What Role Does Pre

Before you contact a real estate agent or start shopping for a home, the first thing you should do is go through the pre-qualification process. And, if youâre really serious, go through the pre-approval process as well. Many real estate sellers expect buyers to have a preapproval letter, and having one could make you a more competitive buyer.

Why? Because sellers are more willing to negotiate with you if you have proof that you can obtain financing for the purchase. Buying a home and financing a mortgage can be a lengthy process, and nobody wants to waste their time negotiating with someone who can’t even qualify for a loan.

Should I Get Prequalified For A Mortgage

Its a good idea to get prequalified early in the home buying process. If youre just starting to think about buying or house hunting, prequalification is a simple process that will tell you how much you can afford and help you set a price range.

Prequalification doesnt guarantee your mortgage approval. But its a useful tool when youre just starting out as a home buyer. And, since the process is pared-down, you can usually get prequalified easily and quickly online.

In this article

The Difference Between A Pre

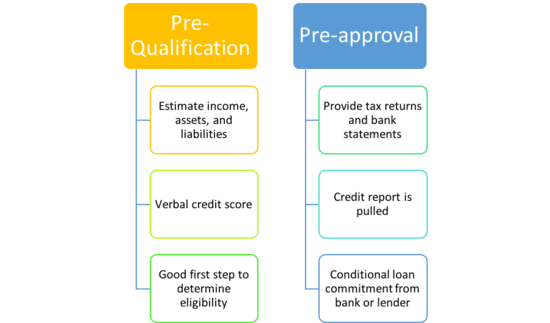

There are two ways to get an approval from a lender before you go through underwriting a pre-qualification and pre-approval.

A pre-qualification is an estimate of what you can afford. The lender asks you a few basic questions, some of which may include questions about your credit. However, the lender does not pull your credit report. You can get a pre-qualification from several lenders and your credit would be unharmed.

A pre-approval is a more concrete approval of sorts. Its not a guarantee of a loan, but it lets others know that the lender actually reviewed your documents and subject to certain factors, you could secure the loan amount they designate. In this situation, the lender does pull your credit, which would put an inquiry on your credit report.

Don’t Miss: How Do Points Work For Mortgage

Lenders Value Job Stability

While your credit score and the size of your down payment matter, don’t underestimate the value of stable employment. While a stint of unemployment will obviously stand out, sometimes even changing companies can make lenders nervous. If you’re contemplating getting a mortgage, you should stay in your current job if possible. The same holds true for any co-signers. Once your mortgage is approved, you can start pursuing new career opportunities again.

Can I Get Mortgage Pre

Its unlikely. Initial qualification without a full credit check may be possible with some lenders at that point, they may be interested simply in whether you have both the income to pay back a mortgage and no credit red flags. But to get full-scale pre-approval will likely require a credit check.

Its important to know how long pre-qualification and pre-approval will be in effect. Different lenders assign different times for which their letters of pre-qualification or pre-approval are good, from 30 to as many as 120 days.

Remember that multiple checks for credit history can negatively affect your credit rating, so you dont want to have them repeated often. For the same reason, you shouldnt apply for it until youre ready to start seriously home shopping. Many lenders and real estate agents can help you get a range of what you can afford in a general sense, so that you can avoid going through the pre-qualification or pre-approval process only to learn that theres nothing in your market that you can realistically afford or want.

Read Also: What Mortgage Companies Use Experian

Can A Mortgage Pre

JMcHood home loan pre-qualificationmortgage approval processmortgage pre-approval

Getting a mortgage pre-qualification is the first step in the mortgage process. Its not a pre-approval, so it doesnt hold a lot of weight with sellers. But, if you are unsure about how much mortgage you can afford, its a good first step.

Does the process hurt your credit score? Because the process does not require the lender to do a hard inquiry on your credit, it does not affect your score.

We discuss the details below.

Monitor Your Credit While Shopping For A Home

While getting prequalified for a mortgage might not affect your credit scores, you want to make sure other negative marks don’t hurt your credit right before you apply for such a large loan. A credit monitoring service could quickly alert you to changes in your credit reports. Experian offers free monitoring of your Experian credit report.

You may want to monitor your other two credit reports as well, because mortgage lenders may use all three of your reports and credit scores based on each report. The Experian IdentityWorksSM Premium program has a free 30-day trial and comes with three-bureau monitoring and multiple FICO® Scores for each report, including the FICO® Score version commonly used for home loans.

Also Check: Can You Have 2 Mortgages On The Same Property

Does Getting Preapproved Hurt Your Credit

Theres one key step you should take to boost your odds of landing your dream home: getting preapproved for a mortgage loan with a lender.

If you do this, sellers will view you as a more attractive buyer. If they receive multiple offers, sellers are more likely to choose buyers who are preapproved for a mortgage than they are those who have not yet obtained financing.

But does getting preapproved for a mortgage hurt your three-digit FICO credit score? Slightly, but the dip in your credit score will be temporary. And the advantages of getting preapproved far outweigh the small hit to your score.

The Difference In The Preapproval

If you decide to move forward with a lender, you may want to get a preapproval before you shop for a home. The preapproval lets sellers and/or realtors know that you qualify to receive the loan necessary to buy the home.

The preapproval takes the prequalification one step further. Rather than telling the lender your income, debts, and asset amounts, you prove it by providing your paystubs, W-2s, asset statements, and a copy of your credit report. The underwriter will evaluate these documents and determine if you qualify for the home.

If you do qualify, the lender will write a preapproval better that will state the loan amount you can receive. It will also state the conditions that you must meet in order to close on the loan. Typically, the conditions have to do with the property itself, but some may have to do with your financial situation too.

You May Like: What Is Deferred Interest On A Mortgage

Can You Be Denied A Loan After Pre

Yes, you can still be denied a loan after pre-approval. Pre-approval for an auto loan is more of an invitation to apply than it is a guarantee that you will be approved once you actually apply. The good news is that a pre-approval suggests that you are likely to be approved for the loan based on your meeting the minimum criteria. However, you still have to apply for the loan, and the lender will have to perform a hard inquiry at which point they may not approve your application.

One of the main reasons why an auto loan may be rejected after pre-approval is because the individuals credit situation has changed. For instance, the individuals credit score may be lower when they apply for the loan then it was when the lender initially received their credit history information. If you are self-reporting credit and income information to get a pre-approval, then any mistakes you make in entering the correct information can also impact denial once you submit the actual loan application and the lender performs the hard inquiry.

To minimize your chances of being rejected for the auto loan after pre-approval, you will want to check your credit score from one or two of the major credit bureaus. If your credit score falls within the range that the lender is looking for, you have a good chance of getting final approval once you have applied. Its important to note that you may also be approved for auto loans that you were not pre-approved or prequalified for.

Gather The Appropriate Documents

Lenders will want to verify your identity, credit history, employment history, income and financial assets to issue a preapproval. Theyll likely ask you to fill out a uniform residential loan application .

The 1003 application asks for your personal information, financial information and loan information, including

- Bank accounts, retirement and other accounts

- Any other assets you have

- Property you own

- Employer contact information

- Debts you owe or other liabilities

Your lender will also likely do a hard credit check, and may require additional documents based on your individual situation, such as pay stubs, tax returns or bank statements.

Read Also: Debt Recovery Solutions Verizon

Also Check: How Old Is Too Old To Get A Mortgage

Does A Preapproval Hurt Your Credit

Getting a mortgage preapproval can cause a slight decrease in your . However, this should not significantly impact your credit score in the long term, and the benefits of preapproval ultimately outweigh any negative short-term effect to your credit.

Still, that doesnt mean you should apply with multiple lenders willy-nilly. Doing so can have a more significant impact, hurting your credit score. Because of this, its wise to limit your rate shopping to a month or so. Credit bureaus will know that you are searching for a home and likely wont hold each listed inquiry against you.

What Happens If You Dont Get Pre

In order to qualify for a mortgage, you must meet specific criteria for income, credit score, down payment, and debt-to-income ratio. Not everyone will pre-qualify for a mortgage, and not everyone will get pre-qualified for amount of money they think they would. If you find yourself in that scenario, there are some things you can do:

- Increase your down payment amount. This can help increase the loan amount you would qualify for, and also help lower your monthly mortgage payments. Learn more about down payments and see why 20% is ideal.

- Decrease your overall debt to improve your debt-to-income ratio. Typically, a debt-to-income ratio of 36 percent or less is preferable 43 percent is the maximum ratio allowed. Use our debt-to-income calculator to estimate your debt-to-income ratio.

- Work to improve your credit score by doing things like correcting errors on your credit report, addressing any red flags such as late or missed payments, and reducing the number of hard credit inquiries on your report. Even if you are deemed to have bad credit, you may still be able to qualify for a mortgage. But in general, a score of 720 and higher will help you get the most favorable interest rates.

Ready to get pre-qualified? In minutes, you can find a local lender on Zillow who can help pre-qualify you for a mortgage.

Related Topics

Recommended Reading: How To Check Credit Score For Mortgage

How To Prep Your Credit For Mortgage Pre

If youre getting ready to buy a home, you can do a few things to prepare your credit and increase the odds of getting pre-approved:

- Check your credit: Checking your credit creates a soft inquiry, which doesnt affect your score. Its a good idea to check your credit for at least several months or even up to a full year before you start looking for homes. Checking in advance gives you plenty of time to take action to improve your history and score if needed.

- Get current on payments: If you have a history of paying late on any of your loans, make an effort to get current on your payments. Pay off any late fees and back-due amounts. Then, commit to paying your loans by the due date every month. You can set up a payment reminder or schedule automatic payments to ensure you dont forget.

- Pay off as much debt as you can: How much debt you have or the amount of debt compared to your income can affect your credit score and eligibility for a mortgage. If you have a lot of debt, try to pay some off before applying for a home loan.

- Correct any errors on your credit report: The credit bureaus can make mistakes. Let the agency know if you notice anything strange or incorrect on your credit report. Common errors include accounts that belong to someone else usually someone with a similar name or accounts youve closed still showing as open. < /span > In some cases, errors in your credit report can be a sign of identity theft or fraud.

resources

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Also Check: What Is A Credit Report And Why Is It Important

Also Check: When Paying Off A Mortgage Early

Cons Of Mortgage Prequalification

- Provides a false sense of security: Prequalification letters arent based on in-depth analysis of a borrowers finances. For that reason, they are merely an estimate and may give some homebuyers create outsized expectations.

- Not a guaranteed offer: Even though prequalification letters include an estimate of how much a lender is willing to extend, they arent a guaranteed loan offer.

Is 7 Credit Cards Too Many

As with almost every question about credit reports and credit scores, the answer depends on your unique credit history and the scoring system your lender is using. « Too many » credit cards for someone else might not be too many for you. There is no specific number of credit cards considered right for all consumers.

What is an excellent credit score? Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent.

What is a 5 24 rule?

Many card issuers have criteria for who can qualify for new accounts, but Chase is perhaps the most strict. Chases 5/24 rule means that you cant be approved for most Chase cards if youve opened five or more personal credit cards within the past 24 months.

Does a soft pull affect credit score? Soft inquiries dont have any impact on your credit scores. Hard inquiries may remain in your credit reports for about two years and they can impact your credit scores.

Recommended Reading: Who Benefits From A Reverse Mortgage

Whats A Hard Credit Inquiry

As we mentioned above, there are two types of credit inquiries: hard inquiries and soft inquiries.

Hard inquiries are typically triggered when you apply for a loan or credit card and the lender checks your credit when making a decision on your application.

While a new card or loan may follow a hard inquiry, a hard inquiry can also lower your credit scores by a few points. A hard inquiry may remain on your credit reports for up to two years, but the damage may be removed even before then.

Hard inquiries have a much smaller impact than most people think, says Randall Yates, founder and CEO of The Lenders Network. He notes that this may be especially true regarding FICO scores, which only consider inquiries from the past 12 months.

Soft inquiries, on the other hand, typically happen when an employer or company checks your credit as part of a background check, or when you check your own credit. A soft inquiry may occur with or without your permission, but it wont affect your credit scores.

As part of the prequalification process, a lender could perform a soft inquiry, which may give it enough information to predict whether youre likely to be approved.

Do Mortgage Payment Holidays Affect Credit Rating

If youve taken a payment holiday from your mortgage, or had a payment holiday on a previous loan or credit card, it all depends on how the lender has recorded this on your credit file.

With payment holidays or agreements to pay a different amount than was originally agreed, some lenders will consider the credit agreement as having been met, and not record any arrangement to pay on your credit file.

Other lenders will say they are happy with the arrangement, but still record this on your file as in an arrangement to pay . Some new lenders will consider this as negative and give you a lower score as a result.

Donât Miss: Does Rocket Mortgage Sell Their Loans

Also Check: What Is The Veterans Mortgage Relief Program

Does Applying For A Loan Hurt My Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

If you keep a close eye on your credit score, you might notice that it drops shortly after you apply for a loan.

That can happen because of a hard inquiry or lenders checking your credit to decide whether to approve a loan. Scoring models typically view a loan application as potentially increasing your risk as a borrower.

That means your application, whether it is approved or not, can shave a few points off your . And if your score is on the bubble for approval, you may need every possible point.

Read Also: Rocket Mortgage Launchpad