Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Find Your Credit Score

Visit AnnualCreditReport.com to get a free copy of your credit report, which reflects your account and payment history. You are entitled to receive one free report every year from each of the three credit reporting agenciesEquifax, Experian and TransUnion. Your report doesnt include your credit score, but it shows you what information the bureaus take into account in their credit score calculations. You may be able to obtain a free copy of your credit score through your bank or credit card provider.

Mortgage Rates By Credit Score

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

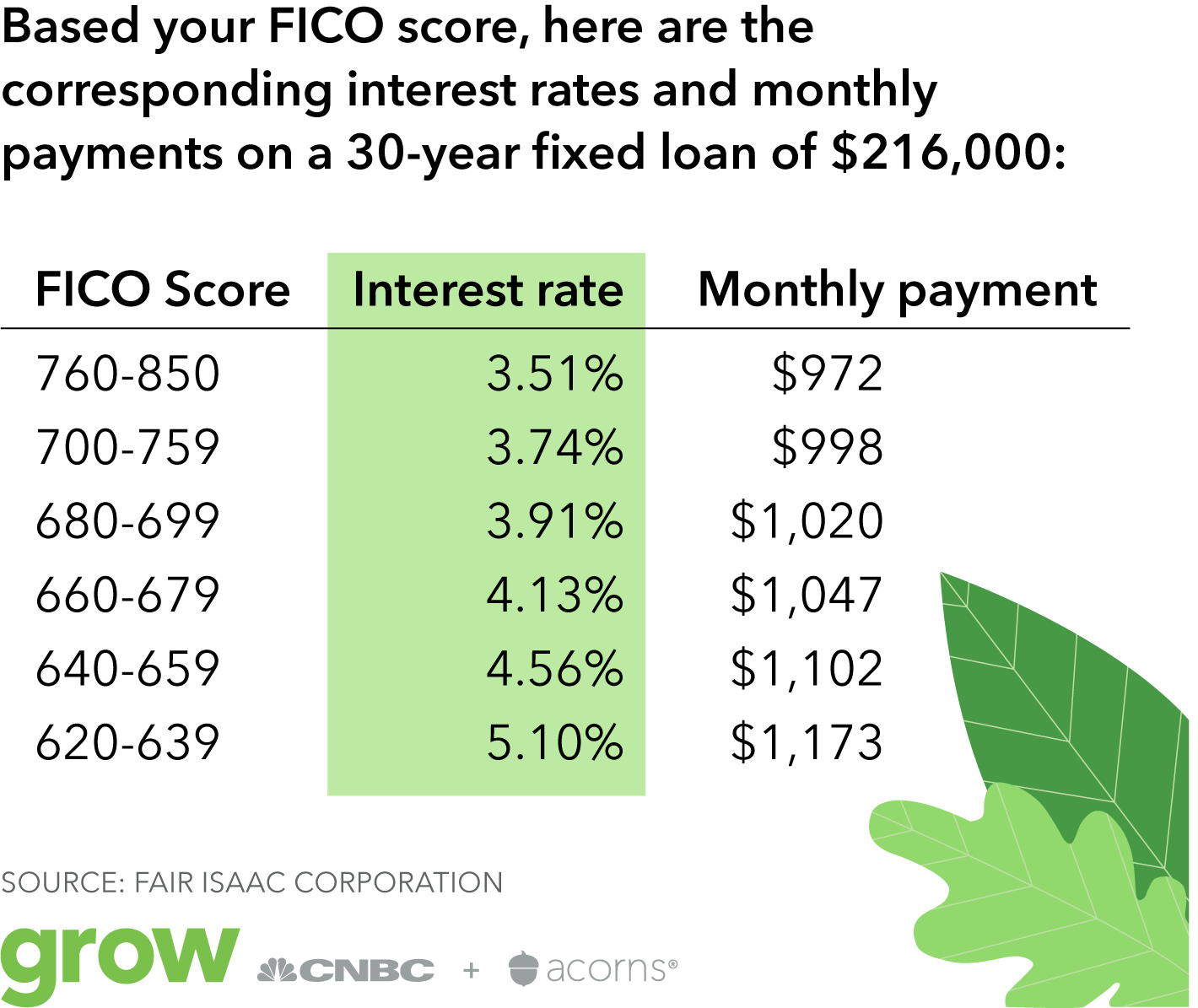

Your credit score is one of the most important factors when applying for a mortgage. It influences your monthly mortgage payment, the total amount of interest you pay on your mortgage loan, and ultimately the total amount you pay for your home. Because your interest rate is based on your credit score, you should make sure your credit is in the best shape possible before applying for a mortgage.

You May Like: Reverse Mortgage For Condominiums

Best For Cosigners: Rocket Mortgage

Rocket Mortgage

-

No USDA loan

Rocket Mortgages completely online process, with the ability to upload documents separately, makes it a great choice for cosigners. Plus, the added benefit is that quotes are available within minuteshopefully, your cosigners higher credit score allows you to qualify for better rates. The lender also has an app, rare among competitors. Users can start the application process there, as well as upload documents and manage monthly payments. However, a credit check is required to get an individualized quote, so you and your cosigners score may be affected, however minor that may be.

FHA loans have a 580 minimum credit score and there isnt any indication on Rocket Mortgages website as to what it is for conventional loans.

You can go through the entire application process online. Either head to Rocket Mortgages website or download their app to fill out the application form. From there, either log into the app or your account online to submit documents and other required information.

Factor: The Home Value

Home values under $1 million often fetch better rates. Thats because:

- theres less competition for $1 million+ mortgages

- theres no way to default insure them , and

- there are fewer ways to raise capital for such super-jumbo mortgages.

As a result, those loans cost incrementally more.

Rate Tip: Your home value is always confirmed with an appraisal or the lenders automated valuation tool.

Also Check: 10 Year Treasury Yield Mortgage Rates

What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

How Much Can I Borrow For A Mortgage

How much you can borrow for a mortgage varies by person, and depends on your financial situation: your credit, your income, and the amount of cash you have available for a down payment. The general rule of thumb for a conforming mortgage is a 20% down payment. On a $400,000 home, that would mean you need $80,000 up front.

Note that this calculation may be different if you qualify for a different type of mortgage like an FHA or VA loan, which require smaller down payments, or if you’re looking for a “jumbo loan” over $548,250 in most parts of the US in 2021 .

You don’t have to go with the first bank to offer you a mortgage. Like anything else, different servicers offer different fees, closing costs, and products, so you’ll want to get a few estimates before deciding where to get your mortgage.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

Why Your Credit Score Matters

Your credit score is more than just a number its a guide banks use to understand your financial history. Its an inside look at your financial health that lenders use to decide if you are capable of making timely payments and have a history of making smart financial choices. In many ways, a high credit score is somewhat like an insurance policy for your lender. The good news is, even with a not-so-great credit score, you can still purchase a home. However, you will be subject to higher mortgage rates.

While this may not seem like a big deal, a house has a large price tag, and small changes in percentages for your rate can make a huge price difference over time. Of course, your credit score isnt the only determining factor when it comes to landing the affordable rate you desire. Your debt-to-income ratio and financial history all play a fundamental role in your eligibility and can help you save money over time.

Best Online Option: Sofi

-

Need to create online account to see rates

-

No FHA or VA loans

SoFi is the best online lender not only because of its simple online application process, but members can receive up to a $500 discount on their mortgage. Becoming a member simply means youre a SoFi customerother benefits include additional discounts on other SoFi products, career coaching, and estate planning assistance. The lender operates in most states, plus Washington, D.C., except for Hawaii, Missouri, New Mexico, New York, and West Virginia. A potential downside is that you will need to create an online account to receive a quote , which could mean youll be subject to marketing emails. Plus, borrowers who want government-backed loans wont find it here with this lender.

SoFi doesnt explicitly state minimum credit and income requirements on their website, but most conventional loans will require a 620 minimum credit score. Though you may be able to put down as little as 5% down on a home, those with lower credit scores may be required to put down more.

Applicants can receive a quote and apply for a SoFi mortgage completely online. To start, youll need to create an online account, then provide required information to receive an initial quote. Afterwards, supporting documentation and communication with the loan officer can be conducted online.

You May Like: How 10 Year Treasury Affect Mortgage Rates

Mortgage Interest Rates Based On Credit Score

Are you aware that your can determine your mortgage interest rate?

Its true, lenders adjust the interest rate on your mortgage based on your credit score and your down payment . The term for the interest rate adjustment is called “loan-level price adjustment”, LLPA for short. The following chart illustrates the interest rate adjustment for aconventional loan. The credit score range can be found on the left side of the table. Along the top is the down payment or equity in the home for a refinance.

| Down payment or equity percentage | |

|---|---|

| 40% or more | |

| 3.25% | 3.50% |

Here’s how the loan-level price adjustment works. Let’s say you’re purchasing a $200,000 home with a 20% down payment. That means your loan amount will be $160,000, and your credit score is 740. The credit score of 740 with a 20% down payment earns a .5% price adjustment. The .5% will increase the closing costs by $800 . Ouch! If the rate adjustment is too much for your budget, the lender could offer you a higher interest rate in lieu of the increased closing cost.Look at the cost adjustment with a 620 credit score . . . $160,000 X .030% = $4,800, or a 1/2 percent interest rate increase. The mortgage interest rate adjustments vary from lender to lender and will change over time based on the stability of the mortgage industry.

PRODUCTMortgage Loans You Can Get With 680 Credit

As mentioned above, a 680 credit score is high enough to qualify for most major home loan programs.

That gives you some flexibility when choosing a home loan. You can decide which program will work best for you based on your down payment, monthly budget, and longterm goals not just your credit score.

Heres a highlevel comparison of the different mortgage loans you can get with a 680 credit score:

| Mortgage Loan Type | |

| Mortgage insurance required, but its lower-cost than FHA or conventional | Buying a home in a rural area |

Home buyers in the 680 range might find themselves deciding between an FHA loan or a conventional loan.

If you can make a 20% down payment, getting a conventional loan should be a nobrainer since youll be spared the cost of mortgage insurance.

If youre making a smaller down payment, you may be better off with a 3%down conventional loan than an FHA loan. Options include the conventional 97 loan, the Fannie Mae HomeReady loan, and the Freddie Mac Home Possible loan.

Both types conventional and FHA require mortgage insurance.

However, a conventional loan allows you to cancel mortgage insurance later on without refinancing the mortgage. Plus, theres no upfront mortgage insurance fee on a conventional loan like there is on an FHA loan.

FHA is typically the better choice for people with credit scores in the high 500s to low 600s, who arent quite over the threshold of qualifying for a conventional loan.

Read Also: Rocket Mortgage Payment Options

How Much Will I Need For A Down Payment

The minimum youll need to put down will depend on the type of mortgage. Many lenders require a minimum of 5% to 20%, whereas others like government-backed ones require at least 3.5%. The VA loan is the exception with no down payment requirements.

Generally, the higher your down payment, the lower your rate may be. Homeowners who put down at least 20 percent will be able to save the most.

How To Improve Your Credit Score Before Buying A House

Improving your credit score is the best way to increase your chances of qualifying for a mortgage loan, as well as getting a lower interest rate.

To do this, you should:

- Pay your bills on time: Late payments can hurt your score significantly.

- Settle any late bills or accounts in collections: These can hurt your score considerably, too.

- Check your credit report for errors: These should be reported to the credit bureau ASAP, as correcting them can improve your score.

- Pay down your balances: Higher balances equal lower credit scores. Using a high percentage of your available credit lines can also hurt your score, so try to lower your overall credit utilization as well.

- Keep your accounts open: Having a long credit history can actually help improve your score, so even if you pay off a balance in full, keep the account open if you can.

Once youre getting ready to buy a home, you should also take steps to protect your credit. Avoid any big purchases, dont apply for any new credit cards or loans, and make sure to shop around for your loan within the same short period. This will keep those credit inquiries from hurting your score and your chances of getting a loan.

Learn More: How to Build Credit Fast

Read Also: Mortgage Recast Calculator Chase

Difference Between Best Credit Poor Credit

All told, you’re looking at a difference of about 1.6 percent between the top of the credit range and the 620 range on a 30-year fixed-rate mortgage. That works out to a difference of about $100 per month per $100,000 of mortgage amount between the best credit and worst , according to Fair Isaac. For example, a borrower with a $300,000 mortgage would pay about $1,400 a month at 4 percent interest, versus $1,700 at 5.6 percent.

It should be stressed that there are a variety of factors that affect your interest rate besides your credit score. Among these are the size of your down payment, the type of loan you’re getting, where you live, any discount points paid, etc. Rates also will vary from lender to lender for the same customer, so it pays to shop around – and compare all costs of the mortgage, and not just interest rates.

How Your Credit Scores Affect Mortgage Rates

Modified date: Mar. 2, 2021

Its no surprise that your credit scores are instrumental in getting approved for a mortgage. Even so, you may not realize just how many ways your credit scores affect mortgage rates and all aspects of the mortgage application process.

Your credit scores affect the kinds of mortgages you can be approved for, how much you can borrow, the mortgage rates youll pay and even how much youll pay for private mortgage insurance.

When it comes to conventional financing at least, you will be required to have a credit score of at least 620 in order to be eligible for a loan. The higher your credit score is beyond that, the better the terms will be.

This is why its so important to understand your credit score in the months before you apply for a mortgage. If you do have impaired credit history, youll want to work to improve your credit scores before you even apply. And if you already have good credit, youll want to keep it as high as possible by avoiding taking on other new debt.

Lets take a look at some of the ways your credit scores affect mortgage rates

Whats Ahead:

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

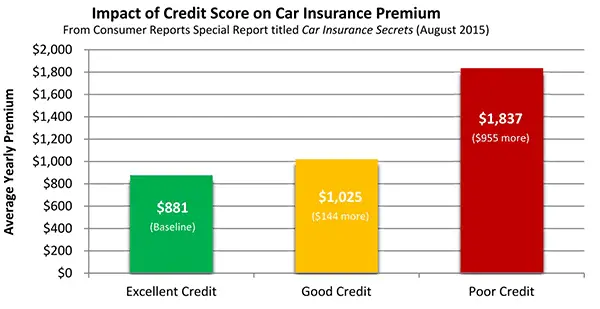

How Insurance Companies Reference Credit Scores

Insurance companies use credit scores as a factor when determining premiums. States that prohibit this practice for auto insurance include Massachusetts, Hawaii and California, Tayne said. Insurance companies use credit scores to get an idea of the risk involved for the company.

Insurance companies want to reduce the chances of a policyholder missing payments, she said.

You May Be Prohibited From Certain Programs

If your credit history is significantly impaired, a lender might exclude you from being able to participate in certain loan programs at all. And where conventional financing is concerned , you wont be able to get a mortgage and all if your credit score is below 620.

Once again, the situation is more pronounced when it comes to non-conforming loans. Since non-conforming loans are issued by non-agency lenders meaning not Fannie Mae or Freddie Mac the lenders can set their own rules. Some do prohibit making loans to borrowers with credit scores below a certain level.

This can be especially true when it comes to loans to purchase investment property, or even second homes. Since both property types involve additional risk to the lender, the lender may decide to extend mortgages on such properties only when the actual credit risk is minimal. A low credit score could leave you completely ineligible.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How Do I Qualify For Better Mortgage Rates

Qualifying for better mortgage rates can help you save tens of thousands of dollars over the lifetime of the loan. Here are a few ways you can ensure you find the most competitive rate possible:

- Raise your credit score: A borrowers credit score is a major factor in determining mortgage rates. The higher the credit score, the more likely a borrower can get a lower rate. Its a good idea to review your credit score to see how you can improve it, whether thats by making on-time payments or disputing errors on your credit report.

- Increase your down payment: Most lenders offer lower mortgage rates for those who make a larger down payment. This will depend on the type of mortgage you apply for, but sometimes, putting down at least 20 percent could get you more attractive rates.

- Lower your debt-to-income ratio: Also called DTI, your debt-to-income ratio looks at the total of your monthly debt obligations and divides it by your gross income. Usually, lenders don’t want a DTI of 43% or higher, as that may indicate that you may have challenges meeting your monthly obligations as a borrower. The lower your DTI, the less risky you will appear to the lender, which will be reflected in a lower interest rate.

What Is An Apr

The annual percentage rate, or APR, shows you more than just the interest rate on your loan. It also includes many of the fees you pay on any mortgage or refinance. While your mortgage interest rate is the biggest long-term cost associated with a home loan, its not the only expense to pay attention to. Anytime you take out a mortgage, there are upfront fees known as closing costs. This can include fees paid to the appraiser and home inspector, as well as loan origination fees, and discount points. All of these costs add up, and can easily be anywhere from 2% to 5% of the loan amount.

These initial costs can vary significantly by lender. So if youre comparing loan offers based only on the interest rate, you could end up paying more fees than necessary. This is why understanding APR is important. If one loan has higher broker fees, that will be reflected in the APR, but not the interest rate. So the APR gives you a better idea of the total cost of the mortgage.

Recommended Reading: Who Is Rocket Mortgage Owned By