Embrace A Frugal Lifestyle

You may be thinking, Oh sure! Ill just find an extra grand in my budget each month to pay more on my house! NO PROBLEM.

For most of us, it actually IS a problem to come up with hundreds of dollars to apply to our mortgage. But it CAN be done if you think of ways to be more frugal. Consider the round up example above. If you wanted to round up $65 each month, what could you do to be a little more frugal and find that amount of money?

Could you bring your lunch to work once a week rather than eating out every day?

Could you do a family movie night at home each week rather than taking the entire family out to the theater? Could you evaluate your TV package to see if there is any way to free up some money there?

Frugality does not mean that you deny yourself every single thing that pleases you. What it DOES mean is that you have to critically consider what things in your life are needs and what things are wants. Are all of your desires really needed, or could you limit some of those so that you could pay off your house years earlier?

How badly you want to be mortgage-free will determine how drastic you are willing to go.

Come Up With The Money

Once youve got a specific dollar figure, you can lock down sources of the extra money required to climb this financial mountain. Not all of the following steps ensure success but in combination they may get you to the summit.

Cut back on spending and stick to a budget In order to make the goal of paying off your mortgage in five years or less, most households need to cut back on spending and stick to a budget. With the goal of paying off the home loan in such a short timeframe, it is short-term pain for a long-term gain. And, you may actually decide that some of those previous purchases were more frivolous than they were necessary.

Boost your monthly income Some homeowners may not have the necessary income to make paying off their home within five years a reality. However, they shouldnt give up on their goal. Boosting your income with a side hustle, promotion or new job could make your dream a reality. There are numerous side hustles available and many employees are significantly increasing their income in the current job market. If you need to learn a new skill to qualify for a promotion or new job, many free online courses are available on the internet.

Refinance With A Shorter

A shorter term on the mortgage means it goes away sooner, but at the cost of a much higher monthly payment and perhaps some out of pocket closing costs. Examine the loan closely.

The monthly payment on a 30-year, $200,000 mortgage at 2.5% would be $790 a month.

The monthly payment on a 15-year, $200,000 mortgage at 2.25 % would be $1,310.

Thats another $520 a month to finish paying off your mortgage 15 years sooner.

30 Years vs 15 Years of Payments| 30 Years of Payments |

|---|

| $235,830 |

| *For a $200k mortgage |

The bottom line on this decision is the bottom line: Can you afford the higher monthly payment of a 15-year loan, or are you better off contributing extra each month when you can to a 30-year payment?

Read Also: When To Refinance Your Mortgage Dave Ramsey

Don’t Miss: Which Way Are Mortgage Rates Headed

How To Calculate Extra Mortgage Payments

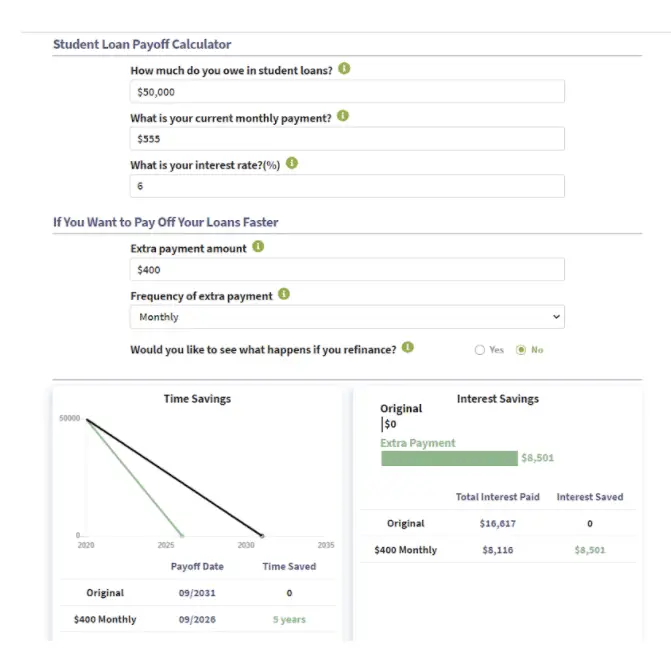

Using our Mortgage Payment Calculator, you can crunch the numbers and discover how much you could save in interest, or how much you would need to pay each month to pay your loan off sooner.

For example, according to the calculator, if you have a 30-year loan amount of $300,000 at a 4.125% interest rate, with a standard payment of $1,454, if you increase your monthly payment to $1,609, you could pay your loan off five years and one month earlier while saving $43,174 during the loan’s lifetime.

Why Is Amortization Important

Remember, an amortization schedule shows you how much of your monthly payment goes toward principal and interest. It helps you see a full view of what itll take to pay off your mortgage.

As with any type of goal setting, an amortization table gives you a game plan and the confidence to take on the mammoth task of paying off your house.

Dont Miss: How Much Of Your Monthly Income For Mortgage

You May Like: Are Mortgage Discount Points Worth It

How Can I Pay Off My Mortgage In Five Years

Its a question thats only asked by the brave. Considering most houses take between 15 and 30 years to pay for, five years is an incredibly brief period.

It is possible to pay off a mortgage in five years, but it does require a lot of focused effort. You may find that your lifestyle changes quite a bit, but you definitely wont regret it.

Your mortgage can be paid off in many different ways. There are a lot of creative approaches, but Ive added some of the best ones here.

Youll learn what works, what doesnt, and how to pay off a mortgage in five years with confidence. Heres how to get started.

This post may contain affiliate links. That means if you purchase an item through these links, I may earn a commission at no additional cost to you. Please read the full disclosure policy for more info.

What The Early Mortgage Payoff Calculator Does

Do you want to pay off your mortgage early? Maybe you have 27 years remaining on your home loan but you would rather pay it off in 18 years instead. The early payoff calculator demonstrates how to reach your goal.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month so you can pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

There are many reasons you might want to accelerate the mortgage’s payoff, but the motivation usually boils down to either or both of these:

-

You want to own your home free and clear by a milestone in life, such as your retirement or the beginning or end of your kids’ college years.

-

You want to reduce the total interest you pay over the life of the loan.

To steadily pay off the mortgage early, you need to know how much more to pay toward the principal balance every month to accomplish that goal. This calculator lets you do that.

When paying down the principal on a mortgage faster, keep in mind that each servicer has its own procedures for assuring that your extra payments go toward the principal balance instead of toward future payments. Contact your servicer for instructions.

Read Also: How To Hire A Mortgage Broker

Find A Lower Interest Rate

Work out what features of your current loan you want to keep, and compare the interest rates on similar loans. If you find a better rate elsewhere, ask your current lender to match it or offer you a cheaper alternative.

Comparison websites can be useful, but they are businesses and may make money through promoted links. They may not cover all your options. See what to keep in mind when using comparison websites.

You May Like: What Is A Va Mortgage Rate

Benefits Of An Early Mortgage Payoff

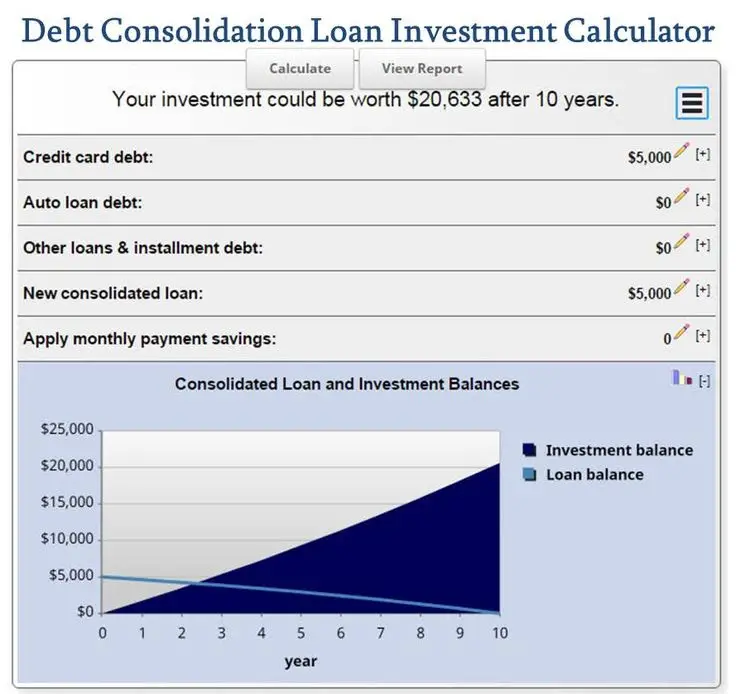

There are two main benefits of paying a mortgage early less interest paid and more home equity faster.

But paying off the mortgage is not necessarily always the best choice if you have more expensive debt, like outstanding credit card balances. Or if you havent yet saved for retirement. You may also want that money to purchase additional real estate, as opposed to it being locked up in your home.

This calculator can at least do the math portion to illustrate the power of paying extra and paying off your mortgage ahead of schedule. Youll then need to weigh those savings against other options like paying your credit cards or ensuring youve saved for retirement.

In other words, make sure youre actually saving money by allocating a larger amount of money toward paying off the mortgage as opposed to putting it elsewhere.

If you want to see the payment schedule, which details every monthly payment based on your inputs, simply tick the box. This will also show you your loan balance each month along with the home equity you are accruing at an ideally faster rate thanks to those additional payments.

To determine your home equity, simply take your current property value and subtract the outstanding loan balance. For example, if your home is worth $500,000 and your loan balance is $300,000, youve got a rather attractive $200,000 in home equity!

And thats all it takes to use this mortgage calculator with extra payments. Happy mortgage saving!

Recommended Reading: What Are Adjustable Rate Mortgages Based On

Create A Monthly Budget

Do you have too much month at the end of your money? Do you ever look into your wallet and wonder where that money has gone? We have all had this experience at some time or another, and we dont ever want to again!

The best way to ensure that you know where your money is going is to create a budget. Most people think of the word budget as a restriction someplace to list all of your debts and bills that have to be paid with no regard for having a life. The best debt advice I ever received was to create a budget to see where my money was going each month.

It helps instead to view a budget as a spending plan. In a spending plan, you PLAN how you will allocate your take-home pay. Do you HAVE to spend $200 per month on ballroom dancing lessons? If the answer is yes, put that in your budget and find other places to trim down if you need to.

Creating a thoughtful, complete spending plan allows you to know exactly where your money is going each month so you can tackle that mortgage faster.

You Can Pay Off Your Mortgage In 5 Years

When you finally achieve your goal, remember that you now have the opportunity never to have a mortgage again. Its a unique situation, and its a great one! So remember the value of owning your home, and dont go back into debt.

This is a big commitment, and a mortgage is a huge debt that many would love to pay off. Its entirely possible to pay off a mortgage in five years.

It takes hard work and patience, but its definitely something that can work out with the right planning and lots of determination. You can do this, and youll likely succeed if you dont give up and make an actionable plan laying out the steps.

Something to think about is what life will be like without a mortgage. Youll be able to afford to do many things.

Many of your savings goals can become a reality sooner. Youll also pay less for bills each month. Remember to keep that no mortgage lifestyle in your head as you progress.

This guide will help you pay off a mortgage in five years. Follow the basic principles of refinancing, saving money, and other techniques, and youll soon be able to make this happen.

Don’t Miss: Do Different Banks Offer Different Mortgage Rates

Reward Yourself Along The Way

All that being said, you likely wont achieve your goal of paying off your mortgage early if its a completely joyless experience. Its important to recognize the hard work that youre doing and what you have accomplished so far. To coincide with your payoff milestone, you should hold parties to celebrate with friends and family. Having the support of loved ones will make your goal seem that much more achievable. In addition to milestone celebrations, give yourself a treat every once in a while. Whether its a fancy date night or a trip to an amusement park, you deserve to let loose and relax every once in a while.

Pitfalls Of Paying Off Your Mortgage Early

Many homeowners think that they should pay off their mortgage early to get out of debt, but does it always make sense?

You do not want to pay off your mortgage and end up low on cash. It’s much easier to take cash out of a checking account when needed than it is to refinance by pulling it out of your home loan.

Ask yourself if you’ll need liquid cash in the near future. If the answer is yes, you’re better off putting your extra money in savings not toward your mortgage.

Always have a small savings buffer to help you pay for immediate expenses.

You May Like: What Is Amortization Schedule Mortgage

Cut Expenses And Increase Monthly Income

Easier said than done, right? However, striving to pay off your mortgage in five years is not an easy task, and it will likely take all of your extra financial resources to achieve. This means cutting certain luxuries out of your life and learning to live more simply. Hitting your five-year goal will require intense budgeting, and youll need to be paying more toward your principal than your minimum balance each month. Most extraneous expenses will need to wait as all your disposable income is being funneled to your mortgage.

The simple equation is: save more than you spend. Some strategies for this that can add up in the long run include:

- Make lunch at home every day vs. eating out

- Bring your own coffee or drink the office coffee instead of buying it every day

- Say no to most vacations for the next few years

- Research budget activities such as free museum days or nearby nature areas

- Sell any extra furniture, clothing, gym equipment, or other non-essentials on Craigslist or at a garage sale

- Consider freelancing on Upwork or another platform

- Make use of happy hour deals for date nights

- Cut out expensive grocery items and choose the non-name brand foods

- Opt for biking or public transportation if there are good options in your area

Though these tips may seem like big changes, after a few weeks youll get used to your new lifestyle and mindset!

Mortgage Payoff Calculator Terms & Definitions

- Principal Balance Owed The remaining amount of money required to pay off your mortgage.

- Regular Monthly Payment The required monthly amount you pay toward your mortgage, in this case, including only principal and interest.

- Number of Years to Pay Off Mortgage The remaining number of years until you want your mortgage paid off.

- Principal The amount of money you borrowed to buy your home.

- Annual Interest Rate The percentage your lender charges on borrowed money.

- Mortgage Loan Term The number of years you are required to pay your mortgage loan.

- Mortgage Tax Deduction A deduction you receive at tax time on the interest you pay toward your mortgage.

- Extra Payment Required The extra amount of money you’ll need to pay toward your mortgage every month to pay off your mortgage in the amount of time you designated.

- Interest Savings How much you’ll save on interest by prepaying your mortgage.

You May Like: Does Mortgage Modification Affect Credit Score

How To Pay Off Mortgage Early

So far, weve only talked about how many dollars youd need to put toward your mortgage each month to pay it off early. But, whats the actual how-to of accumulating those dollars? Where can you actually find the money to make extra mortgage payments?

Check out the steps below. This is what I did to pay off my $54,000 mortgage in just 11 months!

How Can I Pay Off My Mortgage In 5 Years

This is such an awesome part of this tool. Sorry I dont mean to over-sell you on this thing. I just get so excited about it!

Lets go back to the initial example of making 1 extra mortgage payment a year on your $300,000 mortgage. What if, instead of making one extra mortgage payment, you just wanted to pay off your mortgage in 5 years?

How much extra would you need to pay per month?

And the tool says.

$4,050.87.

So, if youd like to pay off your $300,000 mortgage in five years vs. the traditional 30 years, youll need to pay the standard payment of $1,610.50 plus the extra monthly payment of $4,050.87. Thats a total of $5,661.37 each month.

Sounds like a ton, but did you see how much interest this would save you??

$240,069! Now thats a hefty savings!

If you could buckle down and pay off your 30 year mortgage in five years, youd be so far ahead of the game financially, it would be eye-popping!

Recommended Reading: What Does A Mortgage Loan Officer Do

You Have No Other Savings

When unexpected expenses pop up, you want to be able to pay for them. That could mean replacing a flat tire on your car or paying a doctors bill when you get a bad case of the flu.

To make sure you have enough cash savings to cover these costs, start building an emergency fund. A fund worth at least six months will go a long way, though you probably need more if you have dependents.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Also Check: How To Pay Off A 200 000 Mortgage