What To Do If You Cant Get Preapproved

If you cant get a preapproval, try to find out from the lender why you were denied. If its an issue you can remedy, like an error on your credit report thats causing the lender to reject your application, you can address that right away and seek a preapproval again when its resolved.

If you have too low of a credit score or other financial roadblocks preventing you from being preapproved, you can work to improve those areas, too. Raise your score by making payments on time and paying down your debt load, for example, or lower your debt ratio by finding a way to increase your income. Depending on your situation, this could take time, but itll go a long way.

Some lenders have very stringent qualifying criteria, so another option is to work with a different, more flexible lender. If youre an account holder with a local bank or member of a credit union, these institutions might be more willing to work with you to get you preapproved.

Get A Confidence Boost

Getting pre-approved for a mortgage is a giant step in your house hunting journey. Learn more about getting preapproved.

1 Pre-approval is based on non-verified information and is not a commitment to make you a loan by SunTrust Mortgage. Loan approval will be subject to, but not limited to, verification of all income, asset and liability information provided by you, satisfactory property appraisal, compliance with SunTrust Mortgages loan program guidelines and all required closing conditions such as survey and title examination.

This content does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

When To Get A Preapproval

The best time to get a mortgage preapproval is before you start looking for a home. If you dont, and you find a home you love, itll likely be too late to start the preapproval process if you want a chance to make an offer. As soon as you know youre serious about buying a home that includes getting your finances in home-buying shape you should apply for a preapproval.

If youre following mortgage rates, you can to determine the right time to strike on your mortgage with our daily rate trends.

Don’t Miss: Rocket Mortgage Conventional Loan

What To Do If You’re Declined For A Preapproval

There’s always a chance you won’t get preapproved for a mortgage. But don’t be disheartened. One rejection doesn’t mean you can never get a mortgage. Especially during the pandemic, some lenders have tightened their standards for credit scores, down payments and more. But that won’t last forever.

“We’ve been seeing these restrictions starting to soften as the market starts to recover and the economy becomes more accustomed to a completely virtual way of life,” Watters said.

If you do get rejected, be sure you try applying with another lender. If one lender denied you for a credit score of 690, you can probably find a lender that’s still qualifying borrowers for a conventional loan at 620 and above.

If you apply with a few lenders and still can’t get preapproved, don’t lose heart. Under the Equal Credit Opportunity Act , your lender has to tell you why your application was denied. It may have been your credit score, or it may be that you haven’t been at your current job long enough. Whatever the reason is, now you know what to work on so you can get preapproved in the future.

Get It Done In Minutes

Pre-approvals are free. Your lender will need to qualify you for a mortgage at some point anyway, so it helps them to get started early.

If you have your documents together, you can even get a pre-approval within minutes online. It can take a couple of days if you need extra documentation.

Watch: Here are trends you can expect in the housing market this year. Story continues below.

There are plenty of benefits to getting pre-approved and theyre not just financial. Here are the five biggest advantages.

Helping you set a home-buying budget: While you might have a dream budget in mind, a pre-approval gives you a firm upper limit on what you can afford. This allows you to focus your house-hunting efforts on areas and properties within your means.

Knowing the rate you can qualify for: Not everyone qualifies for the lowest advertised rates. A pre-approval tells you what rates youre eligible for given your needs and financial situation.

Calculating your mortgage payments: A pre-approval not only tells you what rate and amount you qualify for, it also shows how much your monthly mortgage payment will be. This lets you know how much of your monthly income youll need to set aside for your mortgage and helps with budgeting.

Don’t Miss: Chase Recast

Why Apply For A Mortgage Pre

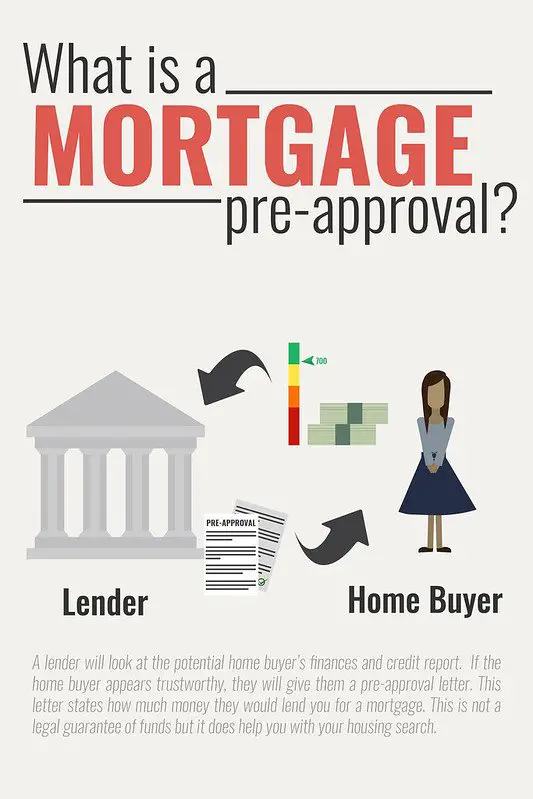

A mortgage pre-approval is an important part of the home buying process. If you are pre-approved, it means that a lender has stated that you qualify for a mortgage loan based on the information you have provided, and subject to certain conditions. A mortgage pre-approval often specifies a term, interest rate and principal amount. Although not a required step, it is helpful as it can give you a clearer picture of how much house you may be able to afford.

It Doesn’t Guarantee You A Home Loan

You might assume that if a mortgage lender pre-approves you for a home loan, you’re automatically guaranteed that mortgage once you’re ready to sign it. But that’s not the case. Mortgage pre-approval is not the same as getting an actual mortgage, and if your financial circumstances change between the time you’re pre-approved and the time you want to apply for a home loan, you may be denied.

Still, getting pre-approved is a step in the right direction. And if nothing changes for the worse, financially speaking, then there’s a strong chance you will get a mortgage once you want one.

You May Like: Rocket Mortgage Launchpad

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Everything That A Homebuyer Needs To Get Pre

Bottom Line PersonalConsumer ReportsPrevention

As you search for a home, getting pre-approved for a mortgage can be an important step to take. Consulting with a lender and obtaining a pre-approval letter provides you with the opportunity to discuss loan options and budgeting with the lender this step can serve to clarify your total house-hunting budget and the monthly mortgage payment that you can afford.

As a borrower, its important to know what a mortgage pre-approval does , and how to boost your chances of getting one.

Read Also: Can You Do A Reverse Mortgage On A Condo

Start The Preapproval Process

If youre ready to start house hunting or even considering it in the near future its time to start the mortgage process by getting preapproved for a home loan.

The approval process will help you lock in your borrowing power and give you an advantage in a competitive housing market. Itll also turn up relevant issues, like a low credit score, that you might fix before beginning your homeownership journey.

Ready to get started?

Things To Know About Home Loan Pre

Here are 10 things every home buyer should know about home loan pre-approval letters:

Read Also: Reverse Mortgage For Condominiums

So What Do These Letters Of Pre

Lets say you find the perfect house. Your real estate agent puts together an offer to buy packet your offer price and contract, and financial information to show youre capable of buying including your letter of pre-qualification or pre-approval for a loan.

And, lets say the seller has some things he or she is looking for in addition to the right price a quick sale and a quick move. When the seller reviews the offers, a buyer pre-approved for a loan equals someone who can close on the purchase in as little as 14 days, according to Blonder. All thats left for the lending institution to do is conduct a home appraisal and make sure theres a cleantitle of ownership.

On the other hand, a buyer pre-qualified for a mortgage is going to close in the typical 30-60 days, if he can actually get a mortgage for the price hes offered, because he still has to go through the loan process that the pre-approved guy went through!

If You Get Declined For Your Preapproval Dont Despair

- Find out why you were declined, so you can figure out what to do to improve your chances of getting a loan in the future.

- Ask the lender to explain why you were declined. Was your credit score too low? Was there specific negative information on your credit report?

- Ask to see a copy of the credit score the lender used. If the lender used your credit score to deny your preapproval request, the lender must send you a notice with the credit score they used to make the decision and instructions on how to get a free copy of your credit report.

- If there are errors on your credit report, get them corrected.

- If you need help improving your credit, contact a HUD-approved housing counselor. You can find a counselor online or by calling 1-800-569-4287.

Read Also: Reverse Mortgage Mobile Home

Get Information From A Source You Trust

It’s natural to have questions. Besides the basics such as the interest rate and term, it’s a good idea to ask about other things like prepayment charges if you plan to sell your property or pay down your mortgage loan faster. To ensure that you get accurate, actionable information we recommend seeking answers from a trusted source. TD Mortgage Advisors are well versed in every aspect of the mortgage process and can be an easily accessible source of information.

Why Is Getting Approved For A Mortgage Important

Getting approval for your mortgage means that a lender has reviewed your financial situation and confirmed your ability to take on mortgage payments.

When you get a mortgage approval, your lender estimates how much you can afford to borrow, what your interest rate could be and how much your mortgage payments could be. You and your real estate agent can use this information to focus on homes you can afford.

A mortgage approval also proves to sellers that you can afford the home theyre selling. Without first securing approval from a lender, the seller might not trust your offer is genuine. Your offer might not be accepted and even if it is, offering to buy a home without lender approval can slow down your mortgage loan application.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Mortgage Prequalification Vs Preapproval Letters: Which One Has A Better Chance Of Getting The House

When it comes time to actually get a mortgage, mortgage prequalification vs preapproval letters are miles apart from each other, says Brian Blonder, Senior Vice President of Mortgage at Capital Bank, N.A. Pre-qualification speaks to someones general ability to execute the process of buying a home. Pre-approval is a commitment, with some contingencies, from a lending institution to give that person a home loan.

Read Also: 10 Year Treasury Vs Mortgage Rates

Whats The Difference Between Mortgage Prequalification Vs Preapproval

Quick quiz: Youre thinking of buying a home Whats the first thing you do?

A. Look online for open houses you can tour

B. Find a real estate agent

C. Talk to a loan officer

The answer is C and not just because were a bank. A loan officer helps pin down your financial profile and supports you in taking the first steps toward home ownership by getting you pre-qualified or pre-approved for a mortgage.

When Should You Apply For Conditional Approval

Homebuyers often apply for conditional approval once theyâve done some initial research like:

- Working out your borrowing capacity using our various financial tools and calculators.

- Working out how much you can afford to repay.

- Looking at the local property market and suburb youâre interested in.

- Viewing the different home loans we have, and using our product selector if youâre not sure which one is the right fit for you.

Donât apply too early – our conditional approval is valid for 90 days from application, but you can apply again.

Don’t Miss: Rocket Mortgage Loan Types

Want To Learn More About Buying A Home

From saving for a down payment to what to do after closing, our first-time home buyer’s guide walks you through the home buying process.

And dont forget another key step to buying a home is properly insuring it. Your mortgage lender may recommend you an insurer, but its up to you to find the right provider that best fits your needs and thats where we come in! At American Family, you can control what you pay for insurance by customizing a homeowners policy built around you. Reach out today, our agents are ready to help discuss the best ways to protect your hard-earned dream.

When Should I Get Preapproved For A Mortgage

Buyers who get a mortgage preapproval before they begin house shopping have an advantage over buyers who have not gone through the mortgage preapproval process. Real estate professionals prefer to work with preapproved buyers, and some sellers will only accept offers from buyers with a preapproval letter.

Additionally, preapproved buyers know what size loan they will likely qualify for and can avoid falling in love with a home only to learn its outside their price range. Also, buyers who have gone through the home loan preapproval process can quickly and confidently make an offer when they find a home they can afford.

For these reasons, its advantageous to go through the preapproval process for mortgage loans before you begin house shopping seriously or start working with a real estate agent. Some buyers may consider getting a mortgage preapproval even earlier to get an idea of where they stand. Doing this provides an opportunity to address any issues.

Heres a look at where a mortgage preapproval falls in the homebuying process.

Also Check: Rocket Mortgage Vs Bank

Are There Drawbacks To A Pre

There aren’t any great drawbacks to obtaining a single pre-approval, but having several in a short period can potentially harm your ability to borrow.

Pre-approvals will be visible on your credit file as a loan enquiry, and having many in quick succession and with multiple lenders might create the impression that you’re financially unstable.

While this shouldn’t discourage you from seeking pre-approval, it does mean it’s a good idea to wait until you’re seriously considering a purchase, rather than applying early in the process when you might just be entertaining the idea.

If youre not quite ready to apply, you can get an idea of how much you may be able to borrow using the Suncorp Bank Borrowing Limit Home Loan Calculator.