Do Conventional Loans Appraise Higher

Once you apply for an FHA loan, one of the loan requirements is that the home appraisal is done at a higher standard as compared to the conventional appraisal. The FHA loan has a minimum down payment requirement but conventional loan has a higher down payment requirement despite its lower standards.

What Is A Conventional Home Loan

When you apply for a home loan, you can try for a government-backed loan, like an FHA-insured or VA-guaranteed loan, or a conventional loan, which isn’t insured or guaranteed by the federal government. Unlike federally insured loans, conventional loans carry no guarantees for the lender if you fail to repay the loan.

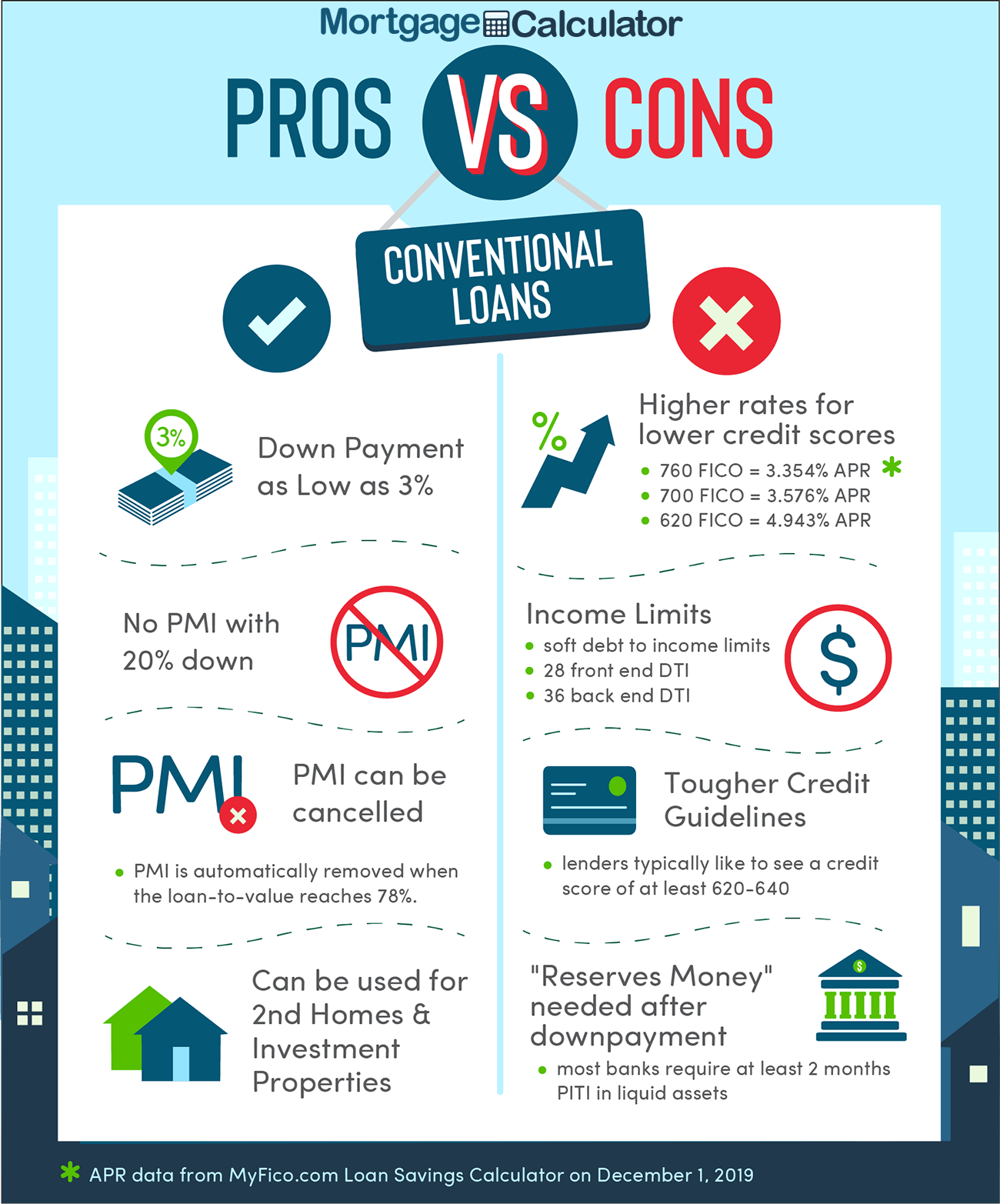

For this reason, if you make less than a 20% down payment on the property, you’ll probably have to pay for private mortgage insurance when you get a conventional loan. If you default on the loan, the mortgage insurance company makes sure the lender is paid in full.

You can get a conventional loan to buy a home to live in, or for an investment property or a second home. Also, conventional mortgages fall into one of two categories: conforming or nonconforming loans.

Why You Might Consider A Conventional Loan

In contrast to an FHA loan, conventional loans receive no federal backing and are therefore secured by a private lender, such as your bank. When loans meet certain requirements, they can later be sold to one of two government sponsored enterprises known as Fannie Mae and Freddie Mac. This allows banks to raise more capital and offer more loans to customers, so standards for qualifying for conventional loans are usually higher in order to meet GSE requirements.

Also Check: Can You Refinance A Mortgage With No Money Down

When Fha Loans Make Sense

FHA loans are best for borrowers with lower credit scores and higher debt-to-income ratios who want to pursue homeownership now rather than waiting until their credit, debt, or income improve. This might sound like you if youre a first-time homebuyer.

People arent robots, and we dont buy homes purely based on financial analysis. Personal circumstances can make homeownership more appealing than renting even if you cant get an ideal mortgage.

What’s The Difference Between Fha And Conventional Loans

The biggest difference between an FHA vs. conventional loan is that FHA loans are guaranteed by the Federal Housing Administration. In other words, if a borrower defaults on an FHA loan, the government covers the balance. A conventional loan has to meet certain lending standards set by Fannie Mae and Freddie Mac, but isn’t guaranteed by any government agency.

Because of that, FHA loans are usually easier to qualify for. They represent minimal risk to the lender, so borrowers can get FHA loans with lower than conventional loans.

You May Like: How Are Mortgage Rates Determined

Comparison Of Fha And Conventional Loan Credit Score Requirements

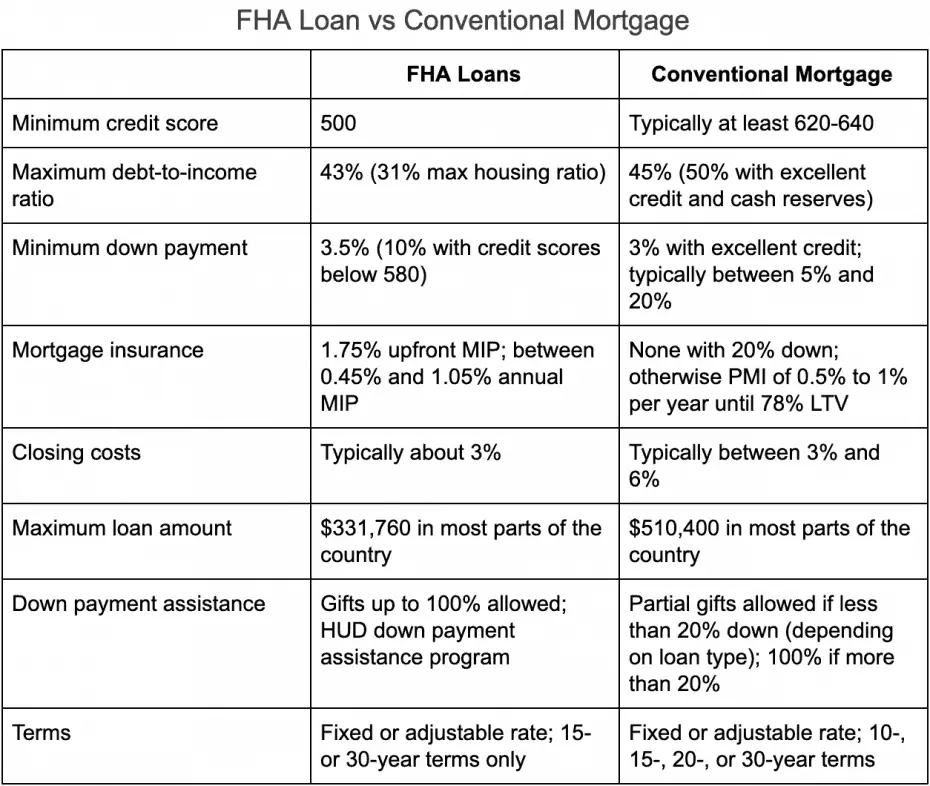

Both kinds of mortgage loan eligibility are heavily influenced by credit ratings.

- Low credit scores are typically accepted for FHA loans: Credit-challenged borrowers or those with lower credit ratings typically receive approval.

- Higher credit scores are typically preferred for conventional loans: To acquire favorable loan terms and rates, borrowers typically need credit ratings in the range of moderate to high.

Are deposits for conventional loans and FHA loans different from each other?

Sure. Conventional loans accept down payments ranging from 3 to 20%, with higher down payments, earning better terms and eliminating mortgage insurance.

For customers who meet the requirements for FHA loans, lesser down payments are permitted.

The Bottom Line: Two Available Paths To Homeownership

Ultimately, understanding which loan is right for you is a matter of understanding your financial situation and needs. You should directly weigh the pros and cons and your own qualifications, so you take your next steps in the right direction.

Are you ready to get started on your home loan approval process? Apply online now and let us help you decide which option will work best for you.

Take the first step toward buying a house.

Get approved to see what you qualify for.

Recommended Reading: Can You Get A Mortgage On A Condo

What Is The Difference Between Fha And Conventional Home Loans

Which loan is better, conventional or FHA? It depends on your income, credit score, employment & assets, and other differences between thetwo mortgage loans. Did you know you that you can borrow more money with a conventional mortgage? And that the FHA loan requires a minimum credit score of 500?

I know that this mortgage stuff is confusing. But, you should be congratulated for taking a few minutes to determine which mortgage loan is best for you. After all, you will probably make a monthly payment for the next 30-years. Here is a comparison ofthe FHA and conventional home loans.

Fha Vs Conventional Loans Comparison

When contrasting the applications and limitations of conventional loans and FHA loans, there are a few key conclusions to draw.

- Refinancing: Both FHA and conventional loans are eligible for refinancing. Nevertheless, refinancing conventional loans is more involved and calls for things like a home appraisal, a credit check, proof of income, and so on.

- Areas with high and low costs that influence loan values: There are loan ceilings and floors, or the maximum and lowest values that can receive, for both conventional and FHA mortgages. The median house price in a region is used to calculate FHA loans. The protection rules for conventional loans differ by lender, state, and county but are typically compliant with Fannie Mae and Freddy Mac.

- Debt-to-income: It’ll be more difficult to obtain a conventional loan the less your debt-to-income ratio. FHA mortgages allow DTIs up to 50% conventional loans normally tolerate DTIs in the 30-to-43% range.

Read Also: Is 15 Year Mortgage Better Than 30

Conventional Loan Vs Fha Mortgage Payments

For home buyers with good credit scores, a conventional loan may be more attractive. Thats because conventional loan costs are more dependent on your credit and down payment than FHA loan costs. And as a result, your monthly payments and PMI are lower when your credit score is higher. This is a key difference from how FHA loans work.

With an FHA loan, your mortgage rate and MIP cost the same no matter what your FICO score.

That means in the short term, FHA loans may be more advantageous.

But over the long-term, borrowers with above-average credit scores will typically find Conventional 97 loans more economical relative to FHA ones.

Remember, mortgage insurance for conventional loans can be canceled at 20% loan-to-value ratio. But FHA mortgage insurance lasts the entire life of the loan.

So if youll be staying in the home long enough to reach 20% equity and especially if you have a good credit score a conventional loan could be your cheaper option in the long run.

Fha Vs Conventional Loan: Which Mortgage Is Right For You

FHA versus conventional loan: If you need a mortgage to buy a house, you may find yourself weighing these two options. Whats the difference, and which one is right for you?

While the majority of home buyers might assume they should get a conventional home loan, about 40% end up with FHA loans, which are insured by the Federal Housing Administration. To help you decide whether an FHA or conventional loan is better for your circumstances, heres more information about each, including their distinct advantages to you as a home buyer as well as what youll need to qualify .

You May Like: How To Get Your First Mortgage

Fha Vs Conventional Loans: The Loan

FHA loans tend to have higher loan-to-value ratios than conventional mortgage loans. To explain why, itll help to explain what FHA loans are and why they exist. FHA stands for Federal Housing Authority. The FHA is part of HUD, the U.S. Department of Housing and Urban Development.

FHA loans arent actually issued or serviced by the FHA. Instead, theyre guaranteed by the FHA but issued and serviced by regular private mortgage lenders. Since 1934, FHA loans have been helping first-time homebuyers go from renting to buying.

Driven by the mission to help more Americans become homeowners, FHA loans offer a higher loan-to-value ratio. To put it in simpler terms, FHA loans comes with lower down payment requirements than conventional loans do. With an FHA loan, you can put as little as 3.5% down. The goal of the program is to help put homeownership in reach of more people.

Kate: A Conventional Loan Is The Easy Choice

Kate has a very high credit score. She wants to buy a home and has saved enough to make a down payment of 20%. Kate has decided to settle in Beverly Hills, her dream home is a bit pricey so she will need a large loan. A Conventional loan is likely the right choice for Kate.

A conventional loan, or conventional mortgage, is not backed by any government body like the FHA, the US Department of Veterans Affairs , or the USDA Rural Housing Service.

Roughly two-thirds of US homeowners loans are conventional mortgages, while nearly three in four new home sales were secured by conventional loans in the first quarter of 2018, according to Investopedia.

Sometimes conventional loans are mistakenly referred to as conforming mortgages, which is a separate type of loan which meets the same criteria for funding from Fannie Mae and Freddie Mac, but although conforming loans are technically conventional loans, the reverse is not always true. For example, an $800,000 jumbo mortgage is a conventional mortgage, since it does not qualify as a conforming mortgage because it exceeds the maximum loan amount Fannie Mae and Freddie Mac guidelines will permit.

Read Also: What Are 15 Year Mortgage Interest Rates

Who Should Not Get An Fha Loan

Borrowers turned off by the loan limit may find FHA mortgages too restrictive.

Likewise, most lenders recommend your monthly mortgage payments should not exceed 31 percent of your gross monthly income. Some private lenders offering FHA loans may allow up to 40 percent. If either of those rates proves to siphon too much of your monthly income, an FHA loan still may not be right for you.

How Exactly Does An Fha Loan Work

A mortgage insured by the Federal Housing Administration, an FHA loan offers a minimum 3.5% down payment for borrowers with a of 580 or more. An FHA loan is especially popular among first-time homebuyers who have little savings or have poor credit.

The FHA insures mortgages that are issued by banks, non-banks, credit unions, and other lenders. The main reason for this insurance is to protect lenders if there is a default on the loan. Because of this setup, FHA lenders can offer more favorable terms to borrowers who would otherwise have more difficulty qualifying for a home loan.

Don’t Miss: How Much To Earn For 200k Mortgage

Fha Vs Conventional Mortgages: Flexibility

When it comes to flexibility, its hard to say whether FHA or conventional mortgages have the edge. Conventional mortgages are available for jumbo loans and vacation homes, neither of which are options if youre taking out an FHA loan. On the other hand, FHA loans let you use a non-occupying co-borrower and are assumable by another borrower if you decide to move.

Fha Vs Conventional Loan

When looking for a mortgage to buy a home, most Americans choose either an FHA loan or a conventional mortgage loan. But when comparing an FHA vs. conventional loan, how do you know which is best? We’ll take a closer look at these mortgage types and the pros and cons of each, so you can decide which is the better fit for your situation.

Jump To

You May Like: Does Debt To Income Include Mortgage

What Are The Cons Of An Fha Loan

FHA loans have their drawback.

Theyre a riskier option for the lender, which means they often come with higher interest rates and require the purchase of PMI.

Furthermore, FHA loans can only be used for a primary residence and have certain borrowing limits.

FHA loans require the purchase of PMI and its ongoing premiums

FHA loans cannot be used for second homes or investment properties

FHA loans have higher interest rates

Not all properties qualify for FHA loans

Mortgage Insurance For Fha Loans Vs Conventional Loans

Mortgage insurance protects the lender if the borrower defaults on the loan. Its referred to as mortgage insurance or MIP on FHA loans. Youll pay an upfront mortgage insurance payment for 1.75% of the loan amount at closing and also a monthly mortgage premium between 0.45% and 1.05% of the loans principal balance. But if you make a down payment of at least 10%, mortgage insurance premiums will fall off after 11 years, or you can refinance into a new loan and put 20% down.

Borrowers who take out conventional loans also pay private mortgage insurance, or PMI, but only if the down payment is below 20%. The cost for PMI can range between 0.58% and 1.86% of the loan amount annually in premiums.

Recommended Reading: Can I Combine My Mortgage And Home Equity Loan

Can You Get An Fha Loan For Land

If you want to purchase land to build a house, you may be interested in an FHA construction loan.

This is known as a 3-in-1 mortgage or a construction to permanent loan.

It finances the whole construction process as well as the purchase of the land.

It also provides a permanent mortgage for your newly built home.

This loan is typically a one time close loan, which means you have just one closing for both the construction and permanent loan.

Heres what an FHA one time close construction loan includes:

Land

Labor

Material

If youre worried about having the money to purchase land then an FHA construction loan is a solid option.

How To Decide Which Is Right For You

While each borrower has unique circumstances, generally, a conventional loan is best for those with strong credit and a bigger homebuying budget. FHA loans are geared toward those who have lower credit scores. Ultimately, the decision comes down to the type of home you want and your financial situation. Consult with a loan officer to weigh your options.

Don’t Miss: Can A Business Get A Residential Mortgage

Fha Vs Conventional Loans: Summary

FHA loans have more lenient credit score requirements: just 500 if you can put down 10%, and 580 if you can put down 3.5%. Because of these looser standards, youll have to pay for upfront mortgage insurance. In many cases, youll also be responsible for monthly mortgage insurance premiums for the life of the loan.

Conventional loans require you to have a credit score of at least 620. The minimum down payment is 3%, and youll typically have to pay PMI unless you put down at least 20%.

With a conventional loans tighter requirements, you can purchase a primary, secondary, or investment home and borrow up to $548,250 in most areas. With an FHA loan, you can only purchase a primary residence and borrow up to $356,362 in most areas.

Readers Ask: What Is The Difference Between A Conventional And Fha Loan

Conventional loans require borrowers to pay for mortgage insurance if their down payment is less than 20%. FHA loans require mortgage insurance regardless of down payment amount. Other differences are: FHA mortgage insurance premiums last for the life of the loan if you make a down payment of less than 10%.

Contents

Recommended Reading: Is Total Mortgage A Good Company

Get Help With Your Conventional Fha Or Va Loan

Picking the right mortgage for your situation can be daunting. If you’re having trouble figuring out what type of loan is best for your circumstances or need other home-buying advice, consider contacting a HUD-approved housing counselor, a mortgage lender, or a real estate attorney.

To learn more about different aspects of homeownership in general, get Nolo’sEssential Guide to Buying Your First Homeby Ilona Bray, J.D., Attorney Ann O’Connell, and Marcia Stewart.

Fha Loans Are Insured By The Fha Conventional Loans Are Not

FHA loans are loans that are backed by the Federal Housing Administration, and they must be issued by an FHA-approved lender.

Conventional loans are not backed by the FHA but are insured by private lenders and therefore they can be issued by a wider selection of lenders.

So what does it mean when the FHA insures a loan? If the buyer defaults on the home and the home forecloses, the lender is protected from a certain degree of loss by the FHA. This extra layer of protection encourages lenders to extend loans to borrowers with lower down payments and , expanding the opportunity of homeownership to borrowers that may otherwise be ineligible under traditional conventional loans.

Recommended Reading: California Mortgage License Requirements

You May Like: How To Lock In Mortgage Rate For 6 Months

Loan Limits For Fha And Conventional Mortgages

The loan limits are set by Congress each year. There are some county exceptions, here are the typical lending limits for most US counties. For a home buyer seeking to purchase a $500,000 one unit home, the FHA home buyer will need a larger down payment than the buyer purchasing the home with a conventional mortgage. Loans that exceed the loan limits are known as jumbo mortgages.2021 Single-Family LimitFHA – $356,362 to $1,233,550 Conventional – $548,250

Fha Vs Conventional Loan: Which Is Better

There’s no one-size-fits-all answer here. Some borrowers are better off pursuing an FHA loan, while others might find a conventional mortgage loan the better option.

Generally, an FHA loan is better if:

- You have a below-average credit score.

- You don’t have a ton of money to put down.

- You want to buy a two- to four-unit property with a low down payment.

On the other hand, conventional loans are better for:

- Borrowers with good credit

- Borrowers who have larger down payments available

- Borrowers who want to buy a vacation home or investment property

The bottom line? Learn about both loan types, then get pre-approvals and rate quotes from some of the best FHA lenders and best conventional mortgage lenders. That way you can not only compare mortgage lenders, but see which mortgage type is the better option for you.

Read Also: What Is Mip On A Mortgage Loan