Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

A Refinance Can Appear On Your Credit Reports As A New Loan

When you refinance your mortgage, youre essentially paying off the old loan in full and opening a new one. Because your credit scores reflect how long different accounts have been established, as well as the most recent activity on each account, refinancing has an impact.

The overall duration of your is factored into your credit scores. If your original mortgage is your longest-held account, closing it in favor of a fresh loan may negatively impact your credit scores, at least initially. Over time, as your other credit accounts age, the impact of a refinance on your credit scores will generally lessen.

Rent Reporting For Subprime Consumers

Unlike the credit invisible, subprime consumers have a credit score, but its not one that potential lenders, employers, or landlords will be impressed by. Experian defines subprime borrowers as those with a FICO® score below 669. And approximately 19% of the U.S. adult population has either subprime or deep subprime credit. Which means:

Paying off debt little by little can take several months or even years to make any significant impact on a subprime credit score. One very effective solution is hiding in plain sight.

Data from a 2018 LevelCredit survey showed that positive rent and utility payment reporting for 2 months improved renters credit scores by an average of 20 points. But, when you look at the consumers who started with scores below 600, their scores increased by an average of 28 points after 2 months. And after two years, an increase of 70 points! For tenants who decide to report rent payments to credit bureaus, those who start out with lower credit scores see the fastest improvement.

Also Check: Can You Refinance A Mortgage Without A Job

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.

Do Rent Payments Affect Credit

All three major credit bureaus Equifax, Experian and TransUnion will include rent payment information in credit reports if they receive it.

-

The most commonly used versions of the FICO score dont use rental payment information in calculating scores.

-

Newer versions of FICO, such as the FICO 9 and FICO 10, do consider rental information if it is in your credit report.

-

VantageScore, FICOs competitor, also considers rent payment information. .

You May Like: Can I Get A Reverse Mortgage On A Condo

Skipping Mortgage Payments During The Refinancing Process Can Damage Your Credit Scores

Refinancing your mortgage may take longer than you expect, so dont count on the process closing by a certain month. Some borrowers have gotten into trouble by skipping a mortgage payment when they assumed their refinance would go through. A missed or late payment can negatively impact your credit scores.

The best way to avoid delinquent payments is to stay in constant communication with your lenders and set reminders for yourself to avoid missing important due dates. Make payments toward your original mortgage as you usually would until your refinance is closed. Remember that payment history generally accounts for the largest portion of your credit scores, and missed payments can remain on your credit reports for seven years after the delinquency.

Even after your refinance is complete, it may take several months for the new account to appear on your credit reports. If you give it time and the loan still doesnt show up, make sure your lender is reporting your payments to the CRAs. The refinancing process has some impact on your credit scores, but how you handle the new loan will be more important in the long term.

How To Report Your Rent Payments To Credit Bureaus

Well timed funds are an important issue of your credit score rating, accounting for a full 35% of your rating. Whereas mortgage funds, automobile loans, and bank cards are all reported on this part, an enormous lacking part is lease.

Sadly, the three main credit score bureaus wouldnt have a bit for lease funds, and just one% of customers have this info mirrored on their credit score experiences.

To make issues worse, late funds and evictions are reported, so actually, renting has historically solely had the flexibility to harm your credit score, not assist it.

Nevertheless, new providers have not too long ago begun to report lease funds to a number of credit score bureaus. However, does this fee info assist you construct your credit score?

In some instances, the reply is sure. Be taught all the things its essential find out about constructing your credit score with lease so youll be able to take motion shortly and successfully.

Read Also: Chase Mortgage Recast Fee

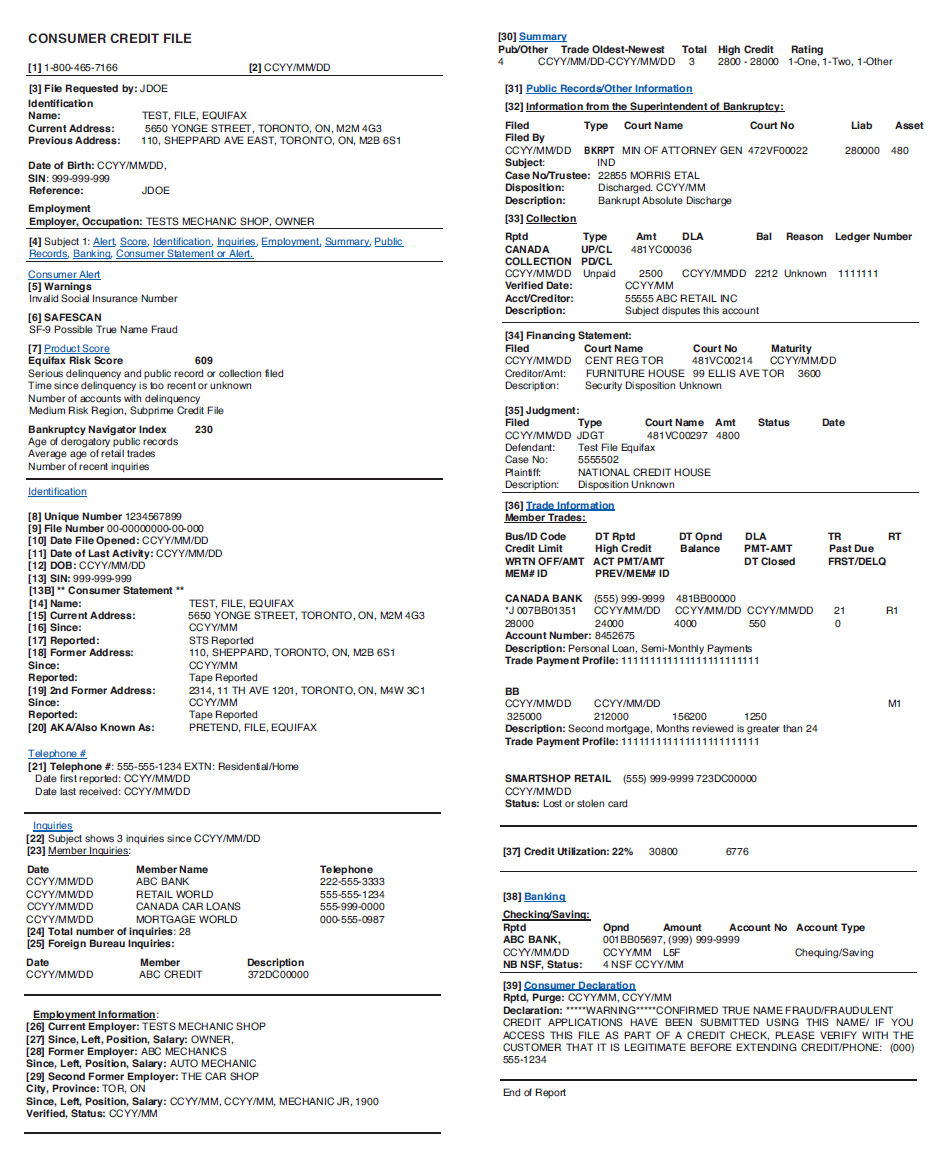

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

What If I Cant Fix My Credit Score

Its important to keep in mind that your credit score isnt the only thing that mortgage lenders look at. If you are not able to improve your credit score and dont want to consider a private mortgage lender, you can consider other options. Making a large down payment can make it easier to be approved for a bad credit mortgage. If you can find a co-signer, their credit score will be considered as well. This is helpful if they have a strong credit score or more income.

If you are over 55 years old, you are eligible forreverse mortgages. Reverse mortgages have no income or credit score requirements, and there are also nomortgage paymentsrequired either. This is particularly useful for seniors as a source of income during retirement.

Renting instead of buyinga home might also be a temporary solution in the meantime. If there is a particular property that you would like to purchase, but cannot afford to do so currently,rent-to-own homeprograms allow you to rent the home for a period of a few years, with a portion of your rent payments going towards your eventual down payment on the house. This allows you to save up money until you canafford a mortgage.

Also Check: Mortgage Recast Calculator Chase

Recommended Reading: How Much Is Mortgage On 1 Million

Consider Adding An Explanatory Statement To Your Reports

If you review your credit reports and find that a creditor has added derogatory information after you missed payments due to COVID-19, you may add an explanatory statement to your reports. Technically, the credit reporting bureaus are required to place a statement in your file only if you’re disputing the completeness or accuracy of a particular item. Though, while the bureaus don’t have to include a statement if you’re only explaining extenuating circumstances or other reasons why you haven’t been able to pay your debts, they usually will.

Once you file a statement with a credit reporting bureau, the bureau must include the explanationâor a summary of itâin any report that has that information. If the reporting bureau assists you in writing the description of what happened, it may limit your statement to 100 words. Otherwise, there’s no specific word limit. But you should try to keep your comment to 100 words or less. That way, the bureau is more likely to use your unedited statement. If your explanation is lengthy, the bureau will probably condense your information to just a few sentences or codes. To avoid this problem, keep your statement clear and concise. For example, you might say something like, “The delinquent accounts showing on my credit report were because I lost my job due to the coronavirus outbreak. I intend to make up the payments as soon as I can.”

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.

Recommended Reading: Reverse Mortgage For Mobile Homes

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

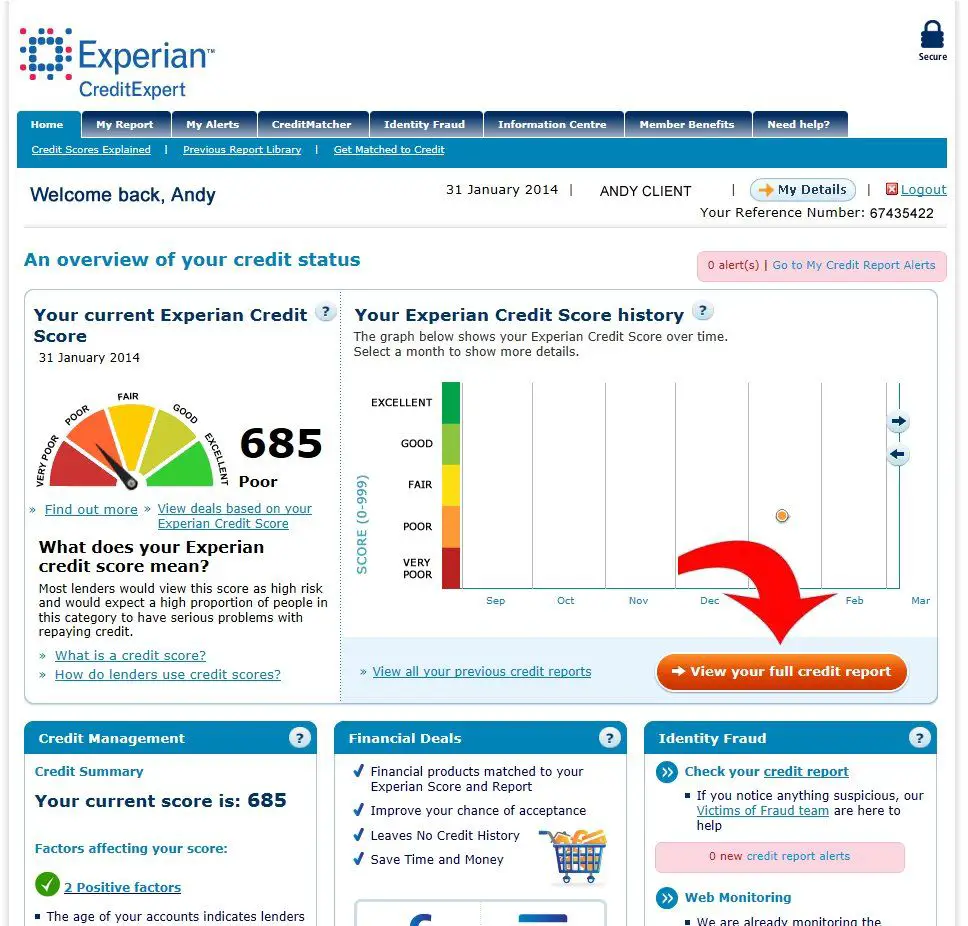

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Soft Inquiries Are Only Visible To You

Soft inquiries are triggered when you or a third party look at your credit report for non-lending purposes. This could include when you ask for your free credit report, or when youre applying for a job or to rent a home.

Soft inquiries dont impact your credit score and they wont show up on your credit report to others, although youll be able to see them. Hard inquiries, which are applications for credit, will stay on your credit report for three to six years.

Anytime you ask for a loan or new credit product, your credit report will be accessed thats a hard inquiry. These inquiries will note the date, the requestors name, and their contact information. Your aim is to not have too many hard inquiries within a short period of time it looks to lenders as though youre shopping for credit .

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

Report Rent To Credit Bureaus & Empower Your Residents

Obviously credit scores and credit history are huge determining factors in the level of financial help your residents are eligible for. Credit affects what down payments and interest rates will be available to them for everything from auto loans, to cellular plans, to mortgages.

You want to avoid turnover. You especially want to retain the residents who pay on time. And while a significant % of the millennial generation have been slower to purchase a home, ideally most dont want to rent forever.

Its true. Millennials are attracted to the luxurious style of living found in an amenity-rich apartment community. An urban oasis situated only blocks from their office or favorite local coffee spot. But buying a house is still the American dream. In fact, 40% of millennials are actively saving to purchase a home, and 31% of millennials said they expect to own property in the future, but arent currently saving for a down payment. Take advantage of being able to appeal to that 71% of millennial renters who are hoping to purchase a home someday.

Also, make your management company sticky. If a resident was debating a move, the fact that your company will report rent payments to credit bureaus might sway them to renew their lease with you instead. Especially once they see how rental payment reporting has added to their credit. Remember, if you offer this program, youre in the 17% of property management companies that do.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House

Common Credit Report Errors To Look Out For

According to the Consumer Financial Protection Bureau, these are the most common errors consumers find on their credit history:

Mistaken identity

- Wrong name, address or phone number

- Accounts from someone with a similar name

- New credit accounts opened by someone who stole your identity

Incorrect account status

- Accounts wrongfully labeled as open, past due or delinquent

- Accounts that wrongfully listed you as the owner instead of authorized user

- Wrong date for the last payment received, date the account was opened or delinquency status

- Same debt listed multiple times

Data management

- Information that is not removed, despite already being disputed and corrected

- Accounts that are listed multiple times, with different creditors

Balance

- Incorrect credit limit