The Rate Of Economic Growth

Economic growth indicators, such as gross domestic product and the employment rate, influence mortgage rates. With economic growth comes higher wages and greater consumer spending, including consumers seeking mortgage loans for home purchases. That’s good for a country’s economy, but the upswing in the overall demand for mortgages tends to propel mortgage rates higher. The reason: lenders only have so much capital to lend.

In a slowing economy, the opposite occurs. Employment and wages decline, leading to decreased demand for home loans, which puts downward pressure on the interest rates offered by mortgage lenders.

Treasury Bonds Drive Mortgage Rates

Because they are longer-term bondsusually 15 or 30 yearsand dependent on individual repayment, mortgages have a higher risk than most bonds. U.S. Treasury notes offer similar term lengthsat 10, 20, and 30 yearsbut are ultra-safe due to their government backing. As a result, investors don’t require high rates.

Banks keep interest rates on mortgages only a few points higher than Treasury notes. Those few points of higher return are enough to push many investors toward mortgages.

As interest rates on U.S. Treasury notes rise, it means banks can raise the interest rates on new mortgages. Homebuyers will have to pay more each month for the same loan. It gives them less to spend on the price of the home. Usually, when interest rates rise, housing prices eventually fall.

What Is A 10

A 10-year Treasury is a bond that guarantees interest plus repayment of the borrowed money in a decade. The 10-year Treasury is just one of a handful of securities issued by the U.S. government. Others include:

Treasury bills, also known as T-bills, are short-term securities, with maturities that range from a few days to 52 weeks. Treasury bills are sold at a discount to their face value, meaning they provide investors with returns by paying them back at the full, not discounted, rate.

Treasury notes, also known as T-notes, are issued with maturities of two, three, five, seven and 10 years. They pay interest every six months and return their face value at maturity.

Treasury bonds, also known as T-bonds, are the longest-term government securities, issued for 20 and 30 years. They pay interest every six months and return their face value at maturity.

Don’t Miss: What Are The Interest Rates On A Mortgage

What You Can Do To Secure A Smooth Refinance

Considering a mortgage refinance? While theres no guarantee about the future direction of rates, the latest economic headlines seem to indicate that they wont fall much further. Here are a few ways you can make the refi process as profitable as possible:

- Shop around: Rates and closing costs vary widely by lender, so get multiple bids. Closing costs can range from as little as 2 percent to as much as 5 percent of the amount of the loan.

- Get your paperwork in order: Dont let something simple like a missing document delay your refinance. Collect PDFs of financial documents including pay stubs, bank statements, tax returns and retirement accounts.

- Ask about rate locks: Lenders typically extend rate locks for 30 to 60 days, meaning you wont have to pay more if rates go up before your loan closes. These arent normal times, though, and many refinances arent closing within 30 to 60 days, so make sure your lender is willing to extend your rate lock if your deal is delayed.

- Keep your credit score tight: Now isnt the time to miss a payment, take on new debt or otherwise do anything to lower your credit score. Lenders are being especially strict about borrowers credit histories.

Will Current Mortgage Rates Last

Mortgage rates have been in a holding pattern for a little over a month. The rise of the Delta variant of the COVID-19 virus has put a damper on the economic recovery and counteracted some of the positive developments that could have pushed rates higher the last few weeks.

This pattern may soon change, however, as COVID infections seem to be plateauing. On the economic front, retail sales, which had been expected to decline, saw a nearly 1% increase in August, which is good news for the economy. On the other hand, Inflation, meanwhile, was a little lower than expected last month.

Why does this matter?

The Federal Reserve has based decisions around tapering its accommodative monetary policy on the strength of the labor market and the economic recovery. The Fed’s position has been that inflation, which is currently over 5% and above the central bank’s target rate of 2%, is temporary. If inflation continues to slow down and other economic indicators, such as employment and retail sales, continue to improve, it could push the Fed to a more aggressive stance on its policy. For now, all eyes will be on the Fed’s upcoming September meeting.

“The fact that interest rates havenât moved much in recent weeks indicates that investors are still waiting for more certainty,” said Matthew Speakman, senior economist at Zillow. “All told, thereâs a good chance that mortgage rates will move notably in the coming weeks, but the juryâs still out on which direction theyâll head.â

Read Also: Can Low Credit Score Get Mortgage

What Are Todays Mortgage Rates

Mortgage rates change all day, every day. And, the only play to get access to live, accurate rate quotes is via a mortgage lender.

Get todays live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

Popular Articles

Resources

Why Mortgage Rates And Treasury Yields Move Together

Historically, the 10-year U.S. Treasury yield has been considered a key benchmark for mortgage rates. However, mortgage rates are not actually based on the 10-year U.S. Treasury note .

Fixed mortgage rates and Treasury yields generally move together. Why? As a fixed-rate asset, mortgage-backed securities are in direct competition with Treasury instruments for investor money.

For mortgages to stay competitive in the eyes of investors, the rates on mortgages inherently follow changes in Treasury yields.

Also Check: Does Bank Of America Do Mortgage Loans

How Mortgage Rates Change

So you know that Treasury bonds and mortgage interest rates are directly related. But, just which bonds affect which rates?

Generally, 10-year bonds affect 15-year mortgage rates and 30-year bonds affect 30-year mortgage interest rates. As you can see, T-bonds only affect fixed rate mortgage loans they do not affect adjustable rate mortgage loans. ARM rates are based on the LIBOR or Prime rate rather than the Treasury bond rate.

Knowing the bond rate can help you determine a general range for mortgage rates. Of course, the actual rate you get depends on the lender and your qualifying factors. Shopping around with different lenders may give you different rates. You can then compare your options and decide which one works best for you.

How Treasury Yields Affect Mortgage Interest Rates

Treasury yields — specifically the yield on 10-year Treasury Notes — and mortgage interest rates move in tandem because both are directly tied to the cost of money, which is the interest income that investors demand for lending money through the purchase of Treasury securities. The 10-year T-Note forms a floor underneath mortgage interest rates, which are higher than T-Note yields by a varying amount known as the spread. The spread exists because mortgage borrowers occasionally default, making mortgages risky. In contrast, Treasuries are backed by “the full faith and credit” of the U.S. government.

Recommended Reading: Can You Sell House Before Paying Off Mortgage

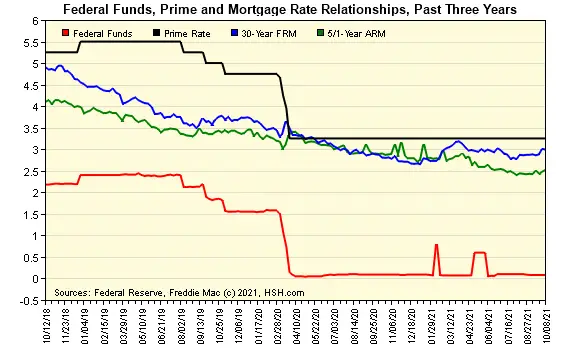

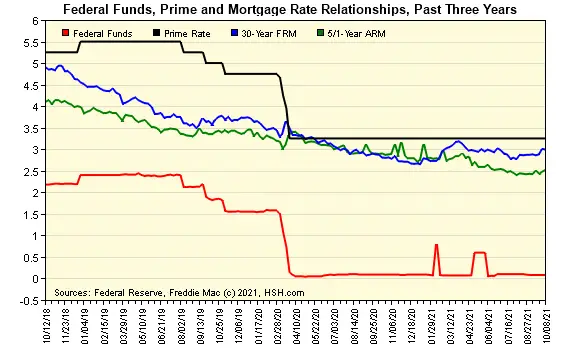

The Fed Stays On The Sidelines

An additional factor that may contribute to what remains a modestly favorable environment for bonds is that the Fed is holding fast to its stance of maintaining a 0 percent target rate for the Fed Funds rate it manages through next year. This is the benchmark overnight lending rate banks charge each other. While that policy guidance remains in tact, some members of the Federal Open Market Committee anticipate that the Fed may begin raising short-term rates by the latter part of 2022.

An important consideration for the Fed is the fact that more than eight million Americans remained unemployed as of the end of August, a significant concern for the long-term health of the economy. Higher unemployment could allow the Fed to justify sticking to its current interest rate plan.

Freedman also notes that the European Central Bank seems committed to maintaining its own interventionist stance, designed to maintain liquidity in the fixed income markets. Theres no sign that central banks are flinching from their current stance, notes Freedman. In short, there is little likelihood that Fed policies will have an appreciable impact on domestic bond markets.

What Is A Variable Rate Mortgage

Category: Loans 1. Fixed-Rate vs. Adjustable-Rate Mortgages Investopedia Adjustable-Rate Mortgages ARMs have a fixed period of time during which the initial interest rate remains constant, after which the interest rate adjusts at a Fixed-Rate Mortgages · Adjustable-Rate Mortgages · ARM Terminology A variable-rate mortgage is a home loan with a

Also Check: How To Remove A Cosigner From A Mortgage

Mortgage Rate Forecast For 2021 And 2022

Wondering if mortgage rates are going up or down in 2021 and the year after? Wonder no longer.

The following table provides 2021 mortgage rate predictions for the 30-year fixed from well-known groups in the industry, along with a 2022 estimate.

Take them with a grain of salt because theyre not necessarily accurate, just forecasts for future rate movement.

| Mortgage Rate Predictions |

How Will Higher Yields Affect Stocks

Stock investors shouldnt be overly concerned about the recent rise in yields, according to David Lefkowitz, head of equities Americas at UBS Financial Services. That’s because there is growing optimism about economic growth and rates are finally “catching up” to the bullish growth outlook in the stock market, he added.

In the past three months, the 10-year Treasury yield has risen by over half a percentage point, a rapid move that is larger than 90% of all the three-month periods since 1990, according to UBS Financial Services.

Still, stocks typically perform quite well during these periods. On average, the S& P 500 registers a 3.9% gain when interest rates rise by more than half a percentage point, data from UBS Financial Services shows. While returns tend to be a bit lower in the three months after a big move in rates 2.5% on average they are no worse than a typical three month period.

The rise in yields does have implications for the stock market and could make shares of companies with high valuations less attractive. Those types of stocks tend to be technology companies, who are priced typically for growth and not for a steady return of dividends like consumer staples, utilities and real estate companies.

Rising rates tend to be favorable for more cyclical sectors, or companies whose businesses and stock prices tend to follow the business cycle. Those include sectors like consumer discretionary, energy, financials, industrials and health care.

Don’t Miss: Can You Refinance A Usda Mortgage

A Roller Coaster Ride For Treasury Rates: Why They Matter

Most consumers pay little attention to 10-year Treasury notes, but the rate on the benchmark bond directly affects how much you pay for your mortgage. The 10-year Treasury acts as a reliable indicator of economic sentiment and as a key benchmark for mortgage rates. In 2019, the gap between the 10-year Treasury and the 30-year mortgage averaged 1.79 points, according to a Bankrate analysis of data compiled by the Federal Reserve Bank of St. Louis.

In late 2019, the rate on the 10-year Treasury was north of 1.9 percent. Then the coronavirus pandemic hit, and rates on 10-year bonds plummeted. The 10-year rate fell as low as 0.52 percent in August.

If the split between Treasury rates and mortgage rates had remained at last years levels, the 30-year mortgage rate would have plunged below 2.5 percent this year.

Thats not what happened. As the coronavirus shook the U.S. economy, the divide widened to as much as 2.72 points.

However, 10-year Treasury rates have recovered since then, buoyed by an improving labor market, a smoother-than-expected presidential election and promising news about a coronavirus vaccine.

Rising yields on government bonds reflect new optimism about the U.S. economy. But the trend could bring unwelcome news for mortgage borrowers: Higher rates on 10-year Treasury notes generally mean rising rates for 30-year mortgages.

Where Can I Borrow Money With Bad Credit Right Now

Category: Loans 1. Best Bad Credit Loans in September 2021 | Bankrate Details: best bad-credit personal loan companies in 2021 Details: best bad-credit personal loan companies in 2021. Best loan for poor credit Coronavirus hardship loans · How To Get A Personal Loan · Editorial Integrity 6 days ago

Also Check: How To Calculate Principal And Interest For Mortgage

What To Consider If Youre Shopping For A Mortgage

When youre shopping for a mortgage, compare interest rates and APR, which is the total cost of the mortgage. Some lenders might advertise low interest rates but offset them with high fees, which are reflected in the APR.

To begin your search compare offers online, read lender reviews and go directly to lenders websites.

If you have a relationship with a lender, bank or credit union, find out what interest rate or customer discount you might qualify for. Often, lenders will work with customers to give them a better deal than they might otherwise get at another place.

Mortgage rates are near historic lows, so while you should pay attention to the Fed and the economy, your best move if you need a property loan is to get a rate that suits your budget and goals rather than wait for still lower rates.

Typical Mortgage Rate Spreads

This spread can widen during times of financial uncertainty, as investors move towards safer investments such as government bonds. In March 2020, as the COVID-19 pandemic affected Canadian markets, some lenders briefly increased mortgage rates even though bond yields fell.

The same mortgage spread movement was seen in the United States. The30-year mortgage ratespread above the 10-year Treasury yield increased from just under 1.8% in January 2020 to over 2.72% on April 23, 2020. This 2.72% spread over the Treasury yield was a record high not seen since 2008.

Also Check: What Is The Current Interest Rate On An Fha Mortgage

Are Mortgage Interest Rates Going To Rise

In 2020, the pandemic and ensuing recession repeatedly drove mortgage rates to new all-time lows. Given how low rates have been, you should expect rates to rise in the future. But when they will rise and how high they will go depends on a handful of influences.

How and when the economy recovers from this recession is likely to be the main factor that drives rates higher. Logan Mohtashami, housing data analyst with HousingWire, believes our economic recovery and the potential for rising rates is tied to the successful implementation of a vaccine. So were likely to see continued low rates until the unemployment rate, and other economic indicators, start to return to pre-pandemic levels, Mohtashami says

Even after the pandemic is behind us, rates should still be historically favorable compared to the double-digit mortgages rates of the 70s and 80s. I would be shocked if I ever saw 6% mortgage rates in my life, Mohtashami says. Rates have been going down for four decades. He believes that unless the government takes extreme measures to stimulate the economy, demographic trends and other macroeconomic factors will keep rates relatively low in the long term.

Changing Yields Over Time

Because 10-year Treasury yields are so closely scrutinized, knowledge of its historical patterns is integral to understanding how today’s yields fare as compared to historical rates. Below is a chart of the yields going back a decade.

While rates do not have a wide dispersion, any change is considered highly significant. Large changes of 100 basis points over time can redefine the economic landscape.

Perhaps the most relevant aspect is in comparing current rates with historical rates, or following the trend to analyze whether near-term rates will rise or fall based on historical patterns. Using the U.S. Treasury website, investors can easily analyze historical 10-year Treasury bond yields.

Also Check: What Salary Is Required For A Mortgage

Are Mortgage Rates Impacting Home Sales

The number of mortgage applications ticked up 0.3% for the week ending September 10, according to the Mortgage Bankers Association. The increase takes an adjustment for the Labor Day holiday into consideration.

- Purchase applications were up a seasonally adjusted 8% from the previous week and 12% lower than the same week last year. On an unadjusted basis, purchase loan volume was 5% lower week-over-week.

- Refinance applications also ticked lower, decreasing 3% from the week prior and 3% lower than the same week last year. Refinancing continued to slow as the share of refi applications dropped to 65% of all applications, the lowest total since July.

Make sure we land in your inbox, not your spam folder.