Disadvantages Of Usda Loans

There are certain drawbacks to USDA loans that borrowers may not encounter with conventional mortgages or mortgages through other government programs such as FHA and VA. These include:

- Geographical requirements: Homes must be located in an eligible rural area with a population of 35,000 or less. Also, the home cannot be designed for income-producing activities, which could rule out certain rural properties.

- Second property/vacation homes not allowed: The property must be used as the borrowers primary residence.

- Income limits: Borrowers must meet specific income requirements based on where they live. If you exceed the income limits, you will not qualify for a USDA loan.

- USDA up-front fee: Borrowers must pay an up-front fee for a USDA guaranteed loan or have that fee rolled into the mortgage loan amount. Depending on that loan amount, this could be several thousand dollars.

- Streamlined refinancing limitations: To qualify for a refinance, you must have a record of 12 consecutive, on-time mortgage payments, and the home must be your primary residence. This program only applies to mortgages with 30-year terms and is not available in all states.

How Long Is The Process For Getting A Guaranteed Usda Loan

The process of securing a USDA-guaranteed loan normally lasts a few weeks and breaks down into the following stages.

Get preapproved: Your lender reviews your financial, employment and credit history before giving you mortgage preapproval. At that point, the lender notifies you of the mortgage amount they feel comfortable offering you. Keep in mind the lender may have specific requirements and conditions outside USDA standards. So read all documentation and ask questions.

House hunt: Hold onto your mortgage preapproval document and search for an affordable home in a USDA-designated area.

Sign off on the mortgage: After you sign off on the mortgage, your lender makes one final review before formally associating t with the property. A third-party appraisal body generally inspects the home youre considering to make sure it follows USDA guidelines and that your mortgage lines up with the propertys value against current market rates.

Final USDA approval: Your lender submits the application to the USDA for its final review.

Close on the deal: You sign the remaining documents and youre ready to move into your new home within a few days.

For More Assistance Reach Out To Us

If youre ready to start your journey to homeownership and have considered a USDA home loan, reach out to the experts at Hero Home Programs. They work tirelessly to find local and federal grants to assist with your home purchase and also work alongside local vendors who will help you save money on your home purchase.

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

They Have Flexible Credit Guidelines

While the USDA doesnt specify a minimum credit score, the lender who makes the loan will likely require a credit score of 640 or more. That is the number that is required to use the USDAs Guaranteed Underwriting System , which was designed to automate the process of credit risk evaluation. If you have a score below 640, a lender would need to manually underwrite that loan, if they decide to grant it.

Given that the average credit score for a conventional loan is about 720, these loans can be a good option for someone who has some blemishes on their credit.

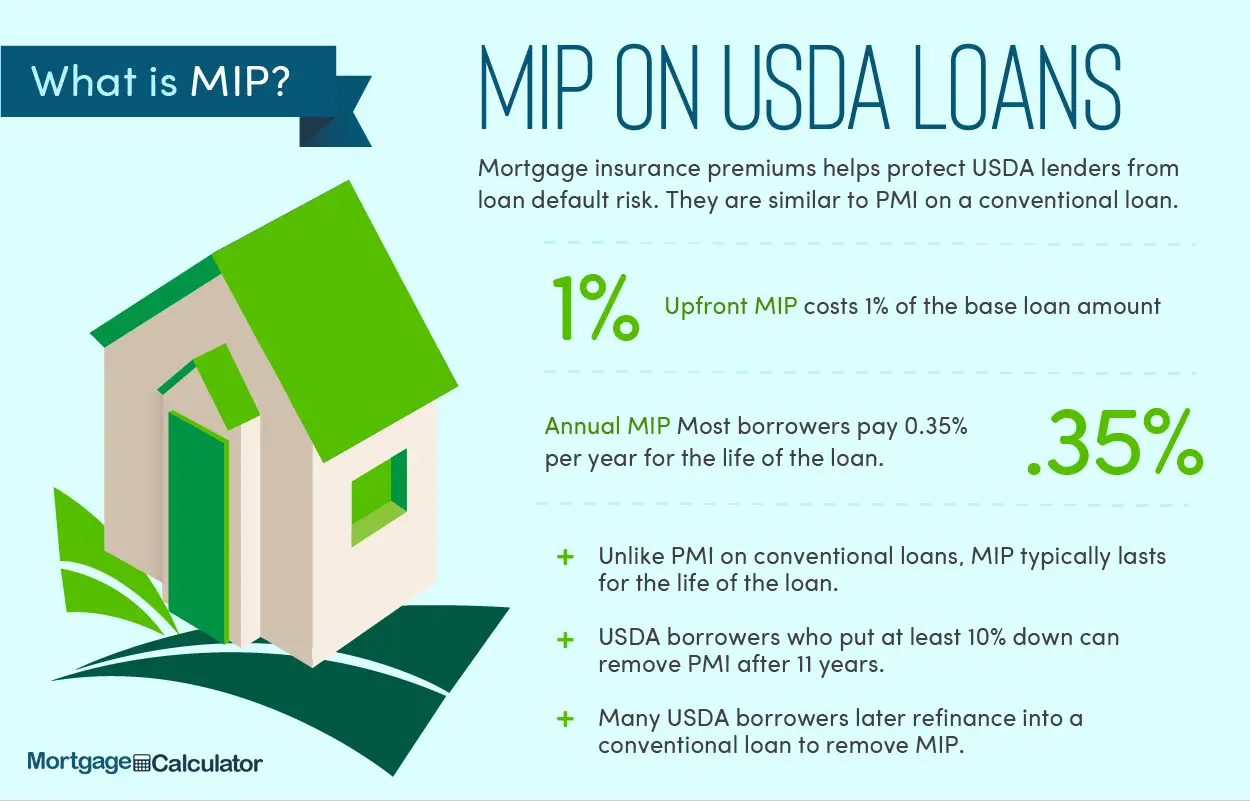

Usda Loans Have Been Cheaper Since 2016

On October 1, 2016, USDA reduced its monthly fee from 0.50% to 0.35%. Your monthly cost equals your loan amount or remaining principal balance, multiplied by 0.35%, divided by 12.

Additionally, the upfront fee fell from 2.75% to just 1.00%. This is a good opportunity for home buyers to get lower monthly payments with this loan program.

Also Check: Who Is Rocket Mortgage Owned By

Applying For A Usda Home Loan

To qualify for a USDA guaranteed loan, you must meet the following requirements:

- Be a US citizen or a US non-citizen national or qualified alien.

- Demonstrate a willingness to meet credit obligations in a timely manner.

- Agree to use your home as your primary residence.

- Purchase a home that meets all criteria set by the USDA.

- Have an income that qualifies as low income or below in your intended purchase area.

- Not have been debarred or suspended from participating in other federal programs.

To qualify for a USDA direct loan, you must meet the above qualifications PLUS:

- Lack of access to safe, sanitary, and decent housing.

- Are unable to secure loans from any other source on reasonable terms that you are able to meet.

How To Apply For A Usda Home Loan Step

The USDA loan program helps low- and middle-income consumers become homeowners in communities across the country.

These government-backed loans allow qualified buyers to purchase with $0 down. They also feature competitive interest rates and low mortgage insurance costs.

The USDA loan application can be started online or in person.

Don’t Miss: Recast Mortgage Chase

The 2 Types Of Usda Home Loans

The USDA Guaranteed and Direct loan programs are very different, although both provide housing in rural areas and offer no-down-payment financing. Here’s what you need to know about how each program works and how to qualify.

To be eligible for a USDA Guaranteed or Direct loan, you cannot be delinquent on any federal debt and must be a U.S. citizen or legal nonresident alien.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

Many Property Types Are Eligible

When you hear rural, you might be thinking a big ranch or lots of acres, but that isn’t the case. USDA loans cover just about any type of dwelling that you might be interested in, from new construction and existing single-family homes to manufactured or modular homes and even condos and townhouses.

Usda Loan Credit Score Requirements

The USDA home loan program delivers affordable financing to low-to-moderate income homebuyers. The minimum credit qualifying score USDA-approved lenders require can vary and credit scores can impact the approval process. However, the USDA does not have a hard and fast credit score requirement, so borrowers with low scores may still be eligible to qualify for a USDA-backed home loan.

Lets break it down.

Recommended Reading: Rocket Mortgage Launchpad

Pros And Cons Of Usda Loans

The benefits of a USDA home loan include less stringent credit score guidelines and no down payment requirement. There is also no formal loan limit, unlike FHA loans. This can be a great program for homebuyers on a budget that are flexible about where they live. The cons mostly have to do with restrictions, like those on where you can buy or how much your family can make.

The Pros And Cons Of Usda Loans

November 14, 2019 By PrimeLending

When the U.S. Department of Agriculture comes up in discussion, people tend to think of agribusiness concerns instead of home loans. That might be why the USDA Rural Development Guaranteed Loan program is often referred to as one of the best-kept secrets of the mortgage market. Could a USDA loan be the tool that makes homeownership a reality for you? Exploring the pros and cons of USDA loans can help you figure that out.

Recommended Reading: Bofa Home Loan Navigator

Requirements See If You Qualify For A Usda Mortgage Loan

If you can check all the boxes below, you may qualify for a low interest rate on a USDA loan:

- Your home is a single-family residence

- You live in the home

- The home is in a rural area as defined by the USDA

- You have a low to moderate income that doesnt exceed 115 percent of the median income in your area

- You have a steady income and enough savings/assets to make mortgage payments for at least 12 months

- You have a steady income and enough savings/assets to make mortgage payments for at least 12 months

Usda Vs Conventional Loans

Unlike a USDA loan, a conventional loan isnt backed by the government. A conventional loan requires a down payment, but doesnt have strict income or geographic requirements. Below is the breakdown of the difference between the two loan programs.

| Loan requirement | ||

|---|---|---|

| 1% guarantee fee 0.35% of loan amount for annual guarantee fee | 0.15% to 1.95% annual premium | |

| Income limits | Up to moderate household income limit based on area | Income maximum is 80% of area median income for HomePossible program and HomeReady Program |

| Property location limits | Rural areas designated by the USDA | No restrictions |

You May Like: Chase Recast Calculator

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Upcoming Eligible Usda Map Changes

USDA had slated changes to its eligibility maps for October 1, 2015. However, according to a source inside USDA, map changes had been postponed.

According to the source, eligibility maps are now reviewed every three to five years. The last review happened in 2014.

USDA runs on a fiscal year of October 1 through September 30. This is why most big changes to the program happen in October. For this reason, watch for a geographical boundary change on October 1, 2020.

Changes are more likely in 2020 and 2021. The reason: The 2020 census. USDA bases its maps on these US-wide population counts that happen every 10 years. Since the USDA has not made major changes to maps since the year 2000, its becoming more and more likely that big updates will happen soon.

Also Check: Who Is Rocket Mortgage Owned By

Usda Home Loan Income Limits

Guaranteed loans are available to moderate income earners, which the USDA defines as those earning up to 115% of the areas median income. For instance, a family of four buying a property in Calaveras County, California can earn up to $92,450 per year.

The income limits are generous. Typically, moderate earners find they are well within limits for the program.

Its also important to keep in mind that USDA takes into consideration all the income of the household. For instance, if a family with a 17-year-old child who has a job will have to disclose the childs income for USDA eligibility purposes. The childs income does not need to be on the loan application or used for qualification. But the lender will look at all household income when determining eligibility.

What Are The Types Of Usda Loans

There are three types of USDA loan programs:

Recommended Reading: Reverse Mortgage Manufactured Home

Is Your Home Eligible

A property must meet the following criteria in order to be eligible for the USDA loan program:

- Located in a rural area, which is generally described as a region outside of a major city with a population of under 35,000 people

- Structurally sound and fully operational, including essential systems such as plumbing and electricity

- With a size under 2,000 square feet

Although metropolitan regions are often excluded from USDA programs, there may be some opportunities in suburbia. Rural areas are always eligible.

Brief History Of Usda Loans

The USDA loan’s story goes back to 1949 with the passing of the American Housing Act.

1949 was post-World War II when U.S. housing was in short supply and millions of families were sharing homes sometimes willingly and sometimes not.

Meanwhile, economic studies showed that homeownership could help build and strengthen weakened U.S. communities and create jobs that generate tax revenue.

With that in mind, the American Housing Act was born.

The law’s passage cleared the way for millions of new homes to be built nationwide while making it easier for renters to become homeowners.

New mortgage loans were made available by the government. Some loans had waived requirements for a down payment. The USDA mortgage, backed by the U.S Department of Agriculture, was one such loan.

The USDA program thrived and, today, the USDA supports hundreds of billions of dollars in U.S. home loans and communities all over the country.

Also Check: Can I Get A Reverse Mortgage On A Condo

What Are The Eligibility Requirements For A Usda Home Loan

The home must be located in an area with a population of 35,000 or less and the home must be a primary residence. Loans are available to those with low and moderate incomes.

Income limits vary depending on where you live and the loan program.

In general, a credit score of at least 640 is ideal, but you may still qualify if your score is lower.

Also, you cannot be delinquent on any federal debt and must be a U.S. citizen or legal nonresident alien.

Usda Home Loan Qualifications And Requirements

To qualify for a USDA loan, you:

- Do not have to be a first-time homebuyer

- Do not have to be employed in the agricultural industry, even though the Department of Agriculture backs the loans

- Must be a U.S. citizen or an eligible noncitizen

You are required to maintain an escrow account with your lender. The lender will use this account to pay the taxes and insurance on your loan.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

How To Apply For A Usda Loan

Applying for a USDA loan is easy. To find out additional information about the USDA loan and to see if you can qualify, you can contact your local USDA Rural Development field office for more information.

Additionally, for residents of Kansas and Missouri interested in securing a USDA loan for a purchase of a rural home, you can simply contact your local Landmark National Bank location. Our dedicated loan and mortgage officers will work directly with you to help you determine if you and the home of your dreams qualify for a USDA loan. Even if thats not the case, we can help you with other home loans at competitive rates.

Homeownership is the American dream, and its achievable with the help of the right financial institution. Landmark National Bank is here to help.

Find A Home In A Usda

Youve been preapproved for a USDA home loan. Now its time to find a home in a USDA-eligible area and make an offer. Your preapproval letter shows sellers and agents youre a lender-verified USDA buyer who can close. Keep it close at hand.

USDAs property eligibility lies in primarily rural areas. But you can also find USDA-eligible homes just outside of major metropolitan areas. In fact, huge swaths of the country are eligible for USDA financing.

Also Check: Recasting Mortgage Chase

Usda Housing Repair Loans

Loans offered through the Section 504 Home Repair program are meant to provide funds to bring homes up to date, make needed repairs, or eliminate health hazards and safety risks. For example, loans may be used to fix structural issues or to connect a home with a water or sewer line. These loans also may be used to install or fix a heating system, put in a new roof or insulate the home so it can be lived in comfortably during the winter.

Loans amounts cant be more than $20,000, and borrowers have 20 years to pay the loan back. The interest rate stays at 1% for the life of the loan. The program also makes grants available for the same use for eligible people who are at least 62 years old and cant afford to repay a loan.