How Much Mortgage Can I Get For 2000 A Month

Most mortgage providers cap their lending at 4.5x your income . If, for instance, you earn £60,000 a year, these lenders may loan you at least £240,000, providing you meet their criteria.

If you can safely set aside £2,000 just for the mortgage, the typical UK lender may offer you a mortgage of between £100,800 and £151,200 although this will fluctuate depending on the term length and the interest rate you end up on.

If youre the only applicant, with a good credit rating, some lenders might stretch to between £117,000 and £180,000. Your money could go further if youre offered favourable rates.

You can work out your maximum borrowing based on these income multiples by using our mortgage calculator below

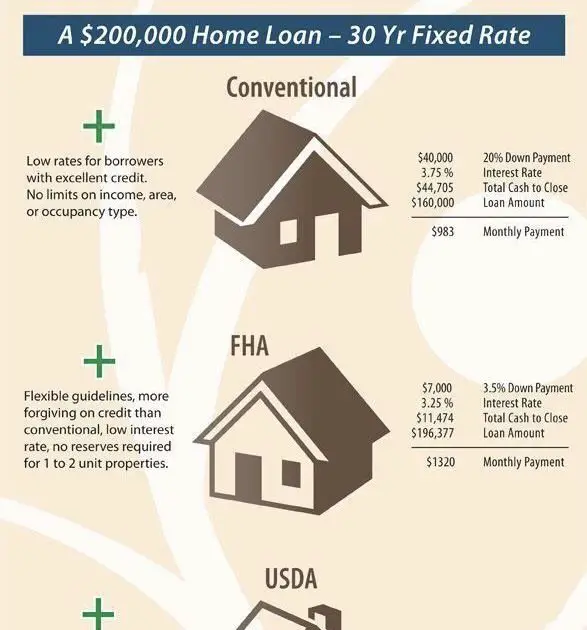

Learn More About Specific Loan Type Rates

The lower the interest rate on your mortgage, the less expensive your monthly payments will probably be. If you’re searching for a home and want to get a mortgage, it pays to compare mortgage rates for several loan types.

Purchase Rates

The term of your loan will also dictate what your monthly mortgage payment looks like. A shorter-term loan — for example, 15 years — will leave you with a lower interest rate on the amount you borrow. But it will also result in a higher monthly payment, since you’re paying off your home in half the time it would take with a 30-year mortgage.

How To Calculate A Down Payment

When it comes to down payments, they are the cash or liquid assets a purchaser is able to contribute to the purchase price of the residence. Most lenders require a 20% down payment on a home, but some will let buyers purchase a home with a significantly smaller percentage.

In addition to the amount of financing, lenders also want to know the length of time the mortgage loan will be needed. While the monthly payments on a short-term mortgage are higher, the overall cost is likely to be lower.

Recommended Reading: Is Reverse Mortgage Worth It

You Might Like These Posts Too:

Wednesday 25th of May 2022

Where do you find gas at $60 a month? LOL

Laura

Wednesday 10th of November 2021

Wow youve done a great job budgeting. With regards to iPhones you might look into Mint Mobile. I pay $15 per month and you get 4 gigs per month.

Anne Salter

Monday 3rd of July 2017

You don’t have municipal tax in the budget ours is about $10 000 per year but our mortgage payments are low. But that’s a tad more than $800 per month. good thing we have good public school and don’t have to splurge for private school for the kids!

Christine

Monday 3rd of July 2017

That’s definitely a super high tax! My budget only shows our bills and regular expenses. I don’t go into taxes and other things that get taken out of paychecks. We do pay taxes but they’re definitely not as high as yours. I’m glad you get good schools out of it!

34 Great Goals to Set to Change Your Life – The Simple Life

Monday 26th of June 2017

Create a monthly budget and stick to it

Compare Net Worth In 10 Years

In this section of the report, it shows the net worth after just 10 years of owning a home. You will accumulate a net worth of $201,963 over 10 years from the financial benefits of home ownership.

These 3 main financial benefits to owning a home are, paying down the principal on the loan, substantial tax deductions at tax time, and accumulated equity gains due to appreciation on the property.

In this example below, I used a conservative 2% annual appreciation rate . When renting, you will have a zero net worth due to paying rent to the landlord for the next 10 years.

As you can see above, there are lots of financial benefits you can gain by owning a home.

If you are short on down payment funds, check out the new 1% down conventional loan program with No monthly mortgage insurance PMI , there is also a Q& A section in the article too.

This 1% down program also allows for the 1% down payment to be gifted. There is also a lender credit available for closing costs. Ask me for more details on this program.

Recommended Reading: How To Pay Off Mortgage In 15 Years Calculator

Interest Rates Are A Primary Motivator For Todays Homebuyers

Even though the uptick in home prices ultimately cancels out the increase in purchasing power brought on by low rates, 55% of people who are moving for pandemic-related reasons said low mortgage rates are a factor in their homebuying plans. Thats according to a survey of more than 1,000 people who plan to buy a home within the next 12 months conducted by Redfin in July.

Im getting a lot of first-time buyers who are excited because they can finally afford a home, said Chriss Houghton, a Redfin agent in Vancouver, WA, located 10 miles north of Portland, OR across the state border. The typical home in Vancouver sold for $385,000 in July versus $470,000 in the city of Portland, and the more affordable housing combined with no state income tax in Washington make it an attractive option, particularly for people who can now work remotely. People who could afford $300,000 before can now afford nearly $350,000, and the difference is a huge motivator. For some families in neighborhoods without fierce competition, the uptick in buying power allows them to purchase bigger houses with more land where more than one generation can live.

The interactive chart below shows how much a homebuyer can afford to spend at different mortgage interest rates, with each line representing a different monthly payment.

Close On Your Mortgage

Once your lender is ready to close on your loan, you’ll bring a check for your down payment and will sign the necessary documents to put your mortgage into place. You’ll also have to pay closing costs on your loan, which can amount to 2% to 5% of your mortgage amount. Most lenders let you roll your closing costs into your mortgage and pay them off over time.

Whether you’re a first-time home buyer or are moving from one home to another, it’s important to know how much house you can afford. Crunch those numbers carefully before you make an offer on a house so you don’t wind up overspending on a home and regretting it after the fact.

Recommended Reading: Can You Get A Home Equity Loan With No Mortgage

The Conservative Model: 25% Of After

On the flip side, debt-hating Dave Ramsey wants your housing payment to be no more than 25% of your take-home income.

Your mortgage payment should not be more than 25% of your take-home pay and you should get a 15-year or less, fixed-rate mortgage Now, you can probably qualify for a much larger loan than what 25% of your take-home pay would give you. But its really not wise to spend more on a house because then you will be what I call house poor. Too much of your income would be going out in payments, and it will put a strain on the rest of your budget so you wouldnt be saving and paying cash for furniture, cars, and education.

Notice that Ramsey says 25% of your take-home income while lenders are saying 35% of your pretax income. Thats a huge difference! Ramsey also recommends 15-year mortgages in a world where most buyers take 30-year mortgages. This is what Id call conservative.

How Much Savings Should I Have Before Buying A House

This depends on how much you intend to put up as a down payment. If you pay less than 20% of the sales price, you will have to pay PMI as part of your monthly repayments. You will also need to pay for mortgage closing costs. Its a good idea to have at least $3,000 to $10,000 saved up to cover these costs or unexpected expenses along the way.

You May Like: How Soon Will I Pay Off My Mortgage Calculator

Using The Mortgage Qualifying Calculator

The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory. Just fill in the various fields with the information requested. Start by choosing if you want to base the calculation on your annual income, the purchase price of the home you’re looking at or the monthly payment you can afford. Then work down the page entering your other information and the calculator will figure out the other two values for you and display them in gray.

For example:

- Enter your annual income and the Mortgage Qualifying Calculator will determine the maximum purchase price you can afford and the associated monthly payment.

- Enter the purchase price and the calculator will tell you the income you need and the monthly payment required. Or,

- Enter the monthly payment you’re thinking of and the Mortgage Qualifying Calculator will tell you the income needed to qualify and the home purchase price that will cover.

Then go down the rest of the page entering the information requested. Your answers will be displayed in gray at the top of the page. Click “View report” for a detailed breakdown and an amortization report.

How Do I Qualify For A Mortgage For 2000 A Month

Weve already discussed how much you would likely need to be earning to qualify for a £2,000 a month mortgage, but here are some additional factors the lender could take into account when assessing your eligibility for a home loan with these specific monthly payments

- How you make your money: Specialist advice may be required if your £2,000 a month mortgage payments will come from self-employment or supplemental sources. For example, there are lenders who offer mortgages with bonuses or commission factored in.

- Your outgoings: Some lenders might be reluctant to offer you a £2,000 a month mortgage if you have significant outgoings, such as outstanding loans or dependent children.

- Whether another person will be named on the mortgage: You could potentially borrow more on a joint mortgage.

- Your credit report: You can access your credit reports and free trials below.

Read Also: How To Shorten A 15 Year Mortgage

If I Make 2000 A Month How Much Mortgage Can I Afford

In the UK, £2,000 per month after tax comes to around £31,000 per year.

If you are on this amount, the mortgages on offer to you would likely range between £139,500 and £186,000. This is because UK providers usually cap their lending between 4.5 and 6 times the borrowers salary, but keep in mind that your choice of approachable lenders, and therefore the best rates, will be more difficult to come by if you need to borrow 6 times your income.

Let The Bank Use Dti To Determine Your Maximum Purchase Price

When you ask a bank to calculate your maximum home purchase price, the bank will give very little consideration to your existing home hunt, or any properties on which youve considered making an offer.

Rather than using a specific sales price, the bank will consider your annual income and your annual debts only.

It will use that data to find the largest mortgage payment you could make without raising your debt-to-income ratio above allowable maximums.

Most conventional loans enforce a maximum DTI of 45%, with the exception of the HomeReady program, .

FHA, VA, and USDA mortgage loans also enforce a maximum DTI near 45%. Jumbo mortgages stop around 40% DTI.

Now, once the bank has found your maximum mortgage payment, it uses to back in to a loan size, which tells you how much you can borrow.

This method of determining how much home you can afford is effective, but dangerous. Its based on borrowing the absolute maximum for which you can get approved, which is often not advisable.

Banks cant tell you what you should pay for a home they can only show you what you could pay for a home.

Your debt-to-income is considered in two parts the front-end ratio and the back-end ratio.

Also Check: Can You Do A Reverse Mortgage On A Condo

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Speak To An Expert Broker About 2000 A Month Mortgages

Unsure and looking for more information on how much mortgage you get for 2000 a month? Call us today on 0808 189 2301 or make an enquiry.

Then sit back and allow us to do the hard work in finding the right mortgage advisor for your situation. We dont charge a fee and there are no obligations.

Ask a quick question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

*OMA Mortgage Approval Guarantee is subject to you providing satisfactory documentation. See T& Cs.

Maximise your chances of approval, whatever your situation – Find your perfect mortgage broker

You May Like: What To Expect When Applying For A Mortgage Loan

How Does My Debt

Your debt-to-income ratio measures your monthly debt compared to your monthly income. A mortgage lender will use your gross income when calculating your debt-to-income ratio for mortgage approval. Generally, lenders like to follow the percentages above so that your monthly mortgage payment does not exceed 28% of your gross monthly income, and your total debt doesn’t exceed 36% of your gross monthly income. However, if your debt makes it so your ratio is higher, you might still get approved for a mortgage, especially if you have a great .

Keep in mind, though, that there’s a difference between qualifying for a mortgage and being able to afford it comfortably. If you already have a lot of monthly debt payments before taking on a mortgage, you may find that it’s difficult to keep up.

Today’s Mortgage Rates In Pennsylvania

| Product |

|---|

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Recommended Reading: What Is A Normal Mortgage Rate

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Documents Needed For Mortgage Application

Here are a few documents you should gather to help you understand your financial situation and how much house you can afford. This information will also be required when you apply for a pre-approved home loan.

- Recent statements from all bank and investment accounts

- Pay stubs and W-2 income tax forms

- Total monthly expenses, including all bills, groceries, clothing budgets, etc.

- All of your assets, including stocks, 401, IRAs, bonds, cash, rental properties, etc.

- All debt including credit cards, student loans, car loans, mortgages, etc.

- Profit and loss statements if you are self-employed

- Gift letters if you are using a gift to help with your down payment

Recommended Reading: How Much Money Should You Spend On Mortgage

How Much Mortgage Payment Can I Afford

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.