How Much House Can I Afford With A Va Loan

Eligible active duty or retired service members or their spouses can qualify for down payment-free . These loans have competitive mortgage rates but usually and dont require PMI, even if you put less than 20 percent down. These loans be a great option if you qualify and can help you get into a new home without overstretching your budget.

The Key Principles Of Mortgage Approval Are As Follows:

- Your income should be secure .

- You can provide evidence of affordability from recent rent and savings patterns that you can afford repayments

- You have an adequate cash deposit

- You have a good credit history, well managed finances and typically no loans or credit card debt.

1. What is the maximum mortgage limit.

- Central Bank rules place a limit of 3.5 times your normal gross income as your maximum mortgage.

- Exemptions above 3.5 times gross income are difficult to secure at present but are available in limited circumstances.

2. How much of a deposit do you need?

- First time buyers 10%

- Second time buyers 20% of the purchase price

- Some lenders are comfortable to have the deposit requirement provided by way of a gift, but as a general rule lenders preference is to see a steady savings pattern contributing to 5% of the purchase price – some tolerance for larger gifts is evident with long rental history

- Deposit exemptions are available at present so that second time buyers with strong incomes are not restricted to a minimum 20% deposit. Each case is assessed on its own merits.

3. Can you afford the repayments?

4. Is your income secure?

5. Can you demonstrate good financial management?

- Good regular savings record

- Minimum of personal debt and credit cards cleared monthly

- Prudent spending habits

- If you have taken out loans in the past – there should be no missed payments

- No online gambling

Mortgage Insurance For Usda Loans

USDA loans do require you to have mortgage insurance. Youll pay for this in a combination of two ways. There is a one-time upfront guarantee fee you have to pay. In 2020, this upfront guarantee fee is 1%. Then there is an additional annual fee that is divided up into your mortgage payment every month. In 2020, this annual fee is .35%. This annual fee lasts the entire duration of the USDA loan life. These percentages can change year to year, but once you close your USDA loan, it will not change because of any yearly percentage rate fluctuation.

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Other Types Of Income That Count Toward Mortgage Qualifying

Heres what you need to know when using other types of income to qualify for a home loan:

- Dividend income: These are cash payments received for owning stock in a company. This income must be regular, and you must show a twoyear history of receiving dividends

- Retirement income: Income must continue for at least three years postclosing

- Social Security income: This income must continue for at least three years postclosing

- Alimony/child support: You must have received regular payments for at least six to 12 months prior to getting the mortgage, and support payments must continue for at least three years postclosing. Youll need to provide a copy of a divorce decree and other court orders

If youre not sure whether your income qualifies, talk to a mortgage lender. Your loan officer can help you understand which types of income are eligible and how much home you can afford based on your monthly cash flow.

How To Prepare For Your Application

Before applying for a mortgage, contact the three main credit reference agencies and look at your credit reports. Make sure there is no incorrect information about you. You can do this online either through a paid subscription service or one of the free online services currently available.

You can check you credit score with one of the three main credit ratings agencies:

Recommended Reading: Reverse Mortgage Mobile Home

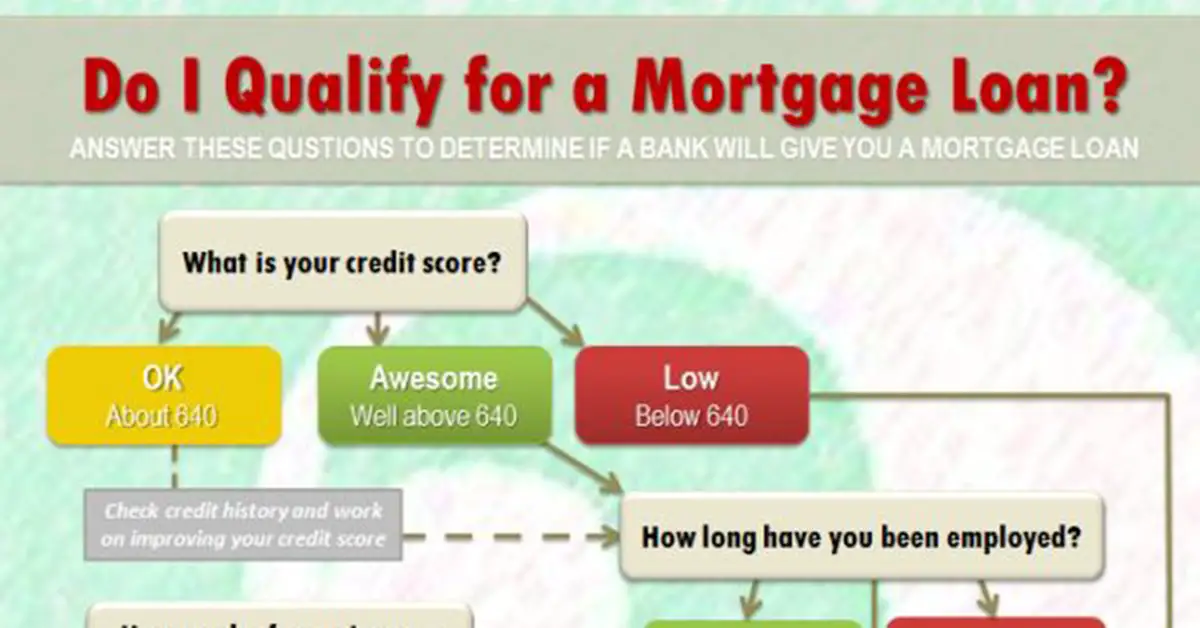

How Mortgages Are Approved

To get a clearer view of the mortgage process, its helpful to know some of the factors that will be considered when your mortgage application is reviewed.

When you apply for a mortgage, your lending specialist will forward your application and the supporting documentation to an underwriter. It’s the underwriter’s responsibility to review your loan scenario and the supporting documentation to ensure that it meets the loan program guidelines and to determine whether or not you qualify for the loan.

The underwriter looks at your information with these basic criteria in mind:

As you move forward, keep in mind that your income, debt, credit history, down payment, savings, home value and loan program guidelines will all play a role in whether your loan application is approved.

Cfpb Shifting From Dti Ratio To Loan Pricing

Both Fannie Mae and Freddie Mac have allowed higher DTI ratios for buyers carrying significant student debt.

While measuring debt-to-income is useful for getting a baseline feel for what you may qualify for, the CFPB proposed shifting mortgage qualification away from DTI to using a pricing based approach.

What Change did the CFPB Propose?

“the Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach.”

Why Did They Suggest the Change?

“The Bureau is proposing a price-based approach because it preliminarily concludes that a loans price, as measured by comparing a loans annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumers ability to repay than DTI alone.”

How Does This Impact Loan Qualification for Low-income Buyers?

“For eligibility for QM status under the General QM definition, the Bureau is proposing a price threshold for most loans as well as higher price thresholds for smaller loans, which is particularly important for manufactured housing and for minority consumers.”

You May Like: Reverse Mortgage Manufactured Home

What Is A Mortgage

There are two components to your mortgage paymentprincipal and interest. Principal refers to the loan amount. Interest is an additional amount that lenders charge you for the privilege of borrowing money that you can repay over time. During your mortgage term, you pay in monthly installments based on an amortization schedule set by your lender.

Another factor involved in pricing a mortgage is the annual percentage rate , which assesses the total cost of a loan. APR includes the interest rate and other loan fees.

Mortgage Loan Preapproval And Loan Prequalification

After basic calculations have been done and a financial statement has been completed, the borrower can ask the lender for a prequalification letter. What the prequalification letter states is that loan approval is likely based on credit history and income. Prequalifying lets the borrower know exactly how much can be borrowed and how much will be needed for a down payment.

However, prequalification may not be sufficient in some situations. The borrower wants to be preapproved because it means that a specific loan amount is guaranteed. It is more binding and it means the lender has already performed a credit check and evaluated the financial situation, rather than rely on the borrowers own statements like what is done in prequalification. Preapproval means the lender will actually loan the money after an appraisal of the property and a purchase contract and title report has been drawn up.

Also Check: Recasting Mortgage Chase

How Do Lenders Check I Can Afford A Mortgage

Lenders will work out your household income including your basic salary and any other income you receive from a second job, freelancing, benefits, commission or bonuses.

Checking affordability is a much more detailed process. Lenders take all your regular household bills and spending into account, along with any debts such as loans and credit cards, to make sure you have enough left to cover the monthly mortgage repayments.

Tips For Qualifying For A Mortgage

If youre considering a home purchase in 2022, heres a brief recap of which programs may be the best fit for your finances:

Qualifying for a conventional loan may be your best bet if:

- You have high credit scores

- You can make at least a 20% down payment

- You are eligible for the HomeReady or Home Possible loan programs

Qualifying for an FHA loan is a good choice if:

- You have credit scores between 500 and 619

- You have at least a 3.5% down payment and a 580 credit score

- You want to buy a two- to four-unit home with a 3.5% down payment

Qualifying for a VA loan may be a good option if:

- Youre an eligible military borrower

- You dont want to make a down payment

- You want to avoid mortgage insurance

Qualifying for a USDA loan is a good fit if:

- You havea low-to-moderate income

Also Check: Reverse Mortgage On Condo

What You Need To Qualify For A Mortgage

When you apply for a mortgage, lenders want to know that you have the capacity to repay the loan through a steady income that isnt already consumed by debt payments. They also want to see that you have the credit to repay it, as demonstrated by a multiyear history of reliably making payments.

Can I Get A Mortgage If My Credit Score Is Low

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

Can I Use A Mortgage Calculator Based On Income +

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Will I Qualify For A Mortgage +

To know if you will qualify for a mortgage based on your current income, try our Mortgage Required Income Calculator. You will need to supply information about the cost of the Mortgage, down-payment, interest rates, and other liabilities, after which the calculator responds with the required minimum income to qualify for the loan.

Also Check: Rocket Mortgage Qualifications

What Are Mortgage Loan Limits

Loan limits restrict the maximum amount of money a homebuyer can borrow to purchase or refinance a home. Government Sponsored Enterprises or GSEs cap the dollar amount of a mortgage based on the county the property is located in using a percentage of the area medium prices for homes in the county the home is located in. This, of course, covers the lenders and gives them a better chance of avoiding a borrower defaulting on their mortgage.

Its Not What You Can Borrow Its What You Can Afford

In some respects, the mortgage lending industry is working against your best interest. If you are deemed a qualified borrower, a lender is prone to approve you for the maximum it believes you can afford. But in some cases, that amount may be too generous.

Buying a home always means dealing with big numbers. And the impact to your budget may seem to be a stretch, particularly in the beginning. The challenge is buying a home that meets your current and future needs, without feeling like all of your money is in your home leaving you without the financial freedom to travel, save for other priorities and have a cash flow cushion.

Now that the NerdWallet How much can I borrow calculator has given you an idea of your buying power, you may want to gut-check the number by:

-

Run affordability scenarios. You can get another view of your home-buying budget by running some what-ifs through the NerdWallet home affordability calculator.

-

Talk to more than one lender. You are more likely to get a better interest rate by comparing terms offered by multiple lenders, and it might be illuminating to see the loan amounts different lenders will qualify you for.

-

Consider all homeownership expenses. Its not just whats built into your monthly payment such as insurance, taxes and the rest but the other having-a-home expenses, like structural upkeep, new furniture, maybe even yard maintenance equipment.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Where And How To Get A Mortgage

You can get a mortgage from a lender, bank, or broker. A lender and a bank are both financial institutions, whereas a broker operates like a private contractor. Working with a lender offers many benefits, including competitive rates, plenty of product options, and flexible qualifying guidelines.

When you apply for a loan, a lender is going to ask for personal information to verify your data is accurate. You may need to provide private information to your lender, such as your social security number, tax records, or bank statements. Depending on your situation, a mortgage advisor might ask you about credit events from your past, and you may have to explain why a credit event is on your history.

No matter what organization you choose to help you fund your dream home, youre going to work directly with one person. This person represents the lending institution and will help you originate your loan. This type of mortgage expert is referred to as a loan officer or a mortgage consultant.

You can start your search by looking at lenders and mortgage consultants in your area. Working with someone close by will be helpful. Feel free to ask for recommendations from friends and family. Another option is to start by visiting a lender at their office or calling them up. If you do prefer to get a loan online, then make sure the lender you work with provides that option. With On Q Financial, you can start your mortgage journey from your phone by downloading a mobile loan app.

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

Read Also: Chase Recast

What Credit Score Do I Need To Get A Mortgage

You credit score is the starting point for lenders and if its not high enough, it also could serve as the ending point. Most lenders want a credit score of 680 or higher to start talking about a mortgage. Its possible to get one with a score under that, but it would be a stretch to think youll get a conventional loan from a bank or online lender.

A credit score between 680 and 750 will lower the interest rate and anything above 750 will get you the lowest interest rate possible. If youve stumbled with your credit history and your score is sub-680, you arent eliminated from finding a home loan, but it may cost you more.

Veterans Administration loans, which are reserved for military families, want your credit score to be above 620. The U.S. Department of Agricultures home loans for low-and-moderate income housing in rural areas, also seeks credit scores of 620 or higher. The Federal Housing Administration offers loans to consumers with scores as low as 580.

What Is The Conforming Loan Limit In 2020

Conforming conventional loan limits change from area to area and from year to year. This year, in 2020, and in most of the mainland U.S., single-family homes have a conforming loan limit of $510,400 and may be more in high-cost areas. The FHA loan limit in most counties is $331,760. These loan limits are set by using a percentage of the area medium price in the county the home is located in.

VA Loan Limits no longer apply to qualified veterans who have full VA loan entitlement! The VA county loan limit in most areas for borrowers with 100% entitlement can exceed the county loan limit of $510,400 with On Q Financial up to $1,500,000 as long as they qualify.

Loan limits still apply to borrowers with more than one active VA loan. Keep in mind that borrowers who have defaulted on a previous loan are only eligible for partial entitlement as long as the lender can obtain a 25% guarantee on the loan. Usually, this 25% guarantee is fulfilled by requiring additional funds for down payment.

You May Like: Rocket Mortgage Conventional Loan