Finding The Right Life Insurance Policy For Your Financial Plan

Life insurance should be integrated into your larger financial plan to maximize its benefits. A financial advisor can help you evaluate what kind of life insurance is the best choice for your circumstances and how you can build a plan to support mortgage debt or other expenses after you die.

1Using cash values through policy loans, surrenders or cash withdrawals will reduce benefits and may affect other aspects of your plan.

Dividends are not guaranteed.

Q: Can A Senior Citizen Purchase Credit Life Insurance On A Mortgage

A: When you say “credit life insurance on a mortgage,” do you mean mortgage life insurance? If so, I’m sorry to say the answer is “it depends.” Some insurance providers won’t sell these policies to people over 50 or 60, although it’s likely there are exceptions. So, contact a number of companies, explain your situation, and see if any of them sell mortgage life insurance policies to people your age. Don’t forget, though, that there are other insurance products you can consider, too. Just remember that the older you are, the more you’re going to have to pay for any of these policies.

If you’re interested in finding out more about term life insurance, compare rates from top companies now to find an affordable plan that protects your home and family.

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions.All content and services provided on or through this site are provided “as is” and “as available” for use.QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site.You expressly agree that your use of this site is at your sole risk.

Get an insurance quote on the phone. Call: | Agents available 24/7

Why Most Families Would Gain From A Term Life Insurance Policy Instead:

Having a mortgage-free home if you die or cannot work may sound attractive, but it doesnt mean mortgage protection insurance is the best way to achieve this.

Most people would be better off purchasing a term life insurance policy big enough to cover their mortgage and provide for other financial needs.

Here are five reasons you should seriously consider term life insurance instead of mortgage life insurance:

Don’t Miss: What Is A Point For Mortgage

How Much Does Mortgage Life Insurance Cost

The cost of a mortgage protection insurance policy depends on a few factors. For example, insurance companies will examine the remaining balance of your mortgage loan and how much time is left in your loan term.

As with a traditional life insurance policy, theyll also consider your age, job, and overall risk level.

In general, you can expect to pay at least $50 a month for a bare-minimum MPI policy.

You Wont Be Penalized For Paying Off Your Mortgage Faster

With mortgage life insurance, your benefit goes down with each month you pay down your mortgage. In this respect, paying your house off early exacts a penalty that could cost you money.

With traditional life insurance, on the other hand, youll get a set death benefit that wont change if you decide to pay off your home early. Term life also covers you for a fixed period, unlike a mortgage protection plan, which is tied to your mortgage length.

Read Also: How To Choose The Right Mortgage Lender

Does Mortgage Protection Insurance Cover Job Loss

When obtaining a mortgage loan, borrowers have the option to purchase unemployment protection insurance. This coverage often is included with mortgage protection policies. If laid off by an employer, MPI can prevent falling behind on mortgage payments for a limited time. Not all insurers will offer job loss and disability protection, so if interested, confirm its inclusion with the policy.

The Benefits Of Mortgage Life Insurance:

- In some cases, a combination of coverage types may provide more benefits than a single product solution, better protecting your home in the event that you pass away unexpectedly.

- The balance owed on your mortgage would always be covered by the combination of one or two life insurance policies.

- Using life insurance for mortgage protection can alleviate the risk of someone being left with an unmanageable financial burden. Many people want to protect their home for their loved ones but arent sure what kind of life insurance to purchase.

- Customizing your coverage can provide short-term protection when your mortgage amount is highest and long-term protection to cover the entire duration of the mortgage.

- The combination approach can work within your budget, provides flexibility and can be designed to cover all mortgage payments.

Read Also: How To Get A Mortgage Without A Credit Score

Advantages Of Mortgage Life Insurance

Mortgage life insurance can give you and your family peace of mind that the mortgage will be paid off. That may also be the case if you buy other types of coverage and specify that you want proceeds spent on paying off the mortgage, but mortgage life insurance benefits go directly to the mortgage lender.

Why You Shouldnt Buy Mortgage Protection Insurance

Mortgage protection insurance has limited advantages and serious drawbacks.

Lack of flexibility. While the death benefit can remove the financial stress of paying a mortgage, your family could still be left with bills and other debt they cant afford. With a regular life insurance policy, your family can use the payout for the most pressing bills, whether that’s mortgage payments, other loans or college tuition.

A term life insurance policy can provide more bang for your buck than a mortgage life insurance policy. A term policy allows you to choose your coverage amount and policy length. If you want to line up those options with your mortgage you can, but youre not forced to.

In short, term life offers most of the benefits of mortgage protection insurance but with lower premiums, more flexibility and more control.

Don’t Miss: Does Mortgage Prequalification Affect Credit Score

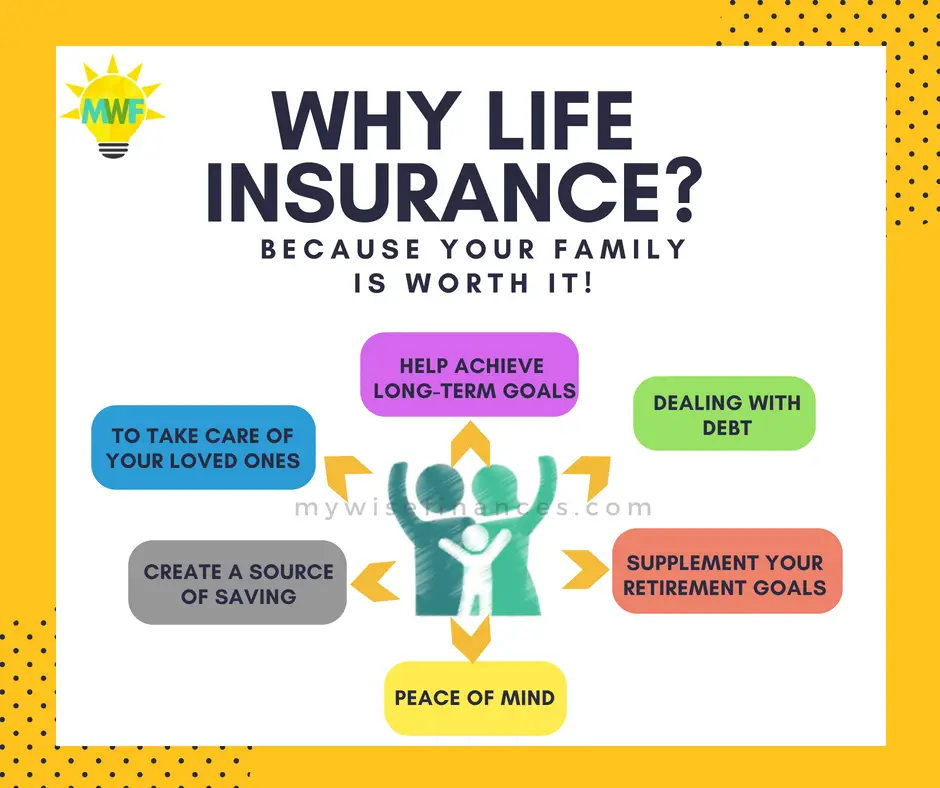

Life Insurance And Your Mortgage

A life insurance policy can help pay off your homes mortgage if you were to pass away. Its one of many ways that life insurance can help protect your loved ones and their financial future.

One of the best ways to factor your mortgage into your life insurance need is to talk with your insurance agent. They can work with you to determine the policy and coverage that can best fit your need and help your family stay current on mortgage payments if you were to pass away.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: What Is A Mortgage Inspection

Mortgage Life Insurance If Youre Married

If youre a married couple and own a home together, having life insurance in place will protect your spouse and children financially in the event of your death.

It could mean the difference between your family being able to continue living in your home or being forced to sell up.

For couples, its not just the breadwinner who needs life insurance. Stay-at-home parents typically take care of childcare, cooking, cleaning and household maintenance. These costs would need to be covered in the event of the stay-at-home parents death.

Is Life Insurance Mandatory

No. Life insurance is not mandatory, but it can be an essential part of helping make sure your loved ones are financially protected. Life insurance proceeds can be used to help pay off a mortgage, but it is not the same as mortgage insurance that you might be required to have as a condition of a loan.

You May Like: Can You Refinance A 30 Year Mortgage

Thinking About Buying Mortgage Life Insurance You May Want To Think Again

Updated on Wednesday, April 18 2018 | 0 min. read| by Bryan Ochalla

Mortgage life insurance may sound appealing. But you should probably ignore it unless you have a sizable mortgage, or you’re unable to afford or obtain traditional life insurance due to health issues.

Most people first become aware of mortgage life insurance when they go to purchase a house. Many lenders offer it to homebuyers as a sort of add-on to their mortgage.

The benefit of this form of life insurance: if you pass away while it’s still in effect, the insurance company will pay your lender the remaining balance of your mortgage.

In other words, you make monthly payments so you and your loved ones can rest easy knowing your home loan will be paid off should something happen to you.

On the surface, such a product probably sounds appealing, especially when you consider that, for most people, a mortgage is the biggest debt they’ll ever have. Dig a little deeper, though, and you’ll find that the return on this particular investment isn’t as impressive as it initially seems.

Why Regular Level Term Life Insurance Makes More Sense

If you need life insurance to cover more than just a mortgage, then you should opt for a regular term life insurance policy. This one is not only more affordable and flexible but also offers maximum protection. With regular level term life insurance, the mortgage will not only be your financial responsibility. Also, you can often get level term at the same rates with great benefits in the long run.

Read Also: Why Would My Mortgage Payment Go Up

It Loses Value Right Away

With mortgage protection insurance, you’re essentially buying a life insurance policy that loses some of its value every year. That’s because your mortgage balance gets paid down over time.

Say you take out a $250,000 mortgage and you also buy mortgage protection insurance. You start out essentially paying for $250,000 in insurance protection. That’s what it would cost for the insurance company to pay off your loan balance if you died soon after borrowing.

But you’ll be steadily paying down your mortgage every year. Eventually, you’ll owe only $200,000, then $150,000, then $100,000, and so on. The value of your protection starts eroding when you make your first payment, but premiums for the insurance typically stay the same for the life of the loan. This isn’t a very good value for you.

What Does Mortgage Life Insurance Cover

Mortgage life insurance covers your mortgage if you were to die.

Unlike other types of life insurance, mortgage life insurance is in place solely to pay off whatâs left on your mortgage. It wonât help pay final expenses, childcare and future education costs, which are other reasons people often buy life insurance.

A mortgage life insurance policyâs death benefits go to the mortgage lender directly, so loved ones wonât receive the money.

Also Check: How To Reduce Mortgage Amortization

Is There Insurance To Pay Off Mortgage In Case Of Death

A mortgage life insurance policy is a term life policy designed specifically to repay mortgage debts and associated costs in the event of the death of the borrower. These policies differ from traditional life insurance policies. With a traditional policy, the death benefit is paid out when the borrower dies.

Bottom Line: Is Mortgage Protection Insurance A Good Idea

Whether mortgage protection insurance is a good idea or not largely depends on your specific needs. If youre in good health and eligible for traditional life insurance, then mortgage protection insurance might not offer the best value for your money.

In that case, a traditional life policy is more likely to give you much better value as it provides coverage beyond mortgagelike taxes, bills, funeral costs, etc.

However, if you have trouble getting approved for traditional life insurance due to underlying health conditions, or if youre employed in a high-risk profession, an MPI policy would make sense.

Overall, mortgage protection insurance is a great way to ensure your loved ones dont sleep out in the cold if you were to pass away or become too disabled to work.

Also Check: When Can You Refinance Your Mortgage

Mortgage Life Insurance For Homeowners With Medical Issues

If you go through the process of applying for a mortgage, you may be offered mortgage life insurance by your lender or its partner companies. While it isn’t mandatory, mortgage life insurance offers enough coverage to pay off your mortgage so your family will not have to move if you pass away.

Find and Compare Mortgage Life Insurance Providers

If you are interested in getting life insurance to cover your mortgage, whether mortgage life insurance is the right policy for you depends primarily on your health. Young homeowners with limited medical issues will get better quotes and greater coverage options with term life insurance. On the other hand, if you have severe health problems and won’t qualify for term life insurance, then mortgage life insurance will offer larger death benefits than many alternatives.

Is Mortgage Life Insurance A Good Idea

Mortgage life insurance comes in different forms. You can choose between policies that pay out a fixed sum or a sum that gets smaller over time .

Nowadays, most mortgages are repayment loans, where every month you pay off interest and a bit of the amount borrowed. Your home loan therefore gets smaller over time, until it is completely paid off at the end of the term.

This means your family will end up with a smaller payment towards the end of the policy than at the beginning, designed to clear the mortgage with nothing over.

Pros and cons of decreasing-term mortgage life insurance v level-term standard life insurance:

Pros:

- A decreasing-term mortgage costs less

- The payout clears the repayment mortgage on the family home

Cons:

- It will only pay off the mortgage, without any money for other needs beyond the home loan

Taking out life insurance to cover the mortgage onlycould be a good idea if:

- You and your other half each earn enough to cover your living costs beyond mortgage payments

- You dont have any children or other people who depend on you financially.

Mortgage life insurance would make sure your other half could keep a roof over their heads.

However, if your partner earns less than you, doesnt work outside the home, or might have to leave their current role to look after children, you might want to choose life insurance that pays out enough to cover extra costs on top of the mortgage.

You May Like: What Is 1 Point On A Mortgage

Term Life Gives Your Family Flexibility

Term life pays a death benefit to any life insurance beneficiary you choose, such as your spouse or child, if you die within the policys term. Your beneficiaries can use the money however they like. If paying off the mortgage isnt a priority for them, they can use the money for more critical needs.

Term Life Coverage Can Extend Past Your Mortgage Term

Many providers offer term life policies lasting between five and 30 years. Buyers can choose a term length for life insurance based on their longest financial obligation, and they are not bound to a specific length.

A mortgage life policy, however, coincides with the length of your home loan. Plus, some mortgage life policies end if you refinance.

You May Like: Would I Be Eligible For A Mortgage

Pros Of Mortgage Protection Insurance

There are a few benefits to buying mortgage protection insurance.

One big benefit is you may not need to go through an underwriting process to get approved. Underwriting determines eligibility and rates for most term life policies, which means your age and health status, as well as a complete medical exam, determine both if you can get covered and how much youll pay. Some insurers offer mortgage protection insurance without underwriting, so you wont have to worry that you wont get approved, and of course, there is no medical exam.

Another bigand obviousbenefit is that your family can stay in your home without having to pay a loan if you die. The coverage amount is matched to your mortgage so you can make certain theres enough to repay all you owe. Not having to worry about this financial burden is a major advantage for surviving family members, especially if you were the primary breadwinner.

What Does Mortgage Protection Insurance Do

First, lets look at how mortgage protection insurance works. Like life insurance, MPI protects your loved ones should you die prematurely. The insurance covers the balance of your mortgage so that your loved ones can continue to live there. In some rare cases, MPI can also cover you in the event that you become chronically ill or permanently disabled, but thats less common.

Unlike life insurance, though, your lender is the beneficiary of your mortgage insurance protection policy. If you die and the insurance company pays out a benefit, they pay it to the lender. While this does pay off your mortgage, giving your loved ones peace of mind, they dont receive the payout themselves.

Don’t Miss: When To Apply For Mortgage Pre Approval

Consider All Your Options Before Buying Mortgage Protection Insurance

Buying insurance is a responsible thing to do to make sure your family members are provided for. You should explore all of your options, including mortgage protection insurance, and discuss them with your loved ones to decide whats best for you. Consider your loan amount and insurance quotes, and read all fine print before making any decisions as well.