How To Get A Mortgage Loan

Getting mortgage pre-approval before deciding on a property can be crucial. It will save you time and make the mortgage process more manageable. Check our home affordability calculator to see how much youll be able to afford in monthly mortgage payments.

Documents needed to apply for a mortgage:

Before applying for a mortgage, make sure to check your . It is also important to compare mortgage lenders.

Even though lenders will pull your credit and it is considered a hard credit inquiry your score will not be affected if all the inquiries are done within 30 days. recognize this as shopping around for the best mortgage rate.

Lastly, check your debt-to-income ratio before applying. Lenders prefer borrowers with a debt-to-income ratio lower than 36%, and many lenders will not even consider borrowers with a ratio higher than 43%.

What Factors Into Current Mortgage Rates

Mortgage interest rates are heavily influenced by external factors like inflation, the Federal Reserve, your lenders specific fees and other economic trends. These monetary forces work together to establish market norms and standardize current mortgage rates for lenders to follow.

Given the constant ebb and flow of the real estate economy, many buyers will wait for the timing to be perfect before pursuing a home purchase. Even borrowers who can afford a mortgage in the current market might hold off on their purchase if the external pressure of the economy is expected to bring down home mortgage rates even further.

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rate you qualify for may change depending on your unique borrowing profile. Here are some of the factors that influence what mortgage rate you qualify for:

The type of mortgage: If your mortgage is for a refinance, rather than a purchase or renewal, youâll be eligible for higher rates. For individuals with an existing mortgage who have good credit and more than 20% equity in their homes, in addition to refinancing, you can also explore a home equity line of credit .

Your down payment: If youâre purchasing a home andyour down payment is less than 20% of the purchase price and the value of the home you are purchasing is less than $1 million, youâll be required to purchase mortgage default insurance . This insurance is added to your mortgage amount and, while it will cost you money, it will result in a lower mortgage rate as your mortgage is less risky for your lender. If youâre renewing your mortgage, in order to be eligible for the lowest mortgage rates you would have needed to purchase CMHC insurance on the original mortgage.

Your intended use of the property: Your mortgage rate will be higher if you plan to rent your property out vs. live in it as your primary residence.

Also Check: Requirements For Mortgage Approval

The Best Rate For Your Mortgage

- The best rate for your mortgage

- What is the best rate?

- Several factors can affect your mortgage rate.

- Renewing or refinancing your mortgage can be a good opportunity to get a better rate.

If youre thinking of buying a home in the near future, youre probably shopping around for a mortgage in hopes of getting the lowest interest rate possible. But did you know that your rate is subject to vary depending on your situation and the product you choose? Heres everything you need to know about finding the best mortgage rate for you.

Best For Specialty Loans

Whos this for? Its sometimes tough to find lenders that offer USDA loans in addition to other standard mortgage options, but PNC Bank includes USDA loans in their lineup. This lender also offers conventional loans, FHA loans, VA loans, jumbo loans and a PNC Bank Community Loan, which is a special program that allows homebuyers to put down as little as 3% while still choosing between fixed-rate and adjustable-rate mortgage terms.

This lender also offers a special loan option catered to medical professionals who are looking to buy a primary residence only. With this loan, medical professionals can apply for as much as $1 million and wont have to pay private mortgage insurance , regardless of their down payment amount. They can also choose between fixed-rate and adjustable-rate terms.

PNC Bank offers online and in-person mortgage application processes, which can be a plus for homebuyers who dont live near a PNC Bank location but still want to apply for a loan. You can get online pre-approval in as little as 30 minutes as long as you have all the documentation on hand.

Also Check: 10 Year Treasury Vs Mortgage Rates

Increase Your Down Payment

Did you know that your down payment amount can have an impact on your mortgage rate? That’s because mortgage rates are generally tiered, and typically lower rates are available for those with a down payment of 20% or more. If possible, check with your lender to see if increasing your down payment will lower your mortgage interest rate.

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

Recommended Reading: Rocket Mortgage Launchpad

What Are Mortgage Points

Also known as discount points, this is a one-time fee or prepaid interest borrowers purchase to lower the interest rate for their mortgage. Each discount point costs one percent of your mortgage amount, or $1,000 for every $100,000 and will lower the rate by a quarter of a percent, or 0.25. For example, if the interest rate is 4 percent, purchasing one mortgage point will reduce the rate to 3.75 percent.

How To Shop For Mortgage Rates

There are a few things to keep in mind when shopping for mortgage rates:

- Make sure you look at national and local lenders to find the best possible rates.

- Avoid applying for mortgages in multiple places as this can hurt your credit score. Instead, pull your credit report and get a keen picture of your credit history that you can share with potential lenders. Ask them to provide you with the rates based on that information. This way you preserve your credit score while getting the most accurate information for your credit profile.

- Use our rate table to help you identify whether lenders are offering you a competitive rate based on your credit profile.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

Selecting A Mortgage Term

Choosing between a short-term mortgage or a long-term mortgage can also affect your interest rate. A short-term mortgage generally offers a lower rate, and, as it requires more frequent renewal, you can benefit from lower interest rates when you renew, if rates stay low at your renewal. Long-term mortgages, on the other hand, offer stability, as you wonât need to renew it often. However, long-term mortgage holders may not be able to take advantage of lower interest rates if the market fluctuates.

Sebonic Financials Standout Feature:

Sebonics proprietary borrowing platform, Octane, is a standout feature. With Octane, borrowers can get a fast rate quote, start an application, upload documents, and sign closing documents, with real-time updates along the way. We found Octane to be one of the best online application processes compared to other lenders weve reviewed. Its easy-to-use, high-tech, and we appreciate the ability to have a full-online digital experience with the option to speak to loan officers.

Also Check: Can You Refinance A Mortgage Without A Job

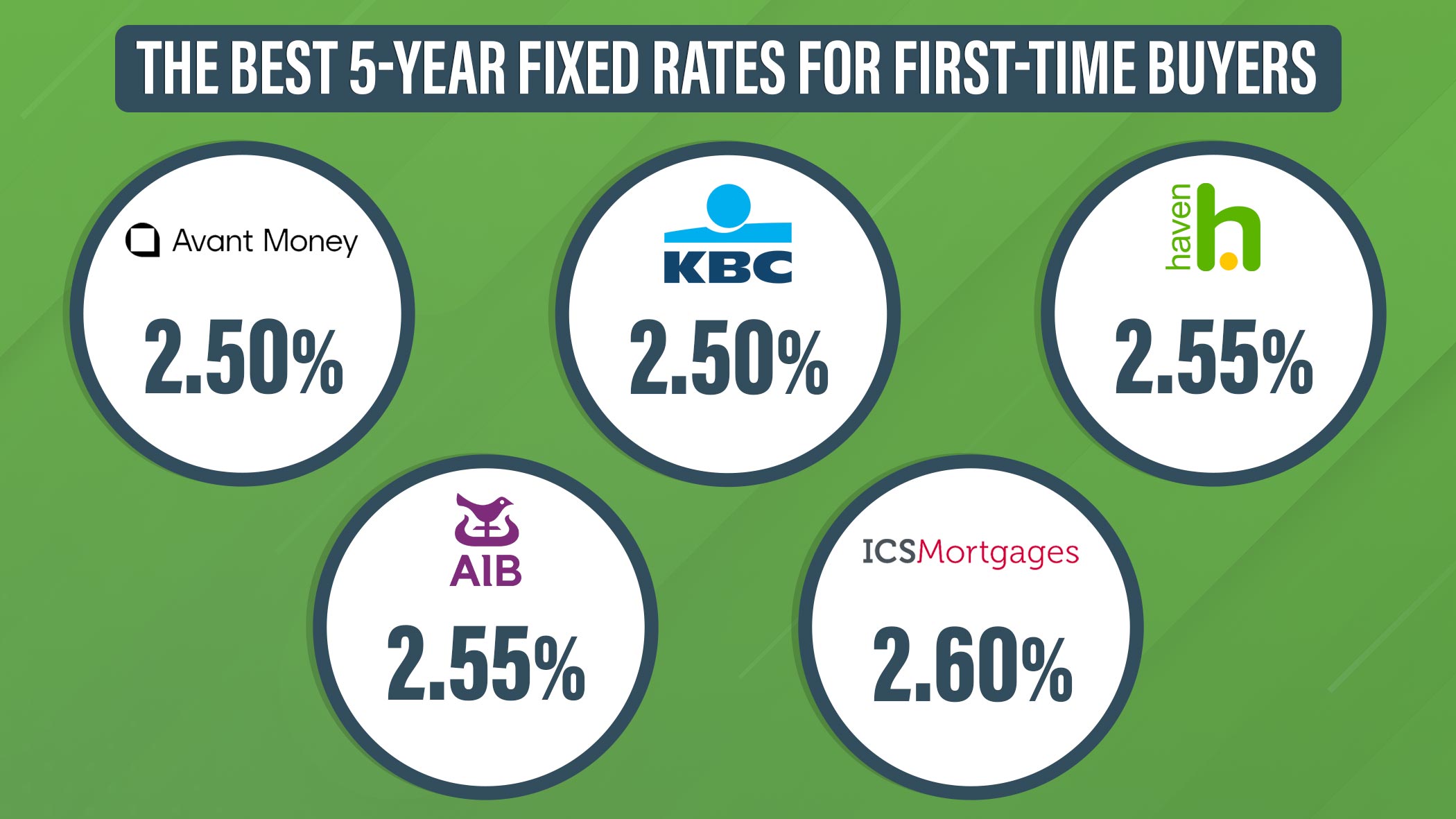

Best Mortgage Rates From Top Lenders

We looked at the 40 biggest mortgage lenders in 2020 to see how their interest rates stacked up.

The 25 companies with the best mortgage rates on average are as follows:

| Mortgage Lender | |

| Citizens Bank | 3.27% |

Note that average rates shown in this table are from 2020, when rates were near record lows almost all year. Todays mortgage rates could be higher than whats shown.

You can still use last years interest rates as a tool to compare lenders side by side. But before you lock in a loan, youll want to get custom interest rates from a few different lenders to make sure youre getting the best deal available today.

The Ascent’s Best Mortgage Lender Of 2022

Mortgage rates are on the rise and fast. But theyre still relatively low by historical standards. So, if you want to take advantage of rates before they climb too high, youll want to find a lender who can help you secure the best rate possible.

That is where Better Mortgage comes in.

You can get pre-approved in as little as 3 minutes, with no hard credit check, and lock your rate at any time. Another plus? They dont charge origination or lender fees .

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Are Interest Rates And Apr The Same

Interest rates and APR are not the same. An annual percentage rate reflects additional charges associated with your mortgage, which includes the interest. The interest rate reflects the cost homeowners pay to borrow money. These fees include charges such as origination fees and discount points, which is why the APR is typically higher than the interest rate.

How Do I Qualify For A Mortgage

While itâs important to think about qualifying for the best rates, you should also give some thought to the basics that youâll need to qualify and get approved for your mortgage. To qualify for a mortgage, here are some of the most important things that prospective lenders will want to see.

A good credit score: You should have a credit score of 680 or higher to qualify for the best mortgage rates, but to qualify for a mortgage at all, youâll need a credit score of at least 560. In addition to looking at your credit score, prospective lenders will also consider any derogatory information from your credit report, such as any missed payments . If you have bad credit, generally defined as a credit score of less than 660, you are unlikely to qualify for the best mortgage rates, and instead youâll need to use a sub-prime mortgage lender like Equitable Bank or Home Trust. If your credit score is even less than 600, you will most probably need to use a private lender like WealthBridge. Sub-prime mortgage lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates. To help you better understand how your credit score affects your ability to obtain a mortgage, you can find more information on this page.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

Best With Fast Preapprovals And Closings 48/5 Stars

Guaranteed Rate is a Chicago-headquartered firm with a strong online presence and 400 branch locations spread across the country. We ranked the company a top choice lender because of its top-of-the-line digital experience, helpful consumer tools, solid customer service, and variety of loan products, including all three government loans.

Guaranteed rate received fewer consumer complaints compared to most other lenders we reviewed. The company logged less than one complaint per 1,000 loans originated with the Consumer Financial Protection Bureau consumer complaint database, the agency responsible for collecting, monitoring, and responding to U.S. consumer complaints about financial services and products.

Best Mortgage Lender For Self

Self-employed borrowers can sometimes face difficulties when applying for a mortgage, with restrictions from many lenders on the amount they are willing to lend, the deposit required and acceptable forms of proof of income. Aldermore Bank, however, markets itself as a specialist in self-employed mortgages, servicing both sole traders and limited companies. As such, it doesnt cap the LTV for self-employed borrowers, can include retained profits as part of the income assessment and offers multiples of up to 5.5 times income for sole and joint applicants with an income of at least £60,000 per year.

As a specialist lender that also approves applications from people with less-than-perfect credit scores all defaults over 3 years old are accepted and each case is individually underwritten it is only available through an intermediary. If you are looking for a mortgage broker, we rate online option Habito*, or you can find an in-person financial advisor near you through VouchedFor*.

You May Like: Reverse Mortgage Mobile Home

Cardinal Financial Company: Best For Low

Cardinal Financial Company, which also does business as Sebonic Financial, is a national mortgage lender that offers both an in-person and online experience and a wide variety of loan products.

Strengths: Borrowers have a range of options with Cardinal Financial, with the lender able to accept credit scores as low as 620 for a conventional loan, 660 for a jumbo loan, 580 for an FHA or USDA loan and 550 for a VA loan. The lender also offers speedy preapprovals, and some borrowers have been able to close in as little as seven days .

Weaknesses: Cardinal Financials current mortgage rates and fees arent listed publicly on its website, so youll need to consult with a loan officer for specifics pertaining to your situation.

> > Read Bankrate’s full Cardinal Financial Company review

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House

Type Of Mortgage Loans

Mortgage companies offer several loan products with varying terms and interest rates to fit the needs of homebuyers.

Conventional loans: The most common type of mortgage loan. Typically offered by private lenders , they have a loan amount limit of $489,350 in most counties and $726,525 in more expensive areas. Homeowners insurance is generally required if the borrower gives less than 20%.

Jumbo loans: Jumbo loans are designed for properties exceeding the limit of $489,350. Non-conforming jumbo loans are meant for properties worth between $1-2 million. Both conforming and non-conforming loans require good credit and a sizable down payment to qualify.

FHA loans: A Federal Home Administration loan protects the lender from default. If the borrower stops making payments on their loan, the FHA pays the lender the unpaid balance on the mortgage. Mortgage rates tend to be lower than conventional loans because of this guarantee by the FHA.

VA loans: Available to service members, veterans and eligible surviving spouses, this loan offers competitive interest rates and doesnt require a down payment or private mortgage insurance. However, it requires a VA funding fee. VA loans include options for Native American veterans, refinancing and remodeling a home for easier access for the disabled. For more information about VA loans, check out our guide to the best VA loans.

Today’s Mortgage Rates: Still Near Historic Lows

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

For today, December 23rd, 2021, the current average mortgage rate for a 30-year fixed-rate mortgage is 3.324%, the average rate for a 15-year fixed-rate mortgage is 2.614%, and the average rate for a 5/1 adjustable-rate mortgage is 3.142%. Rates are quoted as annual percentage rate for new purchase.

A home is one of the biggest purchases you’ll ever make. Current mortgage rates are significantly lower than they were a year ago. You can save thousands of dollars simply by paying attention to the interest rate on your loan.

To land the best mortgage deal for you, it’s important to shop around with multiple lenders. Check out the most recent mortgage rates and get personalized quotes as well as a full rundown of your estimated monthly payment.

Also Check: Reverse Mortgage On Condo

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.