The Fed Begins Tapering In November

To counter the economic fallout of the COVID-19 pandemic, the Fed cut interest rates and accelerated its purchasing of government-backed bonds. Since then, the Fed has been buying $40 billion of mortgage-backed bonds each month.

But the Fed announced it will begin to taper its investment in mortgage-backed securities this month, which could push mortgage interest rates up from their historic lows. The tapering process will continue each month by $15 billion , wrapping up by mid-2022 if all goes as planned.

“When the Fed starts tapering it off, that’s most likely going to cause interest rates to go up unless there’s suddenly a big push from the secondary market — Wall Street, basically — to buy mortgage-backed securities at these low interest rates,” says Brendan McKay, president of broker advocacy at the Association of Independent Mortgage Experts.

Looking To Refinance Your Mortgage Now Is The Time For Action

Experts foresee interest rate rise now that the Fed has confirmed a bond taper is commencing.

Though mortgage and refinance rates remain historically low, experts are increasingly vocal about the possibility of that changing soon. Over the past two years or so, multiple factors — including skyrocketing home values, COVID-19 migration and low interest rates — have combined to create a nearly ideal environment for homeowners looking to refinance, as mortgage rates dipped below 2% for the first time ever.

Though rates have rebounded a little bit since then, they remain remarkably, historically low. But that may soon change, according to a chorus of economists, real estate experts and mortgage sellers. “If you’re thinking about refinancing, do it now,” said Kimber White, past media president of the National Association of Mortgage Brokers.

As the Federal Reserve begins reducing some stimulus programs and the US Treasury continues to flirt with the debt ceiling, a variety of economic trends are converging to rattle the market. The bottom line: If your mortgage rate is 3.5% or higher, this remains a very good time to lock in an all-time low refinance rate.

“Our forecast is for rates to increase gradually over the next year, and we can expect an overall slowing in refinance activity as a result,” said Joel Kan, economic and industry forecaster at the Mortgage Bankers Association. The MBA is forecasting that by the end of 2022, the 30-year fixed-rate mortgage will increase to 4%.

What Affects Your Mortgage Rate In Canada

There are a few different types of mortgage interest rates in Canada: Fixed interest rates, variable interest rates, or a hybrid combination of the two. These mortgage rate options will affect how your interest rate changes over time. Your mortgage rate will also be affected by certain factors that your mortgage lender will look at.

Recommended Reading: Chase Mortgage Recast

Shop Around And Negotiate

When youre shopping for a mortgage, its important to get quotes from multiple lenders. Rates vary widely, and the difference between the most expensive and least expensive lenders can be as high as 0.75%, according to a recent study by the fintech startup Haus. But you cant just focus on the rate, the closing costs are also important.

Two loans may have the exact same interest rate, but one could have thousands of dollars in extra fees. So its important to read each lenders Loan Estimate carefully, and to pay attention to both the mortgage interest rate and annual percentage rate .

If you have multiple offers to compare, it may be easier to talk to a lender and negotiate the rate or fees.

How Does A Bond Loan Work

Bonds are long-term, low-risk investment products. Corporations can issue private bonds but Treasury bonds issued by the federal government are much more well-known. When you buy a bond, you give the government a set amount of money per bond. The bond then accrues two types of interest: fixed interest and inflation interest.

The fixed interest on a savings bond follows the same model as the fixed interest on a mortgage loan. Every year on May 1 and November 1, the U.S. Treasury announces a fixed rate for new loans. Youll earn that percentage of interest on the loan if you buy one before the next interest rate announcement.

Your bond also accumulates additional interest to keep up with inflation rates. Once your bond reaches the end of its term, you get your original money back plus whatever the bond gained in interest. You can also buy and sell bonds on the secondary market like stocks.

Find out what you can afford.

Use Rocket Mortgage® to see your maximum home price and get an online approval decision.

Recommended Reading: Does Prequalification For Mortgage Affect Credit Score

Your Financial And Credit Picture

Lenders have to ensure you can repay your mortgage, and they do that by assessing your risk of default. Lenders pay close attention to your debt-to-income, or DTI, ratio, and your credit score. Your DTI ratio is the sum of all of your monthly debts in relation to your gross monthly income.

Generally, the higher your DTI ratio, the riskier you appear to a lender and the higher your interest rate will be. As a general rule of thumb, conventional lenders want to see your DTI ratio stay below 43 percent, but some loan programs will consider borrowers with a DTI ratio as high as 50 percent.

Your credit score is another indicator of your ability to manage debt and pay bills on time. Borrowers with a lower credit score pay higher interest rates and have more-limited loan options if their credit is less-than-stellar.

As mortgage rates fall, your DTI ratio falls, too, because a lower rate will drop your monthly mortgage payment, which is included in your DTI ratio calculation. As a result, you could afford to buy more house, Selitto says.

Why Save Up For A Large Down Payment If The Mortgage Rate Is Higher

In most cases, a high-ratio insured mortgage will have a mortgage rate that is lower than a low-ratio mortgage with a down payment greater than 20%. Why bother saving up for a large down payment if you can make a small down payment and get an even lower mortgage rate? The answer lies in the cost of the mortgage default insurance, which isnt free.

CMHC insurance premiumscan add thousands of dollars to the cost of your mortgage. The cost of this mortgage default insurance will either need to be paid upfront or it will be added to your mortgage principal balance. Adding the cost of the mortgage insurance to your principal means that you will be paying interest on the insurance over time, adding on to the cost of your mortgage. The CMHC insurance premium will depend on the size of your down payment.

Also Check: Rocket Mortgage Payment Options

Refinancing Will Slow In 2021

As mortgage rates continue to climb, fewer homeowners will be able to save money by refinancing their mortgages.

Were seeing this happen in real time. In February, 18 million homeowners were refinance eligible, that is they could reduce their interest rate by 0.75% or more, according to data from Black Knight, a mortgage technology, data and analytics provider. But as rates surged above 3%, the number of eligible candidates shrunk to just 12.9 million homeownersa 30% reduction in less than a month.

The MBA predicts that refinancing volume will fall from $2.149 trillion in 2020 to $1.191 trillion in 2021, mainly due to rising rates. There will be an even sharper decline of refinancing volume in 2022 to $573 billion, according to MBAs latest forecast. The refinance share of all mortgage originations is predicted to drop to 41% in 2021 from 57% in 2020.

Refinance activity will depend on rates. Even if rates rise a few basis points above where were at now, we can expect a pretty robust refi demand market in 2021, says Odeta Kushi, deputy chief economist for First American Financial Corporation, a title insurance provider. There are still many homeowners who can save money by refinancing.

As rates rise, the pool of people who can save money by refinancing their mortgage will start to shrink again. If rates hit 3.13%, 6.2 million borrowers will no longer be able to cut costs with a new mortgage.

Mortgage Rate Factors That You Control

Lenders adjust mortgage rates depending on how risky they judge the loan to be. A riskier loan has a higher interest rate.

When judging risk, the lender considers how likely you are to fall behind on payments , and how much money the lender could lose if the loan goes bad. The major factors are credit score and loan-to-value ratio.

Read Also: Can You Refinance A Mortgage Without A Job

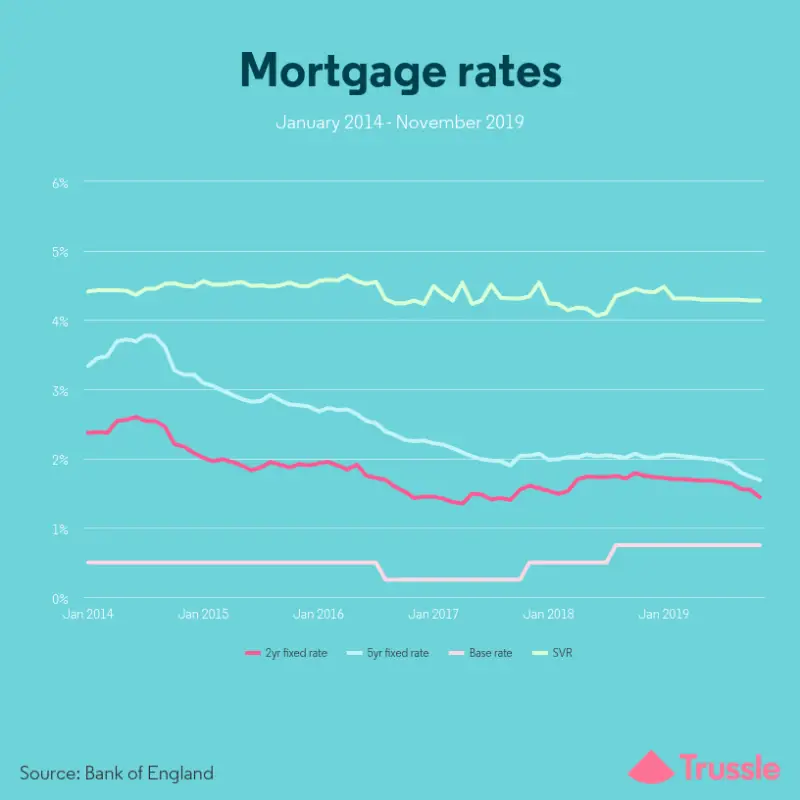

What Is The Bank Of England Base Rate

The base rate of interest is now at 0.25% after the Bank of England voted to increase it. Since March 2020, the rate had been maintained at 0.10% following two cuts at the onset of the coronavirus pandemic.

The rate is important because it sets the level of interest that the commercial banks charge us on financial products like mortgages.

Inflation Drives Prices Higher

In September, the Consumer Price Index for US goods and services was 5.3% higher than a year earlier — its sharpest increase since the US housing market crash in 2008. In his July testimony before the House Financial Services Committee, Jerome Powell, chairman of the Board of Governors of the Federal Reserve System, acknowledged that inflation has risen to unexpectedly high levels, but reassured lawmakers that the Fed is monitoring the situation “night and day.” Though he reiterated that interest rate increases weren’t on the table at that point, that could change. In October, the International Monetary Fund revised its growth forecast for the US economy, citing inflation as a factor.

In November, Powell acknowledged that inflation remains well above the Fed’s 2% goal, and so the Fed will continue to keep interest rates close to 0%, but is expected to increase interest rates around the end of 2022 or early 2023, according to Powell’s speech at the Fed’s September meeting.

However, Powell made clear in November that the Fed will not use the price stability tools at its disposal just yet.

Read Also: Chase Recast Calculator

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

How Do I Lock In My Interest Rate

A rate lock is a commitment by a lender to give you a home loan at a specific interest rate, provided you close on your home in a certain period of timetypically 30 days from when youre pre-approved for your loan.

A rate lock offers protection against fluctuating interest ratesuseful considering that even a quarter of a percentage point can take a huge bite out of your housing budget over time. A rate lock offers borrowers peace of mind: No matter how wildly interest rates fluctuate, once youre locked in you know what monthly mortgage payments youll need to make on your home, enabling you to plan your long-term finances.

Naturally, many home buyers obsess over the best time to lock in a mortgage rate, worried that theyll pull the trigger right before rates sink even lower.

Unfortunately, no lender has a crystal ball that shows where mortgage rates are going. Its impossible to predict exactly where the economy will move in the future. So, dont get too caught up with minor ups and downs. A bigger question to consider when locking in your interest rate is where you are in the process of finding a home.

Most mortgage experts suggest locking in a rate once youre under contract on a homemeaning youve made an offer thats been accepted. Most lenders will offer a 30-day rate lock at no charge to youand many will extend rate locks to 45 days as a courtesy to keep your business.

Read Also: What Information Do You Need To Prequalify For A Mortgage

How Will I Know If Mortgage Rates Are Going Up Or Down

- Heres a fairly simple way to guess the direction of mortgage rates

- Just look at the current yield on the 10-year Treasury and its recent trend

- If it goes up , expect mortgage rates to rise

- If it goes down , expect mortgage rates to drop

Typically, when bond rates go up, interest rates go up as well. And vice versa. Dont confuse this with bondprices, which have an inverse relationship with interest rates.

Investors turn to bonds as a safe investment when the economic outlook is poor. When purchases of bonds increase, the associated yield falls, and so do mortgage rates.

But when the economy is expected to do well, investors jump into stocks, forcing bond prices lower and pushing the yield higher.

Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 19502000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

Read Also: Rocket Mortgage Requirements

Treasurys Only Affect Fixed

Treasury yields only affect fixed-rate mortgages. The 10-year note affects 15-year conventional loans while the 30-year bond affects 30-year loans. When Treasury rates rise, so do rates on these mortgages. Banks know they can raise rates once their primary competitors do.

The Federal Reserve affects short-term and adjustable-rate mortgages. The Fed sets a target for the fed funds ratethe rate banks charge each other for overnight loans needed to maintain their reserve requirement. This, in turn, affects the following:

- The London Interbank Offered Rate : the rate banks charge each other for loans ranging from overnight to one year

- The prime rate: the rate banks charge their best customers

All of these influence adjustable-rate mortgages and other fluctuating-rate loans independently of Treasurys and other bonds. These rates typically reset regularly.

Note: Published LIBOR rates will begin to phase out at the end of 2021, and all contracts based on LIBOR will end by June 30, 2023.

What Fed Rate Decisions Mean For Mortgages

The Fed sets the federal funds rate. This is an interest rate applied to money that banks and other depository institutions lend to each other overnight.

The fed funds rate affects short-term loans, such as credit card debt and adjustable-rate mortgages, which, unlike conventional fixed-rate mortgages, have a floating interest rate that goes up and down with the market on a monthly basis. Long-term rates for fixed-rate mortgages are generally not affected by changes in the federal funds rate.

If the central bank wanted to reduce rates again to stimulate the economy, it would have to push rates into negative territory, a move that Powell, the Fed chairman Powell has said is not being contemplated.

Don’t Miss: How Much Is Mortgage On 1 Million

Why Do Interest Rates Impact The Uk Housing Market

Rising interest rates can increase mortgage costs, making repayments more expensive and increasing the overall size of the home loan.

Rising rates can also hit house prices. A one percentage point rise in the base rate could reduce house prices from between 2% and 11% according to Sir Jon Cunliffe, the Bank of Englands deputy governor.

However many experts suggests that the UK housing market is robust enough to weather any rise in interest rates, especially with demand outstripping supply.

Len Kiefer Deputy Chief Economist With Freddie Mac

Kiefer anticipates the currently low mortgage rates to continue throughout next year. Our forecast is that rates will be relatively flat next year, he says. But Kiefer says rates may not necessarily stay that way. They might bounce around a little bit, he says. And he believes rates may be modestly higher at the end of next year, but pretty flat over the next 12 months.

Kiefer believes any change we see in mortgage rates will be tied to the broader economy. The key thing for the early part of 2021 is going to be what happens with the pandemic, Kiefer says. If the economy opens up, we may see interest rates start to rise a little bit. However, if theres increased economic uncertainty, that would put downward pressure on rates. One thing to keep an eye on is inflation. If inflation increases, he expects rates to rise in that scenario.

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

What The Federal Reserve Does

The Federal Reserve sets borrowing costs for shorter-term loans in the U.S. by moving its federal funds rate. The Fed kept this rate set near zero. The rate governs how much banks pay each other in interest to borrow funds from their reserves kept at the Fed on an overnight basis. Mortgages, on the other hand, track the 10-year Treasury rate.

Changes to the federal funds rate might or might not move the rate on the 10-year Treasury, which are bonds issued by the government that mature in a decade. Though a Fed rate cut doesnt directly push down yields on the 10-year, it can lead to the same outcome. Investors worried about the economy after a rate cut might flock to the 10-year Treasury, considered a safe-haven asset, pushing down yields.

The Fed also influences mortgage rates through monetary policy, such as when it buys or sells debt securities in the marketplace. Early in the pandemic there was severe disruption in the Treasury market, making the cost of borrowing money more expensive than the Fed wanted it to be. In response, the Federal Reserve announced it would buy billions of dollars in Treasuries and mortgage-backed securities, or MBS. The move was to support the flow of credit, which helped push mortgage rates to record lows.