Getting The Best Heloc Rate

This ones on you: The more you research, the bigger your reward. As you look for the best HELOC rates, get quotes from various lenders. Check your primary bank or mortgage provider it might offer discounts to existing customers. Get a quote and compare its rates with at least two other lenders. As you shop around, take note of introductory offers like initial rates that will expire at the end of a given term.

» MORE:9 tips for getting the best HELOC rate

Should You Use A Heloc To Pay Off Your Mortgage

Choosing whether to get a HELOC to pay down your mortgage will depend on your unique financial circumstances. If you have a low remaining balance on your mortgage and can secure a lower interest rate, this option may make financial sense.

On the other hand, if you dont have a lot of equity and already have a low interest rate, you might not be able to get a HELOC with an APR low enough to make it worthwhile.

Also, a variable-rate HELOC usually isnt a good option if your income is spotty or irregular. Experiencing a drop in income when interest rates rise can make it difficult to budget for your monthly payments. If you cant make your payments, you risk losing your home since your house secures your HELOC.

Other things to consider are the upfront costs and annual fees that often come with a HELOC, including:

- Early prepayment fees

Qualify For A Home Equity Line Of Credit

You only have to qualify and be approved for a home equity line of credit once. After youre approved, you can access your home equity line of credit whenever you want.

Youll need:

- a minimum down payment or equity of 20%, or

- a minimum down payment or equity of 35% if you want to use a stand-alone home equity line of credit as a substitute for a mortgage

Before approving you for a home equity line of credit, your lender will also require that you have:

- an acceptable credit score

- proof of sufficient and stable income

- an acceptable level of debt compared to your income

To qualify for a home equity line of credit at a bank, you will need to pass a stress test. You will need to prove you can afford payments at a qualifying interest rate which is typically higher than the actual rate in your contract.

You need to pass this stress test even if you dont need mortgage loan insurance.

The bank must use the higher interest rate of either:

- the interest rate you negotiate with your lender plus 2%

If you own your home and want to use the equity in your home to get a home equity line of credit, youll also be required to:

- provide proof you own your home

- supply your mortgage details, such as the current mortgage balance, term and amortization period

- have your lender assess your homes value

Youll need a lawyer or a title service company to register your home as collateral. Ask your lender for more details.

You May Like: How To Get Out Of Your Mortgage

Best Heloc Lender For Bad Credit In Arizona: Figure

- Figure

Figure only has a minimum credit score requirement of 620, which is one of the lowest on the market.

–

- Starting at 3.24%APR Range

- $15,000 to $400,000Loan Amount Range

- 5 to 30 yearsRepayment Terms

- NoneAnnual Fees

- 24 hoursPre-Approval Time

WHY WE GEEK OUT

Speed and ease of transaction are two of the standout benefits of Figure. This new lender uses blockchain technology to facilitate the application process borrowers can submit an application online and have their application approved in just 24 hours. The lender doesnt have physical centers, which may be a downside for borrowers that prefer in-person banking.

In comparison to other lenders, Figure has a low minimum credit score requirement of 620 and an introductory APR of 3.24%. Its HELCO loan products range in amount from $15,000 to $400,000 with repayment terms between 5 and 30 years, allowing borrowers to customize their loan to best fit their needs. However, it does not lend to unemployed individuals and has strict rules on what types of properties qualify for a HELOC.

PROS & CONS

- Low minimum APR of 3.24%

- Online video notary and support

- Low minimum credit score requirement

- Competitive rates

- Requires proof of employment and income

- No physical branches or financial centers

- Loan Amount: $15,000 to $400,000

- Repayment Terms: 5 to 30 years

- Minimum Credit Score: 620

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Where Can I Buy Mortgage Insurance

Home Equity Line Of Credit Rates For 2022

The table below breaks down the terms and rates of different lenders HELOC loans. It provides an overview and comparison of HELOC rates, along with basic minimum credit score requirements.

The information included was updated as of May 2022. Although we readily update our information, the lenders terms and rates are subject to change, so you should always verify with their website.

- Show more

Pay The Minimum During The Draw Period

If your income is less than its been in the past, you could opt to make minimum interest-only payments during the draw period. Using the example from above, your minimum payment works out to $332 before climbing to $739 during the 15-year repayment period.

In this case, you create significant space in your budget, dropping your monthly payment by about $2,066 during the draw period and $1,659 during your repayment term. Of course, the catch is that you’re paying interest over a much longer period of time 15 years more to be exact and youll pay over $53,000 in total interest.

Again, these numbers dont take into account any rate increases that could come with a variable-rate HELOC. With this option, youll pay more in interest than you would with your original mortgage, but it could create space in your budget.

Don’t Miss: Can You Consolidate Credit Card Debt Into Mortgage

How To Use Your Heloc To Pay Off Your Mortgage

If youre planning on using a HELOC to pay off your mortgage, you first need to make sure that the amount you have available to borrow is equal to or greater than what you owe.

HELOC lenders will usually lend up to 90 percent of your homes value, minus the amount that you owe on your mortgage. For example, if you have a $250,000 loan with a $100,000 balance, 90 percent of your homes value would be $200,000. Subtract the balance on your mortgage and you have $100,000 available to borrow.

In this situation, youd take the full $100,000 as soon as you were approved and send that money to your mortgage lender. You might choose to start repaying interest plus principal on your HELOC, or if your lender offers it, you may be able to make interest-only payments until the loan enters its repayment period.

Advantages Of Getting A Heloc To Pay Off Your Mortgage

If your credit standing is good enough to qualify for an attractive interest rate, and you select the correct option to suit your needs, using a HELOC to pay off your mortgage could be helpful. For starters, you can ultimately end up paying less overall. Interest will continue to accumulate the longer you have a mortgage with an outstanding balance.

While you’ll still pay interest on a HELOC, you may be able to get a rate that’s significantly less than what you’re currently paying on your mortgage. If you can get a better rate, you’ll accrue less interest. You may also be able to get a shorter term, allowing you to pay off what you owe faster and save on the interest that way.

Another advantage of obtaining a HELOC to pay off your mortgage is using the HELOC money for other things. In our example, you only needed $75,000 of the possible $85,000 to pay off the mortgage. You can use that extra money to update your bathroom or kitchen, thereby increasing the value of your home, giving you even more equity. Using the HELOC for home renovations or improvements may be tax-deductible, yet another advantage to you as a homeowner.

Recommended Reading: How Much Is A Mortgage Point Worth

Can I Use Equity To Pay Off My Mortgage

Yes. There are many ways to use equity to pay off your mortgage, but two of the most common approaches are second mortgages and home equity lines of credit . Second mortgages have the same payment each month and give you a lump sum at the start of the loan, which you could use to pay off some or all of your mortgage. HELOCs are a revolving line of credit that you are free to withdraw from or repay as you see fit. Both of these loans carry much lower interest rates than credit cards or other unsecured loans, because they use your house as collateral.

What Are The Disadvantages If I Use A Heloc To Pay Off My Mortgage

Before taking out a HELOCespecially if your goal is to use the funds to pay off and close out a mortgage loanyou need to understand the downsides to this type of debt.

The most significant potential disadvantage is that HELOCs variable interest rates can change based on the current market environment. Now, your rate can decrease and save you money, but it has the potential to rise during the repayment period, too.

If this happens, you could wind up with an interest rate even higher than your original mortgage loan, negating your efforts and increasing the overall cost to repay the borrowed funds. HELOC rates can change as often as every month, especially if the prime index rate changes often.

How can you combat this potential volatility?

Another disadvantage when using a HELOC to pay off your mortgage is taxes. Certain borrowers may be able to deduct all or some of the mortgage interest they pay when they file federal income taxes. However, these deductions dont include the interest paid on a HELOC in most cases.

If you live in a state or are in a situation that allows you to deduct mortgage interest from your taxable income, consider whether a HELOC would cost you more than it would save you. You could consult with a tax professional to run the numbers.

Also Check: What Are Mortgage Interest Rates At

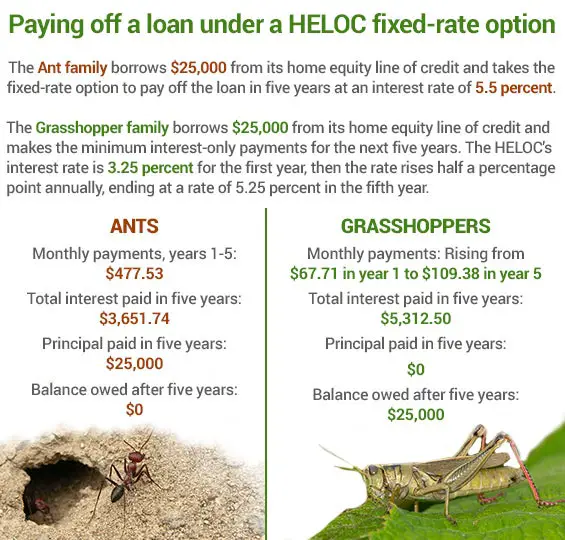

Advantages And Disadvantages Of A Home Equity Line Of Credit

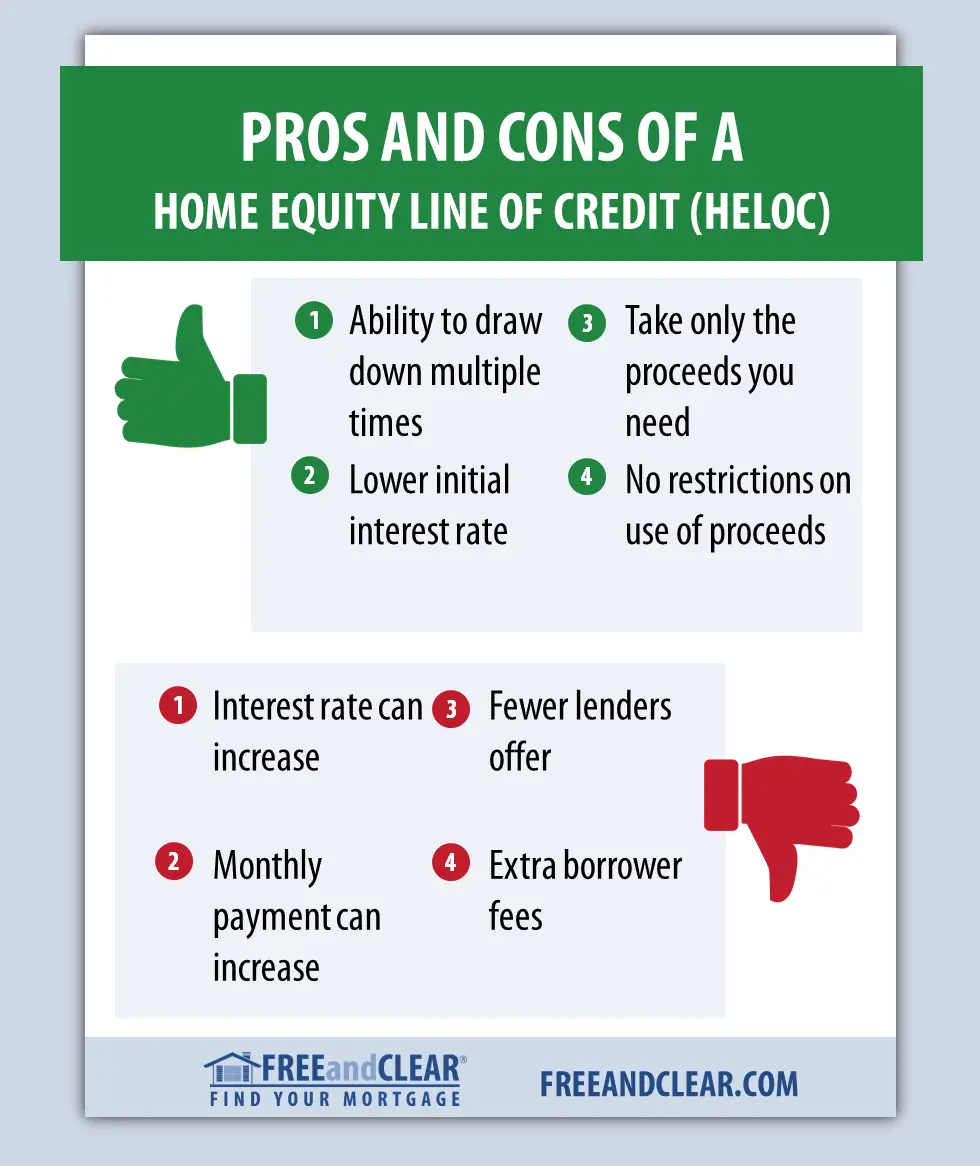

Advantages of home equity lines of credit include:

- easy access to available credit

- often lower interest rates than other types of credit

- you only pay interest on the amount you borrow

- you can pay back the money you borrow at any time without a prepayment penalty

- you can borrow as much as you want up to your available credit limit

- its flexible and can be set up to fit your borrowing needs

- you can consolidate your debts, often at a lower interest rate

Disadvantages of home equity lines of credit include:

- it requires discipline to pay it off because youre usually only required to pay monthly interest

- large amounts of available credit can make it easier to spend higher amounts and carry debt for a long time

- to switch your mortgage to another lender you may have to pay off your full home equity line of credit and any credit products you have with it

- your lender can take possession of your home if you miss payments even after working with your lender on a repayment plan

These are some disadvantages of a home equity line of credit that are common to other loans:

- variable interest rates can change which could increase your monthly interest payments

- your lender can reduce your credit limit at any time

- your lender has the right to demand that you pay the full amount at any time

- your credit score will decrease if you dont make the minimum payments as required by your lender

Use Your Heloc To Make Your Monthly Payments

Each month you are going to use your HELOC to pay off your credit card bill and monthly mortgage payment.

Lets say you put your full paycheck of $5,000 into your $200,000 mortgage, leaving a mortgage balance of $195,000. Meanwhile, all of your monthly expenses are going on a credit card, to be paid in full each month. This means you will have a total of $3000/month payments to your mortgage and credit card companies coming from your lower HELOC variable interest rate.

Repeat until you pay off your personal loan. While there are other variations on the strategy involving different degrees of financial sacrifice and discipline, it doesnt have to be any more complicated than that.

Now that you know how to pay off your mortgage with a HELOC, will it work for you?

You May Like: What Is The Best Refinance Mortgage Company

Cons Of A Home Equity Loan

- Home serves as collateral: Home equity loans and home equity lines of credit are both secured by your property. If you default on these second mortgages, you could lose your home.

- Closing may be expensive: Home equity loans may come with closing costs, though some lenders waive the fees or roll them into the loan. If you have to pay these fees, theyll add to your borrowing costs.

- Loan amounts are limited: You can typically borrow up to 85% of the equity in your home. So if you have $300,000 in equity, for example, the maximum you could borrow is $255,000. If you havent built enough home equity to zero out your mortgage, think about holding off until your home equity increases.

What Are Typical Fixed Rates

Interest rates on all home equity products can vary based on the following:

- How much youre looking to borrow against your home

- Length of your term

- Your credit score

- Your debt-to-income ratio

These factors make it challenging to cite typical fixed rates. But you may notice trends related to interest rates between these products.

Since a cash-out refinance replaces your mortgage loan and provides you with a cash withdrawal against your home equity, it moves into the first-lien position. If you default on your loan repayment, your cash-out refinance lender has first dibs on your property. Interest rates tend to be lower for this product compared to other home equity options because of this.

Average interest rates on home equity loans are similar to those for HELOCs, but theyre often a bit lower. This is likely due to the risk involved: While a home equity loan is a single borrowing event, a HELOC opens up a line of credit to pull from at any time during the draw period.

On average, HELOC rates are slightly higher than cash-out refinance and home equity loans. However, many lenders reserve the lowest HELOC rates for borrowers choosing an introductory and variable interest rate. Borrowers who opt to lock in a fixed-rate HELOC may pay higher rates.

Also Check: How Do You Estimate A Mortgage Payment

A Real Life Heloc Example

After applying for a HELOC, you will receive an offer. Depending on your lender, the credit line will be dependent on the current equity in your house.

When I went to apply for my HELOC, I received the following quote: a $21,000 credit line with a 7.6% variable interest rate. For my HELOC, there would be a 10 year draw period and 20 year amortization period.

This interest rate is not amazingly low, but could lead to some interest rate arbitrage.

One thing to note is HELOC interest is not tax deductible for all expenses. HELOC interest is tax deductible as long as it is used to make improvements to the home, but isnt deductible if the money is spent on anything else.

Does Having A Mortgage Make It More Difficult To Be Approved For A Heloc

Homeowners cant borrow against 100% of their homes equity through a HELOC. A remaining mortgage balance will reduce your HELOC limit by reducing your equity in your property.

Lenders often limit HELOCs to between 70% and 90% of your homes total value, though factors including income, credit score, and location will further affect that amount. If your lender allows for an 85% LTV, you could borrow up to $340,000 against a home worth $400,000:

$400,000 x 85% LTV = $340,000 maximum total debt against the property

But if you have a remaining mortgage loan balance, your lender will consider CLTV instead. Your combined loan-to-value ratio considers all the liens against an individual property, including a mortgage, second mortgage, and home equity loan.

In the example above, if you are limited to a CLTV of 85% and have a remaining mortgage balance, you wont be able to borrow the full $340,000 with your HELOC. Instead, the HELOC limit will be reduced by your remaining mortgage loan: If you owe your lender $115,000, you will have a maximum HELOC limit of $225,000:

$340,000 maximum $115,000 remaining mortgage balance = $225,000 HELOC limit

Of course, lenders reserve their maximum CLTV for the most eligible borrowers. If your credit score or income are lower, your debt-to-income ratio is higher, or youre located in certain states, your HELOC limit could be lower.

Don’t Miss: How Much Should You Pay A Mortgage Broker