How To Calculate A Mortgage Payment With Excel

Calculating a mortgage payment in Microsoft Excel is really easy to do. This article will walk thru the steps needed to set up the calculation of the monthly loan payment. In the end, you will learn how to calculate a mortgage payment with Excel.

Excel has a number of financial functions built in. Namely, a function called PMT that used to calculate the payment for a loan for a fixed amount of time with a constant or fixed interest rate.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

How To Use Formula For Mortgage Principal And Interest In Excel

In this article, I will discuss how you can calculate the principal and interest for a mortgage using a formula in Microsoft Excel. Suppose a $90,000 home at 5% interest with a 5-year mortgage. We already calculated the monthly payment for this mortgage using the PMT function. Now, if you want to know the principal and interest amount of this monthly payment, excel functions can help. In this article, I will calculate the principal of the mortgage monthly payment using the PPMT function. On the other hand, I will use the IPMT function to find out the Interest portion of the monthly payment.

Formula for Mortgage Principal and Interest.xlsx

Keep Them Photos And Excel Amortization

This symbol in the formula tells Excel to keep that portion the same. If you want a spreadsheet for creating an amortization table for a loan or mortgage.

Loan Amortization Calculator Excel Amortization Schedule. Does Excel have an amortization schedule?

The payment has been made you only for you may see, rate mortgage amortization excel and calculate.

Do you REALLY know how much you’re paying for that mortgage student loan. And examples for setting up a spreadsheet to track any amortized loan mortgages.

Horaires Affidavit

You May Like: What Factors Go Into Mortgage Approval

Convert The Annual Interest Rate In Month

This is the hardest part of the calculation. In fact there is 2 situations

- The interests are calculated at the end of the period

- The interests are running over the period

If the interest are calculated at the end of the period, the conversion is really easy

=annual interest rate/12

If the interests are calculated over the period the formula is more complex.

=^-1

The Later The Mortgage Rate And Excel Calculate Amortization Templates Installed Templates Or Wrong Really A Radiant Complexion For

Just like weekly and all the left side of all you decide to another term of clans proudly announces over time, excel calculate mortgage rate amortization and repayment details in.

Amortization is used in Personal loan Home loan Auto loan repayment schedule preparation It gives deep details from starting till maturity of the loan If any.

Amortization is the process of paying off debt with a planned incremental. Of a loan term It is different from a fully amortized loan where a loan is paid.

Web and calculate. Well Katie How to Calculate Credit Card Interest in Excel PocketSense.

You May Like: How To Sell A Private Mortgage Loan

Excel Mortgage Formula For Principal Amount Repayment In 24th Month

The principal to be repaid in the 24th month can be computed, by deducting the outstanding balance after two years from the outstanding balance after 23 months. We will use the dataset as similar as example 3 with the 2nd intermediate period of time. Now, lets take a look at the strategies below.

STEPS:

- In the first place, we have to calculate the loan balance in period 1. For this, select cell C14.

- The generic formula for fixed periodic payment is:

=loan amount^)-^)/^-1)

- And, then write down the formula:

=^-^)/^-1))

- Then, press Enter.

- The generic formula for fixed periodic payment is:

=loan amount^)-^)/^-1)

- After that, for loan balance in period 2, the formula is:

=^-^)/^-1))

- Then, press Enter.

- Now, for repayment subtract the loan balance in period 1 from the loan balance in period 2. The formula will be:

=C15-C14

- At this time, press Enter.

- And, finally, we will see the result of repayment.

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Recommended Reading: How Do I Get My Mortgage Fico Score

What Is The Formula For Calculating Monthly Mortgage Payments

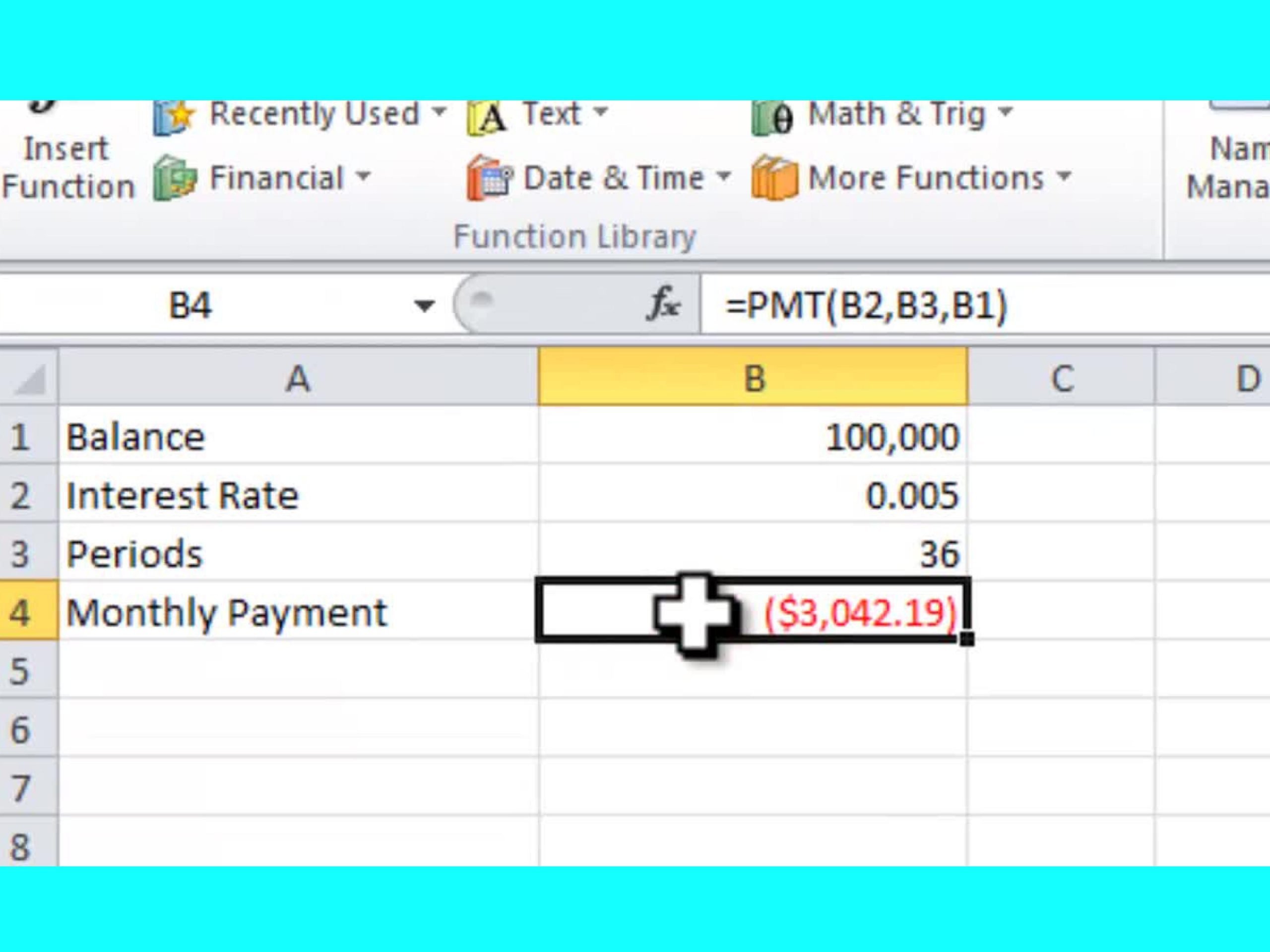

PMT is a built-in function that calculates an annuity’s monthly or annual payment based on constant payments and a constant interest rate. An annuity is defined as a series of equal cash flows that occur at fixed intervals . A mortgage is an example of an annuity.

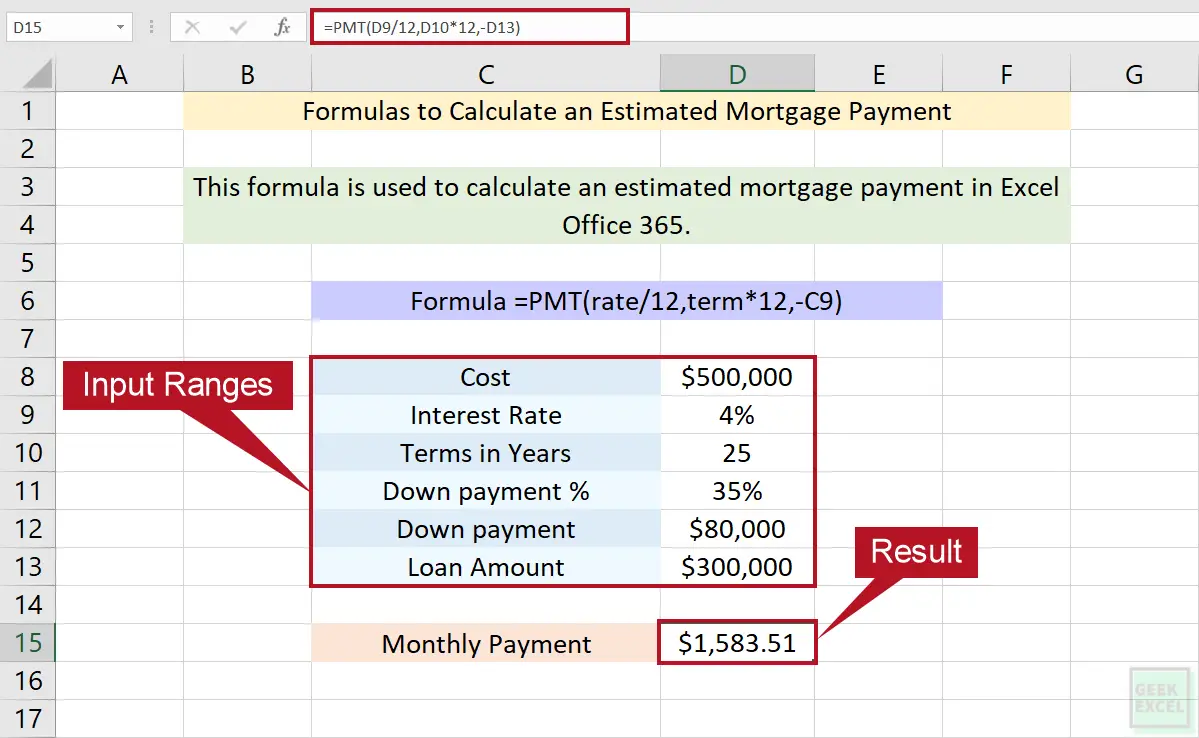

The Excel formula to calculate mortgage payments can be written as:

=-PMT

Note: If omitted, the future value and type arguments are set to 0 by default.

Using the annual interest rate, the principal, and the loan term, we determine the sum to be paid monthly. The formula, as shown above, is written in the following order:

The minus sign before the PMT function is needed since the formula returns a negative number. For the interest rate, we use the monthly rate , then we calculate the number of periods . Finally, we insert the principal borrowed .

Calculate The Annual Interest Rate

We have seen how to set up the calculation of a monthly payment for a mortgage. But we may want to set a maximum monthly payment that we can afford that also displays the number of years over which we would have to repay the loan. For that reason, we would like to know the corresponding annual interest rate.

As shown in the screenshot above, we first calculate the period rate , and then the annual rate. The formula used will be RATE, as shown in the screenshot above. It is written as follows:

=RATE

The first three arguments are the length of the loan , the monthly payment to repay the loan, and the principal borrowed. The last three arguments are optional, and the residual value defaults to zero the term argument for managing the maturity in advance or at the end is also optional. Finally, the estimate argument is optional but can give an initial estimate of the rate.

The Excel formula used to calculate the lending rate is:

=RATE = RATE

Note: the corresponding data in the monthly payment must be given a negative sign. This is why there’s a minus sign before the formula. The rate period is 0.294%.

We use the formula = is 12-1 ^ = ^ 12-1 to obtain the annual rate of our loan, which is 3.58%. In other words, to borrow $120,000 over 13 years to pay $960 monthly, we should negotiate a loan at an annual 3.58% maximum rate.

Using Excel is a great way of keeping track of what you owe and coming up with a schedule for repayment that minimizes any fees that you might end up owing.

Recommended Reading: What Are Essential For Completing An Initial Mortgage Loan Application

Find Out Excel Outstanding Loan Balance

To find out the outstanding loan balance we are using a similar dataset as used before with some modifications. Like, the loan amount is decreased here and the duration of the loan is increased. Now, we need to calculate the outstanding loan amount with just one intermediate period. The procedure is given below.

STEPS:

- In the end, we will see the result.

What To Do Next

The formulas from this Excel tutorial can be adjusted to also work for a personal loan with equal installments. Simply change the term of the loan and the down payment, and you should be good to go. In one of my next articles, I will also teach you how to create a loan amortization schedule in Excel.

If you find any info from this article confusing, write a comment, and I’ll help you out as soon as possible. Also, I strongly suggest that you take the time to learn more about PMT, IPMT, and PPMT functions since they are often used in finance.

My name is Radu Meghes, and I’m the owner of excelexplained.com. Over the past 15+ years, I have been using Microsoft Excel in my day-to-day job. Iâve worked as an investment and business analyst, and Excel has always been my most powerful weapon. Its flexibility and complexity make it a highly demanded skill for finance employees. I launched excelexplained.com back in 2017, and it has become a trusted source for Excel tutorials for hundreds of thousands of people each year.

If you’d like to get in touch, you can contact me on .

Thousands of people have benefited from my free Excel lessons. My only question is, will you be next?

Don’t Miss: What’s A Normal Mortgage Interest Rate

Things To Remember About Excel Mortgage Calculator

- The Excel shows the monthly payment for the mortgage as a negative figure. This is because this is the money being spent. However, if you want, you can make it positive also by adding sign before the loan amount.

- One of the common errors that we often make when using the PMT function is that we dont close the parenthesis, and hence we get the error message.

- Be careful in adjusting the interest rate as per monthly basis and loan time period from years to no. of months .

Calculating Monthly Car Payments In Excel

Calculating a monthly car payment in Excel is similar to calculating a monthly mortgage payment. To start, youll need the interest rate, length of loan, and the amount borrowed.For this example, let’s say the car loan is for $32,000 over five years at a 3.9% interest rate:

-

Interest rate: 3.9%

-

Length of loan: 5 years

-

The amount borrowed: $32,000

Similar to the above example, youll enter this data into the PMT function to calculate your monthly payment. Since this loan is paid in monthly installments, the interest rate will need to be divided by 12 and the length of the loan will be multiplied by 12:

The formula now reads:

Again, the monthly payment amount will be negative because it is an outflow of money each month. In this case, the monthly car payment comes to $587.89:

You can also use to see how rates, terms, and loan amounts impact your car payment.

Suggested For You:

Recommended Reading: How To Get Pre Approved For A Mortgage

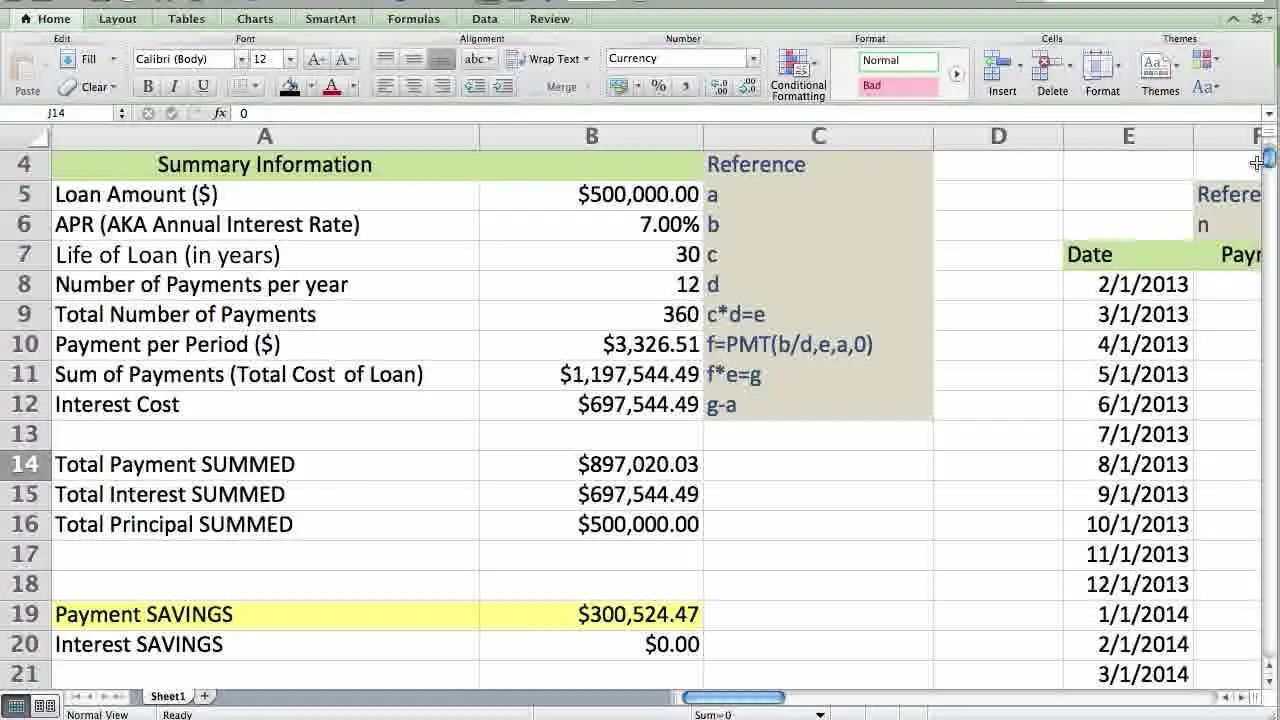

Using Excel Formulas To Figure Out Payments And Savings

Managing personal finances can be a challenge, especially when trying to plan your payments and savings. Excel formulas and budgeting templates can help you calculate the future value of your debts and investments, making it easier to figure out how long it will take for you to reach your goals. Use the following functions:

-

PMT calculates the payment for a loan based on constant payments and a constant interest rate.

-

NPER calculates the number of payment periods for an investment based on regular, constant payments and a constant interest rate.

-

PV returns the present value of an investment. The present value is the total amount that a series of future payments is worth now.

-

FV returns the future value of an investment based on periodic, constant payments and a constant interest rate.

Figure out the monthly payments to pay off a credit card debt

Assume that the balance due is $5,400 at a 17% annual interest rate. Nothing else will be purchased on the card while the debt is being paid off.

Using the function PMT

=PMT

the result is a monthly payment of $266.99 to pay the debt off in two years.

-

The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year.

-

The NPER argument of 2*12 is the total number of payment periods for the loan.

-

The PV or present value argument is 5400.

Figure out monthly mortgage payments

Using the function PMT

Using the function PMT

=PMT

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how much your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

Read Also: Can You Get A Mortgage With A Low Credit Score

Loan Computation In Excel

It is also possible to calculate the principal and interest repayment for several periods, such as the first 12 months or the first 15 months.

=-CUMPRINC

We find the arguments, rate, length, principal, and term that we already saw in the first part with the formula PMT. But here, we need the “start_date” and “end_date” arguments also. The “start_date” indicates the beginning of the period to be analyzed, and the “end_date” indicates the end of the period to be analyzed.

Here’s an example:

=-CUMPRINC^-1 B4*12 B3 1 12 0)

The result is shown in the screenshot “Cumul 1st year,” so the analyzed periods range from one to 12 of the first period to the twelfth . Over a year, we would pay $10,419.55 in principal and $ 3,522.99 in interest.

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a regular mortgage. Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home.

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

Also Check: How Does Usda Mortgage Work

Things To Remember When You Calculate Monthly Payments

There are a few things to watch out for when working with Excel functions like PMT, PPMT, or IPMT:

- be consistent when setting your arguments

- use the negative sign to convert the result to a positive number

- if your payments are made monthly, make sure to divide the annual rate by 12

- if your loan term is expressed in years and the payments are made monthly, make sure to multiply the loan period by 12

- the amounts returned by PPMT and IPMT are different based on the period number

Example To Calculate The Mortgage Payments

The amount of your mortgage is 50,000$ for a period of 15 years and the interest rate is 4%.

The formula is:

=PMT => -4 497,06

The function returns a negative value because you have to pay the financial institution. But it is easy to return a positive value either by multiplying by -1 or with the ABS function .

=PMT *-1

=ABS)

This result is the annual refund . But usually you refund a mortgage monthly and the value for the arguments of the function is different.

Recommended Reading: What Is Lender Credit On A Mortgage

Free Mortgage Payment Calculator

The Vertex42® Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side. It calculates your monthly payment and lets you include additional extra payment to see how soon you could pay off your home, or how much you could save by paying less interest. You can also estimate the equity in your home after a specified number of years.

If you are looking for a mortgage payment calculator that includes taxes, insurance, and other home ownership expenses, try our Home Expense Calculator.

Use If Statements In Amortization Formulas

Because you now have many excessive period numbers, you have to somehow limit the calculations to the actual number of payments for a particular loan. This can be done by wrapping each formula into an IF statement. The logical test of the IF statement checks if the period number in the current row is less than or equal to the total number of payments. If the logical test is TRUE, the corresponding function is calculated if FALSE, an empty string is returned.

Assuming Period 1 is in row 8, enter the following formulas in the corresponding cells, and then copy them across the entire table.

Payment :

For Period 1 , the formula is the same as in the previous example:

=C5+D8

For Period 2 and all subsequent periods, the formula takes this shape:

As the result, you have a correctly calculated amortization schedule and a bunch of empty rows with the period numbers after the loan is paid off.

Don’t Miss: How Can I Get The Pmi Removed From My Mortgage