jumbo mortgages.

As a result, those loans cost incrementally more.

Rate Tip: Your home value is always confirmed with an appraisal or the lenders automated valuation tool.

What Is A Mortgage Rate

A mortgage rate is the interest lenders charge on a mortgage. Mortgage rates come in two forms: fixed or variable.

Fixed rates never change for the life of your loan and in exchange for this certainty, the rate is higher on longer loans.

Variable-rate mortgages can have lower interest rates upfront, but fluctuate over the term of your loan based on broader economic factors. How frequently a variable-rate mortgage changes is based on the loans terms. For example, a 5/1 ARM would have a fixed rate for the first five years of the loan, then change every year after that.

You May Like: Can You Do A 40 Year Mortgage

What Are Closing Costs

Youll likely owe more when you close on the house than just the down payment on the mortgage. There are other expenses that have to be paid to make this big transaction go through. Closing costs often entail taxes and fees associated with the purchase that arent included in the sale price.

Expect closing costs to total around 3% to 6% of the purchase price, so youre looking at between $8,250 and $16,500. They might include fees charged by the lender like loan origination fees, points paid to get a lower mortgage rate, fees associated with the property such as an appraisal or inspection, or prepaid costs such as property taxes or homeowners association dues.

Current Jumbo Mortgage Rate Trends Down

The average rate for a jumbo mortgage is 5.21 percent, a decrease of 39 basis points over the last week. This time a month ago, the average rate was higher, at 5.53 percent.

At todays average rate, youll pay principal and interest of $546.64 for every $100k you borrow. Thats lower by $22.40 than it would have been last week.

Read Also: Does Prequalifying For A Mortgage Hurt Credit

Do I Get A Lower Rate If I Make A Bigger Down Payment

Generally, not. The lowest rates in Canada are typically offered on default insured mortgages. Those are for people who put down less than 20% on their home purchase. Low insured rates are also available to people who transfer their already-insured mortgage to a new lender. Those who put down 20% or more get conventional rates, which are usually higher than insured rates. Occasionally, however, someone putting down 35% or more on a home purchase under $1 million can get great rates similar to high-ratio rates.

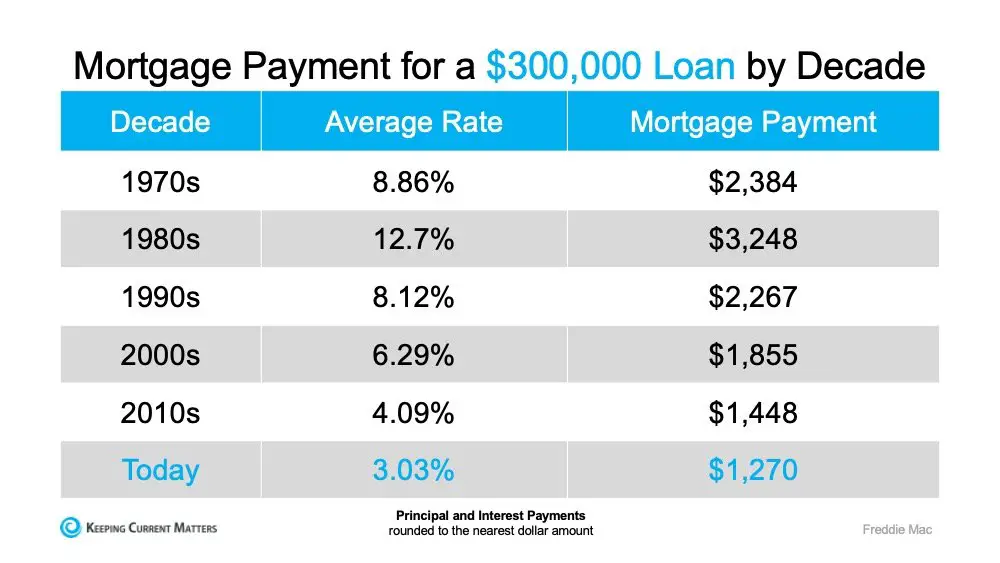

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 6.5% right now.

Read Also: How Long Do You Have To Pay Mortgage

Historical Canada Mortgage Rates

Looking at historical mortgage rates is a good way to understand which types of mortgage attract higher rates. They also make it easier to understand whether weâre currently in a low or higher rate environment, relatively speaking.

Here are some of Canadaâs lowest mortgage rates of the year for different types of mortgages over the past five years.

| 2017 |

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

You May Like: Can You Take Out Two Mortgage Loans At Once

Who Has The Best Mortgage Rates In Alberta

No single bank has the best mortgage rates in Alberta at all times. Every mortgage provider sets its own mortgage rates based on the market, its target customer, as well as its expansion plans. Even for the same mortgage term and rate type, competing providers can vary wildly on their mortgage rates. These factors can change over time, so youll often see lenders going back and forth between offering the best mortgage rate. The best way to get the best mortgage rate on the market is to compare the rates than banks and other lenders are currently offering. You can do that with the tools at the top of this page.

Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 1950â2000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

Also Check: What Kind Of Mortgage Can I Afford

Best Mortgage Rates August 2022

With mortgage rates expected to rise again this month its more important than ever to check you’re on the best mortgage deal. Read on for the best rates, including fees, best remortgaging deals, best 5 year fixed rate, Help to Buy mortgage deals, green mortgage deals and more this month.

Finding the best mortgage rates in a sea of mortgage deals is hard work. So every month well be showcasing the best deals for you, with input from the mortgage experts at L& C.

Is A Variable Rate Better

If youâre comparing a variable rate and a fixed rate at the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thatâs because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In todayâs low interest rate environment, itâs not certain if interest rates can continue to decrease further. While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates donât move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

A fixed mortgage rate would be better if you think interest rates will significantly rise in the near future. Many borrowers also place value on the peace of mind that a fixed mortgage rate gives. The slightly higher mortgage rate might be worthwhile in exchange for not having to worry about interest rate fluctuations.

Also Check: How Can I Lower My Mortgage Payment

About Our Data Source For This Tool

The lenders in our data include a mix of large banks, regional banks, and credit unions. The data is updated semiweekly every Wednesday and Friday at 7 a.m. In the event of a holiday, data will be refreshed on the next available business day.

The data is provided by Informa Research Services, Inc., Calabasas, CA. www.informars.com. Informa collects the data directly from lenders and every effort is made to collect the most accurate data possible, but they cannot guarantee the datas accuracy.

Should I Choose A Mortgage Based On The Apr

The APR is a great tool for comparing two mortgages with different terms, but it’s ultimately important to consider all aspects of your loan when making a decision. For example, if your savings account is well-stocked, you may be willing to pay some higher closing costs for a loan with a lower monthly payment that is more in line with your regular income.

And there are other, non-financial factors as well. Every mortgage lender does business its own way. Some use a personal touch with each customer and others offer the most cutting-edge technology to make your borrowing experience easy. Do you prefer a small, local institution? An online lender? A national bank with a 100-year history and an established reputation? Theres no right answer to any of these questions, but they are important to think about nonetheless. You could be making payments on your mortgage for 30 years, so you should find a lender that suits your needs.

Before you sign your papers, its a good idea to research your lender. Read reviews, the company website and any homebuying material the lender publishes. It can help you get an idea of the company before you do business.

Don’t Miss: Can I Get Cosigner For Mortgage