How Inflation Influences Bond Rates

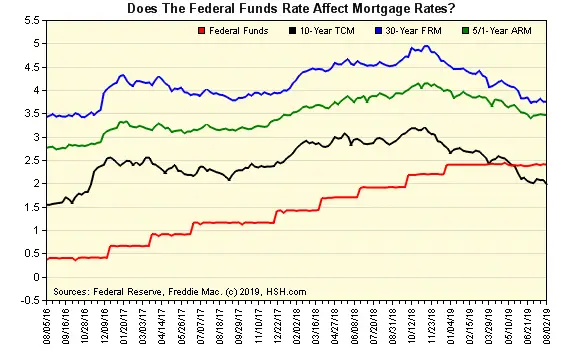

Inflation, the rise in prices over a period of time, reduces the buying power of the dollar. When inflation is high, the income earned by bond investors has less value, because its purchasing power has been reduced. Therefore, fixed-rate bonds tend to be less attractive to investors during periods of high inflation. A decline in bond demand creates a decline in bond prices. Bond yield is a function of the price and the stated interest rate on the bond thus, a decline in its price leads to an increase in its yield.

As noted above, MBS yields and mortgage rates tend to move with bond yields. Since inflation rates impact bond yields, they also impact mortgage rates.

How Will Banks Handle My Mortgage During Hyperinflation

Dear Bob,

Hi: An article I read that came from you talked about the falling value of the dollar. It made me wonder what would happen to a homeowner like myself when out-of-control inflation makes a situation that the dollar I repay as a monthly repayment on my home doesnt satisfy the repayment value for the home. How do the banks handle this type of situation? Many would be in same situation. Are we all on the street while many home are empty? There would be many of us that would not be able to fill a wheelbarrow of cash, plus I cant imagine asking a government for a daily payment so as to buy food before it went up in price. What do you think?

Kind regards,Paul

Dear Paul,

There is a difference between what happens with the falling value of the dollar and what happens in hyperinflation. The dollar has been losing its value slowly since the Federal Reserve instituted a fractional banking system. Thats because as more fiat dollars are printed the value of each of those in circulation is lessened. The dollar has lost about 95 percent of its value since 1910 . That is why you see rising prices in commodities. An ounce of gold will buy essentially what it would 100 years ago in terms of oil and commodities, yet it takes $1,200 to buy that ounce as opposed to $27 as in 1910.

Best Wishes,Bob

Inflation And The Cost Of Living

If prices increase, so does the cost of living. If the people are spending more money to live, they have less money to satisfy their obligations . With rising prices and no increase in wages, the people experience a decrease in purchasing power. As a result, the people may need more time to pay off their previous debts allowing the lender to collect interest for a longer period.

However, the situation could backfire if it results in higher default rates. Default is the failure to repay a debt, including interest or principal on a loan. When the cost of living rises, people may be forced to spend more of their wages on nondiscretionary spending, such as rent, mortgage, and utilities. This will leave less of their money for paying off debts, and borrowers may be more likely to default on their obligations.

Read Also: 10 Year Treasury Vs Mortgage Rates

How Rising Mortgage Rates Will And Will Not Impact Housing Prices

Well, its finally happening, mortgage rates are rising. The average interest rate on a 30-year-fixed rate mortgage has reached 3.22%, according to a Freddie Mac survey. Thats the highest rate since May 2020. You might expect housing prices to drop or at least cool down as a result.

Heres the theory: Higher mortgage rates mean higher monthly payments, which fewer buyers can afford, which means less demand and lower home prices.

But inflation changes things, said Richard Green, a housing economist at USC.

If you look at mortgage rates relative to inflation, they are still very cheap right now, he said. Plus, rents are still rising dramatically. If rents go up, then youre going to say to yourself Id rather not rent.’

Most housing economists expect higher interest rates to marginally slow price growth this year.

And some buyers will be hit more than others because of higher rates, said economist Lawrence Yun with the National Association of Realtors.

It could be $250 additional per month in California, while its only $50 in the midwestern markets, he said.

That could make cities like Boise and Phoenix even more attractive to remote workers in 2022.

Will My Mortgage Go Up

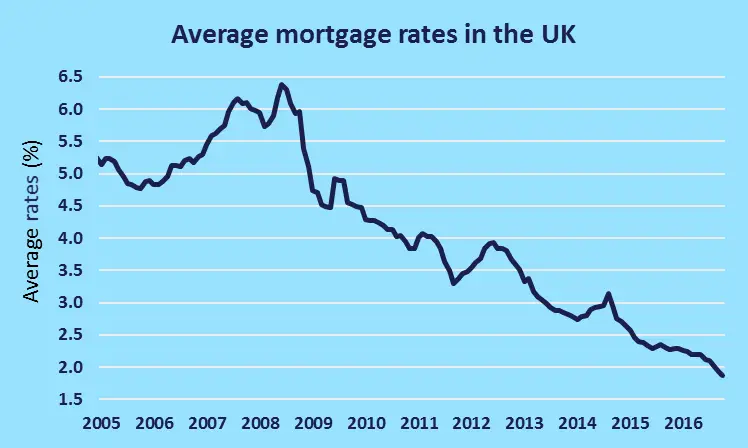

Only if you have a variable rate mortgage typically a tracker that follows the base rate, or a loan on a lenders standard variable rate. A tracker mortgage will directly follow the base rate the small print of your mortgage will tell you how quickly the rise will be passed on, but next month your payments are likely to increase and the extra cost will fully reflect the base rate rise. On a tracker currently costing 2.1% the interest rate will rise to 2.25%.

On a standard variable rate it is less straightforward these can change at the lenders discretion. Most commentators say there is no reason for banks and building societies not to pass on the full increase, so you should expect a rise. If your lender wanted to, it could increase rates by more. As an example, HSBCs standard variable rate is 3.54% if it passes on the full rise borrowers paying it will move to a rate of 3.69%. On a £150,000 mortgage arranged over 20 years that will mean monthly repayments go up by £11.66.

Most borrowers are, however, on fixed-rate mortgages. Interest rates have been so low in recent years that locking in has been attractive, and since 2019, 96% of new mortgages for owner-occupiers have been taken on fixed rates. In total, 74% of outstanding mortgages are fixed, and these borrowers will not see any immediate impact from the change.

Also Check: Requirements For Mortgage Approval

How Does Inflation Affect Banks

Inflation can, over time, decrease how much money your savings will provide, as prices will rise in the future. People with cash should notice this. Having money in the bank means you are earning interest, which mitigates some of inflations effects. Higher interest rates are often paid by banks during periods of high inflation.

The Risks Of Raising Rates Too Quickly

But our example assumes a fixed supply. As weve seen, the global economy has been dealing with massive supply chain disruptions and shortages. And these problems have driven up production costs in other parts of the world.

If high U.S. inflation stems mainly from these higher production costs and low inventories, then the Fed might have to raise interest rates by a great deal to contain inflation. And the higher and faster the Fed has to raise rates, the more harmful it will be to the economy.

In keeping with our car example, if the price of computer chips a critical input in cars these days is increasing sharply primarily because of new pandemic-related lockdowns in Asia, then carmakers will have to pass on these higher prices to consumers in the form of higher car prices, regardless of interest rates.

In this case, the Fed might then have to dramatically raise interest rates and reduce demand substantially to slow the pace of inflation. At this point, no one really knows how high interest rates might need to climb in order to get inflation back down to around 2%.

Also Check: Mortgage Recast Calculator Chase

Inflation What Does It Mean For Your Mortgage

When I was a little girl, inflation was the big economic news of the day. It was the 1970s and inflation was sky high across North America.

Inflation is basically an increase in the price of goods and services. Economists like to keep inflation at about 2-3%. That means something you buy in one year for a dollar will, at least in theory, cost $1.02 a year later.

We want some inflation because it indicates that the economy is growing. But too much, like in the 70s and early 80s, puts a major cramp on the economy. Consumers suddenly cant afford things, especially big-ticket items like houses and cars. Businesses cant afford to buy things either, with consumers shying away from their products or services because of prices and uncertainty.

Meanwhile, over the years, high inflation can erode your savings accounts. In particular, people saving for retirement need to take inflation into account when calculating how much they need to save for their non-working years.

Why talk inflation now? Because interest rates are dead low, and have been for a few years, but The Bank of Canada will raise those rates if inflation starts to climb. Thats because raising interest rates, which puts a cap on how much money is circulating in the economy, helps curb inflation.

Factors That Increase Money Supply

Aside from printing new money, various other factors can increase the money supply within an economy. Interest rates may be reduced, or the reserve ratio for banks may be reduced .

Lower rates and reserves held by banks would likely lead to an increased demand for borrowing at lower rates, and banks would have more money to lend. The result would be more money in the economy, leading to increased spending and demand for goods, causing inflation.

A Central Bank, such as the Federal Reserve Bank , may buy government securities or corporate bonds from bondholders. The result would be an increase in cash for the investors holding the bonds, leading to an increase in spending. The policy of a central bank, such as the Fed, buying corporate bonds would also lead to corporations issuing new bonds to raise capital to expand their businesses, leading to increased spending and business investment.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How The Interest Rate Rise Might Affect You

Everyone in the UK will be affected by rising prices – from a higher gas bill, to harder choices during the grocery shop.

The idea of raising interest rates is to keep those current and predicted price rises, measured by the rate of inflation, under control.

Policymakers at the Bank of England have now increased interest rates to 0.5% from 0.25%, the second rate rise in three months.

Higher interest rates make borrowing more expensive. For households, that could mean higher mortgage costs, although – for the vast majority of homeowners – the impact is not immediate, and some will escape it entirely.

Analysts have also warned that the potential benefit of a better return on savings could be muted.

Read Also: Can You Refinance A Mortgage Without A Job

Ways A Home Purchase Is A Reliable Hedge Against Inflation

Typically, inflation ushers in higher prices for everything, including mortgage rates, home prices and rental costs. So, if youre considering buying a home and think we might be heading for rising inflation, here are some ways buying a home now can help you later.

- Lock in a mortgage with a low, fixed rate. The average rate for a 30-year fixed mortgage is bouncing around the low-3% range, making this a great time to borrow money. As inflation increases, mortgage rates will likely climb, so folks who lock in a low rate now can avoid paying higher interest rates later.

- You wont be exposed to rising rent. The rising inflation tide lifts all boats, including rent prices. Homeowners are shielded from mounting rental prices because their cost is fixed, regardless of whats happening in the market.

- Property values increase over time. Tangible assets like real estate get more valuable over time, which makes buying a home a good way to spend your money during inflationary times.

Inflation Threat Seems Modest For Now

What, if anything, does this turnabout mean for mortgage borrowers? The answer isnt clear yet, but many housing economists say the jump in inflation looks not like a long-term threat but a normal correction following last years sharp decline in spending.

Im not worried about any implications of the 30-year being lower than inflation for a couple of reasons, says Ralph McLaughlin, chief economist at Haus.com. First, it is not that unusual to have the 30-year mortgage rate and inflation rate approximate one another coming out of a recession, and second, inflation looks quite high because of the severe deflation we had at this time last year.

How the inflation picture affects mortgage rates also depends in part on whether consumer prices continue to rise sharply.

The Federal Reserve believes the surge in prices is temporary and that price increases will calm as supply catches up with demand, says Lynn Reaser, chief economist at Point Loma Nazarene University. The bond markets relatively moderate response indicates that it largely believes this view, which has affected markets linked to long-term bonds, such as mortgages.

That explains why mortgage rates made no sharp moves upward after the federal government announced the highest pace of inflation in years.

Recommended Reading: Chase Recast

Inflationary Pressures Cited As Reason For Possible Increase

The Bank of England has already increased interest rates in the UK, while the US Federal Reserve has signalled three rate rises for this year. File photograph: Getty

The head of Irish mortgage provider ICS has said home loan interest rate rises this year cannot be ruled out, given the inflationary backdrop that exists.

Speaking with Inside Business, a podcast from The Irish Times, Fergal McGrath, chief executive of Dilosk, a non-bank lender that offers home loans under the ICS brand, said: Its certainly not on the cards right now but I cant rule it out at all. The inflation pressures that we are seeing, the ECB is arguing are transitory. The market would argue that actually its not transitory.

Rates

We are observing an increase in mortgage rates in the UK and the US, albeit small increases. We are not seeing that yet in Ireland but if we were to look at the wholesale market, or whats known as the swap rates, they have been increasing over the last few months indicating the inflationary pressures and the ECB will have to move. The question is at what point they are going to go up.

Rules

While broadly supportive of the Central Bank of Ireland mortgage rules, Mr McGrath said the income limits imposed on borrowers are quite crude and could go to 4½ times in some cases. At present, consumers can only borrow up to 3½ times their income, with some exceptions.

- Topics:

Interest Rates And Savings

Higher interest rates, in theory, mean people receive a better return on their savings, which should encourage them to save rather than spend.

In New Zealand, for example, state-owned bank Kiwibank announced in October that savers would benefit from higher returns on a range of savings and term deposit rates where money is locked away for an agreed length of time. This followed the first rate rise in New Zealand for seven years in October.

But sometimes higher savings rates can be slow to appear if at all. Commenting on changes to savings accounts following the Bank of Englands rate rise in the UK, Anna Bowes of Savings Champion, which offers free savings advice, says: Very little has happened so far.

What’s the World Economic Forum doing about tax?

The World Economic Forum has published its Davos Manifesto 2020, calling on business leaders to sign up to a series of ethical principles, including:

“A company serves society at large through its activities, supports the communities in which it works, and pays its fair share of taxes.”

Additionally, the Forums Trade and Global Economic Interdependence Platform provides a vital link between trade and tax communities to enable coherent policymaking which responds to societal needs and reflects business realities.

Also Check: Recast Mortgage Chase

Mortgage Rates Move With Bond Rates

Many mortgages are pooled and sold off to investors as securities. The money generated by these sales is channeled back to lenders and used to fund more mortgage loans. These securities provide the investor with a recurring stream of interest and principal payments, just like a bond. The yield earned by investors is driven by the mortgage rate that’s charged to homeowners. Essentially, mortgage-backed securities are an alternative for investors who want to earn fixed income. In order for MBS to be interesting to investors, though, the yields must be competitive to other types of bonds. If MBS yields are too low, no one will buy them. Complicating this dynamic is the underlying demand for mortgages. If mortgage rates are too high, of course, demand for mortgages will decline.