How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

How To Qualify For A Mortgage

To ensure you have the best shot at qualifying for a loan, you should:

Keep Reading: How to Find the Best Mortgage Lender

How To Determine How Much House You Can Afford

Your housing budget will be determined partly by the terms of your mortgage, so in addition to doing an accurate calculation of your existing expenses, its important to get an accurate picture of your loan terms and shop around to different lenders to find the best offer.

Mortgage interest rates are near all-time lows right now, which has made borrowing easier for many buyers. Unfortunately those low rates, coupled with limited available listings, have pushed prices up to record highs. But, if your budget works out, it can still be a great time to buy. Here are some of the factors that can affect your loan terms, which in turn will affect how much you can borrow.

Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

Read Also: Rocket Mortgage Requirements

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

Current Mortgage Balance And Payment

Together with your home value estimate, your current mortgage balance is used to determine how much equity you have for the purposes of loan qualification as well as to figure how much cash you can take out.

The payment can be useful, because sometimes the reason for refinancing is to try to lower your payment usually accomplished either through lowering your rate or lengthening your term. Including this info will make it easier to compare options.

Also Check: Rocket Mortgage Payment Options

How Much Can I Save By Prepaying My Mortgage

The benefit of paying additional principal on a mortgage isnt just in reducing the monthly interest expense a tiny bit at a time. It comes from paying down your outstanding loan balance with additional mortgage principal payments, which slashes the total interest youll owe over the life of the loan.

Heres an example of how prepaying saves money and time: Kaylyn takes out a $120,000 mortgage at a 4.5 percent interest rate. The monthly mortgage principal and interest total $608.02. Heres what happens when Kaylyn makes extra mortgage payments.

| Payment method | |

|---|---|

| $89,864 | $9,024 |

Bankrates mortgage amortization schedule calculator can help you determine the impact of extra payments on your mortgage. Click Show amortization schedule to reveal the section that allows you to calculate the effect of additional payments.

Use Bankrates mortgage payoff calculator to see how much interest you can save by increasing your mortgage payments.

What To Do Next

- Get preapproved by a mortgage lender. If youre shopping for a home, this is a must.

- Apply for a mortgage. After a lender has vetted your employment, income, credit and finances, youll have a better idea how much you can borrow. Youll also have a clearer idea of how much money youll need to bring to the closing table.

| Loan Type |

|---|

Read Also: 10 Year Treasury Yield Mortgage Rates

The Bottom Line: Mortgage Calculators Can Help You Decide How Much House You Can Afford

Mortgage calculators are great for giving you an estimate of what you might expect when purchasing or refinancing a home. While not an official qualification, the act of using a calculator is a nice starting point.

If youre ready to take the next step and get started, you can do so online with Rocket Mortgage®.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Read Also: Does Rocket Mortgage Sell Their Loans

When To Consider Refinancing

Aside from making extra payments, mortgage refinancing is another strategy to shorten your term. But other than that, it can help you obtain lower interest rates. You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. If you have a 30-year mortgage, you can refinance to a 15-year mortgage with reduced interest. Moreover, it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage , and vice versa. But dont forget: It should be done early enough into the loan term.

Heres when its good to refinance from a 30-year to 15-year term:

- If interest rates are low

- If you have a qualifying or high credit score

- If youve paid your loan for just a couple of years

- If you are not planning to move out of the house

- If you are able to make higher monthly payments Refinancing to a shorter term makes your monthly payment higher even with a reduced interest rate. This yields significant interest savings.

Moreover, refinancing is taking out a new loan to replace your old one with more favorable terms. This means you need to go through all the credit checks and paper work. It requires a high qualifying credit score , with the best rates going to consumers with 740 credit scores. On top of this, you must shoulder many fees, including inspection, recording fees, origination fees, and housing certifications.

Refinancing is not ideal under the following circumstances:

Whats the Ideal Interest Rate to Refinance?

How To Calculate Mortgage Payoff

This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems. This article has been viewed 105,033 times.

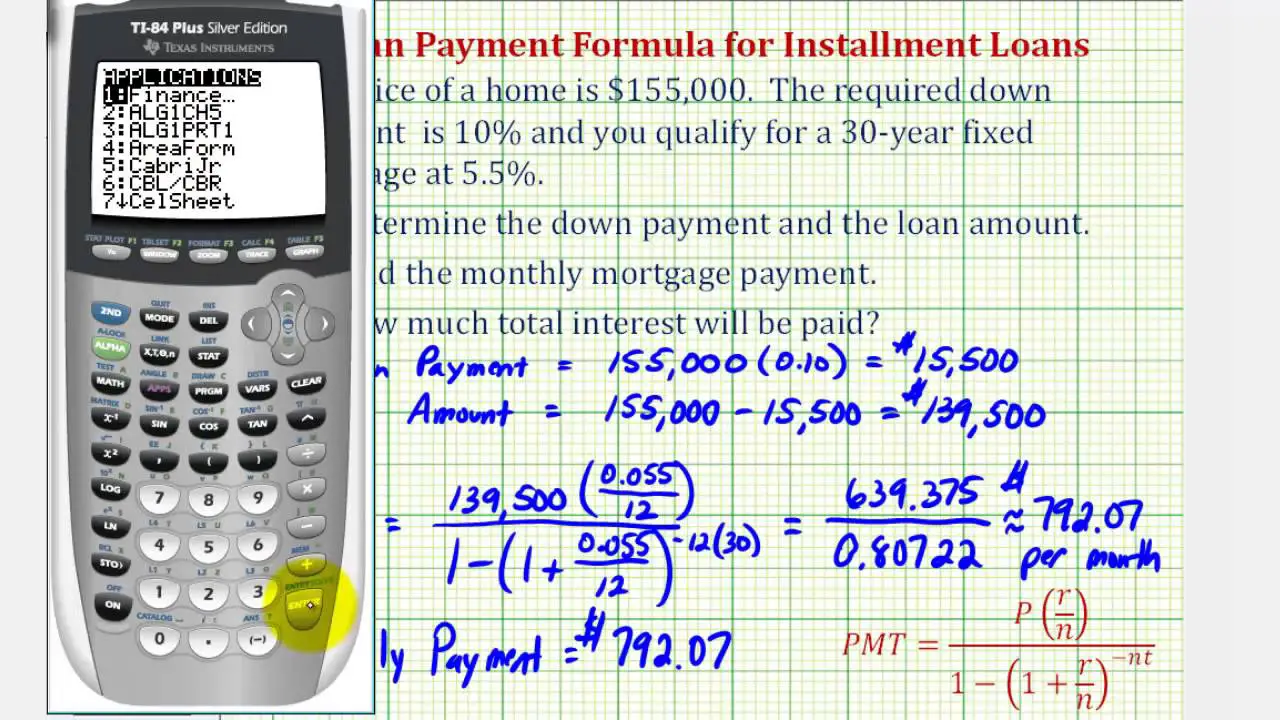

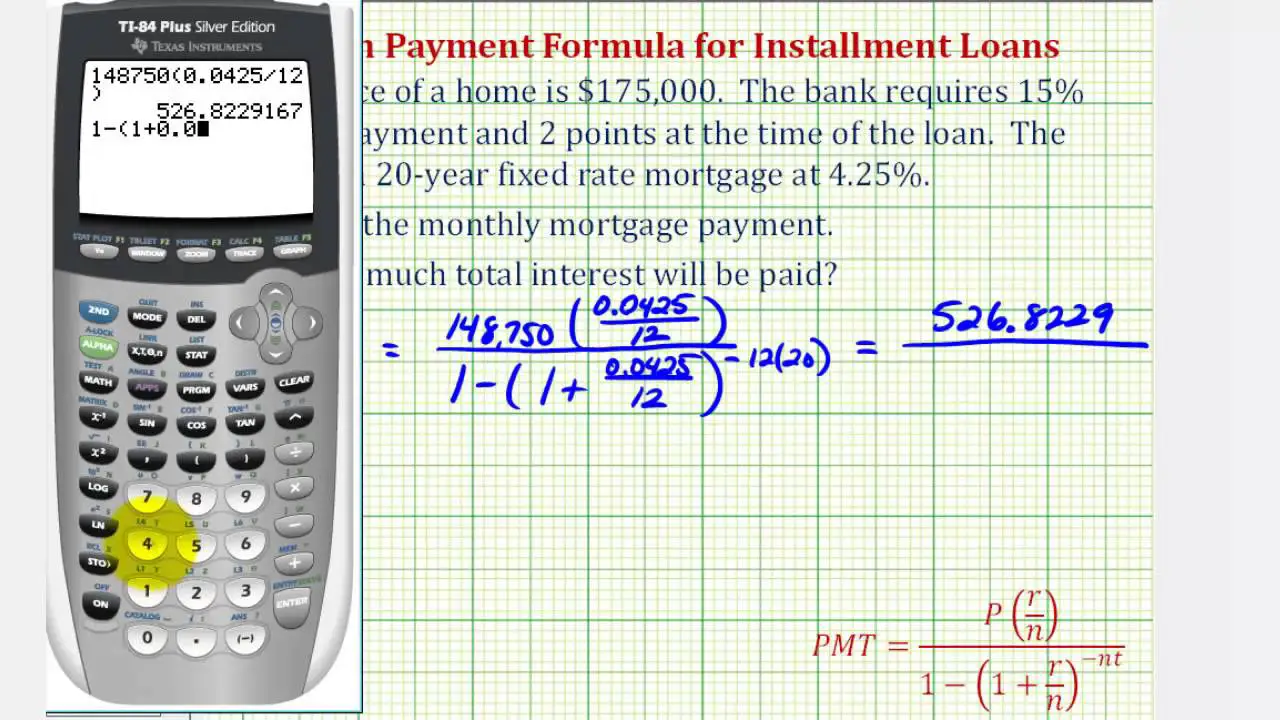

The method for precisely determining the rate of amortization, which is the amount needed to pay off a particular mortgage loan, will vary depending on factors like the type of loan, its terms, and what options are exercised by the borrower. However, there is a standard formula used for calculating the loan payoff amount of a mortgage based on the principal, the interest rate, the number of payments made, and the number of payments remaining. This article provides detailed information that will assist you in calculating your mortgage payoff amount based on the terms of your loan. Contact your lender to confirm that your calculation is correct based on the particulars of your mortgage.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

Calculator: Start By Crunching The Numbers

Begin your budget by figuring out how much you earn each month. Include all revenue streams, from alimony and investment profits to rental earnings.

Next, list your estimated housing costs and your total down payment. Include annual property tax, homeowners insurance costs, estimated mortgage interest rate and the loan terms . The popular choice is 30 years, but some borrowers opt for shorter loan terms.

Lastly, tally up your expenses. This is all the money that goes out on a monthly basis. Be accurate about how much you spend because this is a big factor in how much you can reasonably afford to spend on a house.

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

How Much House Can I Afford With A Va Loan

Eligible active duty or retired service members or their spouses can qualify for down payment-free . These loans have competitive mortgage rates but usually and dont require PMI, even if you put less than 20 percent down. These loans be a great option if you qualify and can help you get into a new home without overstretching your budget.

Recommended Reading: Rocket Mortgage Loan Types

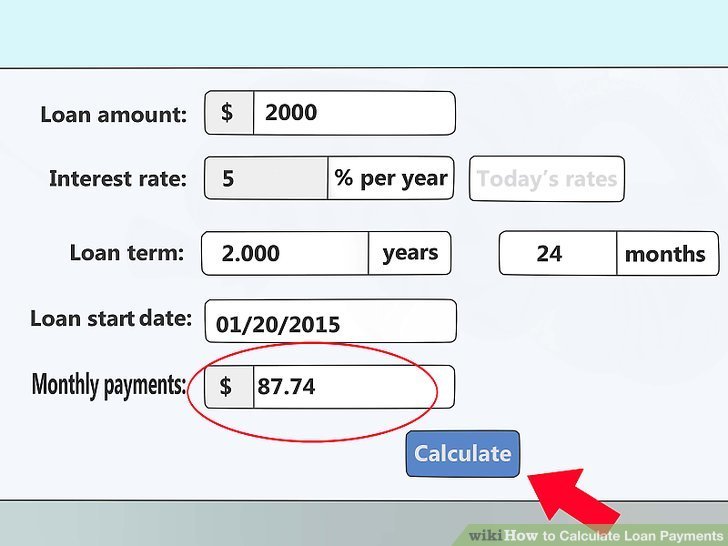

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Also Check: Can You Get A Reverse Mortgage On A Condo

The Interest Rate On The Loan

Your loans interest rate is another piece of information youll need to calculate your estimated mortgage payment. Mortgage interest rates fluctuate with the market and are affected by factors such as the U.S. Federal Reserves monetary policy, the market, the economy and inflation.

The interest rate will determine what the total cost is of borrowing your loan from the lender. Interest is essentially a fee the lender charges for loaning you the money to purchase your home. In the early years of paying off your loan, your monthly payment will primarily be interest.

For borrowers, the interest rate you can secure depends on your credit score and history. Generally, borrowers with higher credit scores tend to receive the lowest interest rates. However, you likely will still receive a good interest rate if your score falls between is mid-range. Use your credit score in your calculations to help you determine what interest rate you may qualify for and how that affects your overall financial obligation. If your credit score is low and results in a high-interest rate, you may want to take some steps to improve your credit score before pursuing a mortgage loan.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

It Is Not Uncommon For Monthly Mortgage Payments To Change During The Term Of The Loan This Can Happen For Two Main Reasons:

- There are changes in your property tax, tax assessment, insurance premium or association fees

- You have an adjustable-rate mortgage and the rate changes

When you take out a mortgage, you can choose a fixed-rate or an adjustable-rate mortgage. On a fixed-rate mortgage, the principal and interest will remain the same. On an adjustable-rate mortgage, the interest rate can change periodically.

Whether the loan is on a fixed-rate or an adjustable-rate mortgage, the mortgage payment can change due to changes in property taxes and insurance premiums. The taxes and insurance portion of your mortgage payment is held in an escrow account until the bills are due at which time they are paid on your behalf. Each year, the loan servicer will perform an escrow analysis and will provide a written notification of changes to the amount of the mortgage payment.

Find Out How Much House You Can Afford

Understanding the limits of your budget is crucial before you engage with any lending institution. Doing so will help you remain realistic and avoid a risky purchase even if its your dream home that could backfire in the future.

To find out how much house you can afford, youll need to input your down payment amount, state, credit score, and preferred home loan type.

Youll also need to indicate either your desired monthly payment amount or your gross monthly income and monthly debts. The latter two are used to determine your debt-to-income ratio, which plays a large role in whether youll qualify to borrow in the first place.

Most lenders and calculators evaluate affordability with the 28/36 rule, which establishes that your housing expenses and total debt should not be more than 28% and 36% of your total pre-tax income, respectively. To calculate this, multiply your monthly income by 28 or 36 and then divide it by 100.

For example, with a $4,500 monthly income, you should spend no more than $1,260 on monthly housing expenses. The formula to calculate this would be x = ÷ 100, where a is your monthly income .

The simplest way to pay off your mortgage faster is by making larger or more frequent payments towards your loan principal. For example, you could make biweekly payments or one extra lump sum payment per year.

You can also refinance to a shorter-term mortgage, which will raise your monthly payments in exchange for a home loan that you can pay off faster.

Also Check: 10 Year Treasury Vs 30 Year Mortgage