What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage payment calculator

Save & exit

Loan termThe amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Must Reads

Why Use The Mortgage Loan Calculator

There are so many different mortgage and loan options to choose from, it can sometimes be a little overwhelming. Whether you are setting up a new mortgage to purchase a home or to refinance a mortgage on a home that you already own, there are always a great many aspects to consider.

To name just a few of the more common choices, there are fixed rate mortgages, adjustable rate mortgages, and fixed to adjustable rate mortgages for those who want something in between. Fixed rate mortgages with terms lasting between 15 and 30 years are currently the most common.

Whichever kind of mortgage you end up using, the information you get from the Mortgage Loan Calculator will remain relevant.

Don’t Miss: What Does Gmfs Mortgage Stand For

Why Should I Use A Mortgage Calculator

Calculate The Cost Of Borrowing

When you buy a home, you already know that you’re going to pay a lot of interest over the life of the loan. However, you may not be prepared for just how much you are going to have to pay. In many cases you could buy your house two or three times over with the amount you end up paying back to your loan.

A good mortgage calculator like the ones we offer at MortgageCalculator.org can help you determine your monthly payment and your total interest payments. However, looking at the total interest you pay may seem too abstract. For instance, if you pay 5 percent on a $250,000 30-year fixed loan, you will end up paying $233,139.46 in interest alone. Since this amount is spread out over 30 years, it may be harder to contextualize the impact of.

Understanding exactly how much you pay in interest each month and each year rather than cumulatively over several decades can help make the amount seem more concrete and immediate. Breaking it down further by every thousand dollars of your mortgage can help you how it all adds up.

On that same $250,000 loan with 5 percent interest, you would pay $5.41 in interest each month for every $1,000 of the loan. You would pay $64.91 each year for every $1,000 of the loan.

Is there something else you could or should have invested in which would have offered better returns?

Higher Returning & More Diversified Opportunities

Recommended Reading: Does Getting Pre Approved Hurt Your Credit

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

How Much Deposit Is Needed

Lending is based on how much you need to borrow offset against the value of the property and this is generally referred to as the loan to value ratio.

If you were to put down a deposit of £10,000 on a property worth £100,000, you would own 10% of it outright and need to borrower 90% of its value from your mortgage lender so, your LTV ratio would be 90%.

The maximum LTV you will find for a residential property in the UK is 95%, so you will need at a deposit of at least £5,000 to get a mortgage for a £100k house.

Some mortgage lenders may prefer you to put down more than that to lessen any risk involved in the deal, and many might insist upon it if you have any bad credit on your file or the property youre buying has non-standard construction.

How Much Mortgage Can I Get For 1000 A Month

We get a lot of enquiries from potential home-buyers asking how big a home they can buy or how much mortgage they can get for a £1,000 per month. While we always encourage home-buyers to seek professional assistance from experienced mortgage advisors, we also share useful information to help them get an idea of their possible budget.

You May Like: Chase Mortgage Recast

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

Mortgage Loan Calculator For Refinancing Or Home Purchase Payments

Get estimates for home loan payments to help you decide what you can afford.

This simple Mortgage Loan Calculator enables you to calculate what your monthly mortgage payments will be – including the principal, interest, property taxes and home insurance . The result you get will be relevant for a wide variety of different mortgage types. It will also display your projected repayment schedule, taking into account your principal loan amount, interest rate, and any additional prepayments you intend to make

Also Check: What Does Rocket Mortgage Do

Can I Still Get A Good Mortgage With 1000 A Month Repayments If I Have A Bad Credit History

Even if you have a bad credit history, the ability to repay £1,000 a month on a mortgage should allow you to secure a mortgage. How good or large that mortgage is, depends on other factors, as detailed above.

If you want to know more about exactly what mortgage you can get with a bad a credit history but the ability to make £1,000 monthly mortgage repayments, then why not speak with an experienced mortgage advisor, like those we work with.

The right mortgage advisor can answer all your questions and help you understand just what mortgage is available to you with a £1,000 per month for repayments, with or without a bad credit history.

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

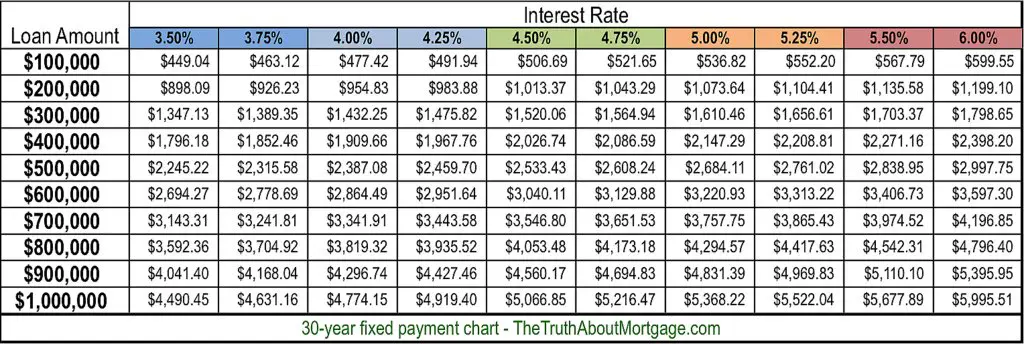

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Don’t Miss: Reverse Mortgage Mobile Home

How To Use The Mortgage Loan Calculator

We have done our best to make this calculator as simple and user-friendly as possible, but if you arent sure where to start, try following these steps:

Personal Considerations For Homebuyers

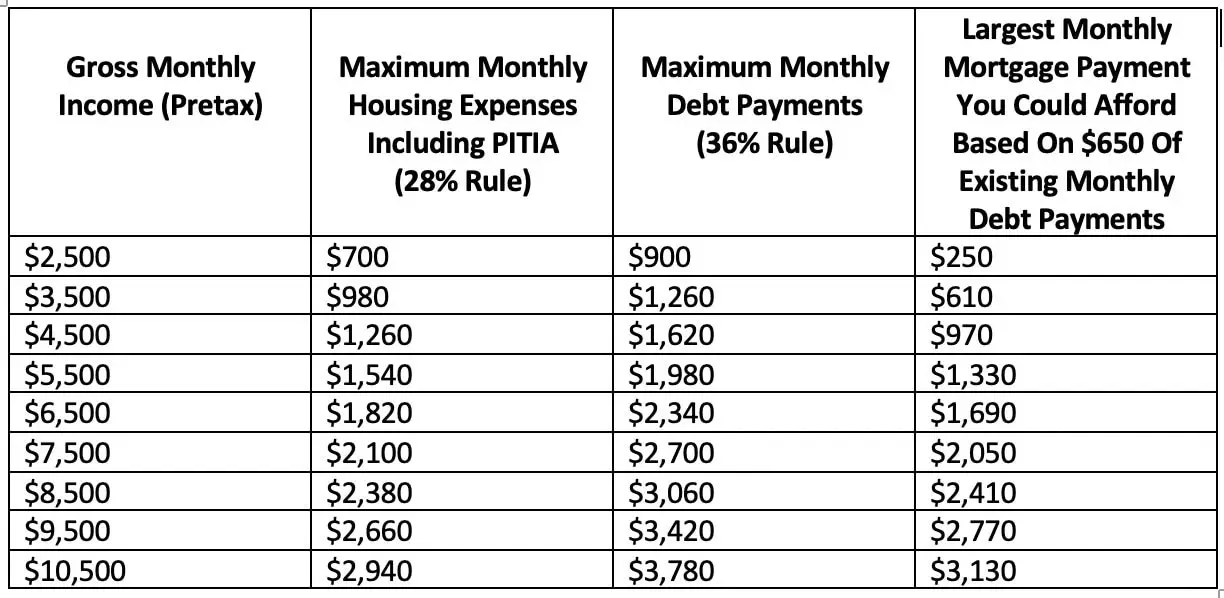

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums, In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

You May Like: How To Get Preapproved For A Mortgage With Bad Credit

How Much Is A 450000 Mortgage Per Month

Monthly payments for a $450,000 mortgage With a $450,000 mortgage and an APR of 3%, you’d pay $3,107.62 per month for a 15-year loan and $1,897.22 for a 30-year loan. Keep in mind, these amounts only include principal and interest. In many cases, your monthly payment will also include other expenses, too.

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

Recommended Reading: Chase Recast Calculator

Where To Get A $100000 Mortgage

To get a $100,000 mortgage loan or any mortgage for that matter youll need to shop around with various lenders.

Because rates and terms can vary from one lender to the next, this will allow you to get the lowest rate and most affordable loan possible.

You can reach out to various mortgage lenders individually and request quotes, though this may take some time. Credible offers a more efficient option. With Credible, you can compare all of our partner lenders at once and receive prequalified rates in a matter of minutes.

How Much Does A 100 000 Mortgage Cost

Monthly payments on a £100,000 mortgage. At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £477.42 a month, while a 15-year might cost £739.69 a month. Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

Read Also: Rocket Mortgage Qualifications

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.