Can I Lower My Monthly Payment

There are a few ways to lower your monthly payment. Our mortgage payment calculator can help you understand if one of them will work for you:

-

Increase the term of the loan. The longer you take to pay off the loan, the smaller each monthly mortgage payment will be. The downside is that youll pay more interest over the life of the loan.

-

Get to the point where you can cancel your mortgage insurance. Many lenders require you to carry mortgage insurance if you put less than 20% down. This is another charge that gets added to your monthly mortgage payment. You can usually cancel mortgage insurance when your remaining balance is less than 80% of your homes value. However, FHA loans can require mortgage insurance for the life of a loan.

Look for a lower interest rate. You can think about refinancing or shop around for other loan offers to make sure youre getting the lowest interest rate possible.

Details Of New York Housing Market

Many people who arent familiar with New York assume that the state is mostly comprised of cities. That viewpoint of the Empire State couldnt be further from the truth. Much of the state is rural, with over 35,000 farms covering seven million acres, as well as the Adirondack Park, which encompasses six million acres.

New York is only the 30th-largest state by size. At 47,200 square miles, its right behind North Carolinas 48,700 and above Mississippis 46,900. However, it has the fourth-largest population in the U.S., with an estimated 19.8 million residents. New York long held the third-largest population until 2014, when Florida surpassed it.

Despite those numbers, New York still contains the largest city in the U.S. by population. Almost 8.8 million people reside in New York City. After New Yorks five boroughs, most of the population is housed in the counties surrounding New York and Long Island. After that comes the western part of the state, including the cities of Buffalo, Syracuse and Rochester.

According to our Healthiest Housing Markets study, the best areas for homeowners are Cheektowaga, West Seneca, Buffalo and Tonawanda, based on a number of factors. The study looked at the average number of years the homeowner lived in the home, negative equity, days on market and a few more indicators. Overall, the state ranked 27th in our study.

Whats Your Debt Ratio

Assuming you have the cash and can prove it, now it comes down to your income and debt ratio. If you dont work, but rather live off your investments, you may be able to use that money as your income. Basically the lender needs to see that you can afford the very large mortgage payment.

Just what debt ratios will they allow? You can count on the lender being a bit stricter than they would with a non-jumbo loan. We are talking about a million-dollar home here, so they have to cover their bases. Just what a lender will require will vary by lender. Lets use the standard conventional guidelines for informational purposes. This means your housing payment cant exceed 28% of your gross monthly income and your total debt ratio cannot exceed 36% of your gross monthly income.

If your ratios are slightly higher than this, you might be able to get an exception if you have compensating factors. In this case, we are talking about reserves. Once you put down the $200,000 and paid the $40,000 in closing costs, do you have anything left? Again, we are not talking about retirement accounts here those dont count. We are looking for liquid assets that you can liquidate in a matter of days and use to make your mortgage payment.

If you have that type of money somewhere, figure out how many months of mortgage payments it would cover. The more reserves you have, the better your chances of getting approved to buy a million-dollar home.

Don’t Miss: How Much Of Your Monthly Salary Should Go To Mortgage

Typical Jumbo Loan Requirements

| Cash reserves | Enough to cover 6â12 months of mortgage payments |

Jumbo loans have strict financial requirements because they’re riskier for lenders. The government won’t back these loans directly, nor can government-sponsored enterprises like Fannie Mae and Freddie Mac “guarantee” them.

Lenders account for this increased risk in one or more of the following ways:

- Charging higher interest rates and closing costs.

- Requiring higher down payment and credit score minimums.

- Ensuring borrowers have substantial cash reserves.

Lower Credit Borrower: $224000 Income Needed

As a rule of thumb, a million-dollar purchase price will require a jumbo loan.

To get a jumbo loan, you typically need a credit score of 700 or higher. But lets say a borrower has a credit score on the lower end of the approvable range.

A lower credit score means theyll have to pay a higher interest rate than our earlier examples. Well say 3.0% instead of the 2.75% used earlier.

Loan summary

- Monthly insurance: $50

That same $224,000 household income will still buy a $1 million home, though the budget comes in at one at $1,005,000 rather than $1,031,000 a full $25,000 lower. And thats still assuming $2,500 in monthly debt payments.

Also Check: How To Check My Mortgage Balance

Reasons To Buy An Expensive House

People choose houses due to different factors, some of them being the neighborhood, the appearance of the house, the closeness to schools and groceries, and others. There are many advantages to buying pricier houses and investing more in them. You might wonder Can I afford a million-dollar home? Well, this is a crucial question but after reviewing some reasons to buy an expensive house you will rethink the question!

1. Spend less on improvements

Even if you think some houses can be overpriced, most of the time the prices are justified by the house conditions, the fresh paint, or freshly done projects around the house which have a lot of influence on the overall price indeed.

2. Higher resale value

Financing a million-dollar home has another great advantage! You can always resell the house at its price or even more.

3. Modern system

You might think that if the house is expensive then living in it will be more expensive but this is exactly where you are not correct. Buying a million-dollar home means you will spend less on your monthly bills due to the fact that these houses have modern electricity-saving systems, eco-friendly solutions, and much more!

The first property is the most important financial decision in life and you should be thoughtful about your actions.

Expect To Need At Least $100k Of Income For A $1m Home

Theres no magic formula that says you need X income to afford a $1 million house. Because income is just part of the equation.

With a really strong financial profile high credit, low debts, big savings you might afford a $1 million home with an income around $100K.

But if your finances arent quite as strong, you might need an income upwards of $225K per year to buy that million-dollar home.

Wondering how much house you can afford? Heres how you can find out.

In this article

| 2.75% | $2,900 |

*Estimates based on 30-year fixed-rate loan, property tax rate at 0.97% annually, home insurance premium of $600 per year, and no HOA dues.Interest rates are for examples purposes only. Your own interest rate will be different.

A million dollars was once a lot of money to pay for a home, and unless you lived in Los Angeles or San Francisco, you probably would never consider purchasing one.

But as home values continue to skyrocket across the country, million-dollar homes are becoming more common outside of California and New York. The good news is that you dont need to be a millionaire to afford one. But you should have your personal finances in order to ensure you get the best rate.

Also Check: How To Mortgage Rates Work

How To Use This Business Loans Calculator

Using this business loan calculator is very simple and easy. All you have to do is adjust the sliders of the business loan calculator for Loan Amount, Interest Rate , and Term to view your estimated monthly payment and total cost of the loan. For the loan term, you can select Years or Months depending on how long your business loan is. Lets quickly define the business loan terminology used in the business loan calculator

- Loan amount. The total amount of money borrowed.

- Interest rate . The annual interest rate charged on the loan.

- Term. The length of the loan is usually expressed in years but can also be months.

You Could Get Better Terms And Better Access

A professional whole of market broker has a network of connections that spans high-value teams at the biggest lenders to major players on the private banking scene.

All of this means more choice and more options. A great broker can help you find products with more flexible term lengths, higher LTV ratios and lower interest rates.

Dont Miss: How Much Would Mortgage Payment Be On 250 000

You May Like: How Long Till I Can Refinance My Mortgage

Qualifying For A Jumbo Loan

As we previously mentioned, jumbo loans often have stricter borrowing requirements than other conventional loans. Here are a few of the requirements youll need to meet:

- The credit score needed for a conforming loan starts at 620, but lenders will probably require even higher credit scores for jumbo loans.

- DTI. As we mentioned, the DTI youll need for a jumbo loan ranges from 36% to 43%. Its better to be on the safe side and have a DTI of no more than 26%.

- Cash reserves. Lenders of jumbo loans will want to know that you have money in the bank in case of an emergency. They usually require enough money to cover 6 to 12 months of expenses in cash reserves.

- Sufficient income history. Its not enough to have an income high enough to qualify for a jumbo loan. Lenders usually look at the past two years of tax returns to ensure that you can maintain that level of income.

- Down payment. As we mentioned, jumbo loan lenders usually require a higher down payment than conforming loans. You should expect to put down at least 20% of the home price.

- Closing costs. Like other types of loans, jumbo loans require closing costs to pay for lender fees, title company fees, an inspection, and more. Conventional closing costs tend to range from 3% to 6% of the purchase price, but jumbo loans can be much higher at 5% to 8%.

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgageâstated another way, itâs the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youâll pay each monthâthe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youâll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still donât know which term to choose, itâs also worth considering whether youâd be able to break evenâor, perhaps, saveâon the interest by choosing a lower monthly payment and investing the difference.

Recommended Reading: What Is A Cd In A Mortgage Process

Total Debt Service Ratio:

Now letâs look at the next debt service ratio: your total debt service ratio. This ratio takes the factors above into account, but also adds in any debt obligations you may have. Hereâs the official formula:

Housing expenses + Credit card interest + Car payments + Loan expenses

divided by

Required income to afford a 2 or 3 million dollar house

The same requirements apply to buying homes that cost more than $1 million. Hereâs a table showing exactly who can buy a $2 million dollar home, how much you need to buy $3 million dollar home, and a $5 million dollar home.

*Required income calculated using TDS assuming $600 car loan and $600 student loan payments.

As you can see, the income to afford a $2-million home and the income needed for a $3-million home are quite high. This is because at these prices, even with a 20% down payment, your mortgage will be very large.

Recommended Reading: Can You Do A 40 Year Mortgage

Running Costs Repairs Renovations And Maintenance

The bigger your home, the more it costs to run. The larger square footage and perhaps higher ceilings that you loved, mean you have a larger volume to heat and cool. So your utility and HVAC servicing bills are going to be a lot higher.

While utility costs vary by location, as a rule of thumb, you can estimate on paying between $1-2 per square foot.

A bigger home also means more to clean and maintain and often comes with a yard that will require upkeep.

In short, keeping a large, expensive home well maintained isnt cheap. And neither are renovations and repairs. So plan ahead and make sure your home buying budget leaves you with a sizeable cushion in your savings account.

Also Check: How 10 Year Treasury Affect Mortgage Rates

Details Of Massachusetts Housing Market

Home of Plymouth Rock and the famed Mayflower landing, Massachusetts has a long history as one of the 13 original colonies. Nicknamed the Bay State for its coastline, Massachusetts has 1,519 shoreline miles and 7,800 square land miles. According to the U.S. Census Bureau, the states population sits at almost 6.9 million. The largest cities by population include Boston, Worcester, Springfield, Lowell and Cambridge.

Currently, the median home value is $418,600. But the housing market is currently hot in certain areas, like in Suffolk County, home to the capital city of Boston, where the median home value is $496,500.

You May Like: Reverse Mortgage For Condominiums

How Much Mortgage Do You Have To Pay For A $ 1 Million House

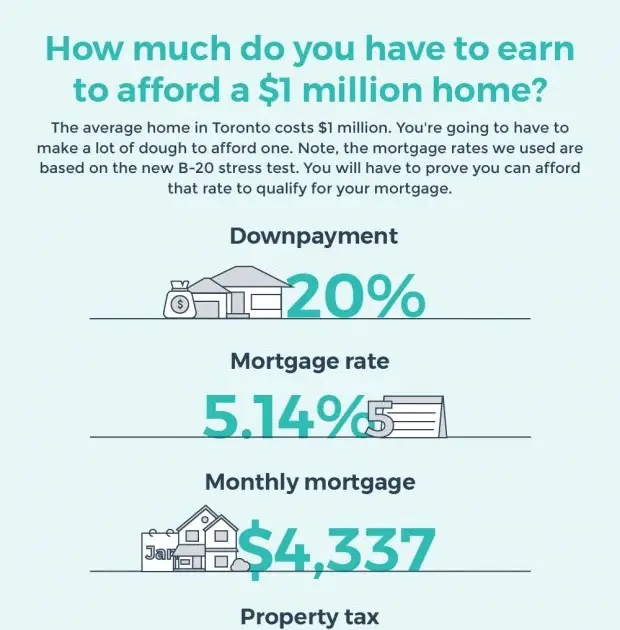

The house you have wanted so much has a monetary value of $1,000,000. If despite the price, you want to get it anyway and you do not have enough liquidity to acquire it, the most sensible thing to do is to apply for a mortgage loan.

Lets consider this example: The deposit available right now is 20%, which corresponds to $200,000, so you will need the other 80% from the bank, which is $800,000.

Assuming that the interest rate is 3% and the payment term established by the lender is 25 years, we would believe that the monthly payment on the $1 million mortgages would be $3,794.

However, some variables will determine the amount you will pay each month to reduce your debt to the bank. One of them is the level of competition of the offer presented to you.

Recommended Reading: Is Peoples Mortgage Company Legit

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youâll make monthly paymentsâwhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

How Much Can I Spend On A House If I Make 80k A Year

For the couple making $80,000 per year, the Rule of 28 limits their monthly mortgage payments to $1,866. Ideally, you have a down payment of at least 10%, and up to 20%, of your future home’s purchase price. Add that amount to your maximum mortgage amount, and you have a good idea of the most you can spend on a home.

Don’t Miss: What Is The Mortgage Rate At The Moment

How Much Income Do You Need For A $500 000 Mortgage

The Income Needed To Qualify for A $500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

What Income Do You Need For A $500000 Mortgage

The Income Needed To Qualify for A $500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

Recommended Reading: How To Know If I Should Refinance My Mortgage

Qualifying For A Small Business Loan

Qualifying for a small business loan can be challenging but there are some basic requirements that youll need to meet to secure financing. These include:

- Personal credit score. Your credit score is a major factor in determining if you qualify for financing.

- Business credit score. Your business credit score will also be taken into consideration when loan officers review your application. If your score is low, you should consider researching how to build business credit.

- Collateral. Depending on the type of loan, you may be asked to provide some form of collateral, such as equipment or inventory.

- Business financial statements. Loan officers will also review your business financials to make sure that you have the necessary income to qualify for a loan.

- Business legal documents. Youll also need to provide proof of legal documents, such as your business license and articles of incorporation.