How Much Should I Pay For A Down Payment

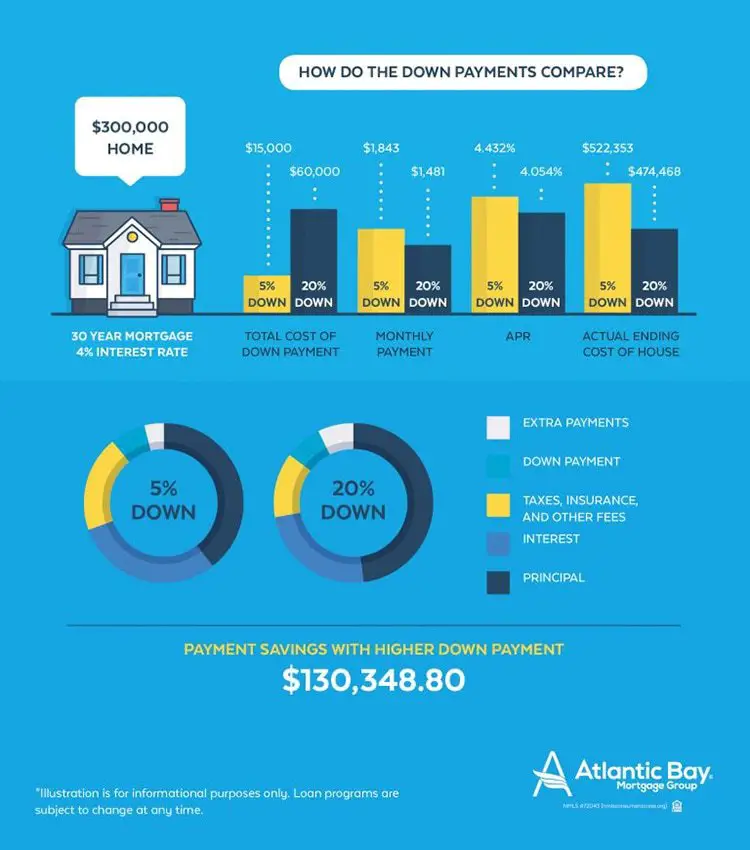

Aim for a down payment thats 20% or more of the total home pricethats $40,000 for a $200,000 house. This minimum is partially based on guidelines set by government-sponsored companies like Fannie Mae and Freddie Mac. Anything less than 20% is considered riskier for a lenderso to cover their butts, they make the mortgage more expensive for you by adding things like private mortgage insurance .2

If this isnt your first time buying a house, youve probably built up some serious equity in your current home by paying down your mortgageand rising home prices have added even more equity. That makes a 20% down payment easier to reach. All you have to do is sell your current home to tap into that equity andpresto!you have yourself a huge down payment for your next home.

If youre a first-time home buyer, a smaller down payment of 510% is okay toobut then you will have to pay that monthly PMI fee.

No matter what, make sure your mortgage payment is no more than 25% of your monthly take-home pay on a 15-year fixed-rate conventional loan . Otherwise, youll be charged so much extra in interest and fees. Its not worth it! You need that extra money to tackle home maintenance and your other financial goals.

FYI: That 25% maximum mortgage payment includes principal, interest, property tax, home insurance, PMI and homeowners association fees.

Benefits Of Putting More Than 20% Down

If you’re able to do so, you may want to consider putting down a payment that’s larger than 20%. Here are some of the benefits:

- Lower monthly payment due to no mortgage insurance and smaller loan amount

- Less interest paid over the life of the loan

- More flexibility if you need to sell on short notice

Cons Of A Big Down Payment

Saving money is great, but making a big down payment does have its drawbacks, too. For example, a big down payment can:

- Delay your home purchase: Since a big down payment requires more money, it may take longer to save up, which could delay your home purchase.

- Drain other funds: You may be tempted to pull from other places, like an emergency fund, to make the payment but you could be shorting your other accounts. This can be a problem when you need to access those accounts for an emergency or home repair. Tying your available cash up in your home puts you at risk of going into debt if something unexpected happens.

- Only provide some benefit: The money-saving benefits of a big down payment dont happen right away. Theyre more long-term, so if you dont stay in the home for a long time, you may not even experience the full benefit of a big down payment.

Also Check: What Salary Do I Need For A 200k Mortgage

Cons Of Putting 20% Down

Putting 20% down isnt right for every buyer. Some buyers simply cant afford it. Others would rather keep some cash reserved for future repairs and other expenses. If youre trying to decide how much down payment you need to buy a house, consider these drawbacks.

More Financial Risk

Once you put money down on your mortgage, its not easy to get it back. If you think theres a chance you might need the money for something important later, it may be wise to put down less and build your emergency fund.

Less Money For Repairs And Other Items

Homes in need of only a few minor repairs can be a bargain for new buyers. However, the larger your down payment, the less money youll have left over to spend on repairs and maintenance.

Longer Time To Save

For most people, saving for a down payment can take months, years or even decades. Waiting until you have a 20% down payment can lead to a huge opportunity cost when you factor in what youd spend each month on rent. It may be more affordable in the long run to buy a home now than it is to pay rent while you save up for a 20% down payment.

How Does A Down Payment Work In Real Estate

When you buy a house with a mortgage, the down payment is the portion of the purchase price that you pay upfront, like a good-faith deposit on the home. The rest of the payment price is covered by your mortgage loan. The larger your down payment, the less you have to borrow from your lender.

For example, if youd like to buy a $200,000 home and are eligible to borrow $180,000 from a mortgage lender, youd make a down payment of $20,000 upfront. Youd then repay the lender the remaining $180,000, with interest, over time.

Also Check: How To Pay Off Your Mortgage Quickly

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Buy With What You Have

You might not think that a less-than-20% down payment is ideal, but it is possible. If you have your heart set on buying right now, and can manage a 3% or 5% down payment, youd likely be able to find a loan that works for you.

This will mean you have to pay PMI, and youll be paying off a larger loan with more interest over time. But if its possible for you to buy with a smaller down payment, it might be worth crunching the numbers.

Don’t Miss: How Far Can You Fall Behind On Your Mortgage

When To Pay Your Mortgage Default Insurance

When you are approved for a mortgage that requires mortgage default insurance, you have the choice of either paying the default insurance premium amount up front or adding it to the principal portion of your mortgage.

Mortgage borrowers can see the amount of their mortgage default insurance premium by looking at their TD Canada Trust Mortgage Loan Agreement. From time to time, the company providing the insurance may amend the calculations for the premiums. In that case, because of timing, this document may not reflect the most current percentages. However, your Mortgage Loan Agreement will always reflect the correct premium amount. Depending on your province of residence, you may be charged a provincial sales tax on the mortgage premium amount, which you are required to pay. As of June 1st, 2015 the following provinces charge a sales tax on the mortgage premium amount: Ontario, Quebec and Manitoba.

The Minimum Mortgage Down Payment

You may have heard that you need a 20% down payment to buy a home. For many buyers, a 20% down payment isnt realistic. Fortunately, 20% down is no longer the industry standard. The average down payment paid for a mortgage is about 6%.

Over the years, the industry has changed to make homeownership more accessible. Its now possible to get a mortgage for as little as 3% down, although some loans loans and U.S. Department of Agriculture loans) require no money down.

Don’t Miss: Can You Negotiate A Lower Mortgage Rate

How Much Mortgage Can I Afford

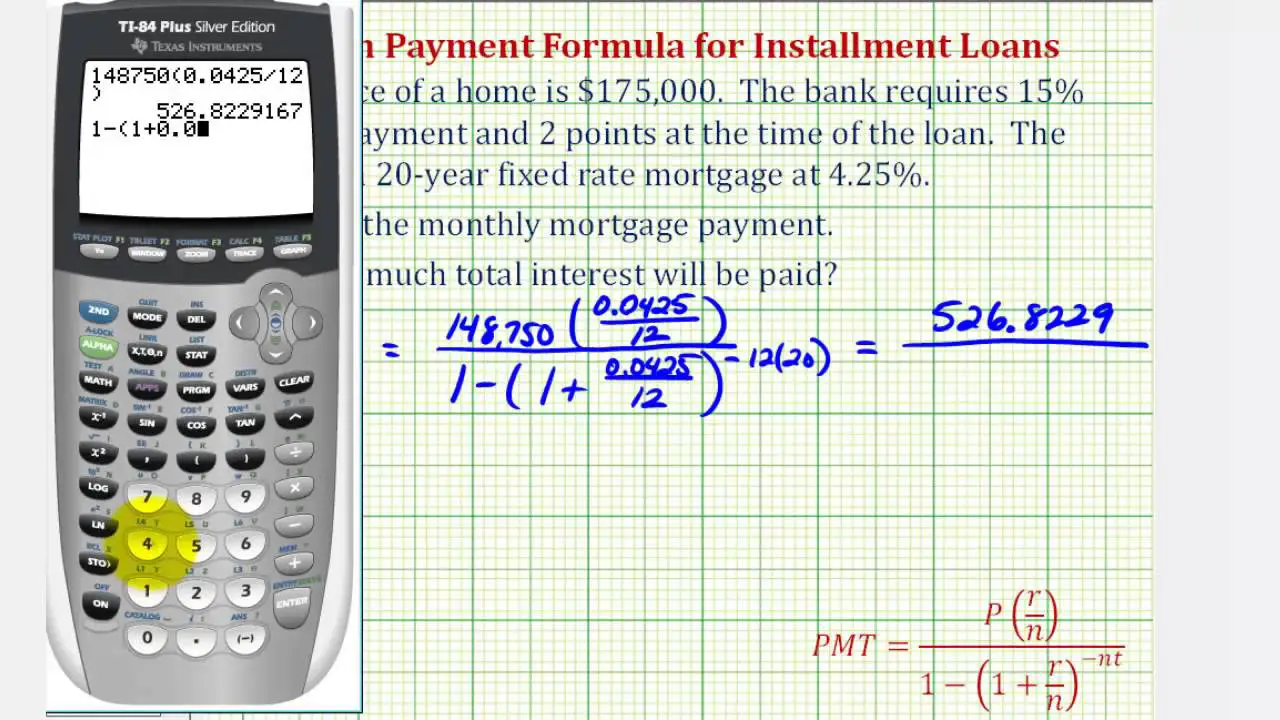

The general rule of thumb for mortgage eligibility is that you can borrow around four times your annual household gross income, and no more than 32% of your gross income should go for housing and mortgage expenses. However, there are more factors involved in calculating your mortgage affordability amount and consequently, the real calculation is more complicated. Your monthly non-housing expenses, such as food and utilities, and also your monthly debt payments are involved as they reduce the amount of income you have for your mortgage payments. A quick way to check is to use amortgage payment calculatorto see how much payments are required every month.

For example, say you have an annual household income of $140,000 and have saved $70,000 for a down payment. Your monthly non-housing expenses are $2,000, youre paying off your student debt at around $300 monthly and yourcar loancosts you $400 per month even with a lowcar loan rate. Thats $2,700 from your monthly income to start with. Your mortgage affordability, the amount you can afford to spend on a home, works out at $658,000.

You can find out how much you can afford by using ourmortgage affordability calculator.

Try out the mortgage stress test using ourstress-test calculator.

Your Down Payment Determines The Amount Of Mortgage Default Insurance You Pay

Your mortgage default insurance premium, calculated as a percent of your mortgage amount, gets smaller as you increase your down payment. To learn more about mortgage default insurance and how it is calculated, please visit our CMHC insurance page.

| Down Payment |

|---|

| 5% – 9.99% |

| $377,991 |

Under Scenario B, the additional $15,000 put towards the mortgage down payment lowers CMHC insurance by $2,423 and saves the homebuyer around $25,000 in interest over the life of the mortgage. However, it is also important to consider the opportunity cost, or alternative uses for the additional outlay, under Scenario B. You must look at your expected returns associated with RRSP contributions, stock investments and/or debt repayments, for example, to make an informed decision.

Also Check: What Were Mortgage Rates In 1980

What Is A Down Payment

A down payment is the cash you pay upfront to make a large purchase, such as a home. You use a loan to pay the rest of the purchase price over time. Down payments are usually shown as a percentage of the price. A 10% down payment on a $350,000 home would be $35,000.

When applying for a mortgage to buy a house, the down payment is your contribution toward the purchase and represents your initial ownership stake in the home. The mortgage lender provides the rest of the money to buy the property.

Lenders require a down payment for most mortgages. However, there are some types of loans backed by the federal government that may not require down payments.

What Is A Down Payment And How Much Will It Cost

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

A down payment is one of the largest costs youll face upfront when buying a home.

Understanding what a down payment is, when youll need one and how much to put down will help you get the most out of your mortgage.

Read Also: Is Biweekly Mortgage Payments A Good Idea

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Low Down Payment: Fha Loans

The FHA mortgage is a bit of a misnomer because the Federal Housing Administration doesnt actually lend money.

Rather, the FHA sets basic lending requirements and insures these loans once theyre made. The loans themselves are offered by nearly all private mortgage lenders.

FHA mortgage guidelines are famous for their liberal approach to credit scores and down payments.

The FHA will typically insure home loans for borrowers with low credit scores, so long as theres a reasonable explanation for the low FICO.

FHA also allows a down payment of just 3.5% in all U.S. markets, with the exception of a few FHA approved condos.

Other benefits of an FHA loan are:

- Your down payment may come entirely from gift funds or down payment assistance

- The minimum credit score is 500 with a 10% down payment, or 580 with a 3.5% down payment

- Upfront mortgage insurance premiums can be included in the loan amount

Furthermore, the FHA can sometimes help homeowners who have experienced recent short sales, foreclosures, or bankruptcies.

The FHA insures loan sizes up to $ in designated high-cost areas nationwide. High-cost areas include places like Orange County, California the Washington D.C. metro area and, New York Citys 5 boroughs.

Note that if you want to use an FHA loan, the home being purchased must be your primary residence. This program isnt intended for vacation homes or investment properties.

Also Check: How Much Does A 200 000 Mortgage Cost Per Month

Split The Down Payment With A Co

Theres a growing trend for homebuyers to purchase with somebody else named on the mortgage. This is called co-borrowing.

A co-borrower can be someone who lives in the home like a roommate. Or it may be an investor non-occupant, who lives elsewhere and has a purely financial role. Those are often parents, siblings, or friends.

The co-borrower typically takes a financial interest in the property and shares the benefit of home sales price inflation with you.

The upsides? Your co-borrower may chip in for the down payment. And his or her income and credit score count when you make your mortgage application.

The downsides? There are few for you, except youre sharing the profits of home price appreciation. And the co-borrower is on the hook if things go wrong.

Home Buyers Dont Need To Put 20% Down

Its a common misconception that 20 percent down is required to buy a home. And, while that may have true at some point in history, it hasnt been so since the advent of the FHA loan in 1934.

In todays real estate market, home buyers dont need to make a 20% down payment. Many believe that they do, however despite the obvious risks.

The likely reason buyers believe 20% down is required is because, without 20 percent, youll have to pay for mortgage insurance. But thats not necessarily a bad thing.

Also Check: What Credit Card Can I Pay My Mortgage With

Using Your Rrsp As A Down Payment

Under the federal government’s Home Buyer’s Plan, first-time home buyers are eligible to use up to $35,000 in RRSP savings per person for a down payment on a home. The withdrawal is not taxable as long as you repay it within a 15-year period. To qualify, the RRSP funds you plan to use must have been in your RRSP for at least 90 days.

Even if you already have enough money for your down payment, it may make sense to access your RRSP savings through the Home Buyers’ Plan.

For example, if you have already saved $35,000 for a down payment-and assuming you still had enough “contribution room” in your RRSP for a contribution of that amount, you could move your savings into an RRSP at least 90 days before your closing date. Then, simply withdraw the money through the Home Buyers’ Plan.

The advantage? Your $35,000 RRSP contribution will count as a tax deduction this year. Use any tax refund you receive to repay the RRSP or other expenses related to buying your home.

However, the money you borrow from your RRSP won’t earn the tax-sheltered returns it would if left in your account. Ask your financial planner if this strategy makes sense for you.

- Learn more about RRSPs.

- Learn more about the Home Buyer’s Plan.

What If I Cant Afford The Down Payment

Not everyone qualifies for a zero-down mortgage. Most borrowers need at least 3% down for a conventional mortgage or 3.5% down for an FHA loan.

But what if you cant quite afford the minimum down payment? Three percent down on a $300,000 home is still $9,000 a considerable amount of money.

Luckily there are programs that can help.

For example, every state has multiple down payment assistance programs . These programs often funded by state and local governments and nonprofits offer money to make homeownership more accessible for lower-income or disadvantaged home buyers.

DPA funds can come in the form of a grant or loan, and the loans are often forgiven if you live in the home for a certain period of time.

To find out whether youre eligible for assistance, ask your Realtor or lender to help you find and apply for programs in your area.

Also Check: How Is Interest Applied To A Mortgage

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.