Getting Qualified And Pre

We are mortgage experts at Gustan Cho Associates. The team at Gustan Cho Associates strives to offer competitive mortgage financing options! We encourage you to check out our reviews as well as our YouTube CHANNEL. Since we do not experience lender overlays, many times we are able to save the day for clients who have been turned down by their current lender. If you have been turned down by your current lender or not getting the customer service necessary, please call Mike Gracz on 630-659-7644.

Can A Loan Origination Fee Be Waived

A loan origination fee may be waived or reduced, and here are a few ways to do it:

- Ask your lender to waive or reduce your fees upfront. Your lender may be willing to do it if you put up a sound argument or if you show that you are prequalified for a loan with smaller fees at a different lender.

- Take a higher interest rate. Your lender may be willing to waive or reduce your fees if you are willing to take a higher interest rate. You may decide it makes more sense to pay the fees instead.

- Ask your seller to cover the fees. Depending on the market, the seller may be willing to cover your loan origination fees. They are more likely to agree in a buyers market meaning there are more houses for sale than there are buyers so the seller may agree to these terms to quickly sell their home.

You May Like: How To Calculate Loan Payments In Excel

Save Money Over The Life Of The Loan

When considering whether mortgage discount points are worthwhile, you need to think about the length of time you plan to live in the house. Generally, the longer you plan to stay in it, the more savings your mortgage discount points will get you. Purchasing points can be a good move if you plan to stay in the house for the long term. You have to keep a mortgage for long enough to make the cost of buying points worthwhile.

Landlords who purchase investment properties may hold on to them for long periods and rent them out to prospective tenants. In this case, mortgage discount points could make a difference. Evernest, APM and Mynd property management in Denver have property managers with plenty of expertise to help homeowners find the right tenants, collect rent and do maintenance. They help to ensure that occupancy rates remain high and cash flow stays consistent.

You May Like: What Happens If I Outlive My Reverse Mortgage

Am I Allowed To Negotiate The Terms And Costs Of My Mortgage At Closing

Yes. You can always negotiate the terms of the mortgage loan up until you sign on the dotted line. However, your lender or the seller can refuse to agree to any changes.

Its usually easier to negotiate the fees charged by your lender than it is to negotiate third-party fees.

You should always ask questions about fees and rates throughout the whole process. You can ask the settlement officer, lender or closing attorney. Ask about anything that you dont understand. This is particularly the case with fees and rates. You should know why you are paying everything you are paying. Make sure you take a list with phone numbers of all of the people involved with your closing in case you have any questions at any time during the closing process.

Here are some tips to think about to help review lender fees:

- Ask for a justification for each lender-charged fee.

- If the lender charges an underwriting fee as well as a processing fee, ask for details of those services. You may find a fee that can be waived or reduced.

- Recognize that some items cant be negotiated. The following items are imposed by governmental authorities:

- City and county stamps

Other items are paid to third parties, and may be more difficult to negotiate. These are fees the lender has paid for, usually at a set price.

How To Buy Down Mortgage Rates With Buying Discount Points

Investors require an upfront interest payment to offer an interest rate for lower credit score borrowers. These costs can add up and it is important to know your financial obligation before entering into a contract. Our loan officers at Gustan Cho Associates will send you an estimated fee breakdown before you put an offer on a home. You need to make an educated decision when buying a long-term investment such as a home.

Don’t Miss: How Much Per Thousand On A Mortgage

All Origination Charges Are Negotiable

You can often negotiate with your lender when it comes to origination fees. It is the most flexible way mortgage lenders make money, and they will often reduce your fees if you ask them.

The larger your loan, the more likely you are to have some of your origination fees reduced.

You need to educate yourself before negotiating your mortgage origination fees. Taking a homebuyers education course will help you know what fees are legitimate and what fees are junk.

You can even start negotiating the mortgage origination fees before you commit to a lender. Ask them what origination charges you can expect to see on your loan estimate if you use their services, and get their answer in writing.

Speak to your mortgage lender with confidence, and youll be amazed at how quickly theyre willing to waive some of the origination fees to keep you as a customer.

How Does An Origination Fee Work

Origination fees are typically intended to cover a range of miscellaneous lender costs, including the processing of your loan application the cost of underwriting the loan, which involves verifying everything from your income and assets to your job history and preparing your mortgage documentation.

The fee is charged based on a percentage of the loan amount. Typically, this range is anywhere between 0.5% and 1%. For example, on a $200,000 loan, an origination fee of 1% would be $2,000.

One important thing to note is that in the same area where youll see the origination fee, you may also see a charge for mortgage discount points. One prepaid interest point is equal to 1% of the loan amount, but these can be bought in increments down to 0.125%. These points are paid in exchange for a lower interest rate.

The points, together with any origination fee, will be included on the Origination Charges section of your Loan Estimate.

Read Also: Is It A Good Idea To Pay Off Your Mortgage

Identify Your Closing Cost Options With Your Mortgage Type

If you are in a good position to start negotiations on closing costs with the seller, look at how much the seller can legally contribute to lowering your closing costs based on your mortgage program.

* This material is provided for information and educational purposes only.** Programs are subject to change without notice.

How Much Are Closing Costs In Idaho

Congratulations! You are in the final stretch! However, the joy of finalizing the real estate deal brings with it the stress of financial planning. Closing costs in Idaho are a sum of expenses you should plan for when buying or selling a house.

Key Takeaways

- Closing costs or settlement costs are a set of final expenses paid for completing a real estate transaction.

- The seller and the buyer both pay closing costs in Idaho.

- The 3 major Seller Closing Costs in Idaho are:

- 1. REALTOR Fee

- The 3 major Buyer Closing Costs in Idaho are:

- 1. Loan Origination Fee

- 2. Escrow or Impound Account

- 3. Appraisal Fee

CLOSING COST CALCULATOR IDAHO»

Recommended Reading: How To Invest In Second Mortgages

Break Down Your Loan Estimate Form

The lender is required to give you the loan estimate form within three days of completing a mortgage application, but theres nothing keeping them from giving it to you sooner, so ask for it. This form includes an itemized list of costs, including your loan amount, interest rate and monthly payments. On page two it has a section called Services you can shop for, including:

- Pest inspection

- Fees for the title search and the settlement agent, and for the insurance binder

The vendors listed on the form could be your lenders preferred vendors, but youre not required to work with them, and your lender is also required to offer alternatives. You can shop around for lower-priced vendors for different services on your own however, if your independently-selected vendor changes its pricing before closing, youll be on the hook for any increase. If you choose a lender-provided vendor instead, its pricing isnt allowed to change by more than 10 percent from the original quote.

Additionally, if youre buying a home, note that the seller or sellers real estate agent might be the ones who chose the title and escrow provider. If you want to get new vendors in this case, youll need to negotiate the purchase agreement with the seller, not with your mortgage lender.

Are Loan Origination Fees Negotiable

Origination fees and many of the lender-side fees are negotiable, so dont be afraid to ask your lender to reduce yours. Origination fees can be lowered by:

- A simple reduction of the fees by the lender

- The lender giving a credit to offset a portion, or all, of the origination fees

- Taking a higher interest rate to reduce your up-front costs

If you are still left with up-front costs, consider asking the seller to contribute to your closing costs. The odds of receiving seller contributions are market-dependent, so be sure to consult with your real estate agent about this.

Don’t Miss: How Much Mortgage Can I Get With 80k Salary

Continue On Your Home Buying Journey

You now have the tools to become a master negotiator! Your next stop on the Home Buying Journey is completing your mortgage process however, before putting everything youve learned into practice, you should take a moment to consider your options. If you do not have a lender, youll want to read the following chapter to learn how to Compare Lenders.

Home Equity Loan Vs Heloc Closing Costs And Fees

Another option for accessing your equity is a home equity line of credit . Before we get into the way the costs and fees for this work, lets briefly discuss how a HELOC compares to a home equity loan.

You can think of a HELOC as having two separate phases: a draw period and the repayment period. During the draw period, it works much like a credit card. You can draw out up to the amount you are approved for and youre only responsible for the interest payments. You can also pay money back to access it later for another project.

After a number of years at the beginning of the loan, the repayment period starts. At this time, the balance freezes and you can no longer take money out, and you make payments of both principal and interest over the remainder of the term.

With a HELOC, at the beginning of the term, you only have to make interest payments. With a home equity loan, you pay principal and interest from the beginning. One of the advantages to a home equity loan is the availability of fixed rates. HELOCs tend to have variable rates like credit cards, so your monthly payment isnt necessarily consistent, especially if the Federal Reserve is moving interest rates.

Like credit cards, HELOCs tend to have low or no closing costs. However, there are other fees to worry about:

Donât Miss: What Is The Current Prime Mortgage Interest Rate

Read Also: How Much Can I Borrow Mortgage Australia

Can You Negotiate Closing Costs On A Refinance

Refinancing your home loan can provide a number of benefits for your personal finances, including a shorter loan term, access to home equity, a lower interest rate, and potentially getting rid of mortgage insurance.

Even so, the high closing costs of a new mortgage loan can be discouraging for many homeowners.

While most people would like to negotiate lower closing costs, not everyone is sure about the best way to ask their loan officer to waive fees or grant discounts.

Fortunately, negotiating closing costs on a refinance is possible, and borrowers can save hundreds of dollars or more with just a little extra effort.

In this article

How Origination Fees Work

Lenders charge origination fees on loans to cover processing paperwork costs, verifying borrower income and assets, securing underwriting and funding the loan. Some lenders charge separate underwriting and processing fees, which is another way to represent origination fees.

Mortgage origination fees are calculated based on a percentage of the total loan. For example, if your lender charges a 1% origination fee on a $100,000 home loan, the origination fee would be $1,000.

Instead of collecting the fees from the borrower upfront, the costs are added to the loan or recovered by charging a higher interest rate. Some lenders offer loans with no origination fees or no closing costs, but this typically results in a higher amount paid over the life of the loan.

Also Check: How Long Can You Be Pre Approved For A Mortgage

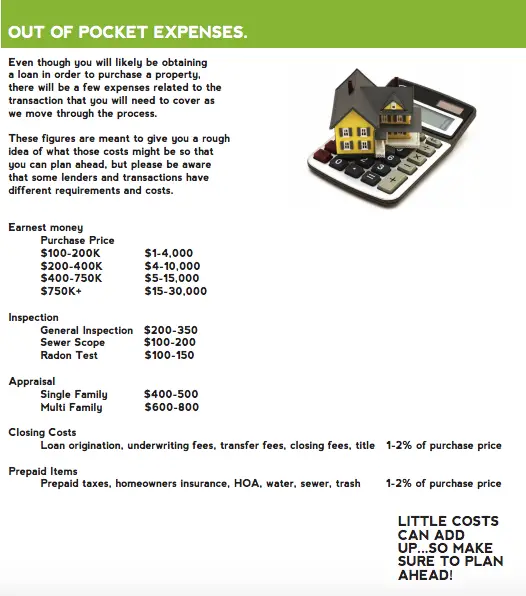

How Much Are Closing Costs

Closing costs vary depending on a number of factors. The most important are:

- The price of your home

- If youre buying or refinancing

Closing costs are charged by the lender and other vendors, and they can add up quickly. As a general rule, you can expect closing costs to cost you about 2 percent to 4 percent of the total home price. In 2021, the national closing costs average on a single-family property purchase was $6,905, including taxes, according to ClosingCorp. For refinancing the same type of property, the national average was $2,375.

Other Fees To Look Out For

When it comes to buying a home, the origination fee is just one of the expenses youll run into. Youll also be bringing money to the closing table for a variety of other fees and purposes.

Other common closing costs include:

- Application and underwriting fees: The application and underwriting fees are paid to the bank for processing your application and underwriting the loan. These fees are a part of the origination charges.

- Appraisal fee: An appraisal is necessary to determine the value of the home and ensure the bank isnt lending more money than the home is worth. As the buyer, youre responsible for paying for the appraisal.

- When you apply for the home, a lender will have to pull your credit report to determine whether you qualify for the mortgage. The credit report fee is a part of your closing costs.

- Title fees: There are several different title costs required with the purchase of the home. These include title insurance and title searches. Youre generally required to buy title insurance for the lender, but title insurance for yourself is optional.

- Taxes and government fees: When you close on your home, you are likely to pay recording fees and transfer taxes to transfer the home into your name.

- Points:Mortgage points are a way for you to buy down your interest rate . Points are entirely optional, but generally allow you to reduce your mortgage rate by a certain percentage usually 0.25% in exchange for a fee often 1% of the loan.

Don’t Miss: What Is Excellent Credit Score For Mortgage

How To Negotiate Closing Costs

Looking to reduce your closing costs? Learn about your options for negotiating, reducing, or eliminating your closing costs entirely!

Closing costs refers to all of the costs it takes to get a mortgage aside from the price of the home itself. Closing costs vary but can include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys, taxes, deed-recording fees, and credit report charges. Aside from those, youve also got prepaid costs that recur over time, such as property taxes and homeowners insurance.

It may seem like a lot, but in general, closing costs can be broken down into four main categories: commissions, loan fees, title charges, and government recording/transfer fees.

Read Also: Is It Easy To Get Loan From Credit Union

How Much Are Home Equity Loan Closing Costs

Home equity loans can be an appealing way to turn your existing home value into cash that you can use to accomplish your financial, homeownership and lifestyle goals, particularly if you dont want to refinance your primary mortgage. But determining whether any loan makes sense is always an arithmetic problem. To solve, you need to make sure you know what all the inputs are.

Today, well discuss the ins and outs of one of those inputs: home equity loan closing costs. Lets start by looking at the scope of what were dealing with.

You May Like: What Is The Trend For Mortgage Interest Rates

Can You Lower Your Closing Costs

Often, the fees youll be charged in conjunction with closing on your mortgage are set in stone, but in some cases, your lender may be willing to negotiate. Your lender is supposed to give you a detailed breakdown of your estimated closing costs well ahead of your closing date, so at that point, youll have an opportunity to familiarize yourself with those fees and see whether your lender will come down on any.

For example, you may manage to get your lender to come down on your loan application fee or waive the points assigned to your mortgage while honoring the rate youve locked in. How do you do that? Speak up and ask.

That said, if you cant manage to lower your closing costs, you still have a couple of options to explore. First, you can see whether your seller is willing to pay some of those costs, thereby easing the burden on you. If youre paying your sellers asking price for your home, he or she may be willing to chip in.

Another option is to roll your closing costs into your mortgage in the form of a higher interest rate on your loan. Doing so means you wont have to come up with so much money upfront, but it will make your mortgage more expensive to pay off on a month-by-month basis.