Why You Should Read Your Mortgage Statement

It may be easy to just put your monthly payment on autopay and ignore your monthly mortgage statement, but there are some good reasons to pay attention to it:

Transaction History Since Last Statement

This section details the date, description, and amount of all recent charges or credits to the account as of the borrowerâs last mortgage statement.

For example, your transaction activity could detail an escrow reimbursement or credit if, at the end of the year, your mortgage company determines you paid too much for property taxes or homeowners insurance premiums and have a surplus in your account.

Dont Miss: Usaa Used Auto Rates

How Can I Pay My Loan Off More Quickly

The best way to pay your loan off more quickly is to make additional principal payments in addition to your required minimum payments. This will save on interest and shorten the length of time required to pay off your loan in full. If your account is current and you satisfy the required minimum payment, any additional payment you send is applied to the principal balance on your loan. If you prefer, you can also use the transfer feature in online banking and select “Principal Only.” As a reminder, principal-only payments do not satisfy your required payment for the cycle and your regular minimum payment is still due.

Don’t Miss: Why Would A Mortgage Be Declined

It Could Be Your Dream Home If Only

The kitchen was updated, it had one more bathroom, you get the picture. Make an almost-perfect home perfect for you and your loved ones with a variety of home improvement and renovation loans that require as little as 3.5% down.

We offer loan products that:

- Allow you to purchase a home that wouldnt meet traditional appraisal guidelines

- Help you to remodel, renovate, and convert or de-convert properties

- Provide financing to use for major repairs so that a property becomes marketable

- Allow you to put as little as 3.5% down

Frequently Asked Questions About Real Estate Taxes

What real estate tax bills are paid from my escrow account?

Regular real estate tax bills are paid on your behalf by Truist from your escrow account. Occasionally, your local government may charge you an additional amount affecting your property. This is not covered by your escrow account and will remain your responsibility.

Some of the bills you are responsible for paying include, but are not limited to, supplemental, Pro-Rata, ½ Year or ¾ Year Levy, special assessment, solid waste, utility, HOA , and water/sewer usage bills. Your escrow account does not include funds to pay these bills.

How are my real estate taxes paid?

We obtain your real estate tax amount based on your tax identification number/assessor parcel number and disburse the funds from your escrow account. Taxes are paid prior to the due date. If the tax office offers an early pay discount, your taxes will be paid early enough to utilize that discount.

Are real estate taxes deductible on my income tax return?

Yes, real estate taxes are usually deductible if you itemize deductions on your tax return. However, you should consult your tax advisor for more information.

How do I handle a Special Assessment Tax Bill?

Special notice to South Carolina homeowners: South Carolina offers a legal residence exemption, if the property is your primary home. Please contact your local tax office to obtain the specific requirements.

What should I do if I receive a real estate tax bill in the mail?

Recommended Reading: When Is A Reverse Mortgage Good

How Can I Find Out Who Owns My Mortgage

Homeowners may think they know who owns their home loan, but finding out is a little more complicated than simply naming your loan servicer.

When you apply for a home loan with a mortgage banker or mortgage broker and go to settlement, you will typically sign mortgage loan papers that list the name of a bank or credit union. It would be natural to assume your mortgage loan is owned by the financial institution listed on your settlement statement. However, many home loans are sold individually to other mortgage lenders or in a package with other loans in a mortgage-backed security.

Will You Accept Less Than The Total Amount Due

In certain situations, we will accept a partial mortgage payment. However, it cannot be applied to your loan until we have received enough funds to satisfy a regular payment. To learn about your options, call mortgage customer service at .

If you are having difficulty making your payments, visit our Borrower Assistance. We may have a program available to assist you.

Also Check: How To Build A Mortgage Business

Frequently Asked Questions About Insurance

What types of home insurance policies are available?

Homeowners insurance ensures that your home will be replaced or the damage will be repaired, up to the amount of coverage obtained, for losses from fire and other hazards covered by the standard extended coverage endorsement.

Flood insurance is required in areas where the dwelling is located in a Special Hazard Flood Area. The flood insurance policy should reflect the same zone as the property rating as determined by a Special Flood Hazard Determination.

Flood insurance is highly recommended for all clients, regardless of flood zone, to fully protect their interest. Please contact your insurance agent if you have questions regarding requirements for flood insurance. The flood insurance policy should also meet the National Flood Insurance Program requirements or the Federal Emergency Management Agency guidelines for a private flood insurance policy.

For condominium units, the homeowners association typically provides the minimum hazard and flood insurance required by us. You should consult an insurance professional for advice on any additional insurance you may need for your own protection. Keep in mind that if the associations policy is not sufficient, then you will be required to obtain additional coverage.

Earthquake insurance is usually carried on a voluntary basis.

What are my homeowners insurance responsibilities?

Should I inform Truist if I make changes to my homeowners insurance policy?

Insurance mailing address:

What Happens If My Auto

If you select a payment date that falls on a weekend or holiday, the payment will be effective dated to the due date. If the account you send the payment from is held at KeyBank, well withdraw the funds for your payment on the business day after that weekend or holiday.

If the account you send the payment from is held somewhere other than KeyBank, the withdrawal will generally occur after the payment date, but the exact timing depends on your financial institutions processing schedule.

You May Like: How Do You Estimate A Mortgage Payment

Cibc Smart Prepaid Visa* Card

Canada and the U.S.

CIBC Client Account Management

If youre a CIBC client and cant keep up with your payments, reach out to us to get your finances back on track. Visit get debt help.

You may receive a voicemail, SMS text, email or letter asking you to call one of the following numbers:

Email and website fraud

Contact us if you think you may have been a victim of fraud . If you email us, describe the incident and include any fraudulent emails you’ve received or your anti-virus or anti-spywarescan logs.

CIBC Investor’s Edge and Imperial Investor Service

Contact us if there’s suspicious activity in your account.

We Provide Financing From The Ground Up

We offer access to two programs designed to take some of the worry out of building your dream home and you can use them together for even more advantages.

Lock in your interest rate for up to 240 days at no cost with SmartLock if rates go lower, you get to take advantage. It offers peace of mind in uncertain rate environments while you build your home.

DreamBuilder gives you home financing during construction to build the home youve always wanted.

When you use them together:

- Lock in your rate for 240 days and take advantage if rates go down

- Financing for a 12-month construction period

- Borrow up to 80% of the homes purchase price

- Only pay for the portion of the funds you use

Building your dream home? Count on us to make it easier.

Read Also: How To Sell A Mobile Home With A Mortgage

How Can I Tell Who Owns My Mortgage

You can look up who owns your mortgage online, call, or send a written request to your servicer asking who owns your mortgage. The servicer has an obligation to provide you, to the best of its knowledge, the name, address, and telephone number of who owns your loan.

Its not always easy to tell who owns your mortgage. Many mortgage loans are sold and the servicer you pay every month may not own your mortgage. Whenever the owner of your loan transfers the mortgage to a new owner, the new owner is required to send you a notice.

If you dont know who owns your mortgage, there are different ways to find out.

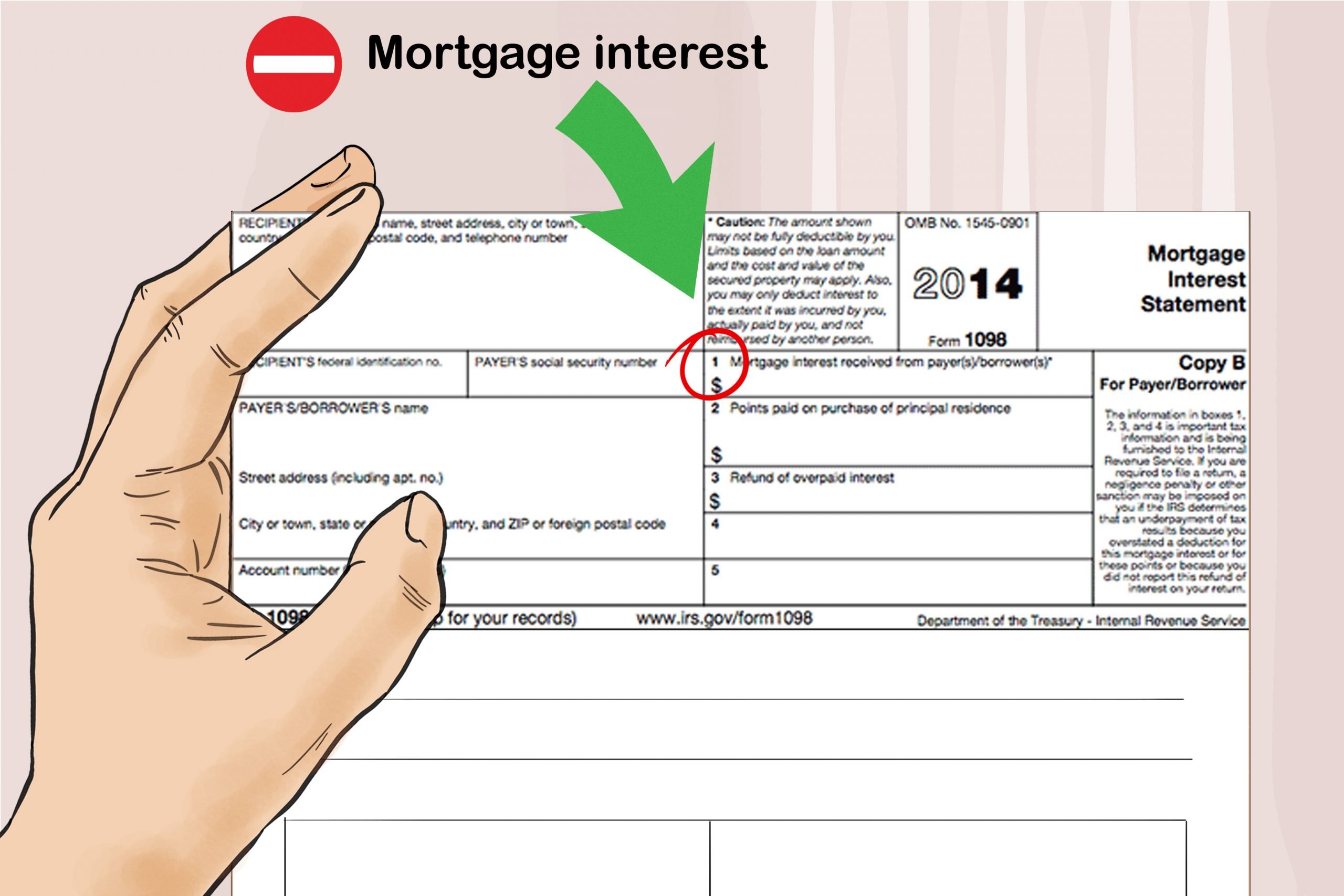

Explanation Of Amount Due

The explanation of amount due is a further breakdown of the amount you owe for the current month. It will detail the following:

-

The principal payment, which is the portion for the current month thats paying off the remaining loan balance.

-

The interest payment, which is the portion for the current month being applied to interest on the remaining loan balance.

-

The escrow payment, which is the portion for the current month going into your escrow account. Your escrow account pays for property taxes, homeowners insurance, and private mortgage insurance if its required.

-

The total payment for the month, which is the sum of the previous three items.

-

Any fees, which could include charges like late fees.

-

The past due amount, which will be indicated if you still owe money from any previous months statements.

You May Like: Which Lender Has The Best Mortgage Rates

Paying Your Mortgage Using Digital Tools

Your lender or bank may offer the ability to make payments using additional modern technology. For example, if you closed with Rocket Mortgage, you can make your mortgage payment with the help of our virtual assistant Liv, via chat. If you have an Amazon Echo, you can simply ask Alexa to make your mortgage payment for you, if you have the Rocket Mortgage skill enabled on your Echo. To set up this feature, sign in to your Amazon account on any device. Then, tap the menu button in the left-hand corner of the screen. Select skills, search for Rocket Mortgage and click enable.

Youre going to be redirected to the Rocket Mortgage login page, where youll be able to sign in to your account and consent to make voice payments. Youre also going to be asked to create a numerical PIN, this will help us make sure that its you when you access your mortgage information or decide to make a mortgage payment.

If you dont have an Amazon Echo, you can also make a payment through our Interactive Voice Response line at 508-0944.

If I Make An Additional Principal Payment To My Loan How Will The Funds Be Applied To My Mortgage

Once your regular payment has been satisfied, any additional funds left over will be applied to your mortgage as a “Principal Only” payment. Note, we can only process the principal payment if your current months payment has been received, your loan is not delinquent and you have no outstanding fees.

Also Check: How To Pay Your Mortgage With A Credit Card

We’ve Made Managing Your Mortgage Even More Convenient

Now, when you access your mortgage account, you will see new features that make it even easier to make payments, access statements, view your loan details and see the current estimated value of your home.

In addition to all your loan details, you will also find great new tools and features:

- Neighborhood information including surrounding home values and the sales history of your home.

- Calculators to help you pay down your loan faster.

- A learning center with information about escrow, PMI, taxes and more.

Simply log into the HUB and check out these new features today. Or contact a Mortgage Specialist to discuss a new mortgage at 1-800-562-6871.

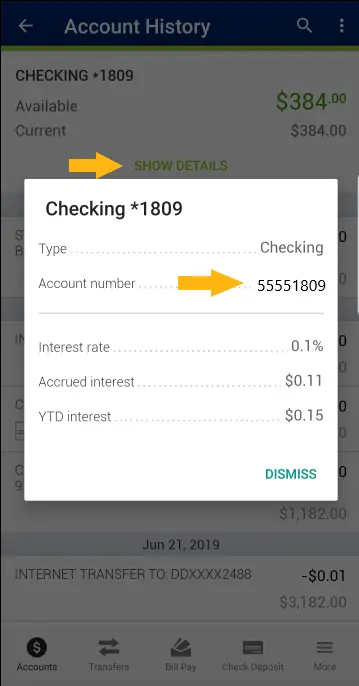

How Can I View My Mortgage Information

Once you have logged into your account you may see more than one loan if you have multiple accounts. You’ll see the loan number, property address, next payment due and previous payment that has been posted to your account. For more detailed loan information, select View Details for the loan you want to view.

Recommended Reading: What Documents Are Needed To Get Pre Approved For Mortgage

Us Bank Mobile App Steps:

For the best mobile banking experience, we recommend logging in or .

How Do I Make Payments By Mail

You can mail your payments to the payment address listed in the important information box in your welcome letter. Please note:

- When you make your payments by check, Wells Fargo Bank, N.A. will clear the check electronically.

- Receipt of your check authorizes us to process your payment as an electronic debit. When this occurs, your payment appears on your bank statement as an electronic withdrawal, showing the date of the withdrawal, check number, and “WFHM Mortgage Check Payment” as the payee.

- The check is destroyed and not returned to your bank.

Please note: We do not provide coupon books.

Did you know?

You can enroll in Wells Fargo Online at no additional cost, and schedule one-time and recurring payments. You can enroll when your account information is available in our system, which is typically 4 to 7 business days after your transfer date. Please refer to your welcome letter to see when your account information will be available.

After you enroll, youll be able to manage your mortgage account online.

To learn about the features of Wells Fargo Online, take a tour.

Want to enroll? You can enroll by completing a brief, one-time enrollment process after your account is online.

Already enrolled?Sign on with your existing Wells Fargo username and password.

Recommended Reading: How To Get Approved For Mortgage With Low Income

Commercial Real Estate Databases For Finding Mortgage Data

As we mentioned to start, one of the challenges with commercial mortgage data is that it is notoriously difficult to find.

Mortgage data associated with private bank loans tend to be the most elusive, as banks are not required to report loan-level detail in the same manner as public entities.

Instead, private banks tend to report categories of data, like total loan volume, rather than report the data associated with individual loans.

Often times, youll need some basic information, like the owner or borrowers name and/or the property address.

Then you can search the countys registry of deeds to pull the public records associated with that property.

That can be a laborious process, however.

There are a few easily accessible commercial real estate databases that can help expedite your efforts of finding commercial mortgage data.

Reonomy

With Reonomy, commercial lenders and banks can quickly analyze the portfolios of owners and lenders with data spanning everything from transaction data, to current debt, to full ownership details.

Reonomy technology connects all of this data to show the interconnectivity of people, companies, and property.

CoreLogic

CoreLogic offers a few different tools that can be helpful for finding mortgage data.

One of those tools, called RealQuest, includes property-specific data for 149 million parcels, including transaction histories, MLS data, valuations and more.

HUD

Also Check: Does Usaa Refinance Auto Loans

I Need Help Making My Mortgage Loan Payments Who Can I Contact For Assistance

Hardships can come in many forms. Unemployment, decrease of income, declining property value, divorce, injury or illness these are all considered hardships. If you are experiencing a hardship that is making it difficult for you to pay your bills, there may be help.

If you are having difficulty making your payments, visit our Borrower Assistance page. We may have a program available to assist you.

Also Check: How To Calculate An Adjustable Rate Mortgage

Mortgage Data Points You Can Find Online

You can find data online for individual loans, the properties and people involved with those loans, and the lending entities involved.

Some data sources have all of this information, whereas others may only have partial data.

You can find data on each of the following pieces of a mortgage:

1. Dates: Loan origination and maturity dates.

2. Dollars: How much the loan is worth.

3. Terms: The length of the loan, specific loan type, and interest rate.

4. Companies: The lenders of the loan, as well as any other entities involved .

5. Names: The people behind property ownershipincluding the names and contact information of the borrowing party.

6. Assets: The property or properties being mortgaged, as well as any other asset being used as collateral to secure the loan.

Mortgage Origination Data

Mortgage Origination DateThe mortgage origination date is the date on which the borrower closed on the property and signed the mortgage deed.

This piece of commercial real estate data is helpful for a few reasons. Most importantly, it tells you when that specific mortgage took effect, and therefore, gives you a rough assurance of when that loan matures.

This is not always the same as the purchase date, either.

A person or entity can carry multiple mortgages on a property at the same time, or over time, in which case the origination date may be different than the purchase date.

Mortgage Maturity DateAs its name implies, the mortgage maturity date tells you when a loan is set to mature.