Use A Mortgage Calculator To Get The Best Rates

To use a mortgage calculator, you’ll enter a few details about the loan, including:

- Home price. The purchase price of the home.

- Down payment. The cash you pay upfront to buy a home.

- Loan term. The amount of time you have to repay the loan.

- Loan APR . The cost to borrow the money.

- Property taxes. The annual tax you pay as a real property owner, levied by your city, county, or municipality.

- Homeowners insurance. Your annual cost to insure your home and personal belongings against theft, fire, natural disasters, personal liability claims, and other covered perils.

- HOA fees: The monthly amount you pay to your homeowners’ association to help cover the costs of maintaining and improving the properties in the association.

It’s easy to change one or more variables to see how it would affect your monthly mortgage payment, mortgage interest, and the total cost of the loan.

For example, if you choose a shorter loan term, your payments will be higher, but you’ll pay less interest over the life of the loan. And, of course, if you have a higher interest rate, your monthly payment will be higherand so will the total interest.

Using a mortgage calculator is a good resource to budget these costs.

Can I Actually Get A Mortgage At 199 Percent Interest

Loans like this are definitely available. To get one, youll have to apply through a broker because theyre only offered by mortgage wholesalers and arent available at your local bank.

Its very realistic, all they have to do is call, said Alex Beadle, president of the Georgia Association of Mortgage Brokers and a mortgage broker at bigmortgagecompany.com in Stone Mountain, Georgia.

Beadle said hes already written two loans with 1.99 percent interest and has about two dozen more clients in process who will likely qualify for that rate.

He added that these rates likely wont last for long, so if locking in a super-low interest rate is your priority, now is the time to act.

These rates werent here last year, and I doubt if theyll be here again next year, Beadle said. If I can give any advice to consumers: take advantage of these rates while theyre here.

Tips To Get The Best Mortgage Rate

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

Its a good idea to comparison-shop for the best mortgage rate you can get, because even a small rate difference can mean tens of thousands of dollars in savings.

Buying a home is one of the biggest financial decisions youll make in your life. And choosing the right mortgage is one of the most important parts of the homebuying process.

Mortgages come in all shapes and sizes, and interest rates can vary widely from lender to lender. The interest rate represents the price of borrowing money and even a small difference in rate can equal a drastic difference in your total costs.

For example, if you take a 30-year, fixed-rate mortgage with a 3% interest rate, your monthly payment will be $843, and youll pay $103,555 in interest over the life of the loan. But that same loan with a 5% interest rate will cost you $1,074 per month and $186,512 in interest costs.

Just a 2% difference in your interest rate adds up to nearly $83,000 in additional interest charges over the loan term.

So as you shop for a mortgage, you want to make sure you get the best mortgage rate. Here are nine tips to help you do just that, and save money on your mortgage in other ways.

Recommended Reading: Monthly Mortgage On 1 Million

What Is The Difference Between The Apr And The Interest Rate

The Annual Percentage Rate is the true cost of the mortgage. It takes into account all the fees and charges you pay when you receive the mortgage and spreads those out over the life of the loan so you can get an idea via an annualized rate of what youre actually paying.

The federal government requires banks to list the APR to preclude hidden or unexpected fees. Looking at the APR can be useful when comparing two different loans, especially when one has a relatively low interest rate and higher closing costs and the other has a higher interest rate but low closing costs. The mortgage with the lower APR might be the overall better deal.

The APR is generally higher than the stated interest rate to take in account all the fees and costs. Usually its only a few fractions of a percent higher, though – you should give anything larger than that a hard second look. When youre exploring 40-year mortgage rates and 30-year mortgage rates, those fees are spread out over a longer period of time. The APR probably wont be much higher than the interest rate. But for 20-year mortgage rates, 15-year mortgage rates and 10-year mortgage rates, the difference between the APR and the interest rate will likely be greater.

Lock In Your Mortgage Rate

Once youve picked the best lender for you, lock in your mortgage rate. A rate lock is a commitment to the interest rate youve been quoted, and the rate shouldnt change unless your credit score, down payment or loan program changes. With a refinance, your rate might change if your appraisal comes in low.

Keep an eye on your lock expiration date if you havent closed by that date you may end up paying costly lock extension fees.

Don’t Miss: Chase Mortgage Recast Fee

The Bottom Line: Better Finances Equal Better Rates

Simply put: The better your financial profile, the better rate youll get. When you receive a quote for a rate, its unique to your personal situation. That means it can be hard to compare your rate with someone else’s. Instead, you should focus on getting your best possible rate.

Now that youre a mortgage rate expert, you can review your loan options with confidence. Try out our mortgage calculator to see how different rates might affect your monthly payment, or, if you’re ready, you can apply online now to get started on your mortgage.

Take the first step towards the right mortgage

Rocket Mortgage helps you get started wherever you are in your journey.

Va Mortgage: Minimum Credit Score 580620

VA loans are popular mortgage loans offered only to veterans, service members, and some eligible spouses and militaryaffiliated borrowers.

With backing from the Department of Veterans Affairs, these loans do not require a down payment or any ongoing mortgage insurance payments.

VA loans also typically have the lowest interest rates on the market.

Technically, theres no minimum credit score requirement for a VA loan. However, most lenders impose a minimum score of at least 580. And many start at 620.

Similar to FHA loans, VA loans dont have riskbased pricing adjustments. Applicants with low scores can often get rates similar to those for highcredit borrowers.

Also Check: How Much Is Mortgage On A 1 Million Dollar House

Hot To Be A Fast Efficient Rate Shopper

Now lets talk about smart rate shopping moves.

Yes, it takes some work to find the best mortgage rate. But the time and effort you put in should pay off nicely.

There could potentially be thousands of dollars worth of savings on the line. So the time you spend searching for a lower mortgage rate could net the best hourly rate youll ever earn.

Choose The Right Loan Product

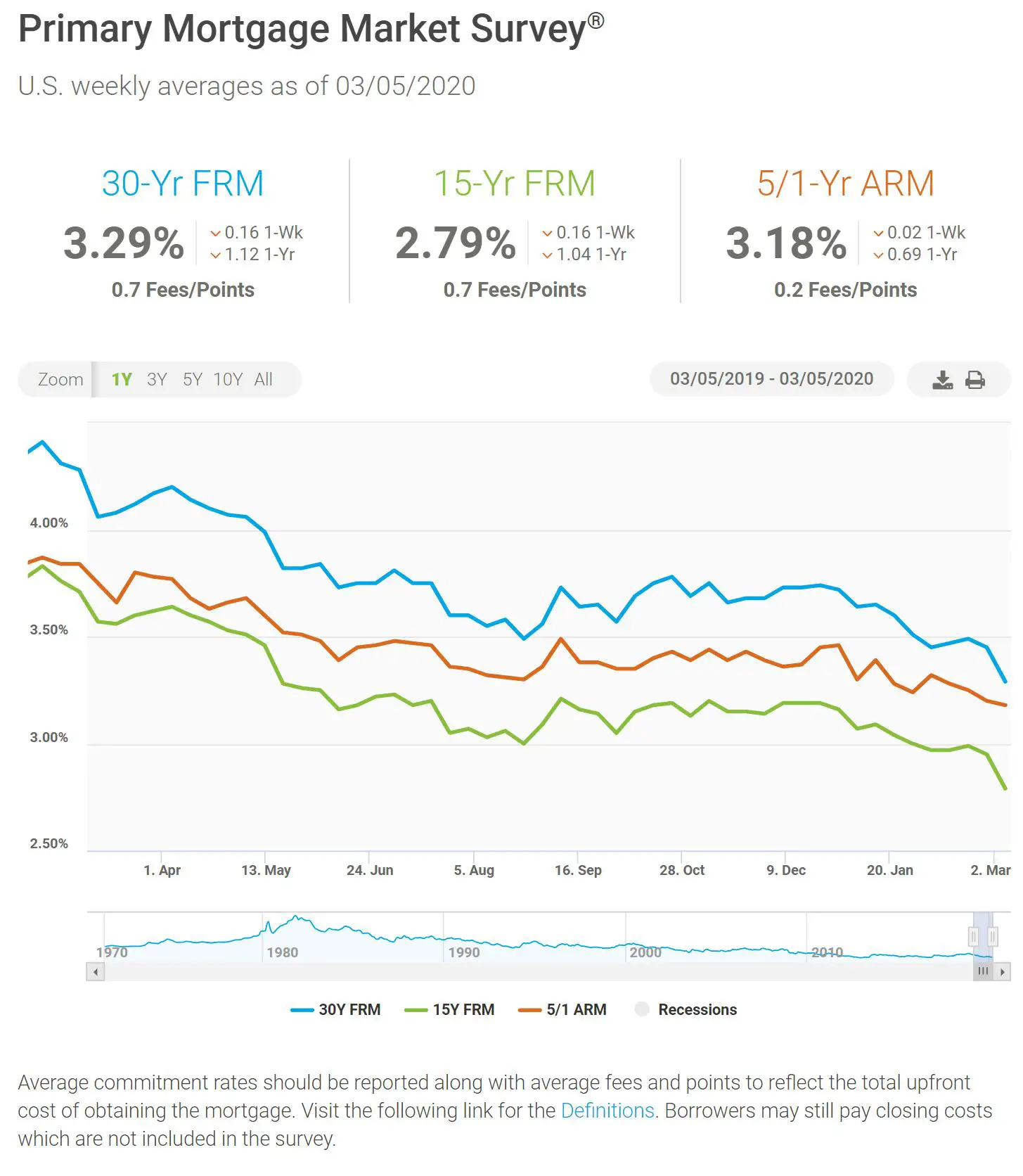

Borrowers can often achieve a lower interest rate just by shortening their loan term. In 2019, the average rate on a 30-year mortgage was 3.94%, according to Freddie Mac. On 15-year loans, it was 3.39%nearly sixty basis points lower.

The catch is that payments are higher on these loans. At 2019s average rates, a $200,000 loan would come with a $947 payment on a 30-year term and a $1,418 payment on a 15-year term. Borrowers will need to prepare for these higher payments before opting for a shorter-term loan.

The same goes for adjustable-rate mortgages, which typically have lower interest rates, too. The caveat with these loans, often called ARMs, is that the rate can increase after a set amount of timeusually five, seven, or 10 years into the loan.

This obviously comes with some risk, but according to Tyrrell, for the right borrowerparticularly one who doesnt plan to be in the home too long, an ARM can be a smart way to save cash. During those first few years, even a quarter of a percentage point can mean a savings of a few hundred dollars a month, Tyrrell says.

According to Mary Foster, a mortgage loan originator at Affinity Federal Credit Union, the key is knowing how long you plan to stay in the home.

For a seven-year adjustable-rate mortgage, its going to be fixed at that lower rate for seven years, and then its going to adjust in year eight, says Foster. Where are you going to be in year eight when that loan adjusts?

Recommended Reading: Rocket Mortgage Conventional Loan

How Do I Pay For Cmhc Insurance

Your lender is actually the party responsible for payingCMHC insurancecosts. In the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan amount. This will slightly increase your monthly or bi-weekly payment.

In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum, or not pass down the cost to you at all. Contact your lender for more details.

Check Your Credit Scores

Your credit score has more impact on getting a low-rate mortgage than any other factor. You can start by getting one free credit report from each major bureau Equifax, Experian and TransUnion at AnnualCreditReport.com.

Although you can also get your free credit score online through several sources, or pay for ongoing access to your credit reports and scores through platforms like myFICO, ultimately your lender will pull a mortgage credit report and use your middle score, or the second-highest score, to help determine your mortgage rate. Generally, a 740 credit score or higher may qualify you for the lowest mortgage rates available.

Don’t Miss: Requirements For Mortgage Approval

When You Apply For A Mortgage Theres One Factor That Could Save You Tens Of Thousands Of Dollars If You Play It Right: Your Interest Rate

Your interest rate impacts how much youll pay your lender over time. Fortunately, you may be able to influence the interest rate you get by taking steps to build your credit, saving for a big down payment and researching your options.

Mortgage experts predict that interest rates will jump by a half percentage point this year, which may seem trivial. But take a closer look: A 30-year, $250,000 mortgage with a 4.25 percent fixed interest rate will cost about $21,400 less over the life of the loan than the same mortgage with a 4.75 percent rate.

Whether youre planning on refinancing your current abode or purchasing a new home, heres what you can do to better your chances of scoring a great mortgage rate:

What Are The Closing Costs

Closing costs are fees charged by the lender and third parties. Closing costs don’t affect the mortgage rate . But they do have an impact on your pocketbook. Closing costs usually amount to about 3% of the purchase price of your home and are paid at the time you close, or finalize, the purchase. Closing costs comprise various fees, including the lender’s underwriting and processing charges, and title insurance and appraisal fees, among others.

Youre allowed to shop around for lower fees in some cases, and the Loan Estimate form will tell you which services you may shop for so you can reduce closing costs.

» MORE:Calculate your expected closing costs

Read Also: Chase Recast Mortgage

Shop Around For The Best Rate In Your Area

Mortgage interest rates can fluctuate depending on the market and national rates can provide a good ballpark estimate as to where your rate might lie. Keep in mind that the rate you’re likely to receive will depend more heavily on factors such as your specific location, and . While you can take a look at each lender’s website to get an idea of what interest rates they charge, the best way to get a solid idea of what you’ll have to pay is to provide the necessary information and check your rate.

That said, it’s important to submit your information and check your rate with more than one lender so you can have a better chance at securing the lowest rate possible. Don’t worry about your credit score getting dinged multiple times when you apply for a mortgage, you can submit your information for a hard inquiry as often as you need to within a 45-day window without your credit score suffering for it.

While you may not always get a drastically low rate between lenders, even a small distinction can make a big difference in how much you end up owing in interest each month.

Consider More Than One Type Of Mortgage

While most people look to fixed-rate mortgages when they shop around, other mortgage types can offer lower rates especially at first. Its certainly true that fixed-rate mortgages offer a steady, reliable interest rate that wont creep up on you years later, but that doesnt mean theyre the right option for every consumer.

With a variable- or adjustable-rate mortgage, for example, consumers start with a fixed rate that lasts anywhere from one to 10 years, then float into a variable rate based on whatever the current interest rates. Because adjustable-rate mortgages, or ARMs, usually offer lower rates to start, they can be attractive options for people who plan to refinance or move after the first few years.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

How Does Interest Work On A Car Loan

When you apply for a car loan, the car is used as collateral.Most lenders will require you to have auto insurance to protect the collateral while the loan is being repaid. If you miss any payments, the bank can repossess the car to cover the costs of the loan.

Because the process of repossessing a car is fairly straightforward and doesnt cost the lender very much in fees, borrowers can expect lower interest rates on car loans. Auto loans typically have interest rates in the 4-5% range.

Tips To Improve Your Credit Report Before Home Buying

Bad credit doesnt necessarily mean you wont qualify for a mortgage. But borrowers with good to excellent credit have the most loan options. They also benefit from lower rates and fees.

If you can polish up your credit report before shopping for a mortgage, youre more likely to qualify for the best loan terms and lowest interest rates.

Here are a few tips to improve your credit report and score before applying:

Removing inaccurate information can increase your credit score quickly. Developing better credit habits will take longer to produce results.

If youre looking to buy or refinance and know you may need to bump your credit score, it can be helpful to call a loan advisor right now even if youre not sure youd qualify.

Most lenders have the ability to run scenarios through their credit agency providers and see the most efficient and/or costeffective ways to get your scores increased. And this can be a much more effective route than going it alone.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

Insured Insurable And Uninsurable Mortgages

Theinsurability of your mortgagewill affect your mortgage rate. Insured mortgages are those with CMHC mortgage default insurance or private default insurance from Canada Guaranty or Sagen. The borrower will pay for the mortgage insurance premiums.

Since the lender has zero risk, they will offer the lowest mortgage rates for insured mortgages. The mortgage rates that you see advertised online are often only for insured high-ratio mortgages, which are mortgages with a down payment less than 20%. Insured mortgages will need to meetCMHC mortgage requirements.

With insurable mortgages, the borrower wont pay for mortgage insurance. The mortgage wont be individually insured either. Instead, the lender can choose to bulk insure their portfolio of insurable mortgages and pay for this insurance themselves.

What this means to you is that the cost of mortgage insurance isnt directly paid by you if mortgage insurance isnt required. Insurable mortgages will have to meet the same requirements as an insured mortgage, but the only difference is that an insurable mortgage will need to have a down payment of at least 20%. Insurable mortgage rates are also slightly higher than insured mortgage rates.

An insurable mortgage can have a mortgage rate that is around 20 basis points added on top of an insured mortgage rate. Uninsurable mortgage rates will have around 25 basis points to 35 basis points added on top of insured mortgage rates.

How Do I Get A Mortgage

Getting a mortgage is the most important part of the homebuying process. Its likely the largest loan youll ever take out. So finding the right lender and getting the best deal can save you thousands of dollars over the life of the loan.

Heres what you need to do.

There are lots of different types of lenders. Looking at the loans and programs that banks, credit unions, and brokers offer will help you understand all of your options.

If youre looking for a specific type of loan, like a VA loan or a USDA loan, then make sure that the lender offers these mortgages.

2. Apply for preapproval

Before you start shopping for a home, youll need a preapproval letter. A mortgage preapproval is different from a formal loan application in that it doesnt affect your credit and doesnt guarantee youre approved. But it does give you an idea of your likelihood of approval.

3. Submit an application

Once youre ready to start comparing loan offers, submit an application. Until you apply, the lender wont be able to give you an official estimate of the fees and interest rate you qualify for.

To find the lowest rate and fees, you should submit applications with two or three lenders. Once you have each Loan Estimate in hand, its easier to compare and determine which offer is best for you.

4. Underwriting and closing

Recommended Reading: Chase Recast