Whats Moving Current Mortgage Rates

How come mortgage rates are rising while the Omicron variant is wreaking havoc with the American and global economies? Surely, theyd normally be falling.

Well, yes. But investors are looking ahead and betting that Omicron will, within a short period, become less prevalent in the US and have left high levels of COVID-19 immunity among the population. Economically, the pain the variant is inflicting now will leave the country much stronger.

This is far from settled science. But we can already see that Omicron typically blows through populations very quickly and that most people experience mild symptoms, if any. Of course, some, sadly, suffer more severely, and relatively few die.

What the UK can tell us about Omicron

The United Kingdom was one of the first advanced nations to be hit by Omicron. It reported its first two cases on Nov. 27, 2021. And, as of yesterday, its number of daily infections had tumbled to 99,652 from 178,250 seven days earlier.

True, its hospitalization and death rates are still rising. But thats because there are inevitable time lags between getting infected, needing hospitalization and, in relatively rare cases, dying.

Of course, the UK and the US are not directly comparable. The proportion of the UK population that has had two vaccinations or more is noticeably higher than here.

However, early signs are encouraging. And investors dont appear outrageously optimistic in wagering on the pandemic looking much better in the spring.

What Is A Purchase Plus Improvements Mortgage

Home \ Mortgage \ What Is A Purchase Plus Improvements Mortgage?

Join millions of Canadians who have already trusted Loans Canada

It can be frustrating finding and financing a property that you want to live in. You might find your dream home, only to find out that it is in need of some major renovations. The costs of renovations can really add up, and you might not be able to afford them. Luckily, there is a solution that will allow you to purchase a property while also covering the costs of renovationsa purchase plus improvements mortgage.

Review Your Credit Dti And Income

Before moving on, make sure your financial health is in order. There are three major factors involved in getting approved for a mortgage:

Find Out: How to Refinance Your Home with Bad Credit

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

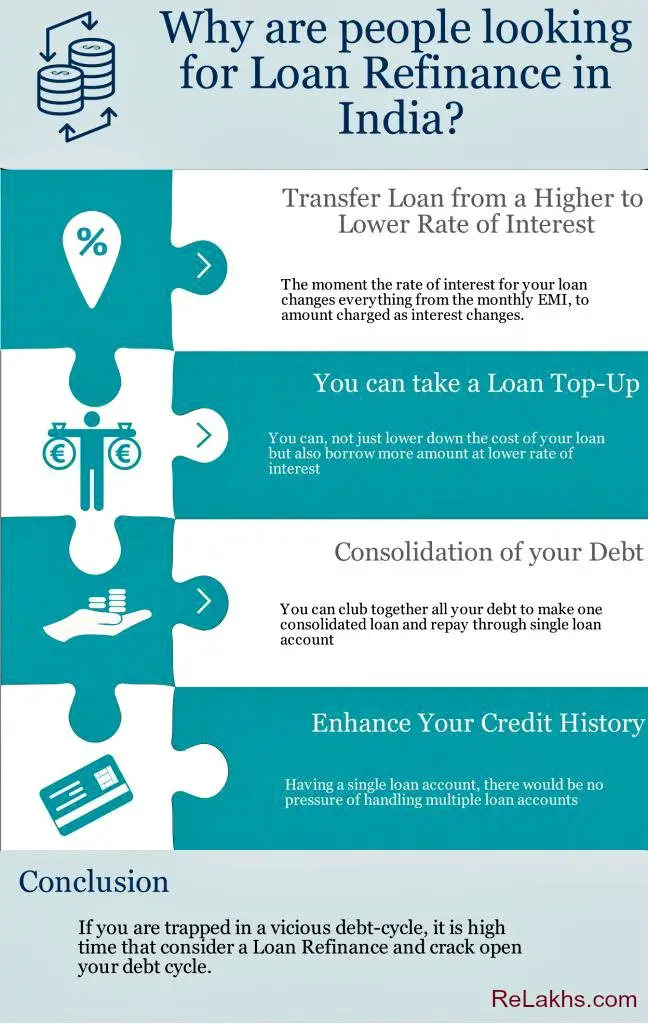

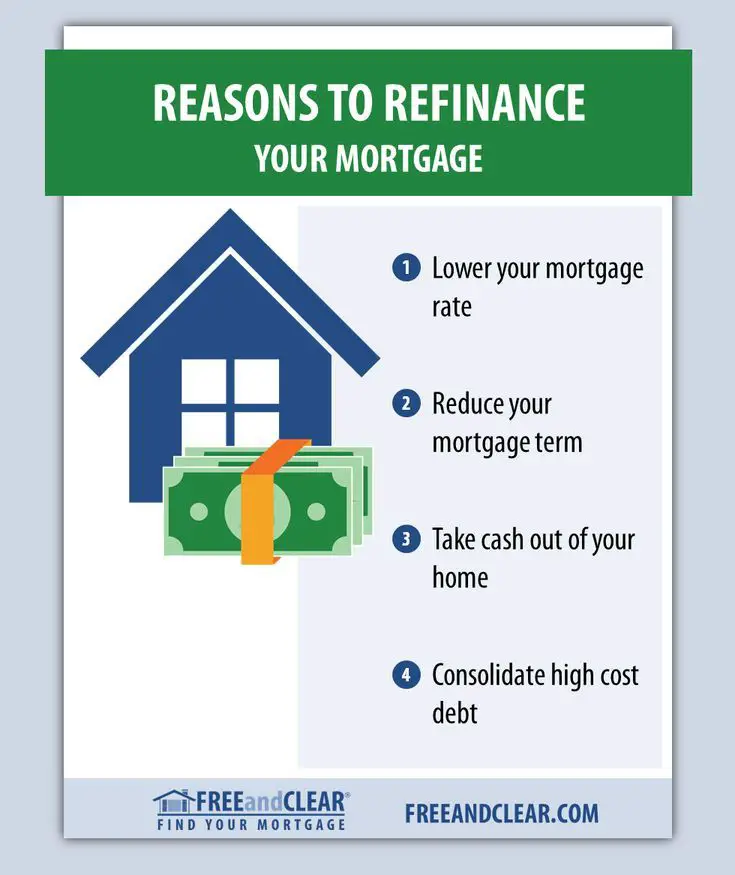

How Many Types Of Refinancing Are There

Homeowners can choose to refinance for a variety of reasons including:

Cash Out Home Equity

Homeowners can extract equity from the homes. The extracted equity can be used as a low-cost source of business funding, to pay off other higher-interest debts, of fund home renovations. If the equity is extracted to pay for home repairs or major home improvements the interest expense may be tax deductible.

Change Loan Duration

Homeowners can shorten duration to pay less interest over the life of the loan & own the home outright quicker lengthen the duration to lower monthly payments.

Lower Interest Rates

If mortgage rates decline homeowners can refinance to lower their monthly loan payments. A one to two percent fall in interest rates can save homeowners tens of thousands of dollars in interest expense over a 30-year loan term.

Change Loan Structure

Borrowers who used an ARM to make initial payments more afforadable could shift to a fixed-rate loan after they built up equity & have progressed along their career path to increase their earnings.

Remove Mortgage Insurance Requirements

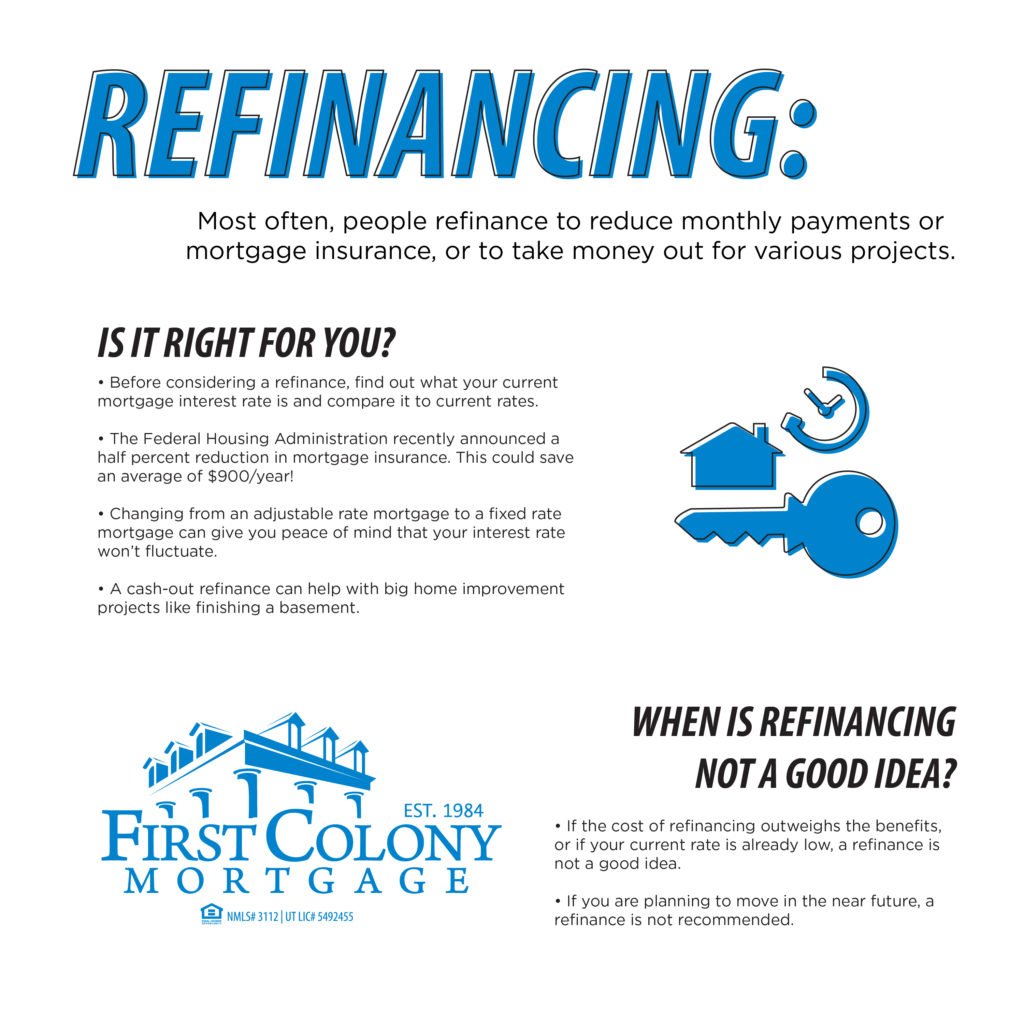

The following graphic explores examples of why a home owner may choose to refinance.

The Cost Of Refinancing Your House

In general, refinancing includes the following closing costs outlined below:

Application fee. Lenders impose this charge to cover the cost of checking a borrowers credit report, and the initial cost to process the loan request.

Title insurance and title search. This charge covers the cost of a policy, which is usually issued by the title insurance company, and insures the policy holder for a specific amount, covering any loss caused by discrepancies found in the property’s title. It also covers the cost to review public records to verify ownership of the property.

Lender’s attorney review fees. The company or lawyer who conducts the closing will charge the lender for fees incurred, and in turn, the lender will charge those fees to the borrower. Settlements are conducted by attorneys representing the buyer and seller, real estate brokers, escrow companies, title insurance companies and lending institutions. In most situations, the individual conducting the settlement is providing their services to the lender. Borrowers may be required to pay for other legal fees and services related to their loan, which is then provided to the lender. They may want to retain their own attorney for representation in the settlement, and all other stages of the transaction.

Read Also: Reverse Mortgage For Mobile Homes

How A Mortgage Refinance Helps Homeowners

Your personal finances arebound to change over the years. Youll build home equity your income mayincrease maybe youll pay off debts and improve your credit score.

As your finances improve,youll likely have access to better mortgage options than you did when youbought your home.

In addition, mortgageinterest rates are constantly in flux.

If rates have fallen sinceyou took out a home loan, theres a good chance you can refinance to a lowerrate and save even if your finances look exactly as they did when you boughtthe house.

You can also change the featuresof your home loan when you refinance.

You can choose the number of years in your loan you can choose the nature of your interest rate and, you can even choose what you pay in mortgage closing costs.

Many homeowners refinance to get a lower mortgage rate. But a refinance mortgage can also help you pay your home off more quickly, eliminate mortgage insurance, or tap your home equity to pay off debt or fund home improvements.

How To Shop For A Mortgage

Shopping around and comparing offers is critical to get the best deal on your mortgage refinance. Make sure to get quotes from at least three lenders, and pay attention not just to the interest rate but also to the fees they charge and other terms. Sometimes its a better deal to choose a slightly higher interest loan if the other aspects are favorable.

You May Like: Rocket Mortgage Requirements

How Much Do I Pay To Refinance

Mortgage refinancing isn’t free. Youll pay several fees to your new lender, and other professionals as well to compensate them for processing the loan. Some of the costs of refinancing include:

- Application fees: This expense covers the cost to process your loan and perform credit checks.

- Origination fees: This is a one-time fee that you pay for loan preparation.

- Appraisal fees: This covers the cost of an appraisal to assess the value of your home.

- Inspection fees: You’ll be charged this fee if your home requires an inspection to assess its condition prior to being approved for a new mortgage.

- Closing costs: This includes fees for the attorney who handles the closing of the loan on behalf of the lender.

Altogether, refinancing fees can amount to 3% to 6% of the remaining principal on the mortgage. Your lender might not require that you pay these fees upfront if you qualify for a “no-cost refinancing,” but you’ll still effectively pay them through a higher interest rate over the course of the loan.

Mortgage Interest Rates Forecast For Next Week

Mortgage rates might rise overall next week. We may be past the worst of the sharp increases. And theres always the possibility of limited falls.

But Id be surprised if we saw a week-over-week drop. Having said that, Im not unused to being surprised.

Mortgage and refinance rates usually move in tandem. And the scrapping of the adverse market refinance fee has largely eliminated a gap that had grown between the two.

Meanwhile, another recent regulatory change has likely made mortgages for investment properties and vacation homes more accessible and less costly.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

Refinancing To Tap Equity Or Consolidate Debt

While the previously mentioned reasons to refinance are all financially sound, mortgage refinancing can be a slippery slope to never-ending debt.

Homeowners often access the equity in their homes to cover major expenses, such as the costs of home remodeling or a child’s college education. These homeowners may justify the refinancing by the fact that remodeling adds value to the home or that the interest rate on the mortgage loan is less than the rate on money borrowed from another source.

Another justification is that the interest on mortgages is tax-deductible. While these arguments may be true, increasing the number of years that you owe on your mortgage is rarely a smart financial decision nor is spending a dollar on interest to get a 30-cent tax deduction. Also note that since the Tax Cut and Jobs Act went into effect, the size of the loan on which you can deduct interest has dropped from $1 million to $750,000 if you bought your house after Dec. 15, 2017.

Many homeowners refinance to consolidate their debt. At face value, replacing high-interest debt with a low-interest mortgage is a good idea. Unfortunately, refinancing does not bring automatic financial prudence. Take this step only if you are convinced you can resist the temptation to spend once the refinancing relieves you from debt.

It takes years to recoup the 3% to 6% of principal that refinancing costs, so don’t do it unless you plan to stay in your current home for more than a few years.

Ways To Reap More Savings When Refinancing Your Mortgage

by Maurie Backman | Published on Jan. 14, 2022

Many or all of the products here are from our partners that pay us a commission. Its how we make money.But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Here’s how to make refinancing even more financially beneficial.

Read Also: Bofa Home Loan Navigator

Apply For Your New Loan

Once you’ve chosen your loan, it’s time to begin your application. You can usually do this online, and you will typically need the following documents:

-

Your last two payslips if employed

-

The last two years of tax returns if self-employed

-

Three months of bank statements

-

Evidence of any rental income

-

Six months of statements for your current home loan

-

Three months of statements for any loans you are consolidating i.e. credit card debt

-

A copy of your current Rates Notice and evidence of payment

-

Personal ID

Having these refinancing documents on-hand will make your application smoother and easier. If you’re refinancing with loans.com.au , we have a process called FastTrax Refi.

We pay out your current lender quickly and you don’t have to contact them, we will do it for you.

What Is Refinancing And Why Would You Do It

Refinancing is the process of switching your existing home loan to a different lender or changing loan products. Many borrowers choose to refinance to take advantage of benefits like lower interest rates, additional features and flexibility, to access home equity or for debt consolidation requirements.

There are a number of pros and cons to refinancing and a lot will depend on your personal situation. But, if youve had you current loan for some time and are thinking of making the switch, weve put together a simple guide to help you understand the process.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Refinancing To Access Your Homes Equity

In the first quarter of 2020, 42% of all refis involved an increased principal balance by at least 5%, indicating the owners took cash out, financed closing costs or both. While cash-out refi rates can be a bit higher than rate-and-term refinance rates, there still may be no cheaper way to borrow money.

You can access your home equity through a cash-out refinance if you will have at least 20% equity remaining after the transaction. Heres an example.

Can I Refinance With The Same Lender

If youre swapping to a different type of home loan, changing your repayments, or splitting and combining loans all while remaining with the same lender we call this a loan transfer.

Before you decide to refinance, its worth looking at what your current lender is now offering because there might be a new home loan with more flexible features or add-ons that can help you meet your goals.

Read Also: Rocket Mortgage Vs Bank

Why Would You Refinance

Refinancing can be a smart way to manage your money. It may give you the option of securing a better deal, consolidating debts, or unlocking equity in your current property, depending on the options you take.

When refinancing, you generally want to increase, decrease, or keep the loan amount the same.

Loan increases may be used to consolidate more debts or release capital for other expenditures, such as home renovations. Home loan rates are lower than those for credit cards, so consolidating your debts into one loan can make repayments simpler and reduce the interest owing each month.

Keeping the loan amount the same suggests that you are likely looking for a better deal. What constitutes a better deal is something that can only be answered by your specific set of circumstances. You may be currently paying for extra facilities you dont need, have improved your credit score and can now secure a better interest rate, or want to change to a fixed or variable rate to take advantage of market conditions. Whatever the case, comparing home loans online is a great way to start, as you will be able to soon gauge what deals appeal to you.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Rocket Mortgage Payment Options

How To Refinance A Mortgage In 8 Steps

Refinancing a mortgage involves replacing your current home loan with a new one. Homeowners might refinance to get a lower interest rate, shorter loan term or change loan types.

Knowing how to refinance a mortgage, including the refinance process, costs, timeline and other factors, can help you better decide if refinancing your home is the right move.

Should I Refinance Right Now

The decision to refinance isnt driven only by market factors such as interest rates or home values, your personal situation also matters. Assessing whether refinancing fits into your financial and life plans, is always a good idea

Generally speaking, refinancing makes sense if you can lower your interest rate by 1% or more. However, there are times when securing a lower interest rate isnt the main driver behind the decision to refinance. As home values rise, many homeowners are choosing to turn their equity into cash via a cash-out refinance. Cash-out refinance loans typically have higher rates compare to other options, but it can be a good way to pay for home upgrades or to pay off other higher interest debt.

At the end of the day, its a good time to refinance if refinancing aligns with your financial goals and helps you achieve them.

Read Also: Mortgage Recast Calculator Chase

How Often Can I Apply To Refinance My Mortgage

While you should only ever refinance your home with good reason, there are no rules that limit how often you can refinance. Lenders, however, will typically set a limit. Keep in mind that your credit report will be pulled each time you refinance, and when this happens too frequently it can negatively affect your credit score. Since your credit score is also a factor in a lenders decision to approve your refinancing, a lower score would also lower your chances of approval.

What Do I Do To Refinance

The first thing you must do when considering refinancing is to consider exactly how you will repay the loan. If the home equity line of credit is to be used for home renovations in order to increase the value of the house, you may consider this increased revenue upon the sale of the house to be the way in which you will repay the loan. On the other hand, if the credit is going to be used for something else, like a new car, education, or to pay down credit card debt, it is best to sit down and put to paper exactly how you will repay the loan.

Also, you will need to contact your mortgage company and discuss the options available to you, as well as discussing with other mortgage companies the options they would make available. It may be that there is not a current deal which can be met through refinancing that would benefit you at the moment. If that is the case, at least you now know exactly what you must do in order to let a refinancing opportunity best benefit you. When refinancing, it can also benefit you to hire an attorney to decipher the meaning of some of the more complicated paperwork.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates