Rent Out Your Spare Room Or Parking Space

Do you have an extra bedroom in your apartment? If you do, consider listing it on an online hospitality website like Airbnb. With Airbnb, you get to control who uses your space and when.

You can approve dates and guests ahead of time and only rent out your spare room when its convenient. You can even block out dates when your rental isnt available if you have a friend or family member coming for a visit.

If you live in an urban area where parking is at a premium, consider renting out any of your assigned parking with an app like JustPark. JustPark lets you rent out your parking space just like youd rent out your spare room on Airbnb. If you live in a heavily populated area, this can be an amazing source of extra cash on the weekends.

How Much House Can I Afford With A Va Loan

If youre an active member of the U.S. military or a veteran, you may qualify for a VA loan. A VA loan is a mortgage thats backed by the U.S. Department of Veterans Affairs. With a VA loan, you dont need to put any money toward a down payment, and you may be eligible to get a mortgage even with a lower credit score.

As is the case with an FHA loan, youll need to be careful with a VA loan to make sure you dont take on too high a mortgage, especially if youre not putting any money toward a down payment. Use a mortgage calculator to play with the numbers based on your loan amount and interest rate.

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Recommended Reading: Can You Get Rid Of Fha Mortgage Insurance

Sell What You Dont Use To Pay Your Mortgage Or Rent

This is a huge topic for everyone because we all have stuff in the house, garage and shed that we do not need any longer.

When the spring cleaningbug comes around Mrs. CBB and I tend to unload all of the items we want to get rid of at a garage sale or through online advertising.

The more stuff you keep around you the clutter starts to pile up which also means lost income potential, especially if products are time-sensitive.

Our rule of thumb is if we havent touched it in 6 months we likely wont need it, so we get rid of it.

Do your homework to see what the items you plan to sell are worth and price them accordingly.

Although donating is a great option when you are tight on money its best to sell what you can.

Know How Much Home You Can Afford

Before you even start looking for a home, you need to know how much you can afford so you donât spend time looking at homes that are out of your price range. When you do that, it’s hard not to feel let down later when you view lower priced homes.

To get an idea of what you can afford, you’ll need to keep these things in mind:

- Your household income

- Your current debts and the monthly payments to carry those debts

- Your monthly housing-related costs, like your mortgage payment, property taxes, home insurance, condo fees, school taxes, utilities and home care costs

- Your closing costs and other one-time costs

- Your spending habits

Don’t Miss: How Do Mortgage Loan Officers Make Money

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Much Of My Income Should Go Towards Paying A Mortgage

There are no set rules regarding how much of your income should cover a mortgage payment. However, lenders will look at how much of your income is going to other outstanding debts before approving another loan. Check out this guide for the different methods for determining how much of your income should go to your mortgage.

Recommended Reading: How Do Mortgage Companies Decide How Much To Lend

So Can You Afford To Buy A Home

Mortgage lenders want to protect you, so they use two different ratios to check that you will be able to carry a mortgage.

The Gross Debt Service Ratio calculates how your income compares to your mortgage expenses.

Rule of thumb: Most lenders say that no more of 30% – 32% of your gross annual income should go to home-related expenses.

The Total Debt Service Ratio looks at how your income compares to any and all debt you might have.

Rule of thumb: Most lenders say that your total debt payments should not be more than 37% – 40% of your gross annual income.

An RBC mortgage specialist can help you identify and budget for all the costs that come with owning a home.

The information in this publication is offered to help guide our clients and is believed to be factual and current, however its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subject matter discussed. This publication is not intended to give specific mortgage, financial, investment, tax, legal, accounting or other advice, and should not be taken that way. Readers should speak with their own professional advisor before taking action.

Personal lending products and residential mortgages are offered by Royal Bank of Canada and are subject to its standard lending criteria. Some conditions apply.

Find Out How Much Mortgage You Can Afford

Weâll help you figure out what home price you may be able to afford.

Ready to start looking for your dream home? Donât just dream about it â let the TD Mortgage Affordability Calculator help you begin your search. Enter a few key details and the calculator will guide you in determining, with confidence, what house price may be within reach.

Step 1 of 6

Don’t Miss: How Much Income To Qualify For 300 000 Mortgage

Plan For Your Down Payment

Your down payment amount has a significant impact on your monthly mortgage cost, since it can determine whether or not you pay private mortgage insurance every month. If you havent started saving for a down payment, start putting money aside each month to save up for your down payment fund. If you already own your home and want to buy a new one, find out how much equity you have in your current house and decide if you want to use potential proceeds from your sale to cover your down payment.

Hidden Items To Add To Your Housing Budget Include:

- Annual homeowners insurance premium : The first years premium is usually paid upfront, at the same time as closing costs.)

- Maintenance: Youll either have to buy a lawnmower or pay someone to mow the lawn, furnace filters and light bulbs will have to be replaced regularly, paint doesnt last forever, and you may need to contract with a pest control service or alarm company. Recurring costs like lawn maintenance or pest control services should be estimated as best as possible. Smaller ones can be bundled into your emergency fund.

- Emergency fund: A new home doesnt come with lifetime guarantees the water heater could explode, or the roof could start leaking. You should save money each month to be used for repairs and other unexpected problems.

Don’t Miss: Can You Have Two Mortgage Loans

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums, In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

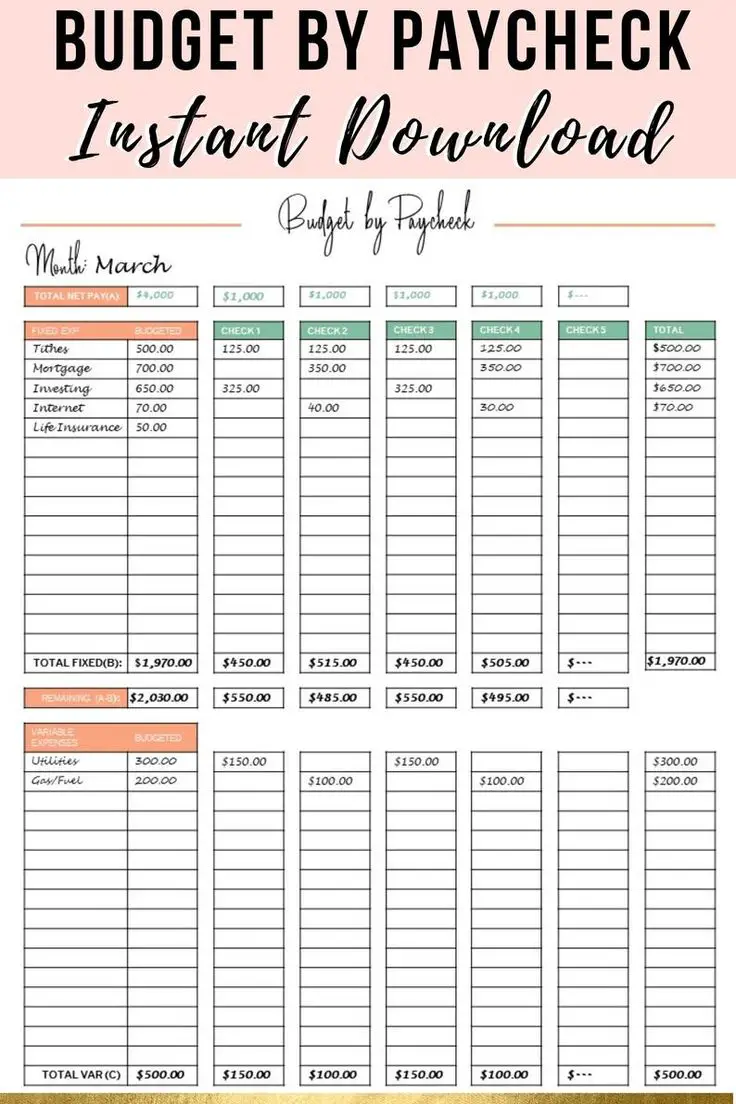

How Do You Add A New Mortgage Into The Budgeting Mix

If youre already a homeowner, youll likely have a good idea of what your new home will cost. If you are renting, think about how much you pay for rent. Now think about how increasing that number will impact your budget. Are you comfortable with your rent amount for a house payment knowing that unexpected housing costs may happen?

Unexpected costs always seem to pop up for homeowners, says Plains Commerce Mortgage Banker Dawn Van Nieuwenhuyzen. Have one months pay in a savings account set aside for the unexpected.

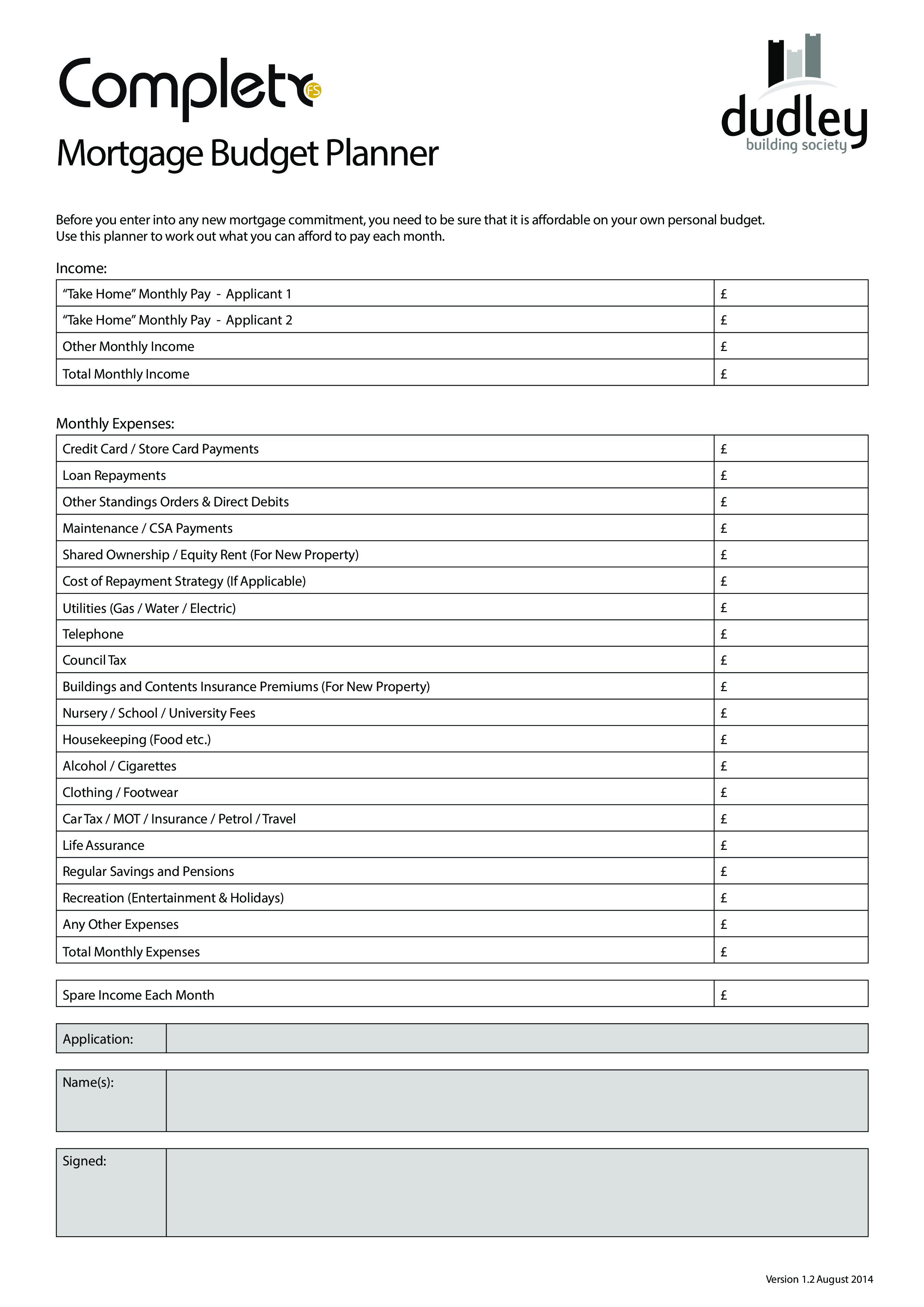

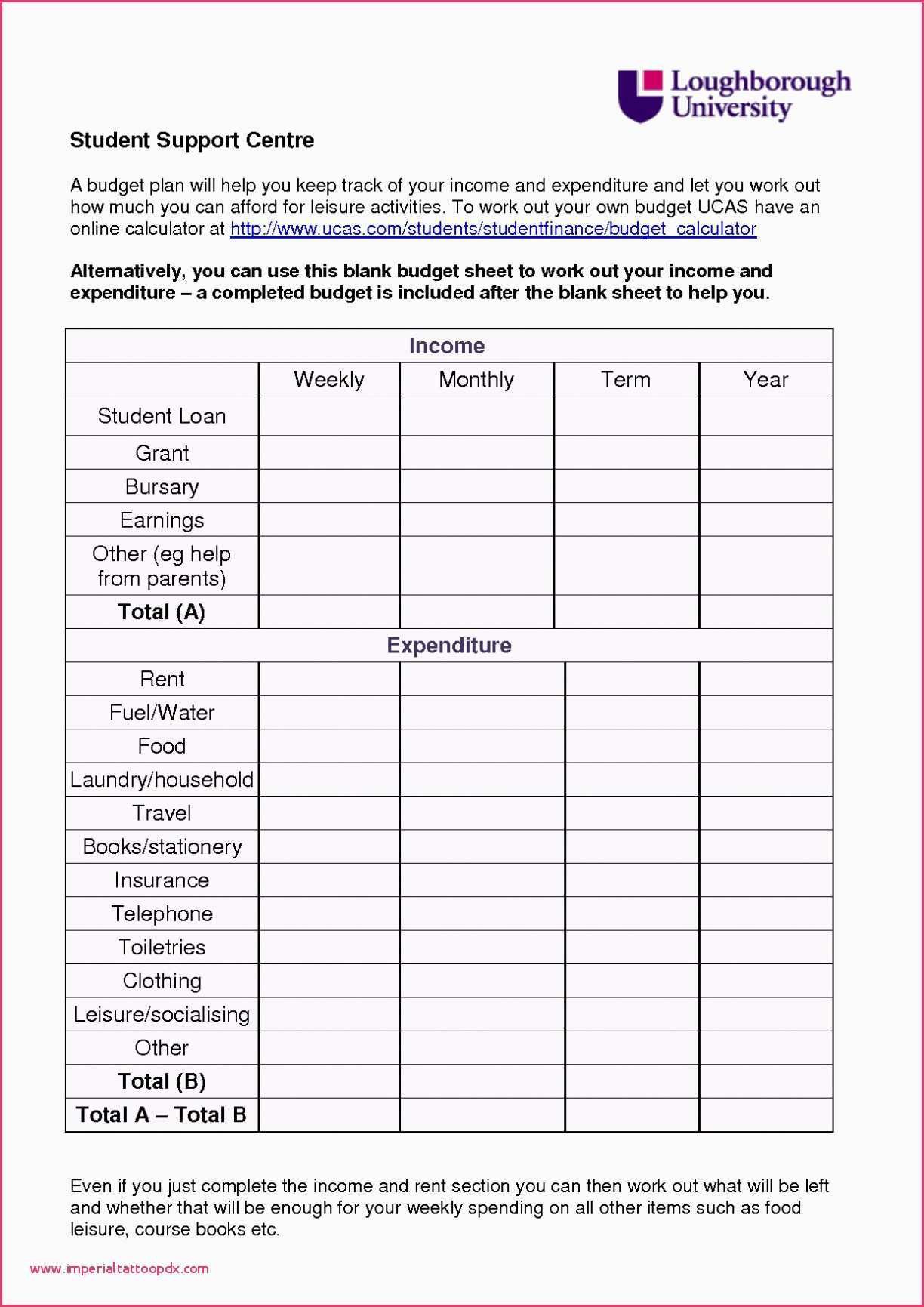

If youve never created a personal budget, now is the perfect time to start one. Many tools exist, beyond spreadsheets, to help you track income and expenses. And chances are that the pre-qualification process has already helped you get a jumpstart on analyzing your finances.

Try to keep your total house debt within 30% of your budget, says Chris. Also, budget for utilities, home insurance, property taxes, and mortgage insurance if you dont have a 20% down payment.

Read Also: Can You Mortgage A Boat

How To Create A Test Budget

If you dont want to get into using a test budget and an actual budget you can simply add to your current rental costs the home you plan to purchase including property taxes and maintenance fees.

Renters most often have utilities included with their rent but for those that dont you already have budget categories for hydro, water, gas and other rentals. Consider these when creating your test budget because you will most likely have to pay for them as a homeowner as variable expenses. This means the costs will go up and down depending on usage and the way you set up your payment plan.

For example:

We rented a room that cost us $500 all-inclusive which means we pay nothing more than the $500 every month. Ah, the life of a renter was easy for us. The internet, cable, water, property taxes, hydro, gas, home phone was all included in that $500 price.

What you need to do is first do an analysis or your debt to income ratio. You need to know how much money you net or bring home each month minus your debts not including the rent. From there you can use one of those handy mortgage calculators to see what you could afford to purchase.

Lets say you are single and earn $50,000/year and take home $3000 a month.

The important thing to remember here is that this test budget will take some work to put together which will include making phone calls but youll learn more than you imagined in the process. You will be thankful, trust me.

- Groceries

- Subscriptions

- Hobbies

Figure Out How Much To Save For Your Down Payment

Depending on your mortgage type and , your down payment will range from 3% to 20% of the purchase price of the home.

Note: If your down payment is less than 20% and you have a conventional loan, your lender will require you to have private mortgage insurance each month until you build up 20% equity in your home. To avoid PMI, you may want to save for a larger down payment. Speak with your lender about your options and what is right for your situation.

Need help saving for a down payment? Learn about down payment assistance programs.

You May Like: Do Mortgage Brokers Get Commission

Think About Your Financial Goals

Identify your short-term and long-term goals. Make saving for those goals part of your budget.

For example, goals may be:

Short-term goals:

- paying off your credit card

- reducing your weekly expenses

- starting to build an emergency fund

Long-term goals:

- paying off all of your debts

- saving to buy a home, a car or booking a trip

- saving to have children, to go to school or to retire

To deal with unexpected situations, create an emergency fund. Your emergency fund should provide you with enough money to cover your living expenses for 3 to 6 months. These amounts can sometimes seem out of reach. That is why you should start by saving a small amount on a regular basis.

Having an emergency fund will help you reduce financial stress and avoid getting trapped in a debt cycle.

The Cost Of Homeownership

After moving into your new home, youâll learn quickly that there is always something to buy. Some purchases may be needed on day one, some after youâve lived in your house for a couple months. These purchases could include new appliances, carpeting, lighting, paint, window treatments, a furnace, a security system, home insurance, mortgage life insurance, or seasonal items like rakes, shovels or a snow blower.

Read Also: Is Quicken Loans A Mortgage Broker

How To Budget For A New Home

4 Min Read | Apr 14, 2022

Owning a home is a huge blessing when you have the money to make it work. But how do you know how much home you can afford?

Thats where the dreaded B-word comes in. Yep, a budget. Budgeting may get a bad rap, but its really quite simple to do. Lets break it down into a real-world example to see how it works.

Build A Better Budget

The first step in the saving process is budgeting. If you dont know where your money goes every month, its impossible to divert money to your down payment.

First, make sure you know how much money youre bringing home each month, and include income from a spouse or partner if theyll also be contributing to your down payment. Then, sit down with your bank statements and all your credit card payments. Look at where youre spending the most money.

Note how much you spend on necessities like rent, student loan payments and utilities. Then consider how much you spend each month in nonessentials like entertainment, restaurants, etc. A budgeting app can help you automate this process if youd like to avoid calculating your expenses yourself. If it all still seems overwhelming, enlisting the help of a financial advisor can help you get a better idea of what your budget should look like.

After you categorize your expenses, look for areas where you can cut back. Set a definite budget for each category and stick to it. Make sure you budget a certain dollar amount to put away for your down payment each month. Consider your savings a non-optional expense.

Read Also: How To Negotiate Best Mortgage Rate

How Much Do You Have For A Down Payment

Your down payment affects the amount you can borrow to buy a home and the size of your payments. This will impact your monthly budget.

You must have at least 5% for a down payment if the home purchase price is less than $500,000.

If the home purchase price is between $500,000 and $999,999.99, you must have at least 5% for the first $500,000 and 10% for the remaining amount.

For home prices $1 million or over, the down payment must be 20%.

If you are a first-time home buyer, you can borrow up to $35,000 from your RSP towards your down payment.1

1. First time home buyers can withdraw up to $35,000, in a calendar year, from their RSPs for a home purchase . They then have 15 years to repay their RSP . Find out more about the RSP Home Buyers’ Plan.

Step 5 of 6

How To Budget After Buying A House

Daniel Milan, managing partner of Cornerstone Financial Services in Southfield, Michigan, told The Balance in a phone interview that “to maintain your financial health as a new homeowner, prepare your budget for the changes you’ll face.”

If you’re going from renting to owning, you’ll want to evaluate the changes in your regular monthly expenses. If you’re moving to a bigger property, your living expenses will likely increase because you’ll be paying more for utilities, and you’ll be responsible for covering any maintenance or repair issues that arise.

One common mistake new homeowners can make is that after they’ve been so focused on saving for the down payment and what they can afford for the mortgage, they forget about the other variables that come with homeownership, Milan said.

Scrutinize the line items in your budget and see where you can make some realistic adjustments. You might want to start, for example, by cutting out some discretionary spending, whether it’s putting limits on entertainment or scaling back vacations.

Once you identify ways to cut back your expenses or increase your income, you can start to allocate those dollars into some new “buckets,” or savings and spending categories.

Recommended Reading: What Credit Do I Need For A Mortgage