Creating An Amortization Schedule

Is It Better To Overpay Mortgage Monthly Or Annually

Overpaying your mortgage can save you money by reducing the size of your mortgage and the amount of interest youll pay overall. Overpay by enough and you could repay your mortgage several years faster. You can either make regular monthly payments over your normal amount or make a one off lump sum payment.

What Is A Bi

A bi-weekly mortgage payment is when your mortgage payment is withdrawn from your account every other week, totaling 26 payments per year. To determine the bi-weekly mortgage payment amount, your monthly mortgage payment is multiplied by 12 months then divided by the 26 pay periods in a year. Many homebuyers choose a bi-weekly mortgage payment because it coincides with their bi-weekly pay period.

Recommended Reading: Reverse Mortgage For Condominiums

How Much House Can I Afford

Your house will likely be your biggest purchase, so figuring out how much you can afford is a key step in the home-buying process. The good news is that coming up with a smart budget is pretty straightforward and not too time-consuming especially with the Bankrate Home Affordability Calculator.

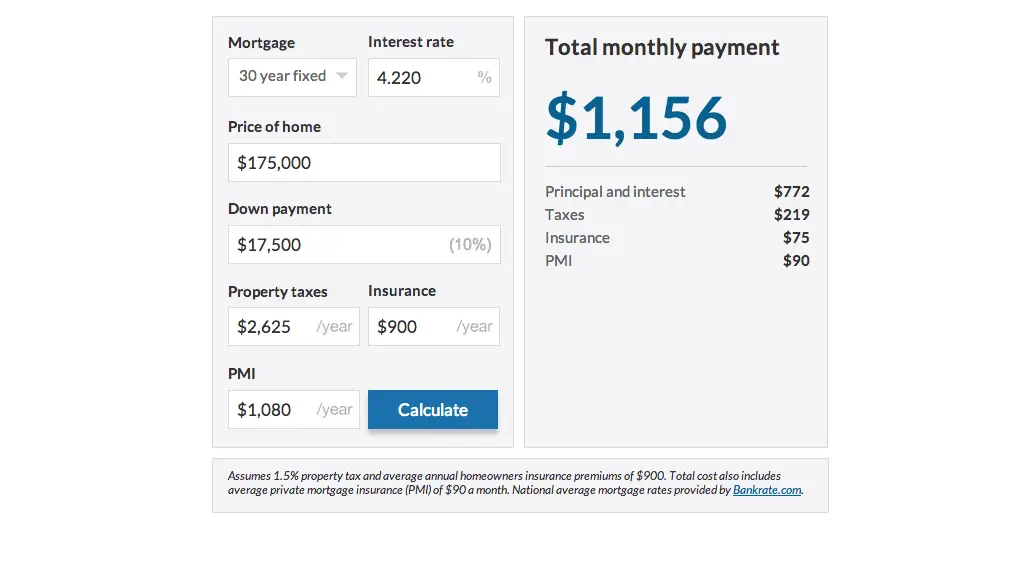

Calculate Your Monthly Payment

Use our free mortgage payment calculator to find out how much you’ll pay each month:

Mortgage Calculator

- Paying a 25% higher down payment would save you $8,916.08 on interest charges

- Lowering the interest rate by 1% would save you $51,562.03

- Paying an additional $500 each month would reduce the loan length by 146 months

If you want to do the math by hand, you can calculate your monthly mortgage payment, not including taxes and insurance, using the following equation:

M = P /

P = principal loan amount

i = monthly interest rate

n = number of months required to repay the loan

Once you calculate M , you can add in the monthly property tax and homeowners insurance premium, if you have them. These are fixed costs that aren’t determined by how much you borrow from the bank, so they can easily be added to the monthly cost.

Don’t Miss: Chase Recast Mortgage

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

What Is My Mortgage

If you have more debt, you might struggle to keep your DTI low while also paying off a mortgage. In this case, it can be useful to work backward before you decide on a percentage of income for your mortgage payment.

Multiply your monthly gross income by .43 to determine how much money you can spend each month to keep your DTI ratio at 43%. Youll then subtract all of your recurring, fixed monthly debt obligations and minimum payments on credit cards and other lines of credit. The dollar amount you have left after subtracting all of your debts lets you know how much you can afford to spend each month on your mortgage.

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Rent: $500

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $200

- Homeowners association fees: $100

In this example, your total monthly debt obligation is $1,250.With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

How Does The Cash Rate Affect Commercial Interest Rates

The cash rate reflects the market interest rate on funds banks lend and borrow from each other overnight. It is set by the Reserve Bank of Australia , which meets on the first Tuesday of every month to discuss any potential moves.

But what does this have to do with commercial interest rates? Simply put, the cash rate serves as a benchmark rate for savings accounts and variable rate home loans. When the RBA raises or lowers the cash rate, banks and lenders tend to modify their own home loan and deposit interest rates soon after.

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

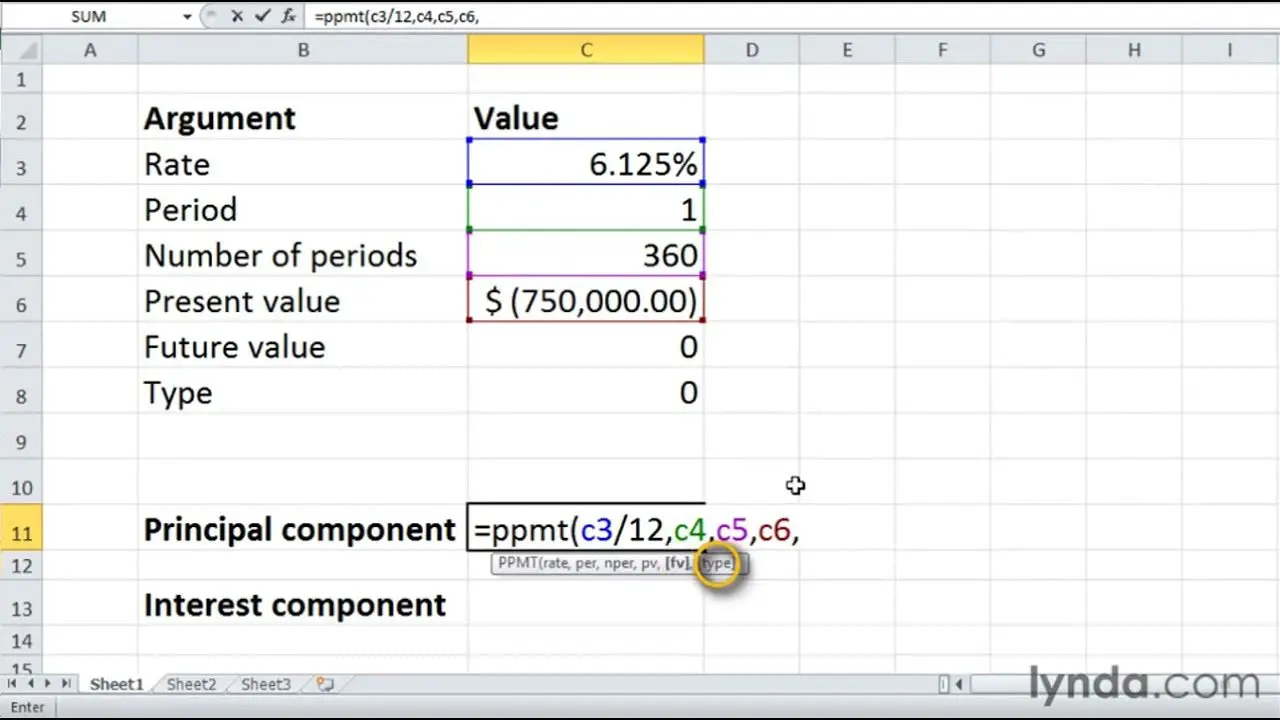

How Do Banks Calculate Monthly Mortgage Payments

CalculatingMortgage PaymentTomortgage paymenttomonthlytomonthlymortgageto calculatemonthly paymentsmake

Besides, how do you calculate monthly mortgage payments?

Equation for mortgage payments

Additionally, how does a repayment mortgage work? Repayment mortgages mean you pay off both the capital that was lent to you and the interest accrued, in a series of monthly payments over an agreed term. Interest-only repayments are exactly what they sound like, the repayments you make each month cover only the interest accrued on the amount lent.

Considering this, how do you calculate the total cost of a mortgage?

How to Calculate the Total Cost of Your Mortgage

How much is a mortgage payment on a 200 000 House?

If you borrow 200,000 at 5.000% for 30 years, your monthly payment will be $1,073.64. The payments on a fixed-rate mortgage do not change over time. The loan amortizes over the repayment period, meaning the proportion of interest paid vs. principal repaid changes each month.

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

Also Check: Recast Mortgage Chase

The Percentage We Recommend

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the maximum amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

Calculating Interest On A Car Personal Or Home Loan

These loans are called amortizing loans. The mathematical whizzes at your bank have worked them out so you pay a set amount each month and at the end of your loan term, youâll have paid off both interest and principal.

You can use an interest calculator to work out how much interest youâre paying all up, or, if youâd rather do it by hand, follow these steps:

1. Divide your interest rate by the number of payments youâll make in the year . So, for example, if youâre making monthly payments, divide by 12.

2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

This gives you the amount of interest you pay the first month.

So for example, on a personal loan of $30,000 over a period of 6 years at 8.40% p.a. and making monthly repayments:

Because youâve now begun to pay off your principal, to work out the interest you pay in the following months, you need to first calculate your new balance. So:

1. Minus the interest you just calculated from the amount you repaid. This gives you the amount that you have paid off the loan principal.

2. Take this amount away from the original principal to find the new balance of your loan.

To work out ongoing interest payments, the easiest way is to break it up into a table. So using the above example, your calculations might look like this:

Read Also: 10 Year Treasury Yield Mortgage Rates

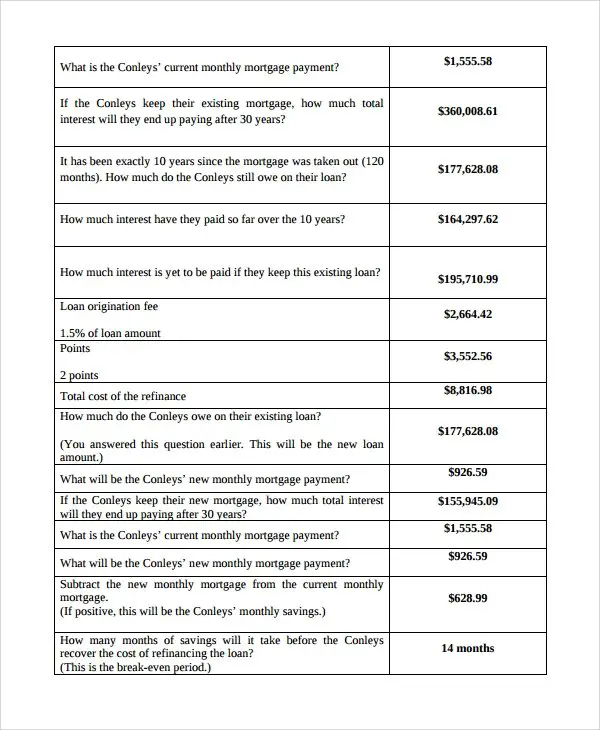

Calculating Arms Refinances And Other Mortgage Types

The equations that we’ve provided in this guide are intended to help prospective borrowers understand the mechanics behind their mortgage expenses. These calculations become more complicated if you’re trying to account for ARMs or refinances, which call for the use of more specialized calculators or spreadsheet programs. You can better understand how these loan structures work by referring to one of our guides about mortgage loans below:

How Do Mortgage Repayments Work

For most of us, buying a property will involve taking out a mortgage. Its one of the biggest loans we will take out, so its really important to understand just how your repayments work and what your options are for reducing them.

When you buy a property, what you pay will be made up of two parts – your deposit and your mortgage. The larger your deposit you have in place, the smaller the mortgage you will need to borrow.

So for example, if your deposit is worth 10% of the purchase price, then you will need to take out a mortgage for the remaining 90%.

The amount that the mortgage will cost you to pay off will be determined by two additional factors – the term of the mortgage and the interest rate.

You will then make a monthly repayment towards the mortgage so that it is paid off when you reach the end of your mortgage term.

Also Check: Reverse Mortgage Mobile Home

What Is A Mortgage Principal

A principal is the original amount of a loan or investment. Interest is then charged on the principal for a loan, while an investor might earn money based on the principal that they invested. When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 afterclosing costsand made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

Your mortgage principal balance is the amount that you still owe and will need to pay back. As you make mortgage payments, your principal balance will decrease. The amount of interest that you pay will depend on your principal balance. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal balance, assuming the mortgage interest rate is the same.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

You May Like: Rocket Mortgage Vs Bank

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

How Your Lender Sets Your Interest Rate

Lenders set the interest rate for your mortgage. They consider factors to help them determine your cost.

These factors can include:

- the length of your mortgage term

- their current prime and posted interest rate

- if you qualify for a discounted interest rate

- the type of interest you choose

- your credit history

- if youre self-employed

Lenders typically offer higher interest rates when the term length is longer. Its not always the case.

Read Also: Can You Refinance A Mortgage Without A Job

Calculate The Number Of Payments

The most common term for a fixed-rate mortgage is 30 years or 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

The Amount You Have Left Over Each Month

Some lenders calculate a minimum amount that we should have left over each month after fixed payments and a living allowance are deducted.

This is called UMI and varies from bank to bank.

For a couple, the calculations are based on combined income. For someone with children, lenders will expect to see less surplus.

If youre borrowing a large amount of the purchase price, lenders will expect you to have more spare income. This is so you can deal better with any future uncertainties like a rise in interest rates or a reduction in income. For example, if someone is borrowing 95%, some banks will want to see a UMI of $750 to $1,000 a month.

Read Also: Recasting Mortgage Chase

How Much Mortgage Can I Afford

To figure out how much house you can afford and estimate the loan amount you will be approved to borrow, youll need to know the following: your monthly household income before taxes your down payment amount and how much you pay towards debt each monthsuch as car payments and credit cards. This will help you and your loan officer determine your debt-to-income ratio .

Total Debts / Monthly Income = DTI

Mortgage lenders use your DTI to determine how much you can afford to borrow. Typically, youll want your DTI below 36%. Add all your monthly debts and divide them by your gross monthly income .

Heres an example:

You pay $500 a month total for your car and student loans and gross $4000 a month in pay. Use the formula: $500 / $4000 = 12%. That is your current debt to income ratio! If you want to know how much house you can afford take the typical DTI ratio and subtract your current DTI ratio which leaves you with 24%. Multiply that percentage by your gross monthly income . Ideally, you would want to keep your monthly mortgage payment below $960 to maintain the ideal debt-to-income ratio. To learn more, and get preapproved, contact your mortgage loan officer.

There are six different mortgage types you should consider when shopping for a home loan.