Can You Afford A 40000000 Mortgage

Is the big question, can your finances cover the cost of a £400,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £400,000.00

Do you need to calculate how much deposit you will need for a £400,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Can I Use A Mortgage Calculator Based On Income

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Can I Get A 400000 Mortgage

If you meet the eligibility criteria listed above, you should be able to apply for a £400,000 mortgage.

However, to be doubly sure that youre eligible for a £400,000 mortgage on your new home, we would recommend contacting our brokers. They will assess your financial situation to establish your suitability.

You May Like: Is Total Mortgage A Good Company

How Much Income Do You Need For A $500 000 Mortgage

4.2/5mortgageincomeyouincome$500,000you should

Considering this, how much income do you need to qualify for a $400 000 mortgage?

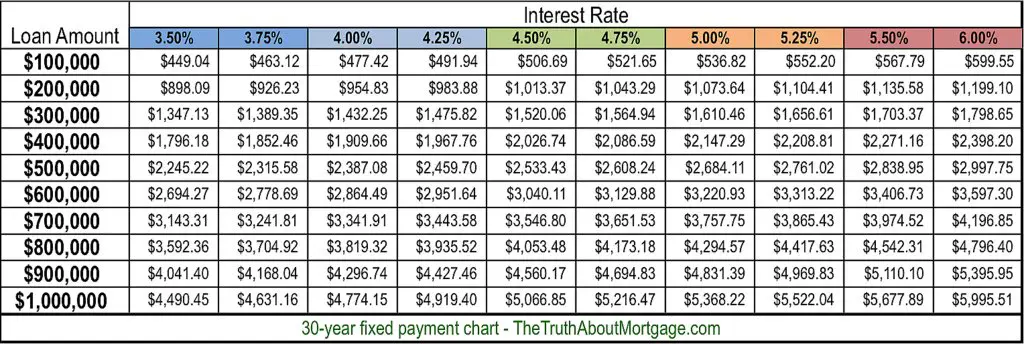

To afford a $400,000 house, for example, you need about $55,600 in cash if you put 10% down. With a 4.25% 30-year mortgage, your monthly income should be at least $8178 and your monthly payments on existing debt should not exceed $981.

Also, how much do I need to make to afford a 450k house? A $450,000 loan for 30 years at 4% would cost about $2150/month. With taxes and insurance it’d be around $2650/month. Assuming no mortgage insurance and $2650/month as the payment, you’d need to make $102k per year. A lender will let you use about 31% of your gross income for a monthly payment.

Similarly one may ask, how much is a $500 000 mortgage?

30 Year $500,000 Mortgage Loan

| Loan Amount |

|---|

What Are The Monthly Repayments On A 400000 Mortgage

Lots of customers approach us to find out how much they can expect to repay for a mortgage of a particular size.

This article is based specifically on £400k mortgages, what factors lenders consider before authorising a mortgage of this size, and how much approximately the monthly repayments on a £400k mortgage will cost you.

The experts can give the right advice, even if youve been declined or have a bad credit history.

The following topics are covered below…

Don’t Miss: Why Are Mortgage Closing Costs So High

Whats The Amortization Schedule For A $400000 Mortgage

When you take out a fixed-rate mortgage, your total monthly principal and interest payment doesnt change for the life of the loan. But the amount of your payment that goes toward principal versus interest does change. This is known as an amortization schedule.

At the beginning of your loan, the amount going toward interest will be far higher than the amount going toward the principal. The situation slowly reverses over the course of the mortgage. By the end, youll be paying more in principal than interest.

The first year of an amortization schedule for a 30-year, $400,000 mortgage with a 4% APR would look like this :

- Beginning balance: $400,000

- Monthly interest: $1,333.33

- End-of-year balance: $393,553.66

Note that at the end of the year, your loan balance is reduced only by the portion of your monthly payment that went toward the principal. The interest portion doesnt reduce your loan balance.

- Beginning balance: $22,427.84

- Monthly interest: $74.76

- Ending balance: $0

On a 15-year mortgage, the amortization schedule works similarly but youll be paying the principal down much faster and paying much less in interest.

How To Get The Best Deal

Got new car fever? Well, first, you need to do a little homework. With the internet, the mystery of the automobile buying process has been unveiled and you can be a well-informed buyer ready to negotiate for the best price. First of all, go to ConsumerReports.org to check out vehicle reliability. You may be eying that shiny red sports car, but if its review states that this manufacturer has a history of poor performance or something like electrical issues, you may want to reconsider.

Test drive the vehicle you have in mind, but renting one from a car rental company for a couple days is the ultimate test.

Don’t Miss: Can You Reverse Mortgage A Condo

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Talk To A Whole Of Market Mortgage Expert Today

If you like what youre reading or require more information surrounding your £400,000 mortgage, call Online Mortgage Advisor on 0808 189 2301 or make an enquiry. Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. We dont charge a fee, and theres no obligation or marks on your credit rating.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

We are an information-only website and aim to provide the best guides and tips but cant guarantee to be perfect, so do note you use the information at your own risk and we cant accept liability if things go wrong. Please email us at if you see anything that needs updating and we will do so ASAP.

Read Also: Can I Get Preapproved For A Mortgage More Than Once

The Internet Has Changed Automotive Shopping

Research Before You Shop

After you have determined the car you want to buy, go to Edmunds.com to find the invoice price. Do not shop without this information in hand. It’s your leverage in the negotiating process. If you don’t have this piece of information, the dealer will work from the MSRP which is a much higher price. Consider MSRP as retail price and invoice price as dealer cost.

Never pay higher than invoice price. And don’t worry, the dealer still makes a profit. There is something called holdback which the manufacturer gives the dealer for each vehicle. It’s usually 2-3 % which they receive quarterly. At times the manufacturer also offers dealer incentives for specific models.

If you have looked ahead and planned your purchase, note that some times of the year are better than others to buy a car. Salesmen work on commission and have monthly, quarterly and yearly goals to meet. So buying at the end of one of these periods can save you money, especially if the salesman hasn’t hit his quota.

Get a Free Online Quote

If you have made a decision on the exact vehicle you want, visiting the dealership late in the day may work to your advantage because everyone is eager to go home. Aside from the information we provide here, you may want to read some personal stories of sale negotiations to better visualize and prepare yourself:

Amortization Schedule On A $400000 Mortgage

An amortization schedule, which breaks down the principal and interest payments for a loan, can help you understand the long-term costs of your mortgage.

As youll see below, the bulk of your payments will go toward interest costs. Once you get further into your loan term, more of your payments go toward your loan balance, and youll start reducing that principal at a faster rate.

Heres what an amortization schedule looks like for a 30-year, $400,000 mortgage with an APR of 3%:

| Year |

|---|

| $0.00 |

Recommended Reading: What Are The Interest Rates On A Mortgage

Advantages & Disadvantages Of Buying Used

| Pros | Cons |

|---|---|

| Cost Second-hand RVs are naturally less expensive than newer models, so buying used can help you stretch your budget. | Pricing While a used RV is typically less expensive than a newer model it can be difficult to know just what a fair market asking price should be. Before buying used research the make and model you are interested in to figure out its current market value. The Recreational Vehicle Blue Book is a good online resource for estimating the current market value of most self-contained and towable RVs. |

| Insurance It is generally cheaper to insure a used motorhome or travel trailer. However, the savings here will be largely dependent on how you will be using it. If you are thinking of making it your full-time home, the discount in insurance may not be that significant. | Vehicle History When buying any used vehicle there is always a question of condition and history of accidents. Before committing to the purchase of any second-hand RV be sure to have it checked out by a reputable mechanic with experience working on motorhomes and travel trailers. |

| Resale Value Again, RVs depreciate in value fairly quickly. Buying used gives you a better chance of recouping a larger part of your investment should you decide to sell your vehicle in the future. | Maintenance A second-hand RV will likely require more maintenance than a new model, and without a manufacturers warranty the cost of the maintenance will be coming out of your pocket. |

Apply For A 190000 Mortgage

To find out more about our range of £190,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Explore this product

You May Like: How Much Money Should You Spend On Mortgage

Mortgage Affordability Calculator Help

This simple mortgage calculator shows the principal and interest portion of a monthly mortgage payment. This calculator is fast and easy, thus ideal to use during the initial home buying stages. Getting a more precise loan estimate requires consideration of many factors such as your credit score and the type of loan program you intend to use.

This calculator does not include fees such as closing costs or origination. It’s set up for a quick, thumbnail sketch to help you see a reasonably close approximation of their monthly mortgage costs. You can always request a pre-approval from a licensed representative for a more precise estimate.

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

You May Like: How Much Is The Average House Mortgage

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

What Is Your Personal Situation

Your marital status will affect your eligibility for a £400,000 home loan.

If youre married, you can use both of your incomes to determine the amount you can borrow . However, bear in mind that if your partner has a low credit score, or is in a significant amount of debt, this could affect your chances of not only getting a mortgage in the first place, but enjoying competitive interest rates on your loan amount.

If youre single, youre no less likely to be accepted for a £400,000 mortgage. The lender will just need to make sure that you are generating enough income to qualify for a loan.

Self-employed mortgage applicants will usually need to provide proof of earnings from the last two years in order to be considered for a £400,000 house mortgage. Those with more complex income structures may be subjected to further investigations during the application process, so if you rely on bonuses, dividends or inconsistent wages, be prepared to answer more questions.

Don’t Miss: How Many Times Can You Pull Credit For Mortgage

Why Should I Use A Mortgage Calculator