Find A Real Estate Agent

You technically don’t have to use a real estate agent to find a home. But as a buyer, there’s no reason not to enlist an agent’s services, since you don’t pay a fee when you’re on the buying side. A real estate agent can help you navigate your local housing market and figure out what offer to make on the properties you’re interested in buying. An agent can also negotiate with sellers on your behalf.

Calculator: Start By Crunching The Numbers

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

The Importance Of Credit Scores For Mortgage Applications

To assess your financial records, lenders usually use three major credit reference agencies . These are Experian, Equifax, and TransUnion. While there are other CRAs, these are most preferred by lenders across the UK. Out of the three, Equifax is the largest credit reference agency used by most lending institutions.

UK Experian credit scores range between 0 to 999, with good credit ratings from 881 to 960. If youre aiming for an excellent rating, your credit score must fall between 961 to 999. As for Equifax, the scoring system starts from 0 to 700, with a good credit rating from 420 to 465. To get an excellent Equifax rating, your credit score should be between 466 to 700. Meanwhile, credit scores for TransUnion range from 0 to 710, with a good credit rating from 604 to 627. If you want an excellent TransUnion rating, your credit score must fall between 628 to 710.

To distinguish different CRA ratings between major credit agencies, refer to the chart below:

| Borrowers likely declined by lenders, usually gets mortgages with high rates. |

Here are several steps to improve and maintain your credit score:

Read Also: What Are Mortgage Loan Closing Costs

Work With A Buyers Agent We Trust

For more guidance on buying a house you can afford, work with a real estate agent. A good agent will help you set the right expectations when shopping for a home in your price rangethey may even be able to find you a home for sale that other buyers dont know about.

For a quick and easy way to find a RamseyTrusted agent, try our Endorsed Local Providers program. We only recommend agents who truly care about your financial path and wont push you to overspend on a house so they can bring home a bigger commission check. Find your real estate agent today!

How To Lower Your Monthly Payments

If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

- Lower purchase price: The less you borrow, the lower your mortgage payment

- Bigger down payment: Putting more money down means youll borrow less. Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors

- Avoid private mortgage insurance: When you put at least 20% down on a conventional loan or 20% home equity on a refinance you can avoid paying monthly private mortgage insurance premiums

- Longer loan term: A longer loan term means lower monthly payments. However, you will pay more in total interest over the life of the loan

- Shop for a lower rate: Rate shopping doesnt have to take long, and its well worth the savings. Here are tips to get your best mortgage rate

Also Check: How To Remove A Co Borrower From A Mortgage

Show The Seller Youre Making A Serious Offer

Youve probably heard of earnest money, but maybe you arent quite sure what it is. Think of it as your security deposit.

Earnest money tells the seller youre serious about buying their home. If you follow through with the contract, the money will be applied to your purchase. If you break the terms of the contract, you risk forfeiting the money to the seller.

There is no minimum requirement for earnest money. Youll negotiate an amount with the seller. Then, within a few days of the seller accepting your offer, youll deposit the earnest money into an escrow account.

Improve Your Credit Score

Lenders view your as an indicator of how likely you are to repay your loan or how likely you are to default. Consequently, it affects both the interest rate and the loan amount a lender is willing to offer you.

By taking concrete steps to improve your credit score, youll show lenders that you are a trustworthy borrower, and theyll reward you with a reasonable rate and, hopefully, a large enough mortgage to afford the home of your dreams.

Read more: How Your Credit Scores Affect Mortgage Rates

You May Like: What Did Mortgage Rates Drop To

I Want To Make Home Improvements Or Repairs

Looking to improve your home by making renovations or repairs? Borrowing against your homes equity with a home equity loan or a HELOC can generate the money you need.

A home equity loan is great if you need an exact amount for a single project. A HELOC is better when completing several projects over the course of many years since youre able to tap your equity as needed.

You can use a cash-out refi for home improvements, too especially if youre interested in getting the lowest interest rate. But again, the drawback is that youll have to finance most of your home value and pay interest over 30 years.

See this comparison of the best home improvement loans for more information.

Save A Bigger Down Payment To Make Your Home More Affordable

Remember, your down payment makes a big impact on how much home you can afford. The more cash you put down, the less money youll need to borrow. That means lower mortgage payments each month and a faster timeline to pay off your home loan. Just imagine a home with zero payments!

Now, Im always going to tell you the best way to buy a home is with 100% cash. But if saving up to pay cash isnt reasonable for your timeline, youll probably get a mortgage. Thats okay! Just save up a down payment thats 20% or more of the home price. If youre a first-time home buyer, a down payment of 510% is okaybut youllhave to pay that pesky private mortgage insurance .

PMI is a yearly fee that usually costs 1% of the total loan value. Its another expense on top of your monthly payment. It protects the mortgage company in case you dont make your payments and they have to take back the house .

PMI might change how much house you can afford, so include it in your calculations if your down payment is less than 20%. If thats you, stick to a 15-year fixed-rate mortgage with a monthly payment no more than 25% of your monthly take-home pay. You can also adjust your home price range to a lower amount so you can put down at least 20% in cash.

Trust me. Its worth taking the extra time to save for a big down payment. Otherwise, youll be suffocating under a budget-crushing mortgage and paying thousands more in interest and fees.

Also Check: What Is Mortgage On A 500k House

Calculate Your Mortgage Qualification Based On Income

In this calculator you can inclue investments, annuities, alimony, government benefit payments in the other income sources. Be sure to select the correct frequency for your payments to calculate the correct annual income.

- daily: 365 times per year

- weekly: 52 times per year

- biweekly: 26 times per year

- semi-monthly: 24 times per year

- monthly: 12 times per year

- bimonthly: 6 times per year

- quarterly: 4 times per year

- semi-annually: 2 times per year

- annually: 1 time per year

This calculator defaults to presuming a single income earner. If your household has 2 income earners then you can expand the “spouse or partner” section to enter their income information. We calculate the mortgage qualification ranges using the following maths:

| Your Mortgage Qualification |

|---|

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

Read Also: Can I Buy A Second House With A Mortgage

How Much House Can I Afford On My Salary

Lets say you earn $70,000 each year. By using the 28 percent rule, your mortgage payments should add up to no more than $19,600 for the year, which equals a monthly payment of $1,633. With that magic number in mind, you can afford a $305,000 home at a 5.35 percent interest rate over 30 years. But youd need to make a down payment of 20 percent.

How We Got Alice’s Mortgage Approved

“I was nervous the last time I attempted to buy a house. I was newly single and had never owned a property before, having rented my last flat with my ex. I thought Id struggle to pass affordability checks and land a decent interest rate since most people I know have joint mortgages and rely on two incomes. I didnt feel confident enough to dive into the market myself but luckily a friend recommended Online Mortgage Advisor, so I thought Id give them a try. After they matched me with a mortgage broker, I was surprised by the number of options available to me. Sarah, the advisor they paired me with, recommended the Help to Buy scheme to boost the equity Id end up with and they really took the stress out of the process while securing me a mortgage.”

Alice, OMA Customer

Don’t Miss: How Much Mortgage Can I Afford For 2500 Per Month

I Own A Home With No Mortgage Balance And Want To Buy Another House

Mortgaging your current home isnt always necessary when buying a second home, vacation home, or investment property. You may already have enough savings for a down payment without tapping into your equity, says Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

Before getting a mortgage on a house you already own, look into mortgage loans that allow low down payments. Home buyers should consider the following types of loans.

How To Calculate How Much House You Can Afford

To figure out how much house you can afford, all you need to do is crunch a few numbers. If math isnt your thing, hang in there. Ill walk you through it step by step.

And for you married folks, make sure you and your spouse look at the results together. You need to be on the same page when it comes to your budget and whats realistic for your money situation. After all, shopping for your home sweet home will feel very unifying and exciting once you both have a shared vision.

To calculate how much home you can afford, simply follow these five steps.

You May Like: Why Is My Mortgage Fico Score Different

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

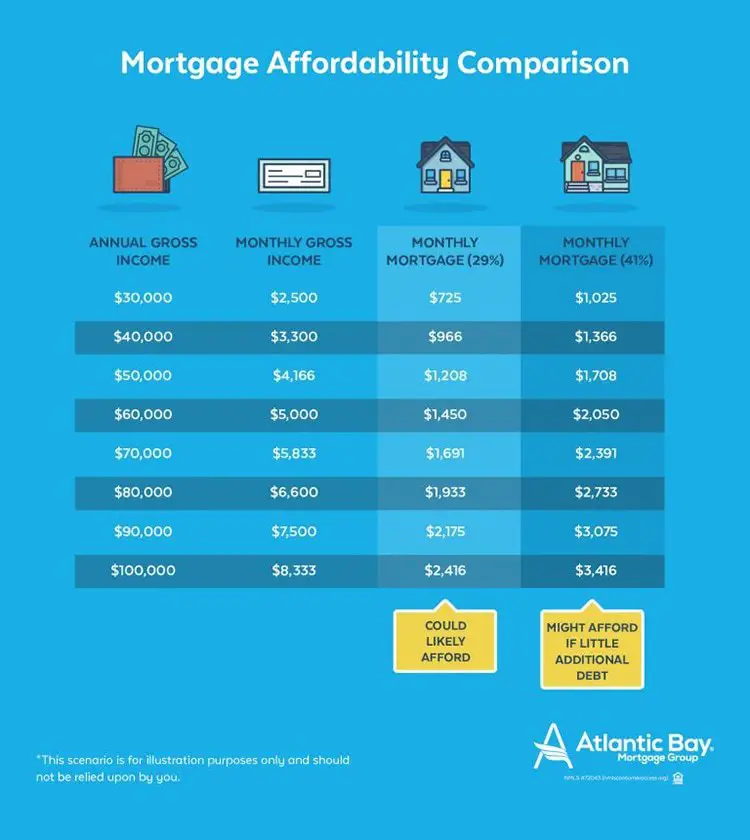

The 29/41 Rule And How It Relates To Calculating Home Affordability

When lenders evaluate your mortgage application, they calculate your debt-to-income ratio. This is your monthly debt payments divided by your monthly gross income. Lenders look at this number to see how much additional debt you can take on.

According to the 29/41 rule of thumb, its best to keep your DTI within a range thats defined by these two numbers. Heres an example.

The first number, 29, represents your housing expense ratio. This is calculated by dividing your mortgage payment into your gross monthly income and converting it to a percentage.

Its defined by the following formula:

Principal + Interest + Property Taxes + Insurance

+ Homeowners Association Dues

- Any other bills that may vary month to month

Step 2: Divide Your Monthly Debts By Your Monthly Gross Income

Next, do a simple calculation. For example, lets say your debts add up to $2,000 per month. If your monthly gross income is $6,000 per month, then your DTI ratio is 0.33, or 33%.

Don’t Miss: What Is The Mortgage On A 1 Million Dollar Home

Government Schemes To Help You Buy A House

The government schemes to help people get on to the property ladder may still be an option when purchasing a home alone. Schemes such as the help to buy and can enable buyers to get on the property ladder. Your mortgage advisor will be able to assist you in learning more about these schemes and if they are a good option for you moving forward. We have blog posts that explain the schemes in more detail- just click help to buy or to find out more.

You can get a mortgage on your own and this can be achieved by having an experienced mortgage advisor to help you achieve your dream. To find out more about single-person mortgages, government schemes or any mortgage questions, contact one of our experienced advisors. Your dream is ours to achieve.

Budget For Homeowner Costs

Beyond the costs of purchasing a home, youll likely have expenses related to owning and maintaining your home:

Homeowners insurance

Lenders will require that you carry homeowners insurance, which protects your property in case of damage. The amount will vary depending on your homes value and location. Certain areas that are prone to floods or earthquakes may have higher premiums.

Property taxes

You will also pay property taxes to your local government. This amount is based on the value of the property and land and is used to cover costs such as infrastructure, school, law enforcement, and fire service.

Maintenance and repairs

Maintenance includes the ordinary expenses that come with owning a home, such as painting, taking care of a lawn, fixing appliances, and cleaning living spaces. The average homeowner spent $2,289 a year on maintenance and repairs in 2016, according to Bureau of Labor StatisticsConsumer Expenditure Survey. If youre preparing your home for sale or just curious about general upkeep, review our home maintenance and repair checklist.

The average Homeowners Association fee is $200 to $300 per month for a typical single-family home, according to Realtor.com. This money usually covers shared amenities and services for a community such as a pool or gym, trash removal, snow removal, or maintenance to common areas.

Also Check: What Does Conforming Mean In A Mortgage

Getting A Mortgage On Your Own

If you are on your own this doesnt mean you cant get a mortgage. As a single person, you can get a mortgage and at Windsor Hill Mortgages we have the advice to help you achieve this.

The mortgage lender will worry if you can afford the mortgage and this is the same if there are one or two parties involved. Typically, two people will likely have a higher combined income enabling them to not only save for a deposit quicker or a larger deposit and have higher income combined which will lead to higher affordability. However, this doesnt mean that a single party applying for a mortgage cannot do the same. Saving for a deposit as a single person can be harder and may take more time but it is possible- we have a whole host of top tips on saving and saving for a deposit in particular.

Everyone will have different situations requiring different things from their mortgage and when searching for a home. At Windsor Hill Mortgages, we provide a personalised approach and will find a mortgage that suits your needs, All your personal circumstances will be taken into account and we will support you from start to finish- with our support you will not be going through your mortgage application alone.