How Turbo Imports The Number

With customer consent, Turbo accesses your tax return in order to get your IRS-verified income. You will not be required to provide pay stubs or bank statements in order for the app to verify your income. Turbo also imports your household income since it uses your tax return, which means if youre married filing jointly and both earning income, youre able to get personalized recommendations based on the full picture. You can also import info about multiple income streams such as being a W-2 employee with a side gig.

This is helpful for your overall financial health profile because it enables Turbo to help provide personalized information about loans and rates for which you may be eligible based on income, credit score, anddebt-to-income ratio.

Are Stated Income Mortgages Illegal

Stated income mortgages are not illegal in Canada. Stated income mortgages became illegal in the United States after the Frank-Dodd Act in 2010 required borrowers to prove their income for owner-occupied properties.

TheEligible Mortgage Loan Regulationsunder Canada’sProtection of Residential Mortgage or Hypothecary Insurance Actstates that mortgage lenders must verify the borrowers income and employment status if they are employed. For self-employed borrowers, lenders just need to judge if the income reported by the self-employed borrower is plausible.

In other words, the stated income that a self-employed borrower declares must be reasonable. To do this, lenders will look at the industry, how long you have been in business for, and your occupation. For example, freelance photographers make roughly $40,000 per year in Canada. If a self-employed freelance photographer in their first year of business declares a stated income of $400,000 per year, their self-employed mortgage application will most likely not be approved. Their income will need to be verified in this case.

Disadvantages Of Getting A Mortgage While Self

Lenders don’t always see the self-employed as ideal borrowers. Borrowers who are employees can be considered to be particularly creditworthy because of their steady, easily verifiable incomes, especially if they also have excellent . Self-employed borrowers will have to provide more paperwork to document income when compared to traditional employees who can produce a W-2.

Another problem self-employed borrowers encounter is that they tend to use a lot of business expenses to reduce taxable income on tax returns, forcing lenders to wonder if the borrower makes enough money to afford a home. Finally, banks may want to see a lower loan-to-value ratio, meaning the borrower will need to come up with a larger down payment.

Many lenders are requiring higher credit scores, larger down payments and more documentation to approve mortgages and other loans. This applies to all borrowers, not just the self-employed, and requirements vary depending on thelender.

Also Check: How Much Is Mortgage Tax In Ny

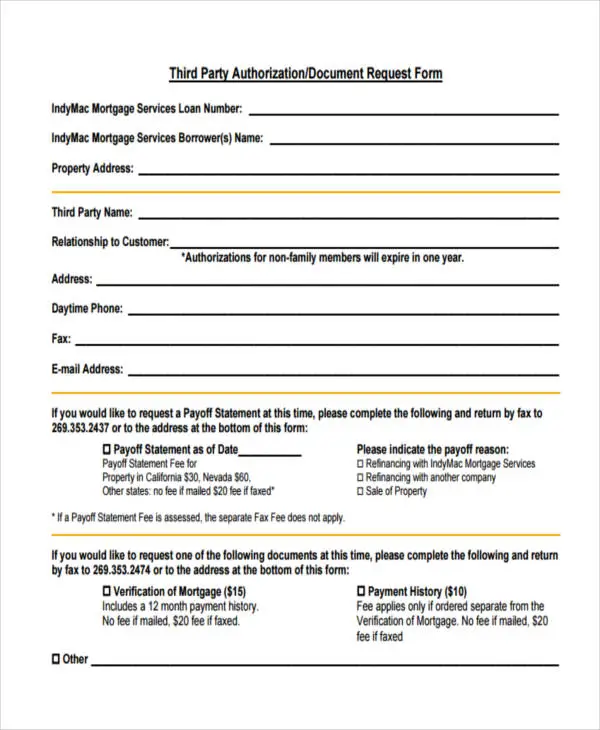

Can You Receive Money For A Down Payment From A Friend Or Relative

Lenders generally allow homebuyers to receive gift money from loved ones for their down payment. Under Fannie Mae and Freddie Macs requirements, these gifts can only come from a family member related by blood, marriage, adoption, or legal guardianship. The gift may also come from a fiancé or domestic partner.

If you receive your down payment money as a gift, youll also have to provide a gift letter written by the donor. The gift letter should specify the dollar amount of the gift, the date, and confirmation that the gift isnt a loan and no repayment is expected.

Insured Stated Income Mortgages

If you dont have the cash to make the large down payment required for a stated income mortgage, youll need to pay insurance premiums as the lender is taking a big risk with this loan. If you opt for an insured stated income mortgage, you can make a down payment of as little as 10%, but youll need to have a good credit score. Youll need to opt for a private mortgage default insurer, as CMHC doesnt insure stated income mortgages.

Sagen Business for Self

Formally known as Genworth Canada, Sagens program allows self-employed Canadians to get a mortgage without income verification. Keep in mind youll still need to verify the history and operation of your business and prove its been operating for a least 2 years. The program is only available for owner-occupied properties so you can have owner-occupied rental properties up to two units with one being occupied by the owner. It doesnt apply for vacation rentals, other rental properties and second homes.

If you have a previous bankruptcy or work as a self-employed commission salesperson, you dont qualify for this program.

A Lenders

A lenders will offer fixed and variable rate mortgages and each will have their own minimum down payment, maximum loan requirements. If you plan to explore the options offered through these lenders as a self-employed individual, youll need to have your Notice of Assessment for 2 3 years prior, financial statements and articles of incorporation .

B Lenders

Private Lenders

Read Also: How Long After Getting A Mortgage Can You Refinance

Can I Get A Mortgage On Unemployment

Bad news first. If you were recently laid off you cant count unemployment benefits as income for a mortgage application.

But dont give up on your home buying plans just yet.

Its possible to buy a house or refinance very soon after returning to work or even before you start a new job if you have a strong offer letter.

If you keep your finances in order while unemployed, this brief period out of work shouldnt stop you from buying a house or refinancing once youre back on your feet.

Be Careful With Making Cash Deposits Before And During Verification

As mentioned above, cash needs to have been deposited in your account a while before your mortgage application process begins in order to demonstrate your ability to save money. However, those cash deposits also need to be verifiable for them to be taken into consideration by the lender as part of your assets.

While youre preparing to apply for a mortgage, it might be wise to shift away from some of your cash-centered money habits and place greater focus on contributing to the assets that can be accounted for as part of your mortgage application. Only withdraw cash as needed, deposit checks directly into your bank account rather than cashing them and make it a priority to present yourself as the most financially stable and responsible applicant possible.

Read Also: Why Do You Need Mortgage Insurance

Va Income Verification Guidelines

The lender must first determine what a VA loan applicants verifiable income is. This means that the income used in calculating your debt ratio must meet VA criteria for being stable and likely to continue.

That means that some income may not qualify and those earnings will be left out of the ratio for loan qualification purposes. If you earn non-traditional income such as online retail sales as a self-employed person, for example, those earnings would have to show the lender a pattern of stability over time.

The thing to keep in mind about this? Lender standards vary, and while there are some specific guidelines in the VA Lenders Handbook , there are also variables that may affect your transaction. The main thing to remember about verifiable income is that the lender must be able to determine your income is dependable and likely to continue.

Some kinds of income count, but only after you have earned for a specified amount of time. If you have not earned commission income for 24 straight months, for example, the commissions may not count toward your DTI ratio. If you have been self-employed for less than two years, that may also apply to those earnings, too.

The VA Home Loan offers $0 Down with no PMI. Find out if youre eligible for this powerful home buying benefit. Prequalify today!

Types Of Lenders That Offer Self

There are multiple types of lenders that will offer self-employed mortgages but its important to note that not all offerings will be the same across the board. A lenders are very strict with their mortgage qualifications so while they may offer some self-employed mortgage products, theyll likely be a lot more strict with their applications and requirements than, say, a B lender or a private lender. Before you choose a lender, take a look at the options below and make a list of things that are important to you as a borrower. Whether its flexibility, a lower down payment requirement or access to better rates, this list will help you choose a lender thats best suited to your needs in the short- and long-term.

Read Also: Can You Add Money To Mortgage For Improvements

How Many Years Of Income Do You Need For A Mortgage

As a rule of thumb, mortgage lenders will typically verify your employment and income for the last two years. An ideal scenario is when the borrower has at least two years of steady / consecutive income. But there are also certain scenarios where an exception can be made.

For instance, if the borrower only has a small gap in employment, but has been steadily employed for years aside from that one gap, the loan could still clear underwriting. This is the exact situation you are in.

Another example is where there are compensating factors to make up for the red flag of interrupted employment. For example, a borrower with excellent credit and a long history of making mortgage payments on time might be given a pass on this general rule for employment and income.

Are You Eligible For A Government

There are a number of no-income-verification mortgage programs for borrowers to refinance their government-backed mortgages. As long as youve paid on time over the past year and have a loan backed by the Federal Housing Administration , U.S. Department of Veterans Affairs or the U.S. Department of Agriculture , you may be eligible for one of the reduced-document refinance loans listed below. An added bonus of these programs: You wont need a home appraisal.

- FHA streamline. Homeowners with an FHA loan can reduce their interest rate or get better terms without any income documents through the FHA streamline refinance program. One drawback, however, is that closing costs cant be rolled into the loan amount unless you agree to a higher interest rate.

- VA IRRRL. Military borrowers can get a lower mortgage rate with the VAs interest rate reduction refinance loan without providing earnings paperwork. The loan amount can be increased to cover closing costs.

- USDA streamlined assist-refinance loan. If you bought your rural home with a no-down-payment USDA loan, you can reduce your rate with the USDA streamlined-assist refinance option. No income docs are needed, and you can add the closing costs to your loan amount.

You May Like: How To Get The Best Interest Rate On A Mortgage

Fha Loans: What Type Of Income Is Verifiable

December 30, 2014 by Justin McHood

Every loan has requirements in terms of income. For FHA loans, it is not about the amount of income that you make, but more so about the debt-to-income ratio that you will have if you were to obtain the new loan. In addition, there is great focus on the reliability of your income and the likelihood that it will continue for the foreseeable future. All of these factors play a role in determining the risk level of providing you with a new FHA loan.

How To Secure A Non

What are non qualifying mortgages? Theyre a non-traditional method of lending, which means if youre interested in securing such a loan, youll need to look at non-traditional providers.

There are also mortgage lenders who specialize in offering loans to borrowers with poor credit. Youll likely pay higher interest rates, but you will be one step closer to getting into your own home.

You May Like: Can Non Permanent Resident Get Mortgage

What Are The Requirements To Get A Second Mortgage With Bad Credit

Getting a second mortgage with bad credit is not a simple process. Even ifyou have equity built up in your home, lenders may deny you financing based on your credit history. Fortunately, there are a few simplesteps you can take to improve your chances of being approved even if you have black marks on your credit report. In fact, getting a secondmortgage can even improve your credit rating. Below, we’ll look at the requirements for second mortgages and what you can do to make yourapplication as attractive as possible to lenders.

What Va Loan Rules Say About Your Debt Ratio

VA Pamphlet 26-7 advises your participating VA lender that the DTI calculation should not automatically trigger approval or rejection of a loan. Your lender is instructed to consider the DTI associated with all other credit factors. That means that even if your DTI is considered high, you may not automatically be out of options for VA mortgage or refinance loan approval.

Read Also: Does Rocket Mortgage Affect Your Credit Score

Proof Of Income For The Self

Tax returns are the main form of income verification for the self-employed, though you may also be required to file a profit-and-loss statement for your business. Once again, they’ll want to see at least a two-year history in the business, with stable or rising income.

They’ll take your average income over the past two years, so total that and divide by 24 to get your monthly income for mortgage qualification purposes. Keep in mind, though, that any business deductions you take on your federal tax return lowers your income for purposes of obtaining a mortgage – which often limits self-employed people to a smaller mortgage that they might like and still comfortably afford.

One way around this is to seek a stated income mortgage through a private lender, rather than a more conventional mortgage backed by an entity like the FHA, Fannie Mae or Freddie Mac. Stated income loans are much harder to find than they were during the housing bubble of the early 2000s, but some specialty lenders still offer them. You’ll pay a premium rate and will need excellent credit and substantial financial assets to qualify, but it is an option for obtaining a larger mortgage when you’re self-employed.

Reduced Documentation For Investment Property Loans

Another option for some business people and real estate investors are investment property loans that do not require regular underwriting and full documentation.

To qualify for these types of loans, the lender looks at the value of the property after repairs are made and what its potential rent income will be. It will use these factors to decide if you should get the loan.

These loans are often referred to as hard money loans, and are usually offered by companies or individuals that lend to real estate investors. Most investors use these limited documentation loans for fix and flip properties. These loans carry high interest and are offered to investors based upon the value of the property.

Also Check: Could I Qualify For A Mortgage

How Much Mortgage Can I Afford With Rental Income

To work this out, most lenders will average these figures against a typical period of two or three years and feed them into their rental income mortgage calculator to reach an average figure on which to base affordability. A small number of lenders may use the most recent 12 months figures .

This total will then either be taken in its entirety as 100%, or treated as a second income and a percentage of the earnings will be used to calculate loan amounts .

What Can Be Used As Proof Of Income

Depending on the lender, different documents are considered more authoritative than others. For example, some may accept a pay stub while others may need a combination of a pay stub and a copy of last years federal tax return. Weve listed below what documents you may need to show proof of income. This isnt an exhaustive list, but it gives you an idea of what documents you can use, where you can get these items, and why some documents may work better than others.Most of these documents should include:

- Your full name

Don’t Miss: What To Watch For When Refinancing Mortgage

Common Proof Of Income Documents

From Your Employer

Documents from your employer can give the most up-to-date picture of your income since it takes into account any changes in your wages from the past year.

- Pay Stubs. Some lenders may require your pay stub to have your pay period and pay frequency listed to verify your income. Provide your most recent pay stub as proof of income to give a more up-to-date representation of your income.

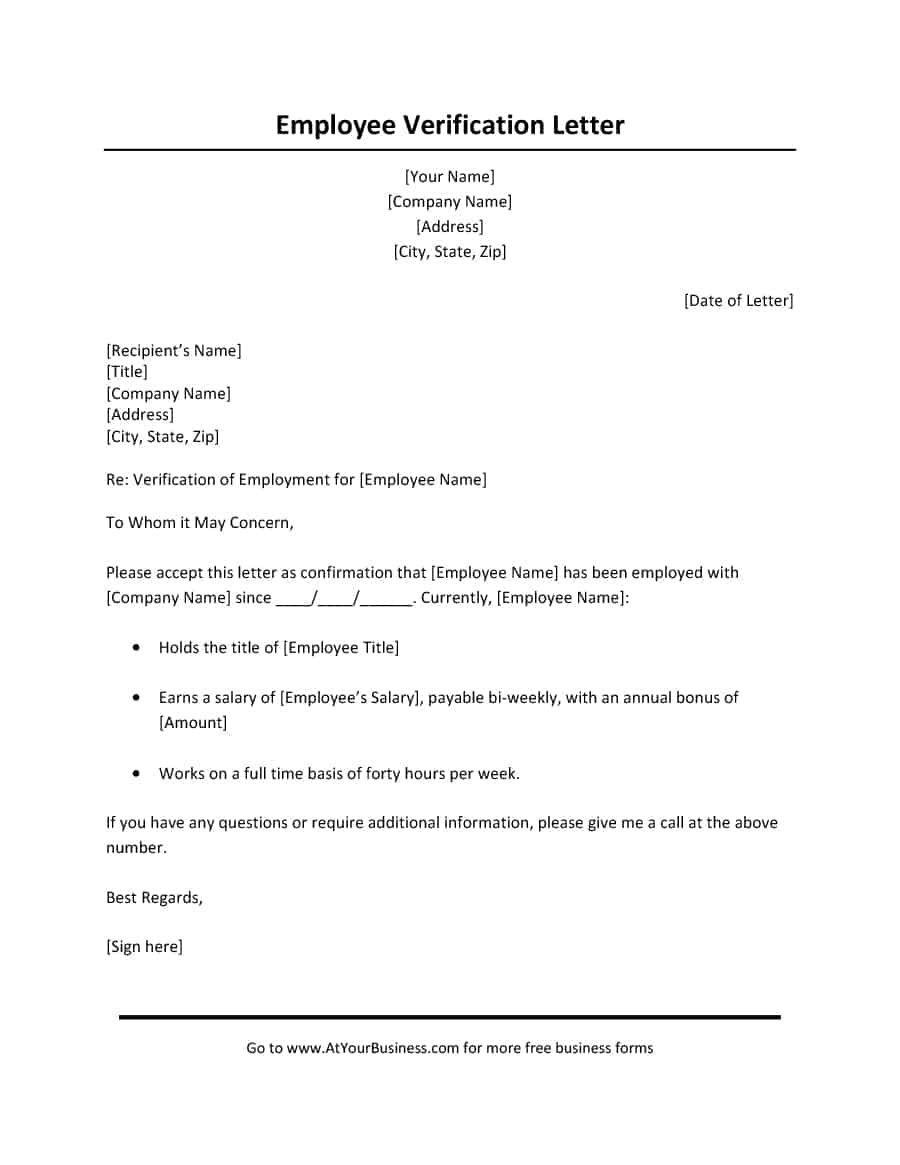

- Proof of Income Letter. This can act as as both a verification of income and a light letter of recommendation depending on your relationship with your employer.

Tax Documents

Copies of your most recent tax documents are sometimes considered the most reliable sources since these are legal documents. However, these documents may be a difficult to retrieve if you dont keep copies readily available after tax season ends.

These documents are also not as accurate as a recent pay stub since taxes are only filed once a year. Any raises or additional income received since the last tax season are not reflected here, so additional documents like pay stubs or bank statements may help paint a more precise picture.

Unearned Income

A handful of documents that fall under this category are government issued. These are also reliable documents for lenders, but you should not solely rely on these streams of income as proof since these avenues sometimes are not always consistent. For example, unemployment benefits and workers compensation eventually end.

Whats A Reverse Mortgage

A reverse mortgage is exactly what it sounds like a mortgage that works in reverse by allowing you, the homeowner, to access the equity you have built up over the years. You will receive cash from the lender in exchange for a portion of your equity on the home. Your home equity is whatever the value of your home is, minus what remains to be paid off from your mortgage. You can choose to receive a lump sum payment , scheduled payments similar to a regular income, or a combination of the two approaches.

You May Like: How Much Is A 180k Mortgage Per Month