Adjustable Jumbo Mortgage Rates

| Time Initial Rate is Fixed | 5 Years |

|---|---|

| Maximum Life Time Caps Over Initial Interest Rate | 5% |

Interest Rates effective 09/23/2022 and are based on a 45-day lock period for purchase transactions.

See important rate information

For loan amounts greater than $970,800

1Interest rates and payments may increase after consummation. After the initial fixed-rate period, your interest rate can increase or decrease annually according to the then current index.2Monthly payments are per $100,000 borrowed and do not include additional costs such as taxes and insurance. Actual monthly payment will be greater.3Since the index in the future is unknown, the Current Adjusted Interest Rate and Current Adjusted Payment are based on the current index plus the margin at the time of the effective date shown above, and are only an example of what your rate and payment would be if your loan adjustment date was the date shown above. The Adjusted Interest Rate and Adjusted Payment may differ when the term for your initial rate expires. Your mortgage will change on the adjustment dates and will be equal to an index, which is based on the 30 Day Average of the Secured Overnight Funding Rate as published daily by the Federal Reserve Bank of New York, plus a margin of 2.75%. For more information on the SOFR index, please visit the Federal Reserve Bank of New York.

What Types Of Jumbo Loans Are Available

There are fixed-rate jumbo loans as well as adjustable-rate jumbo mortgages. Typically fixed-rate jumbo loans are offered in 15-year and 30-year terms, although it varies depending on the type of jumbo loan you take out. ARMs, for example, usually come in five-, seven- or 10-year terms. You can also refinance a jumbo loan, with a standard rate and term refinance or a cash-out refinance just like conventional loans.

/1 Arm Trends Upward +020%

The average rate on a 5/1 ARM is 4.87 percent, adding 20 basis points over the last 7 days.

Adjustable-rate mortgages, or ARMs, are home loans that come with a floating interest rate. In other words, the interest rate can change from time to time throughout the life of the loan, unlike fixed-rate loans. These loan types are best for those who expect to sell or refinance before the first or second adjustment. Rates could be substantially higher when the loan first adjusts, and thereafter.

While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen.

Monthly payments on a 5/1 ARM at 4.87 percent would cost about $525 for each $100,000 borrowed over the initial five years, but could ratchet higher by hundreds of dollars afterward, depending on the loans terms.

You May Like: How Much A Month Is A 150k Mortgage

How We Chose The Best Jumbo Mortgage Rates

In order to assess the best jumbo mortgage rates, we first needed to create a credit profile. This profile included a credit score ranging from 700 to 760 with a property loan-to-value ratio of 80%. With this profile, we averaged the lowest rates offered by more than 200 of the nations top lenders. As such, these rates are representative of what real consumers will see when shopping for a mortgage.

Keep in mind that mortgage rates may change daily and this data is intended to be for informational purposes only. A persons personal credit and income profile will be the deciding factors in what loan rates and terms they are able to get. Loan rates do not include amounts for taxes or insurance premiums and individual lender terms will apply.

What Are Current Jumbo Mortgage Rates

Lenders nationwide provide weekday mortgage rates to our comprehensive national survey to bring you the most current rates available. Here you can see the latest marketplace average rates for a wide variety of purchase loans. The interest rate table below is updated daily to give you the most current purchase rates when choosing a home loan. APRs and rates are based on no existing relationship or automatic payments. For these averages, the customer profile includes a 740 FICO score and a single-family residence. To learn more, see understanding Bankrate rate averages.

Rates as of Saturday, September 24, 2022 at 6:30 AM

Don’t Miss: What Is Included In Apr For Mortgage

What Is A Jumbo Mortgage Loan

Jumbo mortgages are home loans that exceed conforming loan limits. A jumbo loan is one way to buy a high-valued or luxury home. Borrowers are required to have a low debt-to-income ratio and a high credit score.

The limit on conforming loans is $647,200 in most areas of the country, but jumbo mortgages can exceed these limits. If youre considering buying a high-valued or luxury home, a jumbo loan may be right for you.

Keep in mind that if the home you are considering is in a high-cost area, you may still be able to obtain a conforming fixed-rate mortgage or adjustable-rate mortgage for up to $970,800.

Contact a mortgage loan officer to determine which mortgage loan is right for your particular needs and to learn more about jumbo loans and jumbo mortgage rates.

Go Where The Money Is

“It creates a client for life relationship,” Koenigsberg says. “It’s been a strategy for many, many years.”

More affluent customers will likely have more equity in their property, partly because jumbo loans require down payments of at least 20 percent, and the home will be a better piece of collateral for the bank to have, he says.

“This has allowed the larger lenders to reach an audience that would have been harder to reach without this,” Koenigsberg says.

Some lenders give a 0.25 percentage point jumbo loan discount to borrowers who open a checking or savings account with them and sign up for automatic mortgage payment, says Van Tran, vice president of The Federal Savings Bank in Chicago and owner of My VA Rates, a website that helps veterans get VA jumbo loans.

“If you have a mortgage with them and they can see all your assets, then they’re going to call you from time to time and try to sell you services,” Tran says of banks going after clients who are worth millions.

Read Also: What Factors Into Mortgage Approval

How To Find The Best Mortgage Rate

Lets face it: shopping for mortgages can be a struggle. Checking interest rates, filling out loan applications, choosing a lender all the choices and numbers can be overwhelming. But its worth the research and time. Comparing mortgage rates across lenders is one of the first steps in the home buying process. This allows you to budget by giving you an idea of what your monthly mortgage payments will total. Even minor differences in the interest rate on a six-figure loan will add up over the life of a 30-year mortgage. This can have a huge impact on your overall financial goals.

Years ago, it was more common to skip comparison shopping and go right to your primary bank as a mortgage lender. But now, your bank is just one of many lender options you have as a modern homebuyer. You can find reviews, ratings, customer experiences and all sorts of information right from the comfort of your home computer or smartphone. There are lenders who will tell you what rates you qualify for online within minutes and others that require you to speak to a mortgage broker. Whatever your preference, you have all sorts of resources available to you.

A financial advisor can aid you in planning for the purchase of a home. To find a financial advisor who serves your area, try our free online matching tool.

Fixed Or Adjustable Rates

Across the broader real estate market, at the end of 2018 roughly 10% of new refis & 6% of new home purchase loans were structured as traditional or hybrid ARM loans, with the remainer of the market using fixed rates. Fixed rate home loans simply dominate the market.

Compared to the typical homeowner, high-wealth families are more likely to use adjustable-rate loans to lower their short term interest expenses. CoreLogic highlighted how prevalent ARMs are for wealthy families:

ARMs remained the most popular option for those financing luxury homes. Roughly 76 percent of borrowers refinancing ARM loans opted to go with another ARM, and 31 percent of the fixed-rate borrowers switched to an ARM.

Don’t Miss: How Much Will We Get Approved For A Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

About These Rates: The lenders whose rates appear on this table are NerdWallets advertising partners. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a lenders site. The terms advertised here are not offers and do not bind any lender. The rates shown here are retrieved via the Mortech rate engine and are subject to change. These rates do not include taxes, fees, and insurance. Your actual rate and loan terms will be determined by the partners assessment of your creditworthiness and other factors. Any potential savings figures are estimates based on the information provided by you and our advertising partners.

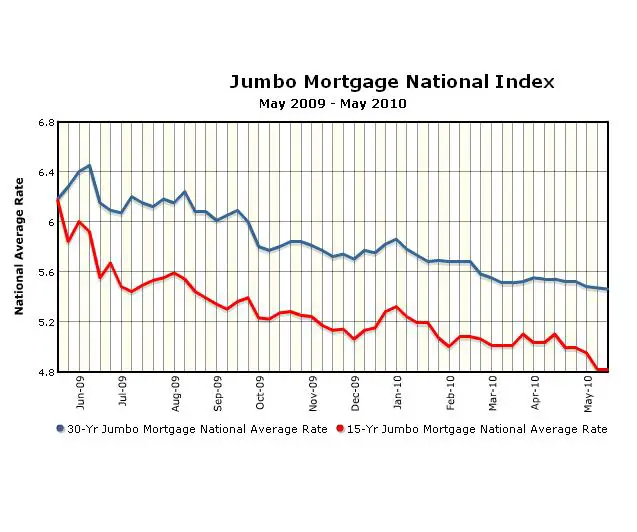

Trends and insights

What Are Jumbo Mortgage Rates

Jumbo mortgage rates usually tend to be higher than conventional mortgage rates, since you’re borrowing a larger amount. However, since rates began rising in early 2022, jumbo loans have had slightly lower rates than conventional loans. Right now, they are almost the same: The 30-year fixed-interest rate for a jumbo loan is now over 6%, keeping in line with the national average for 30-year fixed-rate mortgages, and the national average APR for a 30-year fixed-rate jumbo loan is the same. If you’re trying to purchase a home in a sought-after area with significant housing demand, it’s likely you will need a jumbo loan.

Recommended Reading: When Do I Stop Paying Mortgage Insurance

Super Jumbo Loans The Really Big Ones

- Its a subjective term that may differ depending on who you ask

- A super jumbo used to be a loan amount above $650,000

- Now it might align with a loan amount beyond the high-cost limit

- Though it probably varies by region and company

Some jumbo loans are known as super jumbo loans, much to the excitement of mortgage brokers and loan officers who think theyve got a huge deal on their hands .

While there might be some argument, a true super jumbo loan is probably any loan amount above the high-cost limit for the county, ranging up to $20 million or higher.

This term is certainly relative, depending on the state in which the overzealous loan officer resides. I suppose it can vary based on where you live and what youre used to seeing.

When I worked in the business, a super jumbo was any loan amount over $650,000today it might be a loan amount of $1 million and up thanks to our friend inflation.

CoreLogic defines super jumbo as a loan amount between $10 and $20 million, and have identified over 230 active loans that fit that description.

They note that a whopping 75 percent of them were originated since 2013, a testament to recent sky-high property values.

Tip: You can break up your loan into a first and second mortgage to avoid paying more for a jumbo loan, keeping the first below the conforming loan limit. Just make sure the combined rate is cheaper than what it would be otherwise.

More Mortgage Tools And Resources

You can use CNET’s mortgage calculator to help you determine how much house you can afford. The CNET mortgage calculator factors in variables like the size of your down payment, home price and interest rate to help you figure out how large of mortgage you may be able to afford. Using the CNET mortgage calculator can also help you understand how much of a difference even a slight increase in rates makes in how much interest you’ll pay over the lifetime of your loan.

Get the CNET Personal Finance newsletter

Don’t Miss: Can My Llc Pay My Mortgage

Should I Choose A Mortgage Based On The Apr

The APR is a great tool for comparing two mortgages with different terms, but it’s ultimately important to consider all aspects of your loan when making a decision. For example, if your savings account is well-stocked, you may be willing to pay some higher closing costs for a loan with a lower monthly payment that is more in line with your regular income.

And there are other, non-financial factors as well. Every mortgage lender does business its own way. Some use a personal touch with each customer and others offer the most cutting-edge technology to make your borrowing experience easy. Do you prefer a small, local institution? An online lender? A national bank with a 100-year history and an established reputation? Theres no right answer to any of these questions, but they are important to think about nonetheless. You could be making payments on your mortgage for 30 years, so you should find a lender that suits your needs.

Before you sign your papers, its a good idea to research your lender. Read reviews, the company website and any homebuying material the lender publishes. It can help you get an idea of the company before you do business.

Fixed Jumbo Mortgage Rates

Rates as of 09/23/2022 and can change without notice. Rate is based on 45-day lock for purchase transaction.

See important rate information

1 For loan amounts greater than $970,800.2 The information provided on this page is for informational and comparitive purposes only. Rates and terms may change at any time and without prior notice. Your actual rate, payment, terms, and costs could be different. Get an official Loan Estimate before choosing a loan. Your rate, fees, and terms may differ based on various factors such as: when your rate is locked, actual occupancy status, loan purpose, loan amount, credit score, loan to value ratio, etc. The payment examples are principal and interest only and do not include mortgage insurance, taxes and other property insurance. The actual payment will be higher if mortgage insurance is required on your loan. Your actual payment obligation will be greater considering taxes and insurance premiums.

Also Check: What Is Reverse Mortgage Meaning

How Are Jumbo Mortgage Rates Set

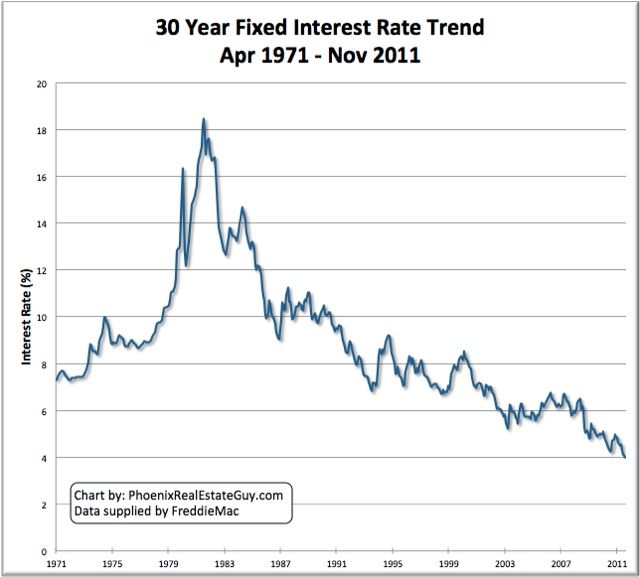

Like conventional mortgages, rates are influenced based on the Federal Reserve benchmarks and on individual factors such as the borrowers credit score. Jumbo mortgage rates will rise and fall in line with the Fed’s short-term interest rates.

Additionally, since these loans are more than half a million dollars and pose a great risk to lenders, borrowers will face more rigorous credit requirements. This includes having a much higher credit score and a lower debt-to-income ratio. Lenders will also want borrowers to prove they have a certain amount of cash reserves. The better your credit profile, the less your jumbo mortgage rate will be.

How Jumbo Loans Work

Recent jumbo loan interest rates for a 30-year fixed at Wells Fargo were 3.875 percent, while a conforming loan for the same term was 4 percent.

Jumbo loans traditionally have higher interest rates than conforming loans, and are meant to help highly qualified borrowers afford expensive homes. Jumbo loans are for more than $417,000 — or $625,500 in Hawaii and Alaska — the limits set by Fannie Mae and Freddie Mac as conforming loan limits.

To qualify for such high loans, jumbo loan borrowers are often required to have lower debt-to-income ratios, higher credit scores of 700 or better, larger down payments of at least 20 percent, and higher reserve funds than conforming loan borrowers.

Jumbo loans aren’t sold to Fannie Mae or Freddie Mac, so banks have more flexibility to down payment and debt-to-income ratios, says Travis Saling, a mortgage loan officer at Sierra Pacific Mortgage in San Diego, CA. Fannie and Freddie charge specific fees called “guarantee fees” to help guard against defaulted loan exposure. Jumbo loans are cheaper, in part, because they don’t have such fees, Saling says.

Recommended Reading: How Late Can You Be On Your Mortgage

Jumbo Loan Rates Make High

Jumbo mortgages are not just for the rich and famous.

With home prices rising nationwide and many high-cost areas getting even more expensive a jumbo mortgage can make sense for many who may not have considered one before.

And a jumbo loan may be surprisingly affordable.

Jumbo mortgage rates are often even lower than conforming loan rates. But with some lenders theyll be higher. So you have to do your due diligence and shop around for the best jumbo mortgage rate you can get.

In this article

Jumbo Loans Vs Conforming Loans

The key difference between a jumbo mortgage and a conforming loan is the size of the loan. For a thorough look at the two, and the pros and cons of each, read about the differences between conforming and nonconforming loans.

Among the other factors that differentiate jumbo loans from conforming loans:

You May Like: How To Find Out If A Home Has A Mortgage