Find Out What Your Monthly Payment And Total Interest Could Look Like On A $500000 Mortgage

Approved for a mortgage of $500,000? You might wonder how much your monthly repayments will cost you on a half a million dollar mortgage and whether you can afford them with your income. Heres a breakdown of what you might face monthly, in interest and over the life of a $500,000 mortgage.

What Monthly Repayments Can I Expect On A 500000 Mortgage

How much is a mortgage for a £500,000 home?

Unfortunately theres no simple answer to this question. When it comes to home loans, how much a mortgage is on a £500k house is dependant on a number of different variables.

All lenders have their own requirements and eligibility criteria which determine what interest rates they offer, and therefore how much a £500,000 mortgage costs you in repayments.

Benefits Of Breaking It All Down

Breaking down your interest payments in this way isn’t just an exercise in math. Getting this kind of analysis helps you to better understand how just the cost of your home can significantly impact how much you pay over the life of your loan. Of course, getting the best interest rate possible will help you to save money. However, if you aren’t able to lower your interest rate any further either because you haven’t been able to put together a larger down payment or because you haven’t been able to improve your credit score then focusing on finding the best price for the home of your dreams can help you save.

Use our easy calculator to get the information you need to put you in a stronger position to negotiate with the seller and to create the right budget for you while also buying the home of your dreams. Just plug in the amount of the loan, the interest rate, the length of the loan, and any loan points, origination fees and closing costs. We’ll mail you an easy-to-understand analysis of your interest charges by month and year in plain English. You don’t need to enter any personal information. Just put in your e-mail and get the results in moments!

Read Also: How Much Is Mortgage On A 1 Million Dollar House

Getting Preapproved Can Tell You Your Home Buying Budget

One of the easiest ways to find your price range is to get a preapproval from a mortgage lender.

Preapproval is kind of like a dress rehearsal for your actual mortgage application. A lender will assess your financial situation as shown by your annual salary, existing debt load, credit score, and down payment size without making you go through the full loan application.

This can tell you whether youre qualified for a mortgage and how much home you might be able to afford.

You could also learn whether you can afford a 15year loan term or whether you should stick with a 30year mortgage. And, a preapproval can show whether youd be better off with an FHA loan or a conventional loan.

Finally, your preapproval shows you the added monthly costs of homeownership such as home insurance, real estate taxes, HOA fees, and mortgage insurance if necessary.

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

Read Also: Rocket Mortgage Loan Requirements

How To Calculate Your Home Buying Budget On A $50000 Salary

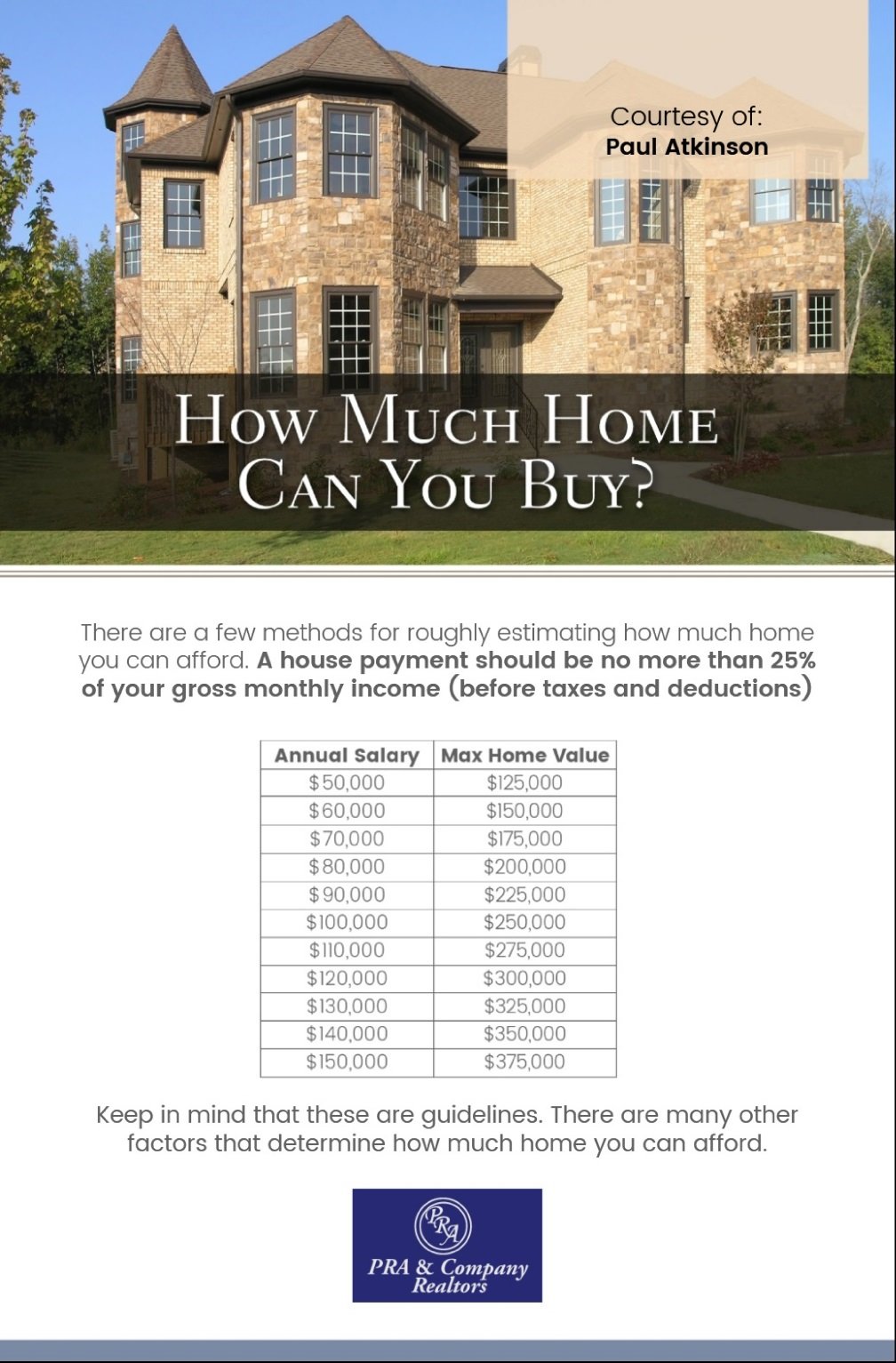

As you can see in the examples above, two different borrowers who both earn $50,000 a year could have very different home buying budgets.

To figure out how much house you can afford, you need to factor in your own income, debts, down payment savings, and projected housing costs like homeowners insurance and property taxes.

Remember, principal and interest on the mortgage arent the only costs youll pay each month as a homeowner.

Luckily, you dont have to do all that math on your own. You can use an online mortgage calculator one that includes taxes and insurance to estimate your monthly mortgage payment.

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Don’t Miss: Rocket Mortgage Vs Bank

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Calculate The Cost Of Borrowing

When you buy a home, you already know that you’re going to pay a lot of interest over the life of the loan. However, you may not be prepared for just how much you are going to have to pay. In many cases you could buy your house two or three times over with the amount you end up paying back to your loan.

A good mortgage calculator like the ones we offer at MortgageCalculator.org can help you determine your monthly payment and your total interest payments. However, looking at the total interest you pay may seem too abstract. For instance, if you pay 5 percent on a $250,000 30-year fixed loan, you will end up paying $233,139.46 in interest alone. Since this amount is spread out over 30 years, it may be harder to contextualize the impact of.

Understanding exactly how much you pay in interest each month and each year rather than cumulatively over several decades can help make the amount seem more concrete and immediate. Breaking it down further by every thousand dollars of your mortgage can help you how it all adds up.

On that same $250,000 loan with 5 percent interest, you would pay $5.41 in interest each month for every $1,000 of the loan. You would pay $64.91 each year for every $1,000 of the loan.

Is there something else you could or should have invested in which would have offered better returns?

Higher Returning & More Diversified Opportunities

Read Also: 10 Year Treasury Vs 30 Year Mortgage

Try A 3%down Conventional Loan

Its possible to get a conventional loan one backed by Fannie Mae or Freddie Mac with a down payment as low as 3% of the purchase price. Whats more, that down payment can often be covered with a down payment assistance grant or gift funds from a family member.

Just note that to qualify for a 3%down conventional loan, most lenders require a credit score of at least 620 or 640. For those with lower credit, an FHA loan might be more appealing.

Why Should I Use A Mortgage Calculator

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Negotiate With The Seller

There is no reason you cant ask for seller contributions instead of negotiating for a lower purchase price. Depending on the type of mortgage you choose, the seller can contribute 3 to 6 percent of the home price in closing costs.

This can make all the difference when you want to buy a new home and stop renting.Seller contributions can cover closing costs, buy your interest rate down to a more affordable level, or make a onetime payment to cover your mortgage insurance.

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

You May Like: Can You Do A Reverse Mortgage On A Condo

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make. When youre ready to apply, compile necessary documentation like income verification and proof of assets and start shopping for the best rates.

Identify The Best Mortgage Type For You

Its important to determine the kind of mortgage you want as well as what you qualify for especially as a first-time buyer.

There are several types of mortgage programs available, but most people go with a fixed-rate loan that offers lower rates than variable-rate mortgages in the long run. You also need to decide whether or not you want a conventional loan or an FHA loan. Here are some of the most popular homeowner programs:

The most popular type of mortgage is the fixed-rate, 30-year, but thats not right for everyone. If youre self-employed and want to take out a large sum of money in order to invest it will be impossible with this kind of loan because they require borrowers to be able to show how they will make their mortgage payments in the long term.

For new homebuyers, finding the right mortgage can be a challenge. Having a real estate agent or mortgage brokers help you navigate the process of finding loans is an excellent way to get started.

Recommended Reading: Rocket Mortgage Loan Types

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

What Is Mortgage Affordability

Mortgage affordability refers to how much youâre able to borrow, based on your current income, debt, and living expenses. Itâs essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term âaffordabilityâ is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but itâs important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

Don’t Miss: Reverse Mortgage For Condominiums

How To Calculate Your Mortgage Payment

Mortgage calculators take into account a variety of different factors when determining your monthly mortgage costs. They can include the price of your home, your down payment, your monthly interest rate and the term length of your mortgage. If your math skills are a little rusty, a mortgage calculator does the hard work for you in order to determine your monthly payment and associated costs.

The basic formula for calculating your mortgage costs: P = A/

- P stands for your monthly payment

- A stands for your loan amount

- T stands for the term of your loan in months

- R stands for the monthly interest rate for your loan

For example, lets say that John wants to purchase a house that costs $125,000 and has saved up a $25,000 down payment. His loan amount is $100,000, the term length is 15 years and the monthly interest rate is 4.20%. In this scenario, Johns monthly mortgage payment will be $749.75.

Johns mortgage cost formula will look like: 749.75 = 100,000[4.2^180/[^180-1)

If John wants to purchase the same house with a 30-year term length, the formula works in much the same way. In this scenario, his loan amount is $100,000, term length is 30 years and monthly interest rate is 4.20%. With a 30-year mortgage, Johns monthly mortgage payment will be $489.02.

Johns mortgage cost formula will look like: 489.02 = 100,000[4.2^360/[^180-1)