Where To Find Down Payment Assistance Programs In Your Area

The best place to start is usually your lender. When shopping for home loans, be sure to ask if you might qualify for any down payment assistance programs.

Also, you can review the US Department of Housing and Urban Developments Local Homebuying Programs page for your state to see what programs are available. Another good place to find links to local resources is FHAs Down Payment Grants page.

Choose Your Mortgage Lender Wisely

If your score falls below 600, youre going to have a very difficult time getting approved through Canadas major banks. So instead, youll more than likely want to work with an alternative lender. These lenders are definitely more lenient, but youll likely have to make a higher down payment and deal with higher interest rates, so approach with caution.

Mortgage Options For Low Credit Scores

Depending on the private mortgage lender, no minimum credit score for a mortgage may be required. Instead, private lenders look more heavily towards the amount of equity that you have in your home. Private lenders do have higher mortgage rates than traditional lenders and are generally a last-resort option for temporary financing. Building up your credit score in the meantime, such as making on-time payments on a, can help you qualify for lower interest rate mortgages at traditional lenders in the future.Mortgage brokerscan also help you to find a suitable mortgage lender that is right for you.

If you are over 55 years old,reverse mortgages can be an option if you need extra cash today. Reverse mortgages, from Equitable Bank or CHIP, do not have any minimum credit score requirements. Instead, there is a minimum home value requirement. Interest rates are also higher.

Recommended Reading: Can I Refinance My Reverse Mortgage

What Numbers Do Mortgage Lenders Look At

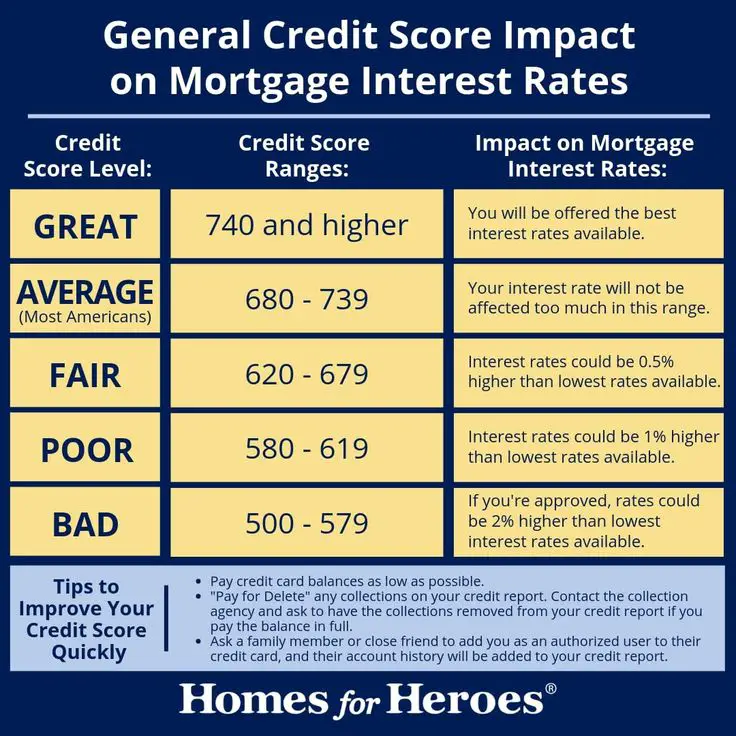

Lenders use credit scores to determine a borrower’s level of risk.

Three credit bureaus Equifax, Experian, and TransUnion calculate an individual’s credit score. The higher your credit score, the better interest rate you’re likely to get which also means you’ll have a lower monthly mortgage payment. Before you apply for a mortgage, it’s a good idea to check your credit score and review your credit report to make sure everything is correct.

Where Does My Credit Score Come From

Your credit score is a numerical value that sums up the information on your credit reports.

The higher your credit score, the more likely you are to make payments. Thats why lenders reward borrowers with good credit scores by approving them for larger loan amounts and lower interest rates.

Your payment history is the single biggest factor in determining your credit score.

This is why first-time home buyers rarely have credit scores that are excellent. Theres just not enough history of managing credit and making payments to make that kind of determination.

Read Also: How Much Conventional Mortgage Can I Afford

Who May Not Qualify

Generally speaking, those who are just starting out in life, those with a little more debt than normal, and those with a modest credit rating often have trouble qualifying for conventional loans. More specifically, these mortgages would be tough for those who have:

- Suffered bankruptcy or foreclosure within the past seven years

- Less than 20% or even 10% of the homeâs purchase price for a down payment

However, if youâre turned down for the mortgage, be sure to ask for the bankâs reasons in writing. You may qualify for other programs that could help you get approved for a mortgage.

For example, if you have no credit history and youâre a first-time homebuyer, you may qualify for an FHA loan. FHA loans are loans that are specifically tailored for first-time home buyers. As a result, FHA loans have different qualifications and credit requirements, including a lower downpayment.

Donât Miss: How Much Usda Mortgage Can I Qualify For

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history and help lenders assess your financial health.

Home buyers with lower credit scores are typically assigned a higher interest rate.

There is no way to get around a credit check. It is one of the things you need to buy a home during the mortgage pre-approval stage so be sure to learn more about how a mortgage pre-approval affects your credit score.

Get pre-approved for a mortgage today.

You May Like: How To Calculate Percentage Of Mortgage

First Lets Talk About Credit Scores

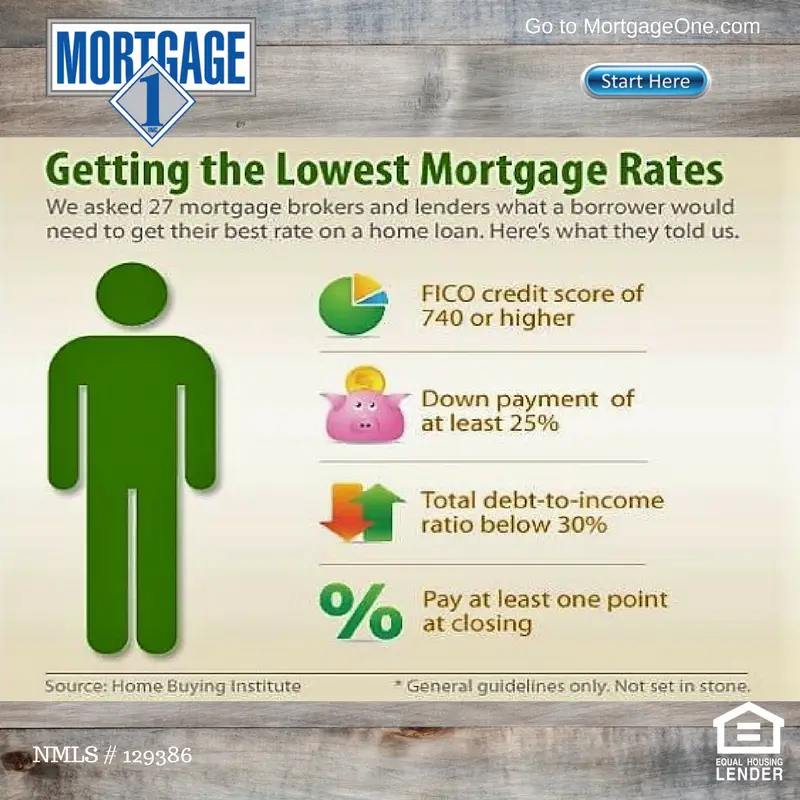

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you donât need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youâre likely to pay your future bills â like your mortgage, for example.

Your Credit Report Should Reflect A Good Diversity Of Credit Products

When youre successfully managing a credit card, a line of credit and a loan, potential mortgage lenders are going to see someone who will be capable of handling one more payment every month. If all you have is one credit card, even if youve managed it well and kept it in good standing, your credit report is not going to look as good as it could. Lenders may still wonder what sort of risk you pose as a borrower – will you be able to handle multiple credit products or is one your limit? There is no way of them knowing. If you have poor credit, there are still ways to go about diversifying your credit products. Look into secured cards, secured lines of credit and credit building programs. for more info on those.

Also Check: How To Get Mortgage To Build A House

Can I Buy A House With A 670 Fico Score

If your credit score is a 670 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. There are many mortgage lenders that offer loan programs to borrowers with credit scores in the 500s.

Good Credit Score Home Loans

Once your credit score climbs into the 700 to 749 range, youre in the good credit score range for a home loan. Qualifying will usually be easier and loans will most likely be less expensive. All types of mortgages are available once you have good credit:

- Conventional loan: A conventional mortgage becomes easier to get with good credit, even if youre carrying a lot of debt relative to your income. Instead of needing a debt-to-income ratio of 36% or less, you might get approved with a ratio as high as 45%. That means your existing monthly obligations and proposed mortgage payment must total no more than 45% of your gross income. If youre putting down less than 20% on a conventional mortgage, a good credit score will reduce your PMI premiums.

- Jumbo loan: If your income is high enough, jumbo loans become accessible with a credit score of 700 or higher.

- FHA loan: These loans become less advantageous as your credit score increases because youre more likely to qualify for a less expensive conventional loan.

- VA loan: Veterans Administration loans are still a great option for those who qualify. The average VA borrower in June 2020 had a credit score of 733 if they were refinancing and 720 if they were buying, according to Ellie Mae.

Learn More: Mortgage Qualifications: How to Qualify for a Mortgage

Recommended Reading: How Does Reverse Mortgage Work After Death

Whats The Minimum Credit Score For A Conventional Loan

The minimum credit score for a conventional loan is typically 620. Lenders will look at your scores from the Big Three credit bureaus: Experian, TransUnion, and Equifax. Theyll use your middle credit score to qualify you for the loan.

So if your scores look like this:

| Equifax | 700 |

Your lender will use the Equifax score of 700 for your application because it falls in the middle of your credit score range.

If you apply with a co-borrower, they will look at their three scores as well. But they will take whichever middle score is lowest to determine your loan eligibility.

Lets assume both of your scores are as follows:

You: 720, 680, 700

Co-borrower: 700, 680, 640

Your middle score is 700, and theirs is 680. The lender will use 680 as the qualifying score, since it is the lowest of the two middle scores.

Read Also: What Information Do You Need To Prequalify For A Mortgage

Down Payment And Closing Costs

It should come as no surprise that to buy a home, you need to have enough funds available to cover the down payment and closing costs However, you can’t just get these funds from any old source. Your lender will need to confirm that the down payment isn’t from borrowed funds and that you’ve had the money in your possession for at least 30 days.

Exceptions can be made, but don’t plan to use the income tax refund you expect to arrive in a couple of weeks to qualify for a mortgage you’re applying for tomorrow. Here is a list of acceptable sources of down payment.

Acceptable down payment sources

- Other investments

You May Like: What Are Second Mortgage Rates

Down Payments In Canada

You need a down payment to buy a home in Canada. A down payment is the amount of money that you pay up front to reduce the amount of money you must borrow through a mortgage loan.

The amount of down payment you need depends on the home’s purchase price:

Less than $500,000

Down payment required: 5% If you have a down payment of less than 20%, you can still get a mortgage but you’ll need to pay for mortgage default insurance.*

$500,000 to $999,999

5% on the first $500,000 10% of the amount over $500,000*

More than $1 million

Down payment required: 20%

Mortgage lenders will either bill you directly for default insurance or add the cost onto your mortgage balance.

Loan Programs That Allow For Mortgage Approval With No Credit Score

In addition to the loan application methods mentioned above, there are also specific mortgage loan programs that cater to low and even no credit score applicants. Some of these are government programs, which insure the loan for the lender and make it easier for them to approve borrowers with added risk factors .

There are four primary types of mortgage loans, each with their own minimum credit score requirements.

Conventional: Conventional mortgage lenders can set their own minimum credit score thresholds, so there is no industry standard. Manually-underwritten loans through Fannie Mae have a minimum score requirement of 620, for example, but exceptions are made for borrowers with no credit score at all.

FHA: In order to qualify for an FHA-insured mortgage loan, youll need to have a minimum credit score of 500. Higher credit scores can qualify you for lower down payment requirements, as well.

VA: A VA mortgage loan is available to eligible active-duty, veteran and reserve military members, as well as certain surviving spouses. This program has no minimum credit score requirement, but instead requires lenders to consider the applicants entire credit history and profile before making a decision.

Conventional loan programs will also not allow you to buy a second home or investment property if you dont have a credit score. FHA, VA and USDA loans are only allowed on primary residences, so you wouldnt choose those programs to purchase anything but a home you will live in.

Also Check: Can You Cancel A Reverse Mortgage

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Building Credit: A Timeline

At a minimum, you need to open at least one credit card in your name. From there, you just need to make a purchase using the card, and then make a payment. Once youve made your payment, your creditor will report your payment to one or more of the major credit bureaus .

Typically, it takes at least three to six months of activity before a credit score can be calculated, says Tracy East, director of communication at Consumer Education Services in Raleigh, NC.

Once youve established credit, you still have some work to do. Credit histories are scored based on performance, much like the grades you got in school. Healthy credit behaviorlike on-time payments and staying well below your credit limitlead to a higher .

Whats more, there are two types of scores: VantageScores and FICO scores. Some mortgage lenders may look at a VantageScore, but FHA lenders are required to use FICO scores.

After opening their first credit account and beginning to make timely payments, it will take at least three months for the person to generate a VantageScore, and six months to have enough information to create a FICO score, says , compliance manager and director of education at Cambridge Credit Counseling of Agawam, MA.

Also Check: Which Way Are Mortgage Rates Headed

Higher Credit Score Requirements

You typically need of at least 620 to qualify for a conforming conventional loan. In contrast, you can qualify for an FHA loan with a credit score as low as 500.

Also, USDA loans have a minimum score of 580, though itâs possible to go lower if the new loan significantly reduces your housing costs, your credit circumstances are temporary and beyond your control, or the new loan provides a benefit to the government.

Recommended Reading: What Is The Payoff On My Mortgage

Whats Considered A Good Credit Score In Canada

range from around 300 which is the lowest credit score to 900 , the highest credit score, and the best credit score to buy a house in Canada. Any score between 660 and 724 is regarded as good because it indicates to lenders that you are not likely to default on your mortgage.

What is a good credit score to buy a house? If you have a 700 credit score in Canada, you would get a pretty good rate. Between 725 and 759 is considered very good while any credit scores 760 and above are regarded as an excellent credit score to get a mortgage.

Lender requirements may differ, but generally, a higher credit score allows you access better rates.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

What Can Impact The Minimum Credit Score Required For A Home Loan

It should also be noted that the credit score required to get approved for a mortgage in 2023 also depends on several other factors associated with the borrower. For example, a borrower with a high income and low debt amount might be able to get away with a slightly lower credit score than a borrower with a lower income and lots of debt.

Similarly, the loan amount required and the amortization period requested will also play a role in the credit score required for mortgage approval. For instance, a higher loan amount would be considered a riskier endeavour for lenders, who may, in turn, require a higher credit score.

Borrowers will also have to undergo a stress test during the mortgage approval process. In order for applicants to qualify for a home loan in Canada, they will have to prove to their lender that theyre capable of affording their mortgage payments into the future if interest rates rise.

Staying Within Your Budget

To qualify for a mortgage, you have to prove to your lender that you can afford the amount youre asking for.

Mortgage lenders and mortgage brokers use your financial information to calculate your monthly housing costs and total debt load. They use this information to determine what you can afford.

Lenders and brokers consider information such as:

- the amount youre borrowing

- any other debts

Recommended Reading: How Does Interest Rate On Mortgage Work

Improve Your Credit Score With Borrowell And Credit Karma

Instead of going directly through the credit bureau, you can open an account with Borrowell or Credit Karma. Both companies will email your credit score and credit report to you for free every week. It’s free to sign up, and you can access your credit report within minutes of becoming a member. In my opinion, this is the easiest and cheapest way to stay on top of your credit. Borrowell will send you a copy of your Equifax Canada credit report while Credit Karma has partnered with TransUnion.

These companies make money through affiliate partnerships with various loan and credit card companies. You will receive credit offers based on your credit score. You are under no obligation to apply, and I would exercise extreme caution before doing so. Instead, take advantage of the free credit reporting, as well as the educational resources both companies offer to help you improve your credit score.

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

Recommended Reading: How Does A Conventional Mortgage Work