% Down Is Great But Not A Requirement

Thereâs a general perception that you have to put 20% down to get a mortgage. Thatâs just not true. There are many mortgage options with low or no down payment requirements.

Depending on the type of loan you choose and the amount of your down payment, you may be required to pay private mortgage insurance . PMI protects the lender against any loss if you fail to pay your mortgage. In some instances, mortgage insurance is required for the life of the loan. Other times, itâs only required until the loan is paid down to a certain percentage of the original amount. Mortgage insurance is known for its bad rap, but itâs not always the enemy. The benefit to you is that it allows you put less than 20% down.

Consider your options. Gifts or loans from relatives and programs like an 80/10/10 âcombinationâ loan can help you avoid PMI. 80/10/10 loans consist of a first mortgage and a second mortgage that total 90% of the purchase price, and a 10% down payment. These loans allow you to put just 10% down while helping you avoid the mortgage insurance payments typically associated with conventional loans with down payments of less than 20%. Our down payment calculator can help you to understand the costs and benefits of different down payment amounts so you can decide what makes the most sense for you.

Where Should I Stash My Down Payment

You could stash your down payment in a simple money market savings account. Youre not going to make tons on interest, but you wont lose money either. Keep in mind: Saving a down payment is not the same as investing for retirement. Saving a down payment should only take you a year or twoso you want to keep your savings in a place thats easy for you to access.

Choose A House You Can Handle

Being a homeowner means you cant call a landlord to fix a broken water heater or bust pipe. Beyond the upfront costs and monthly mortgage payments, be prepared to cover home repairs and upgrades. You may also have to open up your wallet for furniture and decor. So, be sure to buy a house that you can afford to furnish and maintain.

Also Check: What Are The Payments On A $200 000 Mortgage

Save A Bigger Down Payment To Make Your Home More Affordable

Remember, your down payment makes a big impact on how much home you can afford. The more cash you put down, the less money youll need to borrow. That means lower mortgage payments each month and a faster timeline to pay off your home loan. Just imagine a home with zero payments!

Now, Im always going to tell you the best way to buy a home is with 100% cash. But if saving up to pay cash isnt reasonable for your timeline, youll probably get a mortgage. Thats okay! Just save up a down payment thats 20% or more of the home price. If youre a first-time home buyer, a down payment of 510% is okaybut youll have to pay that pesky private mortgage insurance .

PMI is a yearly fee that usually costs 1% of the total loan value. Its another expense on top of your monthly payment. It protects the mortgage company in case you dont make your payments and they have to take back the house .

PMI might change how much house you can afford, so include it in your calculations if your down payment is less than 20%. If thats you, stick to a 15-year fixed-rate mortgage with a monthly payment no more than 25% of your monthly take-home pay. You can also adjust your home price range to a lower amount so you can put down at least 20% in cash.

Trust me. Its worth taking the extra time to save for a big down payment. Otherwise, youll be suffocating under a budget-crushing mortgage and paying thousands more in interest and fees.

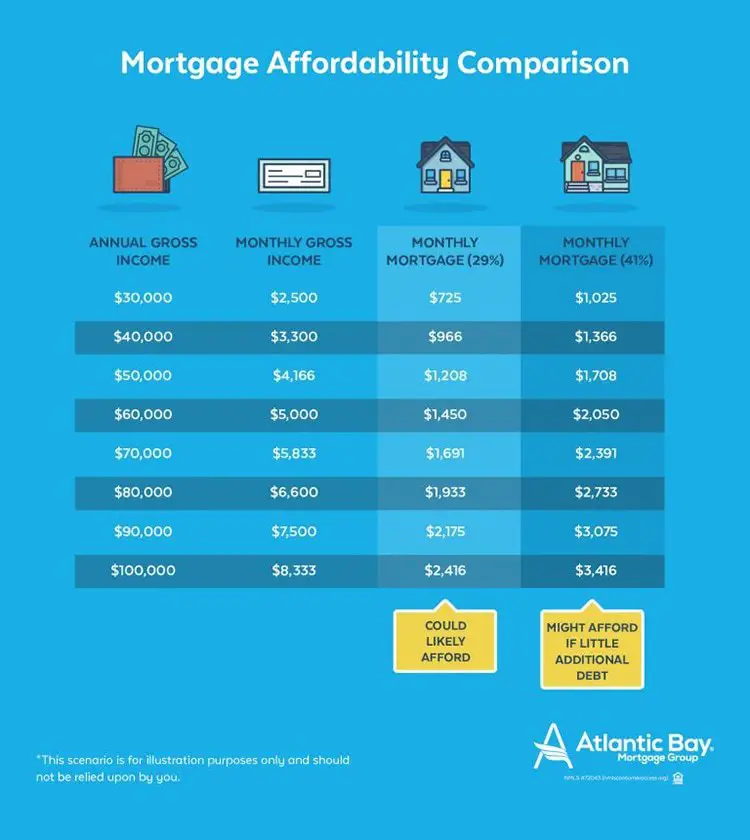

How Much Of A Mortgage Can I Afford Based On My Salary

The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x to 2.5x your gross annual income on a mortgage . Other rules suggest you shouldn’t spend more than 28-29% of your gross income per month on housing.

Recommended Reading: Which Is Better 30 Or 15 Year Mortgage

How Much House Can You Afford

| Monthly Pre-Tax Income | |

|---|---|

| $3,000 | $523,000 |

The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments. The mortgage section assumes a 20% down payment on the home value. The payment reflects a 30-year fixed-rate mortgage for a home located in Kansas City, Missouri. Plug your specific numbers into the calculator above to find your results. Since interest rates vary over time, you may see different results.

In practice that means that for every pre-tax dollar you earn each month, you should dedicate no more than 36 cents to paying off your mortgage, student loans, credit card debt and so on. This percentage also known as your debt-to-income ratio, or DTI. You can find yours by dividing your total monthly debt by your monthly pre-tax income.

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

You May Like: What Is A Hero Mortgage Loan

Explore All Of Your Mortgage Options

Believe it or not, there are severaltypes of mortgage loansavailable to homebuyers. You may want to explore conventional mortgages,FHA loans, and other government-backed financing options, like VA or USDA loans, to help determine which may be right for your situation. There are also manyfirst-time homebuyer resources, which could reduce your upfront costs or help you more easily qualify.

Summary Of Moneys Guide To Home Affordability

How much house you can afford depends mainly on two factors: your eligibility for a mortgage loan and your actual budget when it comes to paying a monthly bill, along with taxes and insurance. Remember these steps when youre getting ready to make your home purchase:

- Calculate your monthly debt and compare it to your gross income to get an idea of your DTI.

- Take into account other monthly expenses such as utilities and groceries.

- Save up for a down payment.

- Consider all your loan options, such as FHA and VA loans.

- Use a mortgage calculator to avoid any surprises.

Also Check: What Does A Mortgage Payment Consist Of

What Factors Help Determine ‘how Much House Can I Afford’

Key factors in calculating affordability are 1) your monthly income 2) cash reserves to cover your down payment and closing costs 3) your monthly expenses 4) your credit profile.

-

Income. Money that you receive on a regular basis, such as your salary or income from investments. Your income helps establish a baseline for what you can afford to pay every month.

-

Cash reserves. This is the amount of money you have available to make a down payment and cover closing costs. You can use your savings, investments or other sources.

-

Debt and expenses. Monthly obligations you may have, such as credit cards, car payments, student loans, groceries, utilities, insurance, etc.

-

Credit profile. Your credit score and the amount of debt you owe influence a lenders view of you as a borrower. Those factors will help determine how much money you can borrow and the mortgage interest rate youll earn.

For more information about home affordability, read about the total costs to consider when buying a home

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross household income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Recommended Reading: Is It Cheaper To Pay Mortgage Or Rent

Tips To Improve Your Dti Ratio

If you want to buy a home but you are carrying too much debt to qualify for a mortgage, you may first want to focus on improving your debt-to-income ratio. There arenât any tricks to decreasing your DTI. You have three main avenues to improve your DTI:

- Increase income

If is holding you back from getting to 36%, you might want to consider a balance transfer. You can transfer your credit card balance to a and pay down your debt before the offer expires.

This means your money is going toward your actual debt and not interest on that debt. Itâs important to remember that if you donât manage to pay down the debt before the 0% APR offer ends, you might end up with a higher interest rate on your debt than you had before.

But if you can swing a balance transfer it might be able to help you fast-track your debt payment and get you to the debt-to-income ratio you need to qualify for a home purchase.

Your other two options, pay off debt and increase income, take time. Perhaps you need to make a budget and a plan to knock out some of your large student or car loans before you apply for a mortgage. Or you wait until you get a raise at work or change jobs to apply for a mortgage.

How To Qualify For A Bigger Mortgage

If you don’t qualify for the mortgage you need to buy your ideal home, there are ways to increase what you’re eligible for. To start, work on improving your credit score. If you can qualify for a lower rate, it will allow you to buy in a higher price range. It’s also important to reduce your credit card debt as much as possible.

Reducing your debts will also put you in a better position to get a bigger loan. If you have tax debt, you can work with an expert to start reducing what you owe. Debt consolidation may also be an option worth pursuing, particularly if it helps save you money by combining your debts into a more manageable payment. There are multiple debt consolidation alternatives to explore.

You can also increase your income – either by taking on a side gig, finding a passive income stream or putting in extra hours at work.

Bottom line: The more income you’re able to free up each month, the more a mortgage lender will be willing to loan you.

Don’t Miss: How To Take A Mortgage Loan

How Much Of Your Income Should Go To Rent

Weve put together some tips for getting it right. How much of your income should go to rent? You could consider the 30 percent rule seek out a place with a rental fee less than or equal to 30 percent of your monthly take-home pay. You could split higher rent with a roommate, as long as your portion fits the rule.

Calculate Your Mortgage Qualification Based On Income

In this calculator you can inclue investments, annuities, alimony, government benefit payments in the other income sources. Be sure to select the correct frequency for your payments to calculate the correct annual income.

- daily: 365 times per year

- weekly: 52 times per year

- biweekly: 26 times per year

- semi-monthly: 24 times per year

- monthly: 12 times per year

- bimonthly: 6 times per year

- quarterly: 4 times per year

- semi-annually: 2 times per year

- annually: 1 time per year

This calculator defaults to presuming a single income earner. If your household has 2 income earners then you can expand the “spouse or partner” section to enter their income information. We calculate the mortgage qualification ranges using the following maths:

| Your Mortgage Qualification |

|---|

Recommended Reading: Who Offers 50 Year Mortgages

How To Increase Your Mortgage Affordability

If you want to increase how much you can borrow, thus increasing how much you can afford to spend on a home, there are few steps you can take.

1. Save a larger down payment: The larger your down payment, the less interest youll be charged over the life of your loan. A larger down payment also saves you money on the cost of CMHC insurance.

2. Get a better mortgage rate: Shop around for the best mortgage rate you can find, and consider using a mortgage broker to negotiate on your behalf. A lower mortgage rate will result in lower monthly payments, increasing how much you can afford. It will also save you thousands of dollars over the life of your mortgage.

3. Increase your amortization period: The longer you take to pay off your loan, the lower your monthly payments will be, making your mortgage more affordable. However, this will result in you paying more interest over time.

These are just a few ways you can increase the amount you can afford to spend on a home, by increasing your mortgage affordability. However, the best advice will be personal to you. Find a licensed mortgage broker near you to have a free, no-obligation conversation thats tailored to your needs.

What Costs Are Built Into A Monthly Fha Mortgage Payment

NerdWallets FHA loan calculator considers the following costs when estimating your monthly FHA loan payments:

-

Principal. This is the amount you owe on the loan, or what you borrowed minus your down payment. For example, if you buy a $250,000 home and put down 10% , the principal would be $225,000.

-

Interest. This is the cost of borrowing the money from a lender, expressed as an annual percentage of the principal.

-

FHA mortgage insurance premium, or MIP. Mortgage insurance protects lenders from losing money if a borrower defaults on the loan. FHA loan requirements mandate mortgage insurance premiums. Youll make an upfront payment at closing. Then, ongoing FHA mortgage insurance premiums are factored into your monthly payment.

-

Property taxes. Annual taxes on your home and land, assessed by a government authority, are often collected as a part of your payment and paid through an escrow account.

-

Homeowners insurance. This helps pay for damage if your home or belongings are damaged by an event covered under your policy. In certain instances, it can also pay your legal bills if you injure someone. When you have an FHA loan, your homeowners insurance is also paid through an escrow account.

With good credit, you can make a down payment as low as 3.5% on an FHA loan. But then you have to pay mortgage insurance for the life of the loan. Consider making a down payment of at least 10%. At this threshold, your mortgage insurance premiums will end after 11 years.

Read Also: Which Credit Score Do Banks Use For Mortgages

Rent Payment Mortgage Affordability Calculator

Calculator developed byHarry Jensen

Have you ever wondered what size mortgage you can afford based on your monthly rent payment? Our Rent Payment Mortgage Affordability Calculator enables you to determine the home loan you could afford if your monthly rent payment was your mortgage payment. It can be helpful to understand what your monthly rent payment equates to in terms of a mortgage amount, especially if you are considering buying a home. This calculator is particularly helpful for people who are paying a high monthly rent as they may not be aware of the home loan they can afford with minimal change in their monthly housing expense.

What Salary Do You Need To Buy A $400000 House

Now lets take what weve learned and put it into an example. Lets say you want to buy a $400,000 house. First, youll need to do the hard work of saving up $80,000 in cash as a 20% down payment. Or if you already own a home, make sure you have enough equity to pay off your current mortgage and cover your down payment when you sell it.

With a 15-year mortgage at a 5% interest rate, your monthly payment would be around $2,500 . To cover that payment, youd need to earn a monthly take-home pay of at least $10,000 .

So, to buy a $400,000 home, your annual take-home salary would have to be more than $120,000 . But youd actually need more than that after adding in the cost of property taxes and home insurance.

If that doesnt sound like you, dont worry. You have a few options. You could save a bigger down payment to lower your monthly mortgage until its no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood.

Read Also: How To Explain Late Payments For A Mortgage Loan Application