It Could Impact Your Other Retirement Benefits

A reverse mortgage may not be considered income for tax purposes, but it could impact your ability to qualify for other need-based government programs such as Medicaid or Supplemental Security Income . Itâs a good idea to discuss this with a benefits specialist to make sure your eligibility wonât be compromised.

Cons Of Reverse Mortgages

The biggest drawback of a reverse mortgage is depleting your equity with every monthly payment. If you have no plans for your home for the long run, this may not be a significant concern. If you want to leave your home to your children as an inheritance, then youll be gutting the value of the gift.

When comparing the costs of each tool, reverse mortgages also tend to be more expensive. Since they are non-recourse loans, the FHA requires up-front mortgage insurance premiums of 2% of the total borrowed and an additional 0.5% mortgage insurance premium each year. This 0.5% is based on the amount borrowed. If there is adequate equity for a home being refinanced, then mortgage insurance isnt necessary.

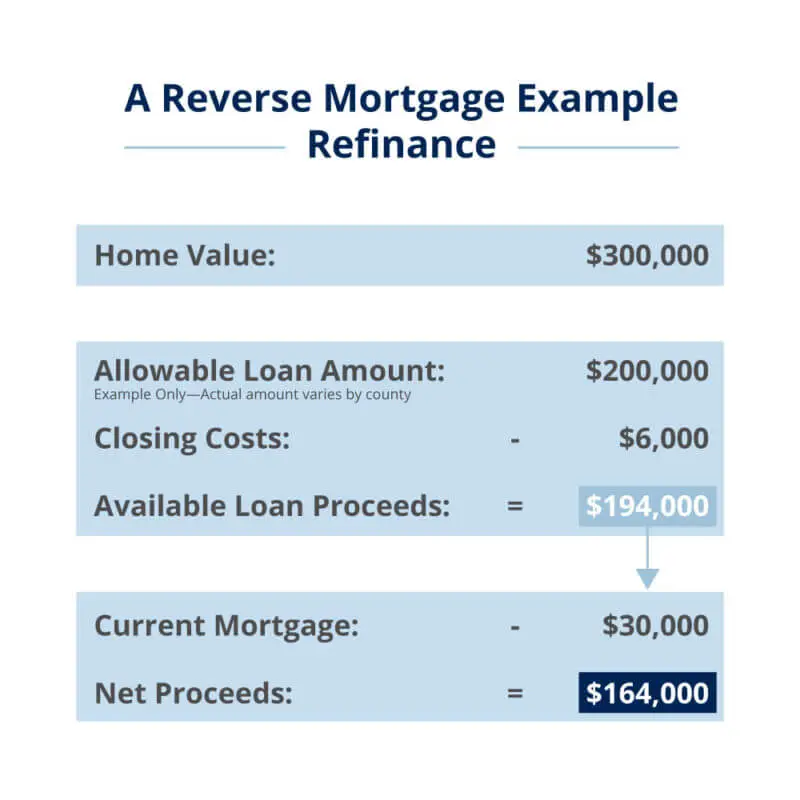

How A Reverse Mortgage Refinance Works

When you refinance a reverse mortgage, youll get a new mortgage that pays off your existing reverse mortgage. Your new mortgage could be a traditional forward mortgage or another reverse mortgage.

- If you refinance into a traditional mortgage: Your new loan will be based on your income, credit score, and interest rate. Youll most likely be doing a cash-out refinance to get the money you need to help fund your retirement.

- If you refinance into a new reverse mortgage: Your new loan amount will be based on your age, home value, and interest rate. Youll also be able to choose how to receive your equity either as equal monthly payments, a line of credit, or a lump sum.

Tip:

See: Home Equity Loan or HELOC vs. Reverse Mortgage: How to Choose

You May Like: How Much Money Can I Be Approved For A Mortgage

Who Can Get A Reverse Mortgage

Reverse mortgages are only available to homeowners who are 62 and older. If youâre 62 but your spouse is 60, you could take out a reverse mortgage but they would not be able to be on the loan.

To ensure they could stay in the home if you pass away or move into assisted living, you have two options: you can name them as a non-borrowing spouse when you take out the loan, or you can refinance to add them to the mortgage when they turn 62.

In addition to the age requirement, homeowners must have significant equity in their homes â typically 50% or more, though lenders may be able to approve you with less, depending on the circumstances.

The home must be your primary residence to qualify for a reverse mortgage, meaning it is where you live most of the year.

Finally, the home must be a qualifying property type:

- Single-family home

Learn more: Why a Reverse Mortgage Loan Should Be in Your Retirement Plan

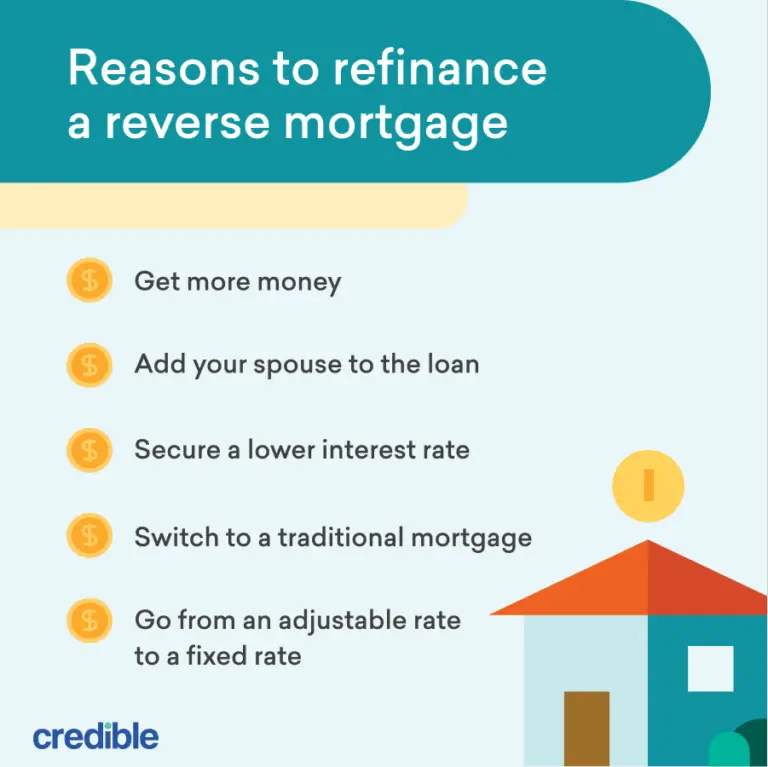

Switch From Variable Interest To Fixed Interest Rate

If the existing reverse mortgage was a variable interest rate reverse mortgage, refinancing with a fixed interest rate for the new reverse mortgage may make sense. This allows you to maintain lower monthly payments when the variable rates are lower, but when they rise you wont be affected by the monthly increase in your loan balance. Refinancing a reverse mortgage with a fixed rate will give your more control over your money.

Don’t Miss: When To Apply For Mortgage Pre Approval

Reasons For Refinancing A Reverse Mortgage

Refinancing any loan can take time and there are certain costs to factor in, so its important to be sure that its worth it before getting started. There are a number of situations where refinancing a reverse mortgage could make sense financially.

For instance, you might consider refinancing a reverse mortgage if:

You Want To Switch To A Different Reverse Mortgage Type

There are three types of reverse mortgages. Borrowers who have a change of needs may want to refinance a reverse mortgage to move to a different loan type.

- Single-purpose reverse mortgages: These loans are available through some state and local government agencies or nonprofit organizations. They are usually for smaller amounts and may only be used for specific purposes, for example, home improvement or property taxes.

- Proprietary reverse mortgages: Some private lenders offer reverse mortgages that the government does not guarantee. Often, these reverse mortgages enable homeowners to borrow above FHA limits.

- Home Equity Conversion Mortgages : These reverse mortgages are insured by FHA and are subject to established loan limits.

Recommended Reading: How To Start A Mortgage Lending Business

You Could Lose Your Home To Foreclosure

In order to qualify for a reverse mortgage, you have to be able to afford your property taxes, homeowners insurance, HOA fees and other costs associated with owning your home. Youâre also required to live inside the home as your principal residence for most of the year.

If at any point during the loan period you become delinquent on these expenses, or spend the majority of the year living outside the property, you could default on the reverse mortgage and lose your home to foreclosure.

Can You Refinance A Reverse Mortgage

Yeseither into a new reverse mortgage or a traditional mortgage

Many homeowners refinance their traditional mortgages to obtain more favorable terms as they pay down their home loans. However, its also possible to refinance a reverse mortgagea loan that lets older adults tap into their home equity without selling or making monthly payments.

Heres how a reverse mortgage refinance works, and when it might make financial sense to refinance one.

Read Also: How Long Are Adjustable Rate Mortgages

Pros And Cons Of Reverse Mortgages

They are a steady stream of income that lasts for years. You can convert the equity in your home into a pile of cash without having to move out.

The money is tax free. Rather than income earned, a reverse mortgage is considered a loan so the IRS cant get its sticky fingers on it. And a reverse mortgage will not affect your Social Security or Medicare payments.

As for the cons, failing to keep up with the monthly fees has cost a lot of people their homes. Of course, if they didnt pay those bills theyd also face foreclosure with a traditional loan.

The difference is that with traditional loan, the debt decreases every month. Since there are no mortgage payments with a reverse mortgage, the loan balance increases every month.

Between the interest and other costs, the debt may eventually exceed the homes market value. If you want your children to inherit the house, they could be stuck with a steep bill.

The good news is you or your estate will never have to pay a lender more than the market value of the house. The bad news is Uncle Sam got tired of paying the difference.

Since 2009, reverse-mortgage losses have cost the Federal Housing Administration reserve fund $12 billion. Thats the same fund that insures low-income newcomers to the housing market.

The average reverse mortgage borrower drew 64% of their equity under the old rules. That will drop to 58%, according to the Wall Street Journal.

Sell Your Home And Downsize

You could sell your home and move to a smaller property if you need more money. Downsizing could also allow you to move to a space where you dont have to worry about maintenance, and you might be able to lower your utility bills as well.

Just remember that if you sell a home with a reverse mortgage, youll need to repay the loan balance before you see any profit from the sale of your home.

You May Like: Does Down Payment Affect Mortgage Rate

What Happens If I Need To Move Out Of My House For Medical Reasons

Reverse mortgage borrowers are allowed to temporarily leave their house for up to 12 consecutive months, for medical reasons. After this period of time, the borrower must return to the home and live in it as their primary residence, or the loan becomes due. The borrower could refinance, pay off the loan, or sell to pay off the mortgage balance .

What Are The Pros And Cons Of A Reverse Mortgage Refinance

A reverse mortgage refinance can allow you to access more home equity and lower interest rates, as well as set up new payment options. You could also add a new co-borrower to the loan, such as a spouse or partner. On the other hand, refinancing involves fees that can eat into home equity faster and make it hard to pay back the loan.

You May Like: What Are Adjustable Rate Mortgages Based On

Ways To Get Out Of A Reverse Mortgage

Before getting into a reverse mortgage, make sure you understand how the loan works, the pros and cons of getting a reverse mortgage and what your financial responsibilities will be including paying for closing costs, paying insurance and property taxes and paying back the loan. Youll also want to make sure that you know what alternatives you have. Reverse mortgage counseling will cover all of these things, which is why its required for the HECM.

If, after all of this careful consideration, you get a reverse mortgage and find that you no longer want the loan, here are five common ways to get out.

If You Need More Cash To Fund Your Retirement Refinancing Your Reverse Mortgage Could Be A Good Option

Refinancing a reverse mortgage is much like a regular refinance, but it can have major drawbacks, so youll want to make sure its the right fit for you.

If youre 62 or older, you may be able to access the equity in your home with a reverse mortgage. While you dont have to repay a reverse mortgage, a time may come when you or your beneficiaries might want to refinance the loan.

If you decide to refinance into a traditional home loan, be sure to shop around for a great mortgage rate. Credible can help with this. You can compare mortgage refinancing options from multiple lenders in minutes.

Recommended Reading: What Is A Jumbo Mortgage Loan Amount

How Do I Refinance My Reverse Mortgage

If you have qualified for a reverse mortgage in the past,you should find the qualifying criteria similar for a refinance of your reversemortgage.

You must:

- Use the home as yourprimary residence.

- Have sufficient equityin your home.

- Demonstrate thefinancial stability to meet the loans ongoing obligations, such as homemaintenance costs, property taxes, homeowners insurance, and homeowners associationfees, if applicable.

Reasonsfor Refinancing

Just because you can refinance, however, doesnt mean youshould. There should be a clear benefit to refinancing. That said, here arethree reasons why refinancing could make sense the first two have to do withputting more money in your pocket the third, with your peace of mind.

1. Your home hasappreciated. Aside from your age and the current interest rate, your homesvalue is a crucial factor in determining your loan amount . Areverse mortgage loan is a tool for converting home equity into tax-free cash,so if your equity has increased, you likelywill be able to pull out more money by refinancing into a new reverse mortgageloan.

Something to keep in mind: For 2022, the home value limit on a government-insured reverse mortgage is $970,800. If your homes value exceeded this limit .

FAQs

Can I refinance myreverse mortgage?

Yes, it is possible to refinance a reverse mortgage loan.Like a traditional mortgage refinance, you will replace your existing loanterms with new terms.

Cant I just add myspouse to my reverse mortgage?

More About Reverse Mortgages

Q: What is a reverse mortgage?

A: A reverse mortgage is a special type of loan that allows you to borrow against the equity that youâve built up in your home. You must be at least age 62 to qualify. You can put the money toward anything you like, from paying medical bills to making home improvements. Unlike a traditional home equity loan, a reverse mortgage doesnât need to be paid back immediately, perhaps not even during your lifetime. That means no monthly checks to write to your lender. The HECM reverse mortgage program is run by the Federal Housing Administration .

Q: Can anyone apply for a reverse mortgage?

A: No, you have to be at least 62. You also have to own your home outright or be able to pay off your home with the proceeds from a reverse mortgage. You must live in your home and your home must meet certain criteria according to HUD. Most single-family homes qualify, as do some condominiums, manufactured homes and multiunit structures that meet FHA requirements.

Q: How do I apply for a reverse mortgage?

Next:With a reverse mortgage, do I still own my home? > >

Q:If I take out a reverse mortgage, does the bank own my home?

A:No, the title remains with the borrower. When your home is sold, you or your estate will need to repay the lender any cash you received from the reverse mortgage, plus interest and other fees. Any remaining equity in the home belongs to you or your heirs.

Q: When do I have to pay back a reverse mortgage?

You May Like: What Not To Tell Mortgage Lender

Who Pays My Property Insurance And Taxes After I Get A Reverse Mortgage

As the homeowner, you will still be responsible for maintaining your property insurance and taxes. This may be different than a traditional mortgage you have had in the past, for which property insurance and taxes are often included in the monthly payment and are remitted by your servicer. However, based on the results of a financial fitness test, you may be required to have a set-aside account containing proceeds from your reverse mortgage that have been set aside for payment of your property insurance and taxes. If this is the case, you should be notified by your lender and your lender would be responsible for ensuring that timely payments are made toward your property insurance and taxes.

How A Reverse Mortgage Works

As opposed to a traditional mortgage, a reverse mortgage pays you by using the equity that youve accrued over years of mortgage payments. Money can be received in a lump sum, a line of credit, or monthly payments. These mortgages are available only to seniors over the age of 62 who have significant equity availablegenerally around 50%.

There are three types of reverse mortgages: home equity conversion mortgages , which are insured by the Federal Housing Administration proprietary reverse mortgages, offered by private lenders and single-purpose reverse mortgages, which are typically offered by state and local governments and nonprofits.

Also Check: What Do I Need To Get A Mortgage

How Refinancing Can Protect A Non

Couples often removed a younger spouse from title prior to 2015 to close a reverse mortgage when one of the two spouses were not yet 62 years of age. The loans borrowers closed with younger borrowers prior to 2015 must be repaid when the older spouse passes or is no longer living in the property.

By refinancing these loans with todays HUD guidelines, younger spouses would not have to refinance the loan or be forced to move when the older spouse passes if they do not have the means to refinance.

Even if that younger spouse is still under 62 years old, the couple can refinance the loan if they qualify under the current HUD program parameters using the eligible non-borrowing spouse designation.

As an eligible non-borrowing spouse, the younger spouse may remain on title and can also stay in the home for life under the terms of the existing loan without having to make a mortgage payment even if the older spouse should predecease the younger spouse.

Borrowers looking to refinance with the sole motivation of a lower interest rate may be disappointed but for some borrowers with high exiting rates, mortgage insurance renewals and servicing fees, there may be a good opportunity at this time.

In addition to possibly receiving more cash, you may be able to get a lower rate, possibly a lower margin and maybe even eliminate a fee such as a servicing fee which lowers the interest that you accrue over time.

What You Need To Qualify For A Reverse Mortgage

A reverse mortgage is a loan taken out against the value of your home. If you are 62 years old or older and have considerable home equity, you can borrow against the value of your home and receive funds as a lump sum, fixed monthly payment, or line of credit. Unlike a forward mortgagethe type used to buy a homeyou wont make any payments to your lender. Instead, the entire loan balance becomes due and payable when the borrower dies, moves away permanently, or sells the home.

A reverse mortgage is one way of accessing the equity youve built up in your home during retirement. Other options include a cash-out refinance or a home equity loan. Each of these financial products has different eligibility and qualification requirements. In this article, well look at what you need to qualify for a reverse mortgage.

There are three types of reverse mortgages. The most common is the home equity conversion mortgage . The HECM represents almost all of the reverse mortgages that lenders offer on home values below $970,800, so thats what this article will discuss. If your home is worth more, however, you can look into a jumbo reverse mortgage, also called a proprietary reverse mortgage.

Don’t Miss: How Many Years Of W2 For Mortgage