Is It Better To Get A 15

For many, a 30-year fixed-rate mortgage loan is the ideal product. Thats because, quite simply, it allows for more affordable monthly payments. The downside is, it can take longer to accumulate equity and pay off your loan.

Thats why some homeowners opt for a shorter loan term in the form of a 15-year mortgage.

You can pay off the loan twice as quickly, over the life of the loan you pay much less in interest, and you grow home equity at a much faster rate, says Robert Johnson, professor of finance at Heider College of Business, Creighton University.

That doesnt mean that a 15-year loan is always the best choice, however.

The main drawback to a 15-year mortgage is that monthly payments are much higher since you have to pay off the same amount in half the time. As a result, many homeowners simply cant swing the monthly payments.

Its up to you and your loan officer to compare the costs and potential savings of a 15 vs. 30-year mortgage, then chose the right one for your financial situation.

How Soon Do You Want To Be Mortgage

One huge benefit when it comes to going for the 15-year loan term is you’ll be able to pay off your house 15 years sooner than you would if you were to go with the 30-year mortgage.

Being mortgage-free means you’ll have more room in your budget for other things some homeowners may want to pay off their house as quickly as possible so they can purchase a second property and focus on paying off the mortgage for that instead.

Other people may just be emotionally uncomfortable with having debt and prefer to get rid of it as quickly as possible. Keep in mind that while taking on a 15-year term to be mortgage-free sooner can come with a slightly lower interest rate and more money saved on interest overall, you’ll wind up having to make higher monthly payments as a trade-off.

Less In Total Interest

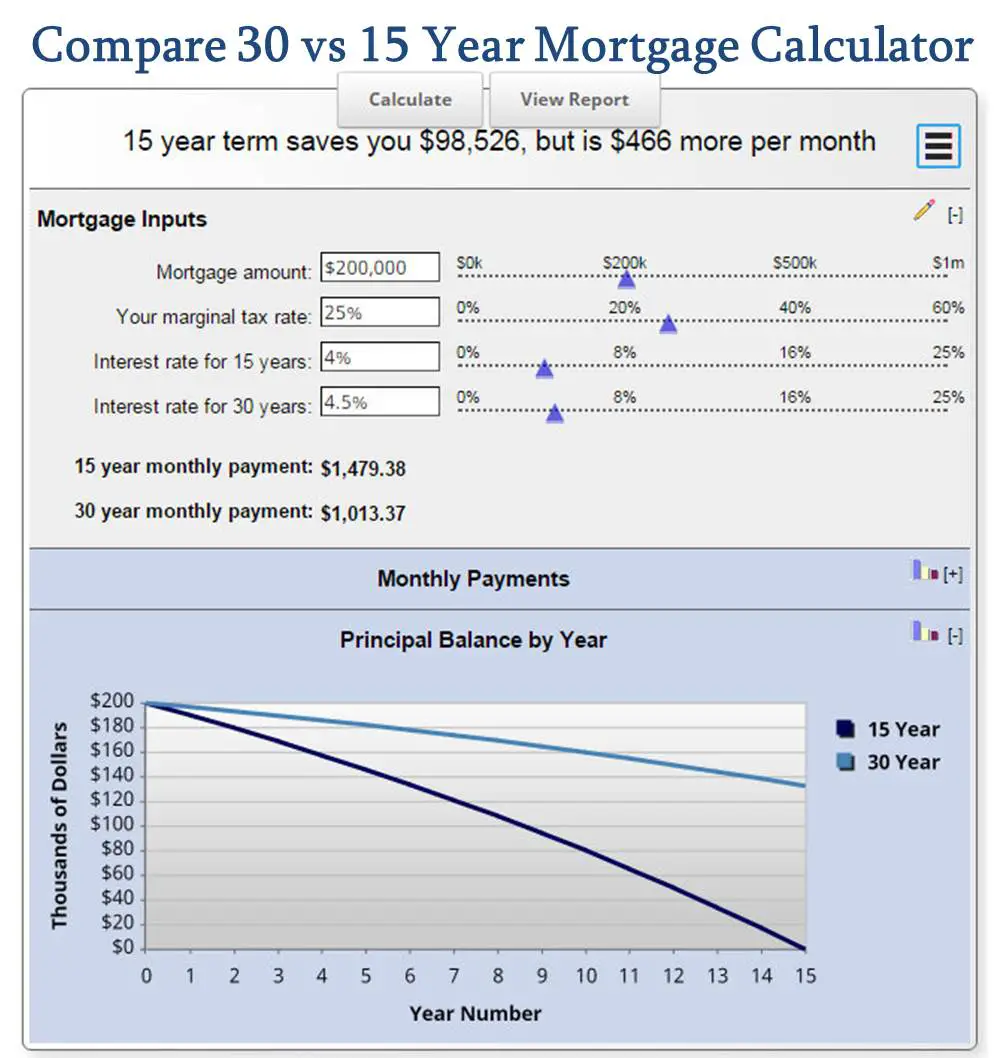

A 15-year mortgage costs less in the long run since the total interest payments are less than a 30-year mortgage. The cost of a mortgage is calculated based on an annual interest rate, and since you’re borrowing the money for half as long, the total interest paid will likely be half of what youd pay over 30 years. A mortgage calculator can show you the impact of different rates on your monthly payment, as well as the difference between a 15- and a 30-year mortgage.

Also Check: How To Find Total Interest Paid On A Mortgage

Which Is Right For You

It might be appealing to stretch your payments out over 30 years if you’re concerned about your monthly cash flow, and you might not be approved for a 15-year mortgage, in any event. Lenders approve your loan application based in part on your ability to repay it. They compare your monthly income to your monthly debt payments. This is your debt-to-income ratio, and it might disqualify you for a 15-year loan.

Primary Benefits Of A 30

We all know that economic setbacks happen. We all know that many people lose their homes during a pandemic, or recession. We all know that the more flexiblity you have, the better chance you have of keeping your home.

Just because you took out a 30-year loan doesnt mean you have to follow the payments. You will start off with a slightly higher interest rate, but you will always have the flexibility to pay as needed.

So while your neighbor has a 15-year mortgage, when both of you get laid-off as a results of the industry failing during a recession, or struggling during a recession, choosing a 30-year mortgage prior will give you a better chance of making it through.

Lets compare the rates and payments:

Assuming a $100,000 household, we will compare a 30-year mortgage vs a 15-year mortgage:

Scenario 1:30-Year Mortgage

- Amount of Interest Paid: $41,250

- Overall Amount Paid: $141,250

As mentioned before, from the surface, it seems like the 15-year mortgage is the obvious answer. But there is something that youre not considering:

- Opportunity Cost

For those of you who dont know,

Opportunity cost is the cost of missing out on the next best alternative. Essentially, choosing one option over another may not cause you to lose money, but you lose opportunity cost.

For example, if you buy a stock that rises 5%, but the stock you were considering rose 10%, you just lost 5% in opportunity cost because you COULD HAVE invested in the stock that paid 10%, and made 5% more money.

Read Also: What Is Amortization Schedule Mortgage

Consider Your Other Goals

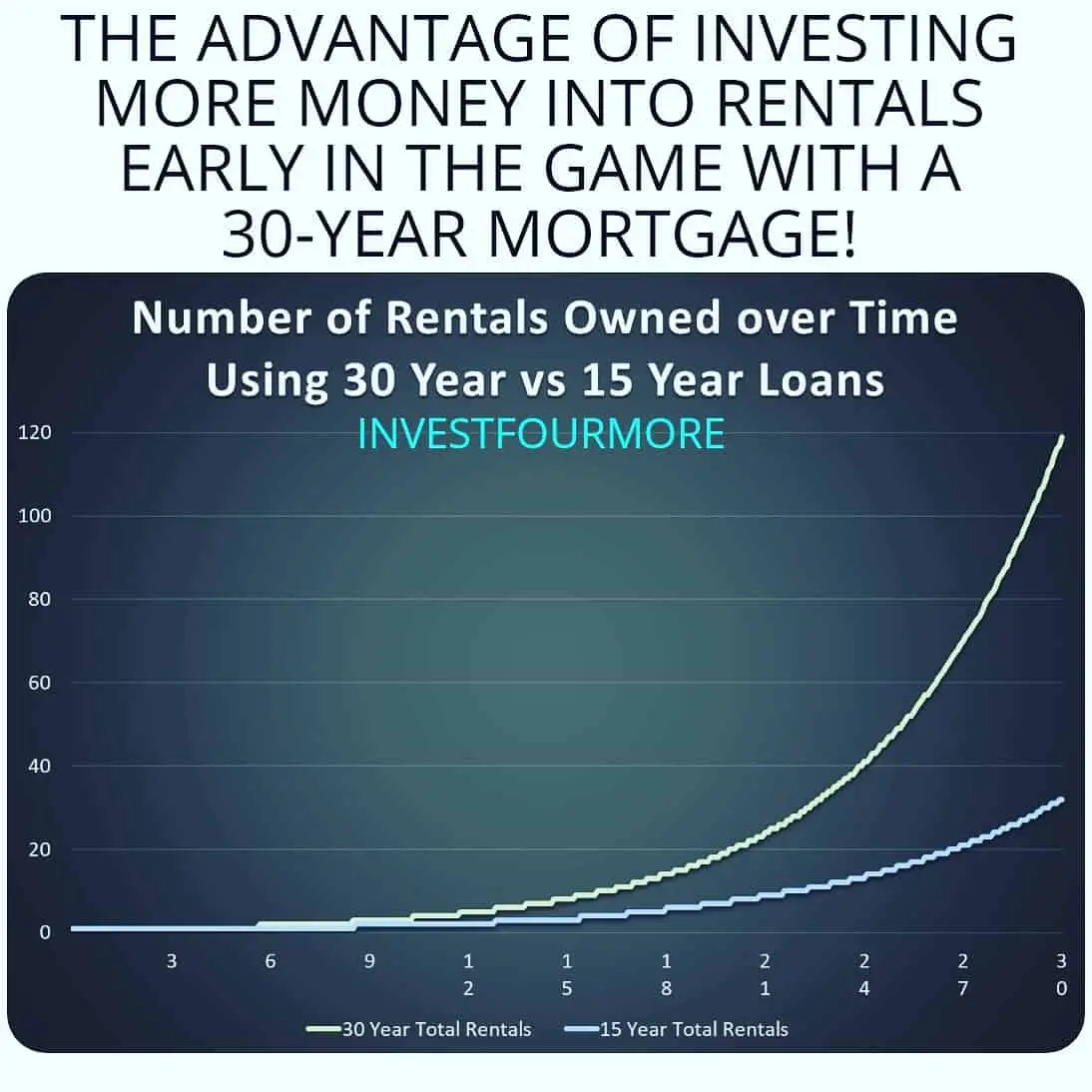

A 30-year mortgage makes it easier to save for retirement. Youll have more free money in your budget to put toward long-term goals instead of making a hefty mortgage payment every month. However, you might not be better off with a 30-year loan if you spend that extra money on wants and luxuries each month instead,

Do You Pay More Interest On A 15

The average interest rate for a 30-year mortgage has been around 0.51% higher than a 15-year mortgage for the past several years.1,2

One percentage point may not seem like a huge differencebut keep in mind, a 30-year mortgage has you paying that difference for twice the amount of time compared to a 15-year mortgage. Thats why the 30-year mortgage ends up being so much more expensive.

Don’t Miss: Who Pays Mortgage Broker Fees

Time It Takes To Pay Off The Mortgage

The biggest difference between a 30-year and a 15-year mortgage is obvious: the length of time it takes to pay off your mortgage. With a 15-year term, youll be making half as many payments, so those payments will be higher. With a 30-year-term, youre spreading the amount over twice as many paymentswhich means youre paying more interest over time.

Overall, a 15-year term is a better deal. If someone has the financial capacity to take on a 15-year, its at least worth exploring, says James McGrath, a licensed real estate broker at Yoreevo, a New York City real estate brokerage.

More Flexibility In Payback Terms

Cruz prefers the 30-year mortgage because it gives you the ability to speed up your payments on your own schedule.

In my opinion, they are the best option and offer much more flexibility than shorter mortgages because you can always choose to pay off a 30-year mortgage early without having to actually commit to the 15-year mortgage, Cruz explains.

One option is to get a 30-year mortgage that doesnt have any prepayment penalties, then calculate what your payment would be if you had a 15-year mortgage, and start by paying that amount monthly. This will reduce the principal faster and save a lot of interest, but it leaves you a way out if money unexpectedly tightens later on down the line.

If you do this method, you can always revert to the smaller monthly payment if you face financial hardship, Cruz says. You can move between the two payments without ever needing to refinance which would also save you thousands in closing costs.

In fact, by using this method, you can set your mortgage term to any length you want. Just calculate your original loan amount by the terms you wish to pay on your loans current interest rate, and then make your normal mortgage payment, suggests Cruz.

Recommended Reading: How Much Is Mortgage Insurance Monthly

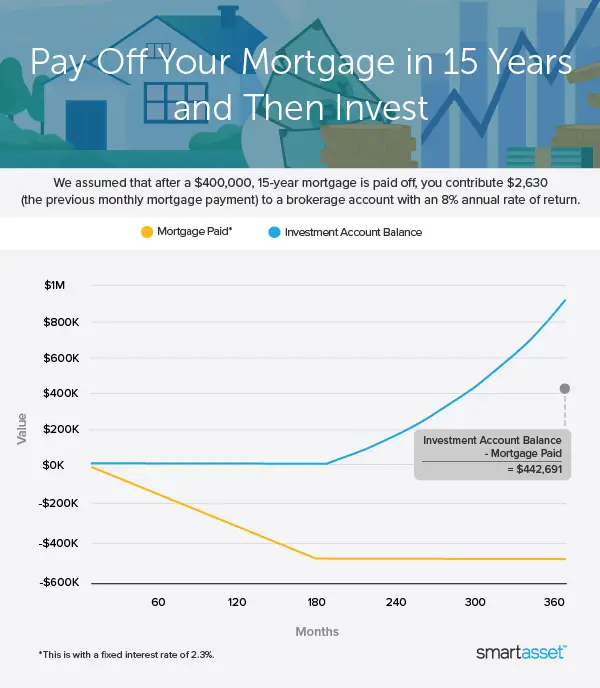

Best To Save Money Over Time: 15

The 15-year mortgage may be best for those who wish to spend less on interest, have a generous income, and also have a reliable amount in savings. With a 15-year mortgage, your income would need to be enough to cover higher monthly mortgage payments among other living expenses, and ample savings are important to serve as a buffer in case of emergency.

Con: Your Monthly Mortgage Payment Will Be Much Higher

Life happens, and sometimes, it happens quickly. Before you commit to a higher monthly mortgage payment, take an honest look at your monthly budget and consider your lifestyle. You dont want to end up house poor, meaning all your money goes into your house, leaving you with little left over for other expenses.

Recommended Reading: How Much Does Biweekly Mortgage Payments Save

Investing Skills And Risk Tolerance

Also, your investing skills and experience play an essential role. If you are neither a proficient investor, nor motivated to take the extra risks, then youre almost always better off with a 15-year mortgage. When you use a 15-year mortgage, the money you save from a lower interest rate is guaranteed, and you do not have to take investment risks.

How Do I Pay Off A 30

There are a few ways to pay down a 30-year mortgage in 15 years. First, you could consider refinancing your current mortgage into a 15-year fixed mortgage. Another way is to make extra payments towards the principal amount or make biweekly payments equally one additional mortgage payment per year. This might not get you to the 15-year mark, but the amount of principal would most certainly go down.

Also Check: What Would My Mortgage Payment Be On 150 000

Save Money On Interest

One of the top perks of choosing a shorter loan is the money you’ll save on interest costs. Lenders base the mortgage interest you pay on several things, including the principal balance and interest rate.

Because you repay a 15-year loan faster, your principal balance decreases faster. As a result, you spend less money on interest. You can talk to a lender to learn the difference, but it might surprise you.

Additionally, you save money on interest by getting a lower interest rate for choosing a shorter loan. When you compare the difference in interest charges, you’ll see a large difference.

Of course, you can always pay extra money toward your principal balance. Lenders often call this a principal-only mortgage payment. If you do this, you’ll decrease your principal balance faster, helping you save even more.

Can I Refinance My 30

Looking for another way to cut into the overwhelming interest of your 30-year loan? You may like the idea of refinancing the entire mortgage as a 15-year loan.

Youd have to pay closing costs again, but youd be hitting the reset button on your home loan, starting over with a lower-cost loan.

Homeowners who make more money now than they made when they bought the house often like this idea.

And, combining a refinance with a cash-out equity option to pay for home improvements can be an efficient solution, solving two problems with one loan.

Read Also: How Can I Legally Get Out Of My Mortgage

Is It Better To Get A 15 Year Mortgage Or Pay Extra On A 30 Year Mortgage

15 Year Vs 30 year mortgage: whats the difference?

In simple language, the main difference between a 15 year and 30 year mortgage is the term. On a 15 year mortgage, you will pay off what you owe within 15 years whereas with a 30 year mortgage, it will take double the time.

Why a 15 year mortgage is better

Depending on your circumstances, a 15 year mortgage can usually be more beneficial. Some of the reasons why are explained below.

Savings on interestWhile the interest rate will be the same regardless of the term of your mortgage, as interest is calculated daily and paid with each monthly payment, the shorter the period you pay your mortgage over, the less interest you will pay in total.

Build home equity fasterWith a shorter term, your monthly repayments will be higher to ensure the full amount is repaid by the end of your mortgage term. This means that with each repayment you will be building the equity you own in the property faster than if you were paying lower monthly repayments over a longer term. Please note, this is only applicable for mortgages on a capital and interest repayment basis and not interest only repayments.

Own your property in half the timeAs long as you have opted to repay your mortgage on a capital and interest only repayment basis, at the end of the 15 year term, you will own your property outright. This means you wont have to make any more mortgage repayments.

Why a 30 year mortgage is better

Getting the right mortgage

The Amount Of Time It Takes To Repay

A big difference between a 15 and 30-year mortgage is the amount of time it takes to pay them each off. Depending on your financial situation, one may be better than the other. Thirty year loans will have smaller monthly payments, but in the end you will end up paying back more because of the interest over the 30 years. With a 15-year loan, you could save tens of thousands of dollars in interest, but have higher monthly payments.

For example: if you want to take out a mortgage loan for $125,000 at a 3.5 percent interest rate over 30 years, you would end up paying $202,069.05 over 30 years. If you were to have the same rate for a 15-year loan, you would instead end up paying $160,848.75 overall. That’s a difference of $41,220.30 you would save/spend, depending on which loan plan you choose.

Read Also: How To Get A 500 000 Mortgage

Scenario : Invest Gradually While Paying Off Your Mortgage In 30 Years

First, well see how much a $500,000 home will cost over time with a 30-year mortgage. Remember, Monica is putting the full 20% down, meaning her loan will be for $400,000.

With a monthly mortgage payment of $2,350, Monica will pay a total of $845,842 over the 30-year term of the loan, including a whopping $445,842 in interest payments.

However, the lower monthly payments also allow her to begin growing a nest egg in the stock market much earlier. Since her mortgage payment is $797 less than what it would be with a 15-year mortgage, Monica invests that money every month and watches it grow to $977,952 over the course of the 30-year period. Not bad at all!

When To Consider A 15

The main draws of 15-year fixed-rate loans are their lower interest rates and the fact that they’ll be paid off more quickly. Like any fixed-rate loan, they also offer stability the monthly payment wont change no matter what happens to inflation or market interest rates.

But the monthly payment will be much higher than that of a 30-year loan for the same property due to the shorter term, and that will make it harder to qualify for the loan.

» MORE:Pros and cons of 15-year mortgages

Don’t Miss: Why Do You Need Mortgage Insurance

Summary Of 30 Vs 15 Year Mortgage: Which Is Better

30 year mortgages are the perfect loan for anyone looking for maximum flexibility. You can always pay extra to payoff the loan faster and the average person does not stay in the same house without refinancing every 3-5 years. Use flexibility to pay down high-interest debt or put towards other parts of your life. Save for a vacation, college, wedding, or retirement. 15 year mortgages are perfect for someone in a strong financial position seeking the lower interest rates on the market.

The difference of rates with a 30 vs 15 year mortgage can vary based on a given market. Sometimes the rates are similar and sometime the spread widens. Our experienced Loan Officers are trained to understand your scenario and make recommendations based on what makes the most sense. Simplistic options to choose from allow you and your family to make the best and right decision for your unique scenario. Click Get Started below to find out the options available for you!

Consider A Shorter Mortgage When Buying A House

A new home purchase will likely be the most expensive thing you buy. Naturally, therefore, you’ll probably need to finance it.

However, getting a 15-year mortgage might be in your best interest, as you can see all the benefits they offer. Would you like to learn more about interest rates, loan options, and real estate?

Feel free to browse through our blog for more helpful topics and insight about loans and real estate.

Read Also: What’s The Difference Between A Mortgage And A Loan

Mortgage Interest Rates For Dec 16 202: Rates Decline

Today some notable mortgage rates moved down, though rates remain high compared to earlier this year. As interest rates surge, it’s getting more expensive to buy a house.

A few notable mortgage rates moved downward today. The average interest rates for both 15-year fixed and 30-year fixed mortgages decreased. The average rate of the most common type of variable-rate mortgage, the 5/1 adjustable-rate mortgage, also sank.

Mortgage rates have increased fairly consistently since the start of 2022, following in the wake of a series of interest rate hikes by the Federal Reserve. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. But the Fed’s actions, designed to mitigate the high rate of inflation, are having an unmistakable impact on mortgage rates.

If you’re looking to buy a home, trying to time the market may not play to your favor. If inflation continues to increase and rates continue to climb, it will likely translate to higher interest rates — and steeper monthly mortgage payments. As such, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

What Is A 15

Its a simple concept: 15-year mortgages are paid off in half the time of the traditional holy grail of finance, the 30-year mortgage. While 30-year mortgages are still common, some homebuyers are opting for a 15-year payoff period.

Here are the advantages of a 15-year mortgage:

- Lower interest rates: Lenders are always computing risks, and the risk of someone defaulting on a loan over the course of 30 years is greater than over 15. Thats one reason why interest on a 30-year loan is higher than on a 15-year one. The difference isnt huge anywhere from a quarter to a full percentage point but on a long-term loan, the lower interest rate can be a significant difference in your overall payback amount.

- Lower interest payments: Mortgage interest is computed on the outstanding balance of a loan. Because of that, the faster you pay off the principal of a mortgage, the less money youll spend each month on interest.

- Lower interest overall: Since a 15-year mortgage is repaid in half the time, thats 15 years you wont be paying interest, which represents some real savings.

Monthly payments for a 15-year mortgage are a lot higher than 30-year mortgages, and if interest rates were higher, the monthly payment on the shorter term could be painful. But historically low interest rates have made 15-year mortgages increasingly popular.

You May Like: What Is Prime Rate For 30 Year Mortgage