Condo Reverse Mortgage Eligibility

Your property must meet specific criteria in order to be eligible for this form of financing. The HUD reverse mortgage guidelines require that the borrower must:

- Be at least 62 years old

- Own the property outright or have a considerable portion of the propertys equity

- Occupy the property as the primary residence

- Have no delinquency on federal debt

- Participate in mandatory HECM counseling

To confirm a senior homeowner meets the requirements above, a lender will verify the applicants income, assets, monthly living expenses, and credit history. They will also check for timely payments of property taxes and homeowner insurance premiums.

You May Like: Reverse Mortgage On Condo

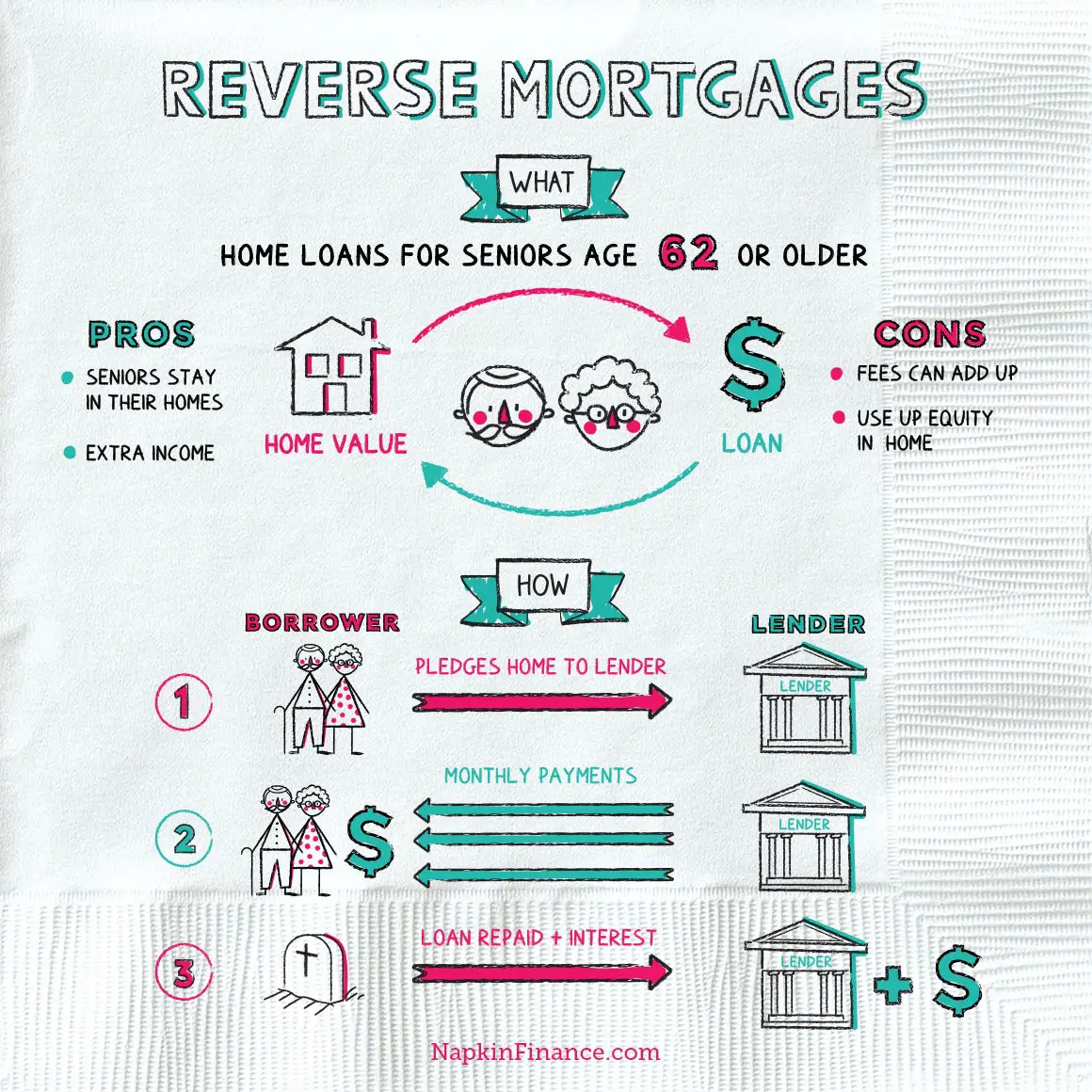

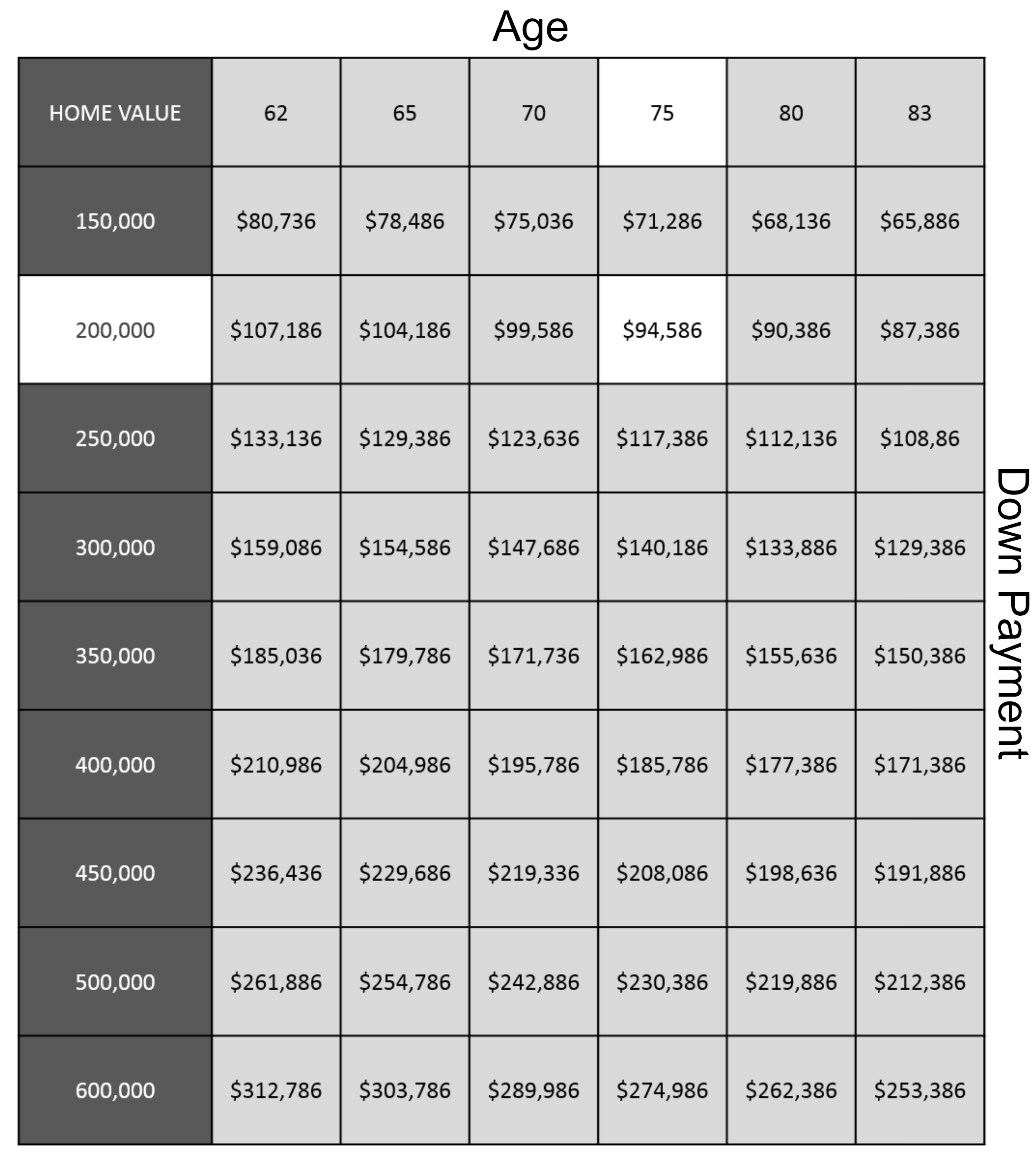

Making Sense Of The Reverse Mortgage Age Chart And Reverse Mortgage Age Table:

The two most rudimentary qualifications for a reverse loan are an age requirement and an equity requirement. For a non-married man or woman, the minimum age is 62. With every passing year, you get just a little bit more money. The highest loan amount possible relative to the value of your home is for a 90 year old. In other words, a 92 year old or 96 year old doesnt get any more money than a 90 year old. However, a 63 year old gets more than a 62 year old. A 64 year old gets slightly more than a 63 year old..and on and on.

For a married couple, the percentage you get is based on the date of birth of the youngest borrower.

The reverse mortgage age chart illustrates what percentage of the appraised value a lender lends you based on your age. The reverse mortgage age table covers every year from age 62 to 90. If you happen to be married to someone that is younger than 62, you can still participate in program . However, the loan amount would then be based on the age of the underage spouse and could therefore be less than what you see on this reverse mortgage age chart.

Reverse Mortgage Vs Refinance: Which Is Better

Reverse mortgages can be a good idea for seniors who need more retirement income but still want to live in their homes. However, this might not be the best choice for you if you want to pass your home down to your children, or if you plan on vacating the home soon.

If youre not sure a reverse mortgage is right for you, there are other refinancing options for seniors. For a homeowner in the right situation, one of these types of mortgages could provide a very viable or even better alternative as it accomplishes one of the major goals of a reverse mortgage accessing equity but allows more flexibility for you and your heirs.

Rocket Mortgage offers cash-out refinances. Read our guide to refinancing to see if this option makes sense for you.

Find a match.

You May Like: Monthly Mortgage On 1 Million

You May Like: When Will My Mortgage Insurance Drop Off

Now A Younger Spouse Can Be Listed As A Nonborrowing Spouse

In 2013, a federal court ruled that the HUD regulation that allows lenders to demand that surviving spouses immediately repay reverse mortgage loans upon the death of their spouses violates federal law. Under revised HUD guidelines:

- For loans issued on or after August 4, 2014, the nonborrowing spouse may remain in the home after the borrower dies, and the loan repayment will be deferred, if specific criteria are met.

- For HECMs taken out before August 4, 2014, the lender can choose to assign the mortgage to HUD and the nonborrower spouse can remain in the home so long as specific criteria are met.

If you’re thinking about taking out a reverse mortgage with a nonborrowing spouse, be very careful and be sure to talk to a lawyer or HUD-approved housing counselor to learn how to protect the nonborrowing spouse in this situation adequately.

Who Is Eligible For A Reverse Mortgage

Eligibility for a reverse mortgage can depend on what type of reverse mortgage youre interested in getting. For example, some state and local government agencies, as well as certain nonprofit organizations, offer reverse mortgages, but if youre looking for a federally insured option, then you need a home equity conversion mortgage . These reverse mortgage products are backed by the U.S. Department of Housing and Urban Development .

So who qualifies for an HECM? To be eligible, homeowners generally must:

- Be age 62 or older

- Own their home outright or have paid down the majority of their mortgage balance

- Not be delinquent on any federal debts

- Have financial resources to cover the ongoing costs of homeowners insurance, property taxes, maintenance, and repairs

- Attend HUD-approved consumer counseling

You also must own and reside in an eligible property. Under HUD guidelines, eligible properties include:

- Single-family homes

- Individual condominium units that meet Federal Housing Administration approval requirements

- Manufactured homes that meet FHA requirements

Requirements for eligible properties may be different if youre getting a reverse mortgage through a program that is not affiliated with HUD. There are unscrupulous lenders out there, so be extra careful if you are getting an unaffiliated one.

In addition to your financial resources, your potential future income and also may be considered as part of the reverse mortgage application process.

Recommended Reading: What Is The Lowest Mortgage Amount You Can Borrow

What Can Go Wrong With A Reverse Mortgage

Foreclosure: If you dont make your property tax and insurance payments, that could trigger a foreclosure. Similarly, if you dont respond to annual correspondence from your lender, that could also prompt foreclosure proceedings.

The impact:Explore foreclosures across the U.S.

Unfortunately, minor infractions like not returning a residency postcard, missing tax or property insurance payment, or poor servicing can lead to foreclosure quickly. In those cases, seniors can face long stressful battles to hold onto their homes and sometimes they still lose them anyway.

Non-borrowing spouse: If your spouse is not a co-borrower on the reverse mortgage when you pass away, what happens next depends on when the reverse mortgage was taken out.

If it was taken out on or after Aug. 4, 2014, a non-borrowing spouse can stay in the home after the borrower dies but does not receive any more of the loan funds as long as he or she meets these eligibility requirements:

Remain married until the borrower dies

Named as a non-borrowing spouse in the loan documents

Live and continue to live in the home as the primary residence

Able to prove legal ownership after the borrower dies

Pay the taxes and insurance and maintain the homes upkeep

If that doesnt happen, the surviving spouse can be hard hit, receiving a foreclosure notice within weeks of their husband or wifes death.

Shop around, too.

Dont Miss: Rocket Mortgage Loan Requirements

Tips To Protect Yourself

- Consult with an independent financial adviser to find out what reverse mortgage package best suits your financial situation and needs.

- If you do not have a financial advisor, discuss your situation with a counselor approved by the US Department of Housing & Urban Development HUD-approved counseling agencies are available to assist you with your reverse mortgage questions. You can call 800-569-4287 to find a counselor in your area.

- Make sure you understand all the costs and fees associated with the reverse mortgage.

- Find out whether the reverse mortgage you are considering is federally-insured. This will protect you when the loan comes due.

- Find out whether your repayment obligation is limited to the value of your home at the time the loan becomes due.

- Make sure any reverse mortgage payments are first made directly to you do not allow anyone to persuade you to sign over the funds to someone else.

- Be wary of anyone who tries to pressure you into a decision that you are not completely comfortable with, such as investing the payments from your reverse mortgage into an annuity, insurance policy, or other investment product, or pressuring you into receiving a lump-sum payment over monthly payments.

- If you are uncomfortable with the reverse mortgage that you entered into, exercise your right of rescission within three days of the closing. A right of rescission allows you to cancel the mortgage within three days of closing without penalty.

Recommended Reading: How Does Costco Mortgage Work

How Do I Determine My Equity

Equity is determined by the current appraised value of your home minus the amount that you owe on the house. Since home values vary based on market conditions, your equity can increase or decrease based on the appraised value of your home. In a period of high housing values, your equity will increase despite your payments staying the same. Conversely, in a housing crash, your equity may go down as your investmentyour homeloses value.

My Lender Told Me I Would Have To Complete Repairs To My Home Before They Will Give Me A Reverse Mortgage Should I Do It

Sometimes a lender will include certain repair and/or maintenance provisions in the terms of a reverse mortgage. This is because, for the majority of reverse mortgages, the loan is secured by the value of the home. As such, a lender is within their rights to require a consumer to make certain repairs as a prerequisite to obtaining a reverse mortgage. In addition, after a reverse mortgage is made, a lender may require a borrower to maintain the home through ongoing repairs. If a borrower is unwilling or unable to complete such repairs, a lender may arrange for such repairs and pay for it with loan proceeds.

Also Check: How Much Mortgage Can I Afford Nerdwallet

How The New Condo Rule Is Playing Out For Reverse Mortgage Lenders

In late 2019, the Department of Housing and Urban Development issued new condominium guidelines that aimed to make it easier for single units to be approved for Federal Housing Administration financing. This included transactions under the Home Equity Conversion Mortgage program.

Historically, an entire condo complex would need to be approved for FHA financing in order for one unit to receive the financing, so the changes are significant. In terms of the new rules effects on originators, there has been a discernible effect in certain parts of the country, but additional perspective is provided when asking major lenders and brokers about the effects of the new condo rules handed down late last year.

While the new guidance has made it slightly easier to gain a single-unit approval, in many cases the process seems to remain in the realm of requiring a full project approval, according to reverse mortgage industry participants at several levels.

Also Check: Rocket Mortgage Launchpad

What Is Private Mortgage Insurance And How Will It Affect My Reverse Mortgage

Private mortgage insurance or PMI is an insurance policy taken out and paid for by a borrower for the benefit of the lender. Whether the reverse mortgage loan is made in accordance with the HECM program or New York Real Property Section 280 or 280-a , it is likely that an additional monthly amount will be added to the balance of your reverse mortgage to cover the cost of the PMI. It is important that you discuss the financial impact of PMI with your lender and a housing counselor or attorney before getting a reverse mortgage.

Read Also: Can You Get Pre Approved Mortgage Online

Recommended Action Steps For Fha Approval

The first step is to determine if your condominium is FHA-approved. HUD keeps a database of all FHA-approved condominiums. You can visit the opens in a new windowHUD website to find out if your condo is already eligible for a reverse mortgage.

On this publicly accessible database, you can search for your condo by state, county, or even the name of the property. Remember that these steps are crucial if you want to borrow a reverse mortgage on a condo and want to opens in a new windowenjoy a happy retirement.

If you notice that your condo project features a certificate of FHA approval in the past, its a sign that the association may consider FHA approval in the future. Open a discussion with your association and ask the member and find out if they are willing to allow reverse mortgage in the project.

You can also contact a lender, who can broach the subject to your HOA on your behalf to see it is feasible to do reverse mortgages in your project.

If you own an FHA-approved unit, consult with your mortgage loan officer to proceed.

What Are Some Alternatives To Reverse Mortgages

A reverse mortgage is best seen as a last resort to fund your retirement â there are other options for you to consider first. If youâre only partway through your retirement and can already see the balances of your savings accounts dwindle, you may want to consider one of these other options as a way to supplement your income:

Read Also: How Many Times Can I Apply For A Mortgage

How To Tell If A Reverse Mortgage Is Right For You

Its true reverse mortgages dont have a stellar reputation and Gilbert says they arent right for everyone. For example, it might not be the best choice for someone who is definitely not planning on remaining in their home for at least the next two or three years to justify the cost.

Additionally, if there is another family member who needs to inherit the property, for example if you have a child with a disability and want the child to stay in the apartment long-term, a reverse mortgage may not provide long-term security.

However, Gilbert says she has seen cases where a senior child over the age of 62 and a parent have gone in on a reverse mortgage together and says it allowed tremendous protections for both generations.

Read Also: Who Is Rocket Mortgage Owned By

Income And Credit Checks

Reverse mortgages dont have income or credit score requirements. This is one of the ways in which reverse mortgages differ from a home equity loan or a home equity line of credit . HELOCs provide homeowners access to home equity. Unlike a reverse mortgage, home equity loans and HELOCs require borrowers to make payments and to qualify you must have a respectable credit score. On the other hand, they may come with fewer fees and can be a less expensive alternative to a reverse mortgage.

You May Like: Why Is Mortgage Cheaper Than Rent

Refinancing Your Current Mortgage

If you currently have a mortgage on your home, you could refinance it to lower the payments. Again, you’ll have to meet credit and income requirements and make monthly payments.

Also, taking out a new 30-year mortgage when you’re close to retirement might cause issues in the future when you have higher health care costs. Consider getting a mortgage with a shorter term, like a 10- or 15-year mortgage.

These Can Vary Depending On Who Is Offering The Product

Reverse mortgages allow homeowners to turn their home equity into retirement income. These products are designed for older people who own their homes outright or have paid down most of the mortgage. Qualifying for a reverse mortgage can depend on a number of factors, including your age and, if youre married, your spouses age.

Also Check: What Is The Difference Between Mortgage Interest Rate And Apr

What Are The Costs Of A Reverse Mortgage

HUD adjusted insurance premiums for reverse mortgages in October 2017. Since lenders cant ask homeowners or their heirs to pay up if the loan balance grows larger than the homes value, the insurance premiums provide a pool of funds that lenders can draw on so that they dont lose money when this happens.

One change was an increase in the up-front premium, from 0.5% to 2.0%, for three out of four borrowers and a decrease in the up-front premium, from 2.5% to 2.0%, for the other one out of four borrowers. The up-front premium used to be tied to how much borrowers took out in the first year, with homeowners who took out the mostbecause they needed to pay off an existing mortgagepaying the higher rate. Now, all borrowers pay the same 2.0% rate. The up-front premium is calculated based on the homes value, so for every $100,000 in appraised value, you pay $2,000. Thats $6,000 on a $300,000 house, for example. In fact, the fee is capped at $6,000, even if your home is worth more.

All borrowers must also pay annual MIPs of 0.5% of the amount borrowed. This change saves borrowers $750 a year for every $100,000 borrowed and helps offset the higher up-front premium. It also means that the borrowers debt grows more slowly, preserving more of the homeowners equity over time, providing a source of funds later in life, and increasing the possibility of being able to pass down the home to heirs.