Commercial Mortgage Brokers Fee 0

This fee only applies if you use a broker or platform to arrange and negotiate your commercial financing options. For arranging a small-balance commercial mortgage , youâll typically see a fee hovering around 1â1.5% of the loan amount. If youâre unsure that your broker is worth a 1% fee for helping you with financing, check out this previous blog post:

Is your mortgage broker worth 1%?

A good commercial mortgage broker brings more to the table than financial metrics can state â things like certaintyâ¦

blog.stacksource.com

When reviewing a fee agreement with a commercial mortgage broker, be advised that some less-than-transparent brokers may also collect a fee from some of their lending partners, essentially âdouble dippingâ on the fee. In the commercial financing space, this is legal and not altogether uncommon.

How Are Closing Costs Paid

If youre buying a home, closing costs must be paid in cash and cant be rolled into your mortgage payment, as they can with a mortgage refinance. Budget these costs into your home purchase and plan on how you will cover these costs at closing time.

That said, you can always try negotiating on your closing costs to help reduce your out-of-pocket expenses.

Prorated Real Estate Taxes

When someone sells a property, theyre usually required to pay the real estate taxes for the portion of the year for which theyve held the property. This is because the buyer will pay the real estate taxes for the full year when they get their property tax bill at the next billing cycle. The seller is simply crediting back the real estate taxes due for the portion of the year they owned the property.

You May Like: How Much Is Mortgage On 1 Million

What Is A No Closing Cost Mortgage

A no-closing-cost mortgage is one in which you aren’t required to pay closing costs upfront. … The only difference is that, under a no-closing-cost mortgage, your lender will either add those fees onto your principal balance or charge you a higher interest rate on the loan to cover those closing costs, Meier says.

How To Reduce Or Avoid Closing Costs

When youve spent months or even years saving for a down payment, searching for a property, negotiating a purchase price, going through due diligence and securing financing, paying closing costs can be an unwanted surpriseand they can make it that much harder to afford your new property.

With that in mind, a lot of people want to try to reduce or avoid closing costs. While its impossible to eliminate closing costs entirely, there are some things you can do to reduce your expenses, including:

Additionally, certain closing costs can sometimes be added to a buyers loan amount, rather than paying it in cash at closing. What costs can be rolled into your loan vary by lender, but may include origination fees, appraisal and inspection fees or title fees. While this can lead to some initial cost savings, it will actually increase the total mortgage cost, as youll pay interest on these expenses over the life of the loan.

Read Also: Chase Mortgage Recast Fee

How To Pick The Right Mortgage In Oklahoma

not all mortgages are created equal.lenderloan terminterest rate

- Lender: Banks, credit unions, and independent mortgage brokers will each offer you different terms and conditions.

- Term: Most conventional mortgages last for 15 or 30 years. The shorter your loan term is, the higher your monthly payments will be, but youâll likely enjoy a low interest rate.

- Interest rate: Interest rates can vary greatly depending on the lender, but you can expect a rate of around 4.3% for a 30-year fixed mortgage.

interest rate of 3.5-4%

Managing All Your Costs

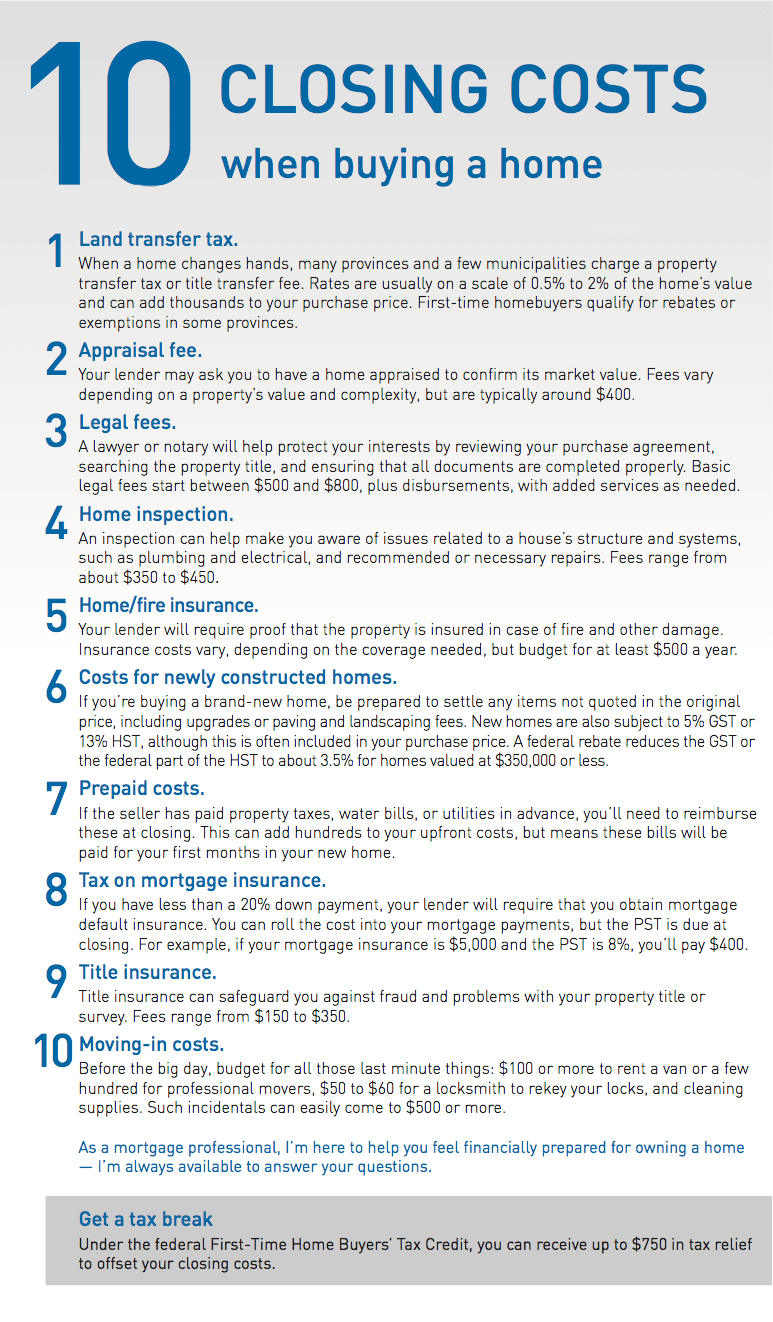

If youâre planning to work with a real estate agent, lawyer, movers or other professionals, you may want to get a detailed estimate from them early on. This can help you determine how much these outside services will cost ahead of time so you can begin to set aside money for these additional costs as well. Being aware of and closely tracking every expense from every source is a great start to creating a realistic budget that can help you account for and meet all your financial obligations.

Speak to a mortgage specialist for help identifying and sorting out the many costs associated with closing, moving and moving into your new home.

All residential mortgages and lending products are provided by Royal Bank of Canada and are subject to its standard lending criteria.

Also Check: What Does Gmfs Mortgage Stand For

What Should I Know About Closing Costs

Closing is the last step in the home-buying process. Closing happens in a meeting between a combination of the buyer, the buyer’s agent, the seller, the sellers agent and a closing agent. The closing agent is either an attorney or a representative from the title company which manages the homes ownership paperwork.

What Is Earnest Money

Earnest money is a deposit made to a seller that represents a buyer’s good faith to buy a home. The money gives the buyer extra time to get financing and conduct the title search, property appraisal, and inspections before closing. In many ways, earnest money can be considered a deposit on a home, an escrow deposit, or good faith money.

Read Also: Chase Recast Mortgage

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Homeowners Association Transfer Fee

If you buy a condominium, townhouse, or property in a planned development, you must join that communitys homeowners association . This is the transfer fee that covers the costs of switching ownership, such as document costs. Whether the seller or buyer pays the fee may or may not be in the contract you should check in advance.

The seller should provide documentation showing HOA dues amounts and a copy of the HOAs financial statements, notices, and minutes. Ask to see these documents, as well as the covenants, conditions, and restrictions , bylaws, and rules of the HOA before you buy the property to ensure its in good financial standing and a place you want to live.

Also Check: Reverse Mortgage Mobile Home

Closing Costs V Concessions

One of the big benefits of VA loans is that sellers can pay all of your loan-related closing costs. Again, theyre not required to pay any of them, so this will always be a product of negotiation between buyer and seller.

In addition, you can ask the seller to pay up to 4 percent of the purchase price in concessions, which can cover those non-loan-related costs and more. VA broadly defines seller concessions as anything of value added to the transaction by the builder or seller for which the buyer pays nothing additional and which the seller is not customarily expected or required to pay or provide.

Some of the most common seller concessions include:

- Having a seller cover your prepaid taxes and insurance costs

- Having a seller provide credits for items left behind in the home, like a pool table or a riding lawn mower

- Having a seller pay off your collections, judgments or lease termination fees at closing

In some respects, as long as you stick to that 4 percent cap, the skys the limit when it comes to asking for concessions.

VA buyers are also subject to the VA Funding Fee, a mandatory charge that goes straight to the VA to help keep this loan program running. For most first-time VA buyers, this fee is 2.30 percent of the loan amount, provided youre not making a down payment. Buyers who receive VA disability compensation are exempt from paying this fee.

What Is Earnest Money Used For

In real estate, earnest money is effectively a deposit to buy a home. Usually, it ranges between 1-10% of the homes sale price. While earnest money doesnt obligate a buyer to purchase a home, it does require the seller to take the property off of the market during the appraisal process. Earnest money is deposited to represent good faith in purchasing the home.

Don’t Miss: Rocket Mortgage Qualifications

Understand The Different Costs

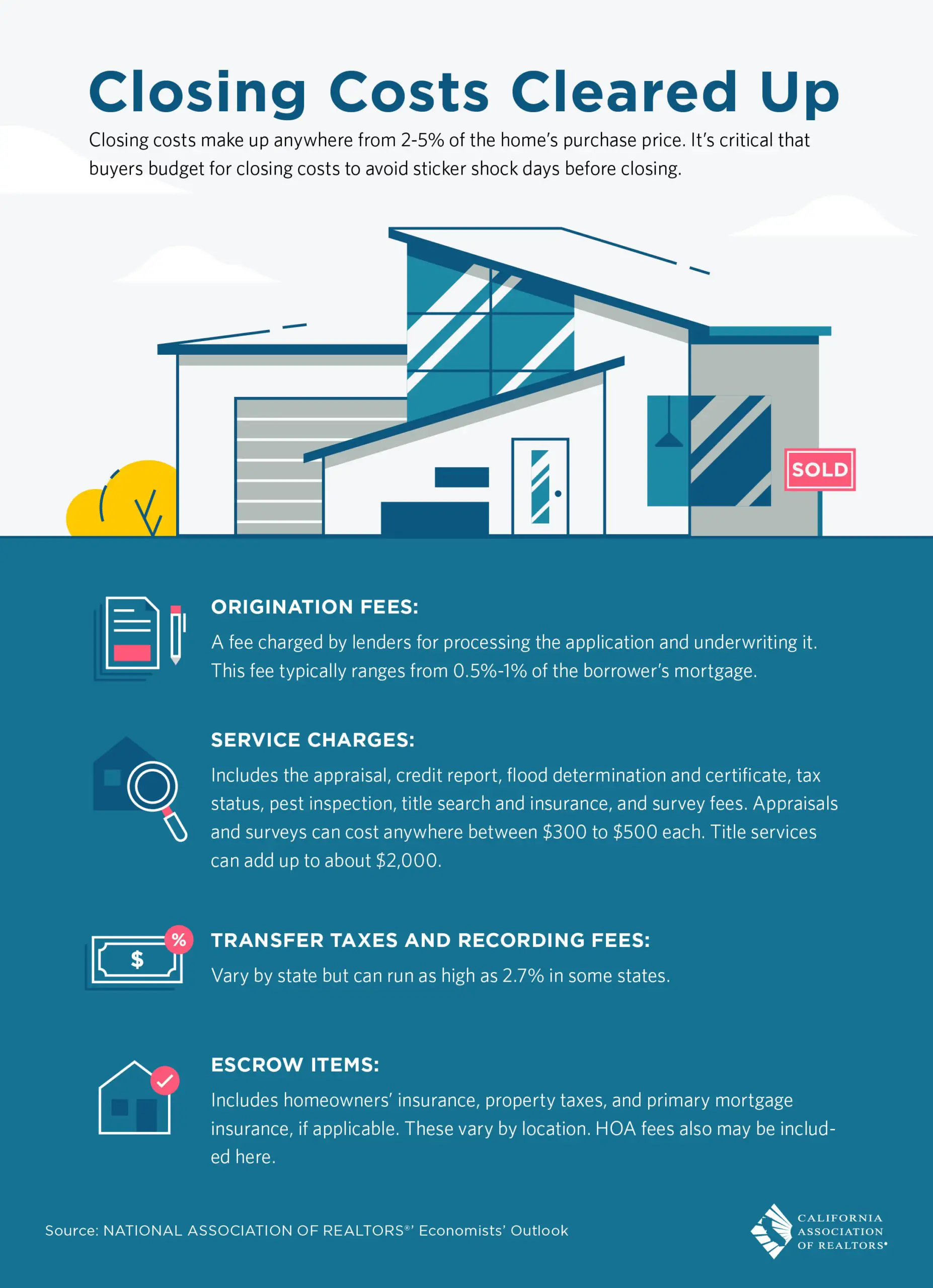

Closing fees come in different sizes and from various sources. There are the fees that the lender charges, and then there are also state and federal taxes that homebuyers have to pay. Lender fees are going to vary from one bank or mortgage broker to the next, and this is where you can find the most potential savings. On the other hand, theres little to no room for negotiation with things such as city, county, and state transfer taxes, prepaid property taxes, and recording fees.

The most common costs that homeowners will face to close on the home include a land survey, a home appraisal, credit checks, a loan origination fee, an application fee, and home inspection fees. A borrower may also purchase points to lower the interest rate over the life of the mortgage loan. The amount that someone is going to pay in closing costs depends on the financial company and the mortgage-related fees that it charges, the state in which the home is located, and how much the loan is for.

In 2019, the highest average closing costs, excluding taxes, were in the District of Columbia , New York , Hawaii , California , and Washington , while the lowest were in Indiana , Nebraska , Iowa , South Dakota , and Arkansas .

How They Get Paid

Mortgage brokers charge a fee for their services, about 1% of the loan amount. Their commission can be paid by the borrower or lender. You can take a loan at par pricing, which means you wont pay a loan origination fee and the lender agrees to pay the broker. However, mortgage lenders typically charge higher interest rates. Some brokers negotiate an up-front fee with you in exchange for their services. Make sure you ask prospective brokers how much their fee is and who pays for it.

You May Like: Requirements For Mortgage Approval

***miscellaneous Fees That Are Not Applicable In All States***

State Tax/Stamps Mortgage In some states there are state charges whenever you do any type of Real Estate transaction including Refinances. These are state or county specific charges that are required to be paid and are usually based on the dollar amount shown on the Deed or Mortgage.

Intangible Tax This is just like the State Tax/Stamps Mortgage and is required for all Real Estate Transactions in some states. Again the example is Florida where there is a mandatory state charge. Other States such as Texas, Illinois, Pennsylvania and New Jersey have other miscellaneous additional charges not seen on all Good Faith Estimates as they are either local or state fees that vary from transaction to transaction but usually do not add up to be too significant as far as the dollar amount of the cost.

Closing Costs: What You Need To Know

When it comes to saving money to buy or refinance a home, youve probably been pretty focused on the down payment. But youll also need to plan for closing costs, which are due on closing day.

Understanding what closing costs are, how much they cost on average and whats included can help eliminate any unexpected last-minute financial obstacles when you close on your new home.

Don’t Miss: Who Is Rocket Mortgage Owned By

How Do I Calculate Closing Costs And What Should I Expect To Pay

On average, most home-buyers will pay between three and six percent of the purchase price of their home in closing costs. This amount varies depending on the amount of the mortgage loan, the loan type and the region in which you are purchasing.

For example, if your home costs $200,000, you may pay between $6,000 and $12,000 in closing fees. Before closing, discuss the details of these costs with your lender and find out if they are willing to offer you a loan with lower fees.

The average total cost of closing fees for home-buyers is about $3,700. The higher the purchase price of your home, the higher your closing costs will be. While the average closing cost amount for a $150,000 house might be between $3,000 and $7,500, the average closing costs for a $600,000 are between $12,000 and $30,000.

If you dont have a real estate agent to estimate the total amount of your closing costs for you, you can calculate the total by adding the fees yourself.

Though the seller does cover certain closing costs, there are closing costs that the buyer should expect to be responsible for paying. But how much will each fee actually cost you? Here is a breakdown of the typical closing costs that home-buyers can expect to pay:

What Does 60% Ltv Mean

As the name suggests, LTV is the maximum amount that the lender will consider loaning to you as a percentage of the value of the property. For example, a mortgage with a Maximum Loan to Value Ratio of 60% would probably be offered with a lower interest rate.

What do closing costs pay for? These costs include, but are not limited to: land or property transfer taxes, lawyer fees and inspection fees. In most cases, they have to be paid upfront and cannot be rolled into your mortgage. Generally, it is a good idea to budget between 3% and 4% of the purchase price of a resale home to cover the closing costs.

Is a LTV of 40 good? What is a good loan to value ratio? As a general rule of thumb, your ideal loan to value ratio should be somewhere under 80%. Anything above 80% is considered a high LTV there are plenty of mortgages available for people with LTVs at 80, 90 or even 95%, but you’ll be paying much more on interest.

Also Check: Mortgage Recast Calculator Chase

How To Lower Your Closing Costs

While you cant avoid paying all closing costs, there are some that can be negotiated, potentially saving you money. Here are a few tips:

- Consider working with a mortgage lender that doesnt charge an origination fee, or thatll offer you a discount. If youre getting your mortgage at your bank, you can also try asking for a discount or fee waiver, since youre already a customer.

- If youre a first-time homebuyer, explore down payment assistance and grants that can help you cover closing costs.

- Look into a no-closing-cost loan but dont let the name fool you. No-closing-cost loans do, indeed, still charge closing costs they are simply rolled into the principal, so youll be paying them back, with interest, with your mortgage.

What Are Closings Costs

Closing costs are things that have to be paid in order to close on your home, like property taxes, homeowners insurance, title search fees, appraisal fees, etc.

Services completed and costs involved in the loan process need to get paid. All of those fees and expenses are lumped together under the umbrella of closing costs.

Now, although they are called closing costs, you may be asked to pay for them as the action happens such as the home inspection or the appraisal.You may be able to negotiate as part of your sales contract that the seller of the property cover some or all of your closing costs , but it doesnt hurt to be prepared for them and understand them.In general, you can expect to see between 2-6% of your purchase price in closing costs. Because each state has different requirements, some items mentioned below may not apply to your specific situation. Things like transfer taxes, mortgage insurance, and title insurance are not flat-rate type costs. Be sure to ask your loan officer for more information on these items.

Read Also: Monthly Mortgage On 1 Million

What Are Typical Closing Costs

Closing costs typically range from 3%6% of the homes purchase price. Thus, if you buy a $200,000 house, your closing costs could range from $6,000 to $12,000. Closing fees vary depending on your state, loan type, and mortgage lender, so its important to pay close attention to these fees.

Homebuyers in the U.S. pay, on average, $5,749 for closing costs , according to a 2019 survey from ClosingCorp, a real estate closing cost data firm. The survey found the highest average closing costs in parts of the Northeast, including the District of Columbia , Delaware , New York , Maryland , and Pennsylvania . Average closing costs in Washington State were also among the highest. The states with the lowest average closing costs included Indiana , Montana , South Dakota , Iowa , and Kentucky .

A lender is required by law to provide you with a loan estimate within three business days after receiving your mortgage application. This key document outlines the estimated closing costs and other loan details. Though these figures might fluctuate by closing day, there shouldnt be any big surprises.

Helping You Earn Through Partnerships

Our top priority is to help you learn and earn. Our articles are provided free of charge, and the information found here can help you build wealth for life. We offer an independent perspective on financial services, financial markets, and good practices for personal finance. Our main goal is to help you grow your money.Wealthy Millionaire helps you earn by recommending services through our carefully vetted list of partnerships. Our research and professional insight were built through years of financial industry experience, and our recommended products are based on an independent analysis of the best service providers in the market. These recommendations are objective we do not accept special payments to recommend products and services from our partners.Loan offers that appear on this site are from companies from which Wealthy Millionaire receives compensation. This compensation may impact how and where products appear on this site . Wealthy Millionaire does not include all lenders or loan offers available in the marketplace.

Don’t Miss: Recasting Mortgage Chase