What Credit Rating Do You Need To Buy A House

Youve spent years saving up your deposit for a new home. Youve waited for the right moment. Now its here. The only thing left is to secure your mortgage. We can help show you how.

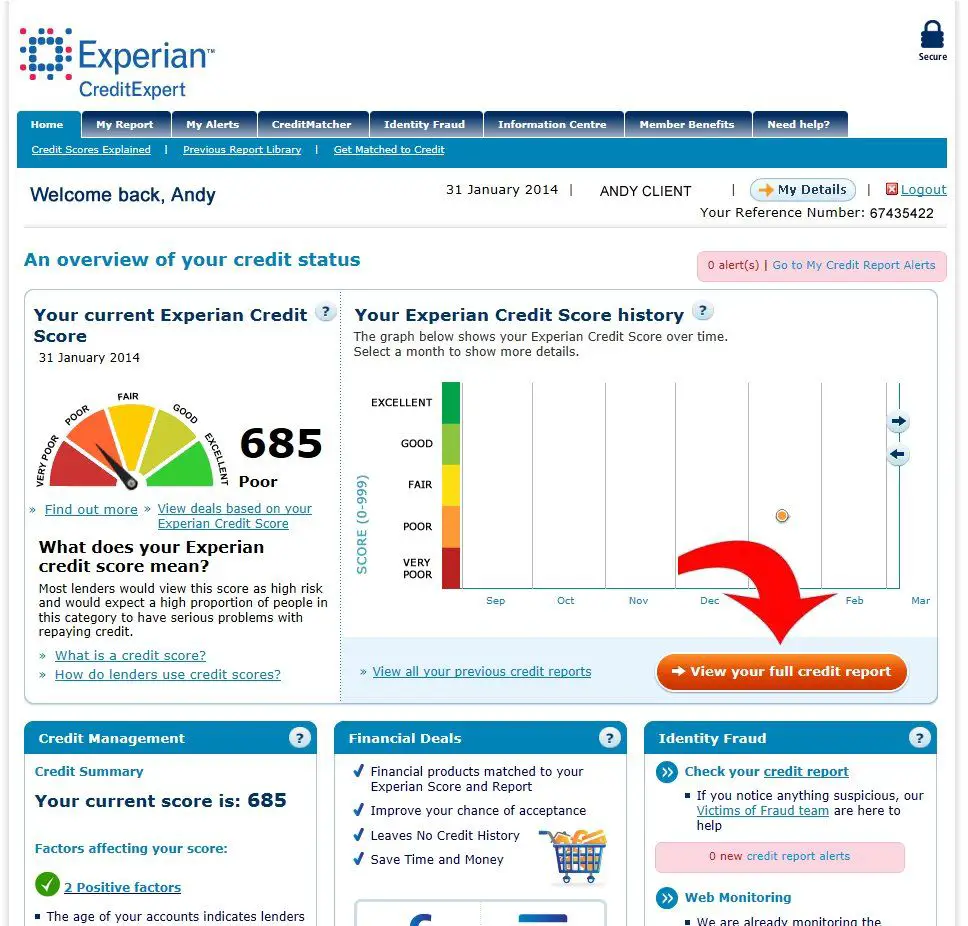

If youre thinking of buying a home, youll need a credit rating thats good enough to secure a mortgage. Your credit rating is a snapshot of how youve managed money in the past including past borrowing, repayments, how much of your available credit you routinely use, how many payments youve missed and several other factors to create a score. The higher the score, the better your chance of being offered a better deal on your mortgage.

There are three major credit reference agencies each with a slightly different scoring system. So its a good idea to check your credit rating with all three to find out how you rate. That way, youll know whether youre likely to get a mortgage.

Check Your Credit Report For Fraud

Look for accounts that don’t belong to you on your credit report. Accounts that you don’t recognize could mean that someone has applied for a credit card, line of credit, mortgage or other loan under your name. It could also just be an administrative error. Make sure it’s not fraud or identity theft by taking the steps to have it corrected.

If you find an error on your credit report, contact lenders and any other organizations that could be affected. Tell them about the potential fraud.

If it’s fraud, you should:

- report it to the Canadian Anti-fraud Centre

The Canadian Anti-Fraud Centre is the central agency in Canada that collects information and criminal intelligence on fraud and identity theft.

After My Down Payment What Other Related Mortgage Fees Do I Need To Consider

Once youve settled on a down payment, its important to take stock of your closing costs. Closing costs often run between two to three percent of your total loan. Other fees include the loan origination fee, the loan application fee, the title services fee and appraisal fee. Additionally, you might consider setting up an escrow account, which guarantees 12 months of property taxes and homeowners insurance.

You May Like: Does Usaa Have Mortgage Loans

What Is Considered A Good Credit Score

Since different credit agencies use different rating systems, a good score will vary from one agency to the next. For Experian, a score of 881-960 is considered good, and a score of 961-999 is considered excellent. For Equifax, a score of 420-465 is considered good, and a score of 466-700 is considered excellent. For TransUnion , a credit score of 604-627 is considered good, and a score of 628-710 is considered excellent.

What If I Need To Improve My Credit

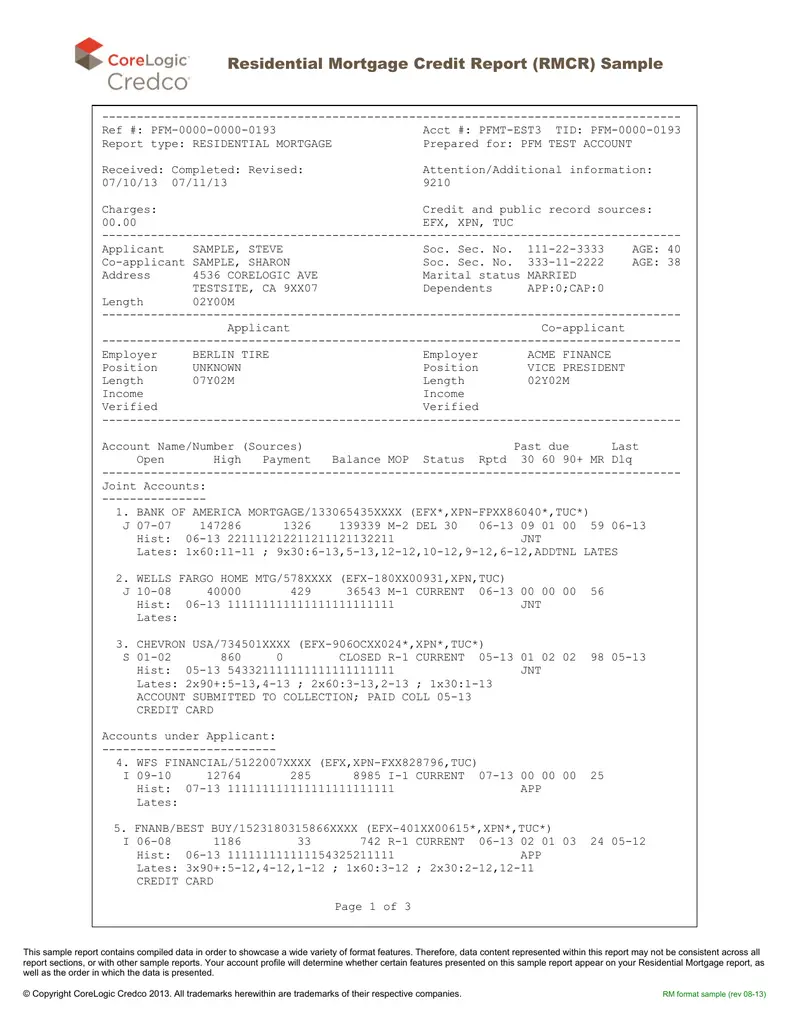

When youre preparing to buy a house, its a good idea to check all three of your credit reports as issued by the three major consumer credit bureaus essentially creating your own compiled report. Having all three credit reports can give you a good picture of your overall credit health, which can allow you to dispute any errors or investigate any problems you find before a lender sees them.

And because your residential mortgage credit report contains many of the same factors that are in your individual credit reports at the three major consumer credit bureaus, the steps you can take to clean up your reports and improve your credit are the same for an RMCR as they are for an individual report, Morse says.

The consumer credit bureaus may prohibit or frown upon lenders sharing RMCRs with borrowers, but the report contains a lot of useful information on how you look to lenders. And while its not advisable to make an issue of it if the lender says no, it wont hurt to ask the lender for your residential mortgage credit report.

About the author:

Read More

Read Also: What Is Typical Debt To Income Ratio For Mortgage

What If You Don’t Have A High Enough Credit Score To Buy A House

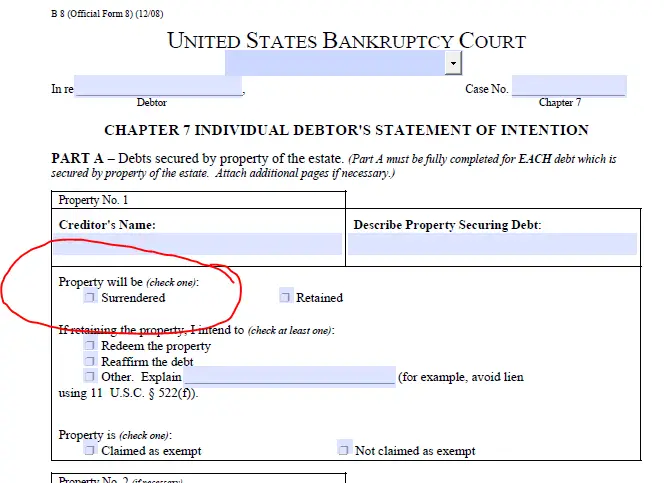

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

Improving Your Mortgage Score

Despite having a lower-than-expected mortgage score, Atlanta resident Moore managed to improve it and buy a home.

First, she paid down an outstanding debt to help raise her score. Then she did intensive shopping for a loan, talking to several banks and credit unions before finally securing a mortgage that was aimed at first-time home buyers.

I found that if you get approved by a bank, you may be able to get a lower rate or better offer from another bank, says Moore, who closed on her house in December.

To help improve your mortgage score, here are four guidelines.

Also Check: How To Qualify For More Money For A Mortgage

The Credit Score Needed To Buy A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

What Numbers Do Mortgage Lenders Look At

Lenders use credit scores to determine a borrower’s level of risk.

Three credit bureaus Equifax, Experian, and TransUnion calculate an individual’s credit score. The higher your credit score, the better interest rate you’re likely to get which also means you’ll have a lower monthly mortgage payment. Before you apply for a mortgage, it’s a good idea to check your credit score and review your credit report to make sure everything is correct.

You May Like: What Does A Co Signer Do For A Mortgage

How To Add Missing Mortgage Payment History To Your Credit Report

What if your mortgage information isn’t on your and you’ve checked all the possible reasons above? Start by contacting your mortgage company to verify that they report to the credit bureaus. Individuals cannot report information to credit reporting agencies, so the only way your mortgage payment history can be added to your credit report is if your lender reports it.

If the lender has been reporting to the credit bureaus and they have the correct information about you, such as your name, Social Security number and other identifying details, ask them to contact the credit bureaus to find out why the mortgage isn’t appearing in your account.

Cmhc Releases Its Residential Mortgage Industry Report

Ottawa, September 10, 2020

CMHC Releases its Residential Mortgage Industry Report

Total outstanding mortgage debt stabilized in 2019, before accelerating at the beginning of 2020 and into the first months of pandemic-induced lockdown period in April and May 2020, according to CMHCs annual Residential Mortgage Industry report.

The Residential Mortgage Industry report provides in-depth view of the residential mortgage market in Canada: from mortgage origination to funding, covering insured and uninsured mortgages, and encompasses activity from all mortgage lender types. It is based on data available at the end of the second quarter of 2020.

Don’t Miss: Is Fairway Mortgage A Broker

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

How To Improve Your Credit Before Applying

Before applying with a lender, start by checking your credit score and report. This will give you a better idea of what types of loans and credit cards you might qualify for. You can access your Experian FICO® Score and for free at any time, or sign up for free credit monitoring with alerts that let you know when changes have been made to your credit file.

Unless your credit score is already top-tier, there’s always room for improvement. And moving from “good” to “very good” credit, for example, may open the doors to lower interest rates, more favorable terms or simply a better chance of approval. Although there’s no quick fix for your credit, there are steps you can take to bring your credit score up. Here are a handful of tips to consider:

The same advice holds if you don’t have much of a credit historyor your credit file is “thin” . It may take time to build the credit score you aspire to, so start working on it now. Building good credit from scratch may take multiple steps. You may need to begin with a secured credit card or start with a . Over time, as long as you manage your credit responsibly and continue to make all payments on time, your positive credit history will populate your credit report and build up your score.

Recommended Reading: Can You Get A Second Mortgage With An Fha Loan

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Would You Like To Know If You Qualify For A Loan With Your Credit Score

People with lower credit scores may still have options to qualify for a loan. Are you interested in buying a home, refinancing a home, or getting cash out of your home equity? Call one of our knowledgeable Loan Advisors at to discuss the Freedom Mortgage loans that may be available to you!

Other Insights

Don’t Miss: Can I Have A Co Signer On A Mortgage

How To Strengthen Your Credit Score To Buy A House

If your score doesnt qualify for a great rate or the type of mortgage you’d prefer, it might make sense to put off homebuying for a while and use the time to build your credit profile. Heres how:

-

Pay all bills on time: Payment history is the biggest of all the factors that affect your credit score.

-

Maintain low credit card balances: Experts recommend you use no more than 30% of the limit on any credit card, and much lower is much better. How much of your available credit you are using is called your, and its the second-biggest factor in your score.

-

Check your credit reports: Look for score-lowering errors. If you find something, dispute it. Through April 2022, you are entitled to at least one free credit report from each of the three credit bureaus, Experian, Equifax and TransUnion, every week.

-

Keep credit cards open: Closing a card reduces the amount of available credit you have, which can send your credit utilization up and ding your score. Make a charge occasionally and pay it off promptly that keeps the issuer from closing your account for inactivity.

-

Look at your credit mix: If you have only credit cards or only installment loans, consider adding the other type so you can demonstrate a good payment record across diverse credit lines. If youre trying to build up a thin credit file, you could consider a secured credit card or a credit-builder loan.

How The Two Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person.

But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989.

Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game.

The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

According to VantageScore reports, there were approximately 10.5 billion VantageScores used between June 2017 and June 2018.

Don’t Miss: How Do Mortgage Loan Officers Make Money

Can You Get A Mortgage With No Credit History

It may be possible to get a mortgage if you have no credit history, but theres a fair chance it will make things harder. If lenders have nothing to go on, they cant be sure whether you are a responsible borrower who will pay back the money youve been given. If you do find a lender willing to offer you a mortgage, it might not be the type youd prefer and the interest rate might be less competitive.

If you are worried that your lack of credit history might affect the success of your application, you might want to take some time to build a history before applying. There are specialist credit cards for people who have not used credit before, as well as other ways of building a credit history.

Why Doesnt My Mortgage Appear On My Credit Report

A home is the biggest purchase most Americans ever makeand a home mortgage is the biggest loan most of us will ever take out. So shouldn’t your mortgage show up on your credit report? Generally, it willbut there are some situations where your mortgage may not appear on your report. Your mortgage may not show up on your credit report if your lender doesn’t report to credit bureaus, if your mortgage is new and hasn’t been reported yet, or if there’s an error on your loan paperwork, among other reasons.

To understand why your mortgage might not show up, it’s important to know how credit reports work. A is a record of how you use credit, based on factors such as the amount and type of debt you carry and whether you pay your bills on time. Each of three major credit reporting agenciesExperian, TransUnion and Equifaxcompiles a credit report on you based on information provided by your creditors and other sources. Whenever you apply for a loan, credit card or other type of credit, lenders can look at this report to assess your creditworthiness.

You May Like: What Do Mortgage Rates Follow

Why Should I Check My Credit Score Before Applying For A Mortgage

Some soon-to-be borrowers make the mistake of applying for loan or mortgage products without knowing their credit score and their chosen lenders stance on whether theyll lend to someone with their circumstances.

Always check your eligibility before applying for any line of credit to avoid damaging your credit report. Lenders can see your previous loan applications when accessing your credit report and a recent rejection for credit can hinder your ability to get approved for a future loan.

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all.

So, it makes sense to check and monitor your credit scores regularly especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Don’t Miss: What Makes Mortgage Rates Change

Check Your Mortgage Score First

Before you start touring open houses, make sure to look up your mortgage score.

Its important to do this before you fall in love with a house and make an offer, says Lucy Randall, director of sales at Better.com, an online mortgage provider.

You have to pay a fee, though, to get your mortgage credit scores as well as regular updates. At myFICO.com, for example, you can see up to 28 different FICO scores, including mortgage scores, for $19.95 a month and up.

Another option is to go to a lender for a mortgage preapproval. That lender can do an informal credit check from a single bureau that won’t affect your credit score, says Randall.

If you are working with a housing counselor approved by the Department of Housing and Urban Development , that counselor can help you gain access to your mortgage score, says Bruce McClary, senior vice president of communications at the National Foundation for Credit Counseling .

You can find a HUD-approved housing counselor at the agencys website. Or you can find one through the NFCC who may also offer credit and debt counseling, says McClary.